Venmo is another controversial topic in PayPal's acquisition history. In 2013, two years before PayPal was spun off from eBay and a year before Schulman took over as PayPal CEO, eBay spent $800 million to acquire white-label payment processor Braintree and its upstart peer-to-peer payments app Venmo. Venmo handled $270 billion worth of transactions in 2023, according to Autonomous, but its revenue and profit margins were slim compared with PayPal’s main business. To some extent, profitability meant trying to get customers to use Venmo’s credit card and use the app like a neobank for external purchases (rather than just transferring money within the Venmo system)—but competition in both areas was already fierce. Meanwhile, PayPal had some trouble integrating Venmo with its core platform in a way that made the sum of its parts greater than the sum of its parts. In June 2023, at his last investor conference, Schulman revealed the difficulties PayPal faced in integrating its fragmented payment infrastructure while answering questions from FT Partners' Craig Maurer.

Schulman said he had been working on this problem since he joined PayPal in 2014. But PayPal alone has four different payment stacks, while Venmo and Braintree have their own independent payment platforms. He said: "Eight years ago, we set this goal, which is to integrate all the independent payment platforms into one modern payment platform. But it's like running a marathon and doing a craniotomy at the same time, because what needs to be integrated is our payment processing stack, which cannot be down for a moment."

In Schulman's words, different systems make it difficult to scale efficiently, and a large number of engineers have to focus on solving this problem. “Honestly, it’s been a long, hard process, but we’ve done it,” he added, noting that now that PayPal, Venmo, and Braintree finally have a unified payments platform, the company can “start doing a lot of things that we couldn’t do before with our legacy infrastructure, including interoperability between Venmo and PayPal.”

Essentially, it took PayPal eight years to merge its two systems, and during that time it couldn’t do it on its own technology alone — it still needed a product from Visa called Visa+ to help with the process. “It’s amazing to admit that,” Maurer said. Schulman countered in an interview, saying, “It was a very complex, detailed migration that required building and stress testing every part of the architecture… PayPal wouldn’t have been able to innovate on top of a modern technology stack without all of that hard work that had to be done perfectly.”

PayPal stopped reporting Venmo’s revenue after 2021, when it was about $900 million, which may also suggest that its growth is slowing. Beyond Venmo, integration challenges may help explain why PayPal has struggled to get the most out of more acquisitions.

Meanwhile, PayPal has built a fast-growing business by helping businesses accept online payments with its Braintree technology, competing with fintechs including Stripe and Adyen.

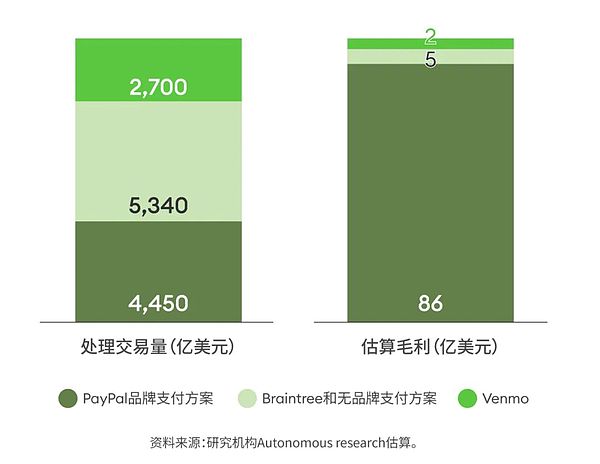

PayPal’s non-branded payment processing unit, much of which is powered by Braintree, completed $534 billion in transactions in 2023 (compared to Stripe’s $1 trillion), up from $299 billion in 2021.

So what’s the problem?

PayPal is in such trouble partly because it has adopted a risky strategy - price war.

Analysts point out that PayPal only charges 0.2% of each transaction as a service fee for non-branded payment transactions (that is, the payment process does not prominently display the PayPal logo, but the payment processing is done in the background, and the checkout process remains on the merchant's website), while in branded transactions (that is, the transaction process will prominently display the PayPal logo and brand), this ratio is as high as 1.5% to 2%. Darrin Peller, managing director of Wolfe Research, said that under the leadership of Alex Chris, PayPal has become less aggressive in pricing. Today, investors are mainly concerned about profitability, which is not Braintree's strong point.

Autonomous Research analyst Ken Suchoski believes Schulman didn’t innovate enough on branded transaction buttons during his tenure. Not surprisingly, Schulman disagrees. He says PayPal has achieved remarkable results in terms of payment speed, transaction clicks, number of features offered and fraud prevention during his tenure as CEO. He also points out that when he took over PayPal’s technology system, it was “ancient” and he oversaw PayPal’s code overhaul, taking it from 200 software updates per year to tens of thousands per year.

