Author: Mason Nystrom, Junior Partner at Panteral Capital; Translator: 0xjs@黄金财经

In last month’s Blockchain Letter, we introduced my Solana Breakpoint debate, in which I argued that every sufficiently large application would eventually launch its own blockchain. This month, a sufficiently large application, Uniswap, announced that it would launch Unichain, its own Ethereum L2 network.

Originally a simple decentralized trading protocol that allowed users to trade long-tail assets, Uniswap has grown into a cryptocurrency behemoth that spans multiple applications, multiple protocols, and now its own chain.

The launch of Unichain has several important implications for cryptocurrency, including:

– Unichain provides a new model for token value accumulation

– DeFi activities migrate off the Ethereum mainnet

– Unichain solidifies the fat app theory and the continued commoditization of block space

Let’s discuss.

UNI is reborn and a new token value accumulation model is introduced

Historically, Uniswap's token UNI has served as a governance token, holding control over the Uniswap DAO and Uniswap protocol fee conversion, allowing exchange fees to be added and redirected to the DAO's treasury.

According to the white paper, Unichain proposes to launch a decentralized sorter to manage transaction sorting on Unichain. As part of the decentralized sorter, validators must stake UNI to sort transactions and will receive a portion of fee rewards based on the stake-weighted token value. This means that the UNI token will move from a nearly useless governance token to a token with more direct value accumulation (such as sorter fees). More importantly, the demand for the UNI token may increase because there is a limited number of validators, and those with the highest UNI stake weight will validate the network and earn fees.

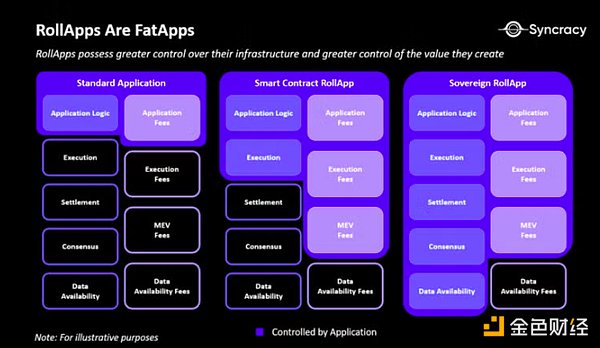

It’s worth understanding the tradeoffs Uniswap made when it launched Unichain. By moving to its own L2 blockchain, Uniswap sacrificed some composability with the rest of the Ethereum DeFi ecosystem in favor of more control over its blockspace and improved economics that the protocol (and applications) can capture. By moving liquidity and transactions to Unichain, the protocol can offer higher throughput and capture more of the overall economic value from its own chain through sorters. When protocols like Uniswap run on Ethereum, they can capture fees from their applications. But with Unichain, UNI token holders can capture a portion of all the economic activity — lending, non-Uniswap DEX (decentralized exchange) swaps, stablecoin transfers — that happens on their chain because every transaction is sorted through Unichain validators.

This has brought huge profits to Coinbase and Base, and general-purpose Rollups such as Arbitrum and Optimism have also earned millions in sorting fees. Now, Unichain will seek to use its influence as a DeFi giant to capture the broader transaction economic activity occurring within its block space.

With many other applications looking to launch their own chains, Unichain proposes a replicable model that realigns the incentives of token holders and allows protocols to capture more of the economic value associated with application chains.

Awkward Conversation: Unichain vs. Ethereum Mainnet

Unichain has a significant impact on the Ethereum Mainnet. Today, even with the growth of L2s like Arbitrum and Base, the Ethereum Mainnet still accounts for the majority of DeFi activity and tens of billions in mainnet assets (excluding stablecoins). It is possible (perhaps likely) that Ethereum Mainnet DeFi activity will migrate to Unichain, as it provides incentives for UNI stakers, fees for LPs, and better pricing for exchange users.

More importantly, Unichain has decided to have Unichain validators stake their UNI on the Ethereum Mainnet, rather than on Unichain, which may help strengthen Ethereum’s security value proposition.

Ultimately, Ethereum has made a directional decision to move activity away from the mainnet, in stark contrast to chains like Solana, which are designed to maximize the scaling of Layer1. However, Ethereum’s biggest value proposition is the strength of its underlying asset, which still serves as the gas token for Layer2s including Unichain, and represents one of the most liquid assets in the industry, as well as a key tool for collateral across DeFi protocols.

Fat App Theory Rises Again: Verticalization, Up to Their Own Chain

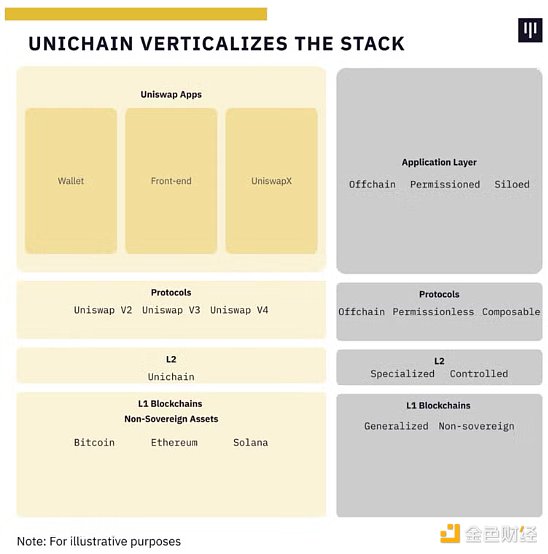

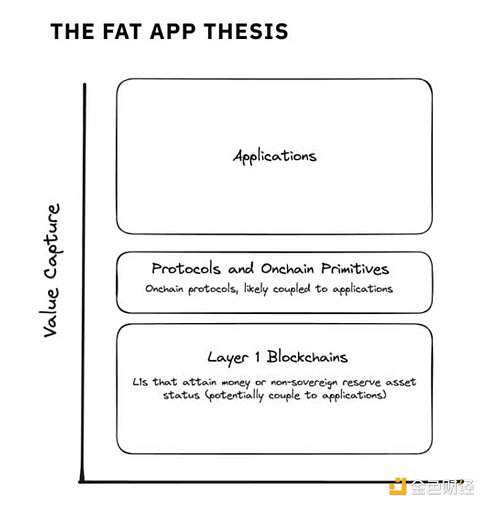

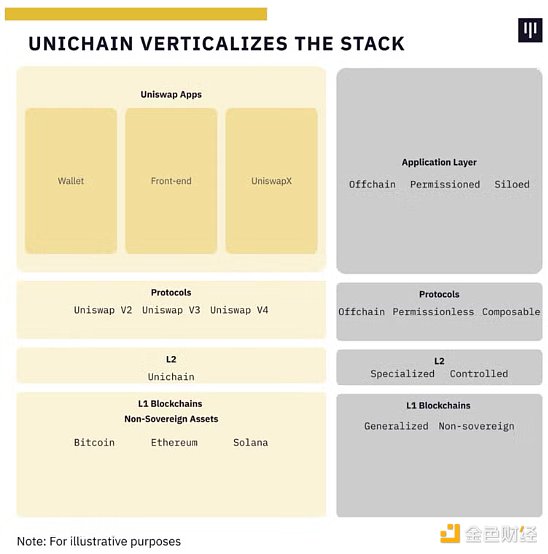

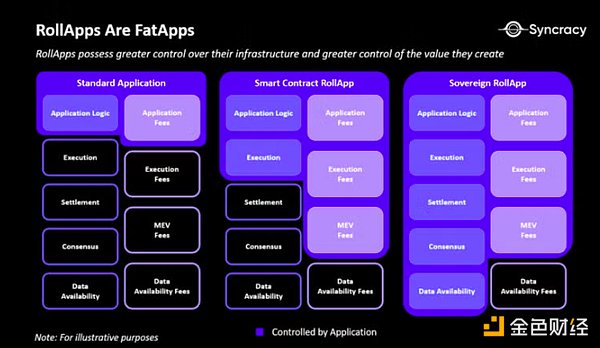

The launch of Unichain reinforces the fat app theory - crypto applications will capture the majority of value because they are able to verticalize other parts of the stack.

I believe this will be a continuing trend for modern crypto applications - verticalization once they gain sufficient user scale or block space demand. And Uniswap is not the only company moving in this direction. Worldcoin, a human identity verification network, once accounted for 50% of Optimism’s mainnet activity, prompting them to launch their own app chain. Even on a high-performance chain like Solana, oracle provider Pyth accounted for 20% of Solana’s transactions and decided to move to its own SVM-L1. Elsewhere in consumer crypto, top NFT projects with strong brands like Pudgy Penguins have chosen to build their own chains. As CEO Luca Netz explained, control of block space is beneficial to the accrual of value for the Pudgy brand.

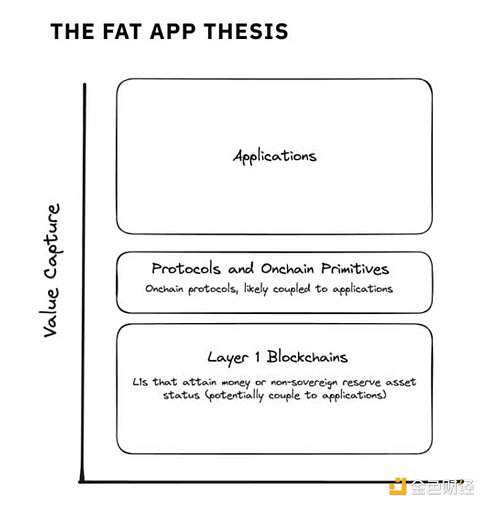

My current take on the fat app thesis is that we will see the majority of value accrue to the application layer of the stack, where control over users and order flow puts applications in a privileged position. These applications will likely be coupled with on-chain protocols and primitives, similar to how Uniswap’s applications leverage their on-chain DEX protocol, and soon Unichain. Ultimately, these protocols can still accrue significant value, but applications will likely accrue more value given their proximity to users and off-chain components that provide a more defensible moat for the application.

Finally, I still believe there is a path for Layer1 blockchains (e.g. Bitcoin, Ethereum, Solana) to capture significant value as non-sovereign reserve assets, where the underlying asset (e.g. ETH) gains significant value due to its use as a commodity (e.g. gas), a capital asset (e.g. yield), and has value as an extremely liquid collateral asset in the L1’s respective DeFi ecosystem. These monetary properties make up the lion’s share of L1 asset value.

Finally, I still believe there is a path for Layer1 blockchains (e.g. Bitcoin, Ethereum, Solana) to capture significant value as non-sovereign reserve assets, where the underlying asset (e.g. ETH) gains significant value due to its use as a commodity (e.g. gas), a capital asset (e.g. yield), and has value as an extremely liquid collateral asset in the L1’s respective DeFi ecosystem. These monetary properties make up the lion’s share of L1 asset value.

It is possible that, given enough time, applications will attempt to build their own L1s, just as they have built their own L2s. However, building a commodity L2 blockspace is very different than launching an L1 and turning tokens into commodities and collateral assets, so this is likely a discussion far into the future.

The point is that as more and more crypto applications launch their own blockspaces to control liquidity, users, and order flow, the crypto world will re-evaluate applications as people draw the logical conclusion - fat apps are coming.

Alex

Alex

Finally, I still believe there is a path for Layer1 blockchains (e.g. Bitcoin, Ethereum, Solana) to capture significant value as non-sovereign reserve assets, where the underlying asset (e.g. ETH) gains significant value due to its use as a commodity (e.g. gas), a capital asset (e.g. yield), and has value as an extremely liquid collateral asset in the L1’s respective DeFi ecosystem. These monetary properties make up the lion’s share of L1 asset value.

Finally, I still believe there is a path for Layer1 blockchains (e.g. Bitcoin, Ethereum, Solana) to capture significant value as non-sovereign reserve assets, where the underlying asset (e.g. ETH) gains significant value due to its use as a commodity (e.g. gas), a capital asset (e.g. yield), and has value as an extremely liquid collateral asset in the L1’s respective DeFi ecosystem. These monetary properties make up the lion’s share of L1 asset value.