Suchoski said PayPal’s share of the $6 trillion global e-commerce market has fallen from a peak of 8% in 2021 to 7% in 2023. Apple Pay, the native payment method on the iPhone, has soared from 0.5% to 3% market share in just five years and may have become the fastest and easiest payment method used by Americans today. Suchowski also said that Shop Pay, the payment app of Canadian e-commerce software Shopify, is well integrated into the former's e-commerce ecosystem and has reached a market share of 1% in the same period.

In earnings calls and interviews, Alex Chris has been calling 2024 a "transition year." "We have a plan to get the company back on track," he said in April. Wall Street analysts have described him as more focused than Schulman.

One of the core of Chris's plan is Fastlane.

This is a new product developed under Schulman's leadership that aims to make non-member checkout (that is, checkout on websites where buyers are not registered) faster. The product allows customers who don't use the PayPal button to save their shipping and credit card information so that when they shop again, they only need to enter their email and a verification code sent to their mobile phone to pay.

Chris said 60% of e-commerce transactions are non-member payments, but nearly 50% of these transactions are canceled. But PayPal found that in early cases using Fastlane, 80% of customers who used non-member checkout continued to make purchases.

These statistics sound promising, especially considering that the total addressable market for non-member checkout is in the trillions of dollars. But because the product is a non-branded service for PayPal, it is still unknown how much Chris can charge merchants and how much real profit it will bring. "As we move forward with Fastlane in 2024, we may be very aggressive in pricing because we want to promote this product," Chris said in April. Later, he gave an ambiguous promise about the profitability of the product: "Rest assured, we will price it based on value to ensure that we can get a reasonable return."

Analysts expect PayPal to charge large customers about the same price as Braintree at the beginning, about 0.2% of the transaction amount. Then, it will need to sign up small businesses to charge higher fees on each transaction. Because this feature is not yet popular, and the industry structure is shifting toward larger merchants, analysts at Autonomous and FT Partners believe that Fastlane will take several years to accumulate before it can bring meaningful changes. Maurer said: "I think if they expect Fastlane to have a substantial impact on the holiday sales season in 2024, this idea may be too radical... It will take until the second half of 2025 before we can fully understand whether Fastlane has the energy." Others are more optimistic about this move. For example, Japan's Mizuho Financial Group recently adjusted PayPal's stock rating from "neutral" to "buy". Senior analyst Dan Dolev estimates that PayPal will eventually charge 0.7% of each transaction from Fastlane, and in the next 18 months or so, PayPal will be able to earn an additional $1 billion to $1.5 billion on top of its $14 billion in annual net profit.

Dolev also said he was pleased that the loss of market share for the PayPal button has leveled off, based on Mizuho's study of online transaction volumes at top retailers. "You don't want it to be an ice cube melting in the oven, but the evidence suggests it's more like an ice cube melting in the freezer. That's a more acceptable scenario," he said. In a recent research note, he commented on the apparent plateau: "This probably means that PayPal has survived the worst of the loss of market share to Apple Pay and others, which we can see in the stock price."

More optimistic analysts, including Dolev, estimate that PayPal's gross profit will grow 6% to 7% in 2025 and 2026. Ken Suchowski and others have a different view - they believe that PayPal's gross profit will only grow more slowly, around 3% to 4% over the next two years. Of the 45 analysts covering PayPal, Ken Suchowski is the only one with an "underperform" rating on the stock, according to Bloomberg. (Twenty of the analysts have more neutral ratings on PayPal, such as "neutral," "hold," and "market perform.") Having just one negative analyst may be encouraging, but PayPal's stock performance is no laughing matter—it's down about twice as much as the average publicly traded fintech stock over the past 12 months. Suchowski argues that people who buy shares of payment software companies could get better returns by buying shares of companies like Fiserv and FIS. Both companies trade at similar valuation multiples as PayPal, he says, but don't face the same competitive pressures and are growing revenues by as much as 8% annually. "Basically, you can buy another business for the same price, but their revenue is still growing, and you don't have to face the situation of turning losses into profits like you did with PayPal."

Since earlier this year, Alex Chris seems to have become more conservative - he no longer preaches that PayPal will surprise people. Darin Peller of Wolfe Research said: "He wants to set the bar lower at the beginning and then slowly and steadily raise the bar. This is a better way to increase its stock price."

Sanya

Sanya

Sanya

Sanya JinseFinance

JinseFinance Xu Lin

Xu Lin CryptoSlate

CryptoSlate dailyhodl

dailyhodl Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph