Author: Prashant Jha, CoinTelegraph; Compiler: Deng Tong, Golden Finance

Tether, the world's largest stablecoin issuer, has launched a new crypto payment option for Philippine citizens, allowing them to pay Social Security System (SSS) contributions in USDT.

In the Philippines, the Social Security System is a state-run social insurance program that serves employees in the official, informal, and private sectors.

The SSS is mandated by law to provide assistance to citizens in difficult times. It currently manages two programs: Social Security and Employee Compensation.

Tether allows payment of government insurance programs with USDT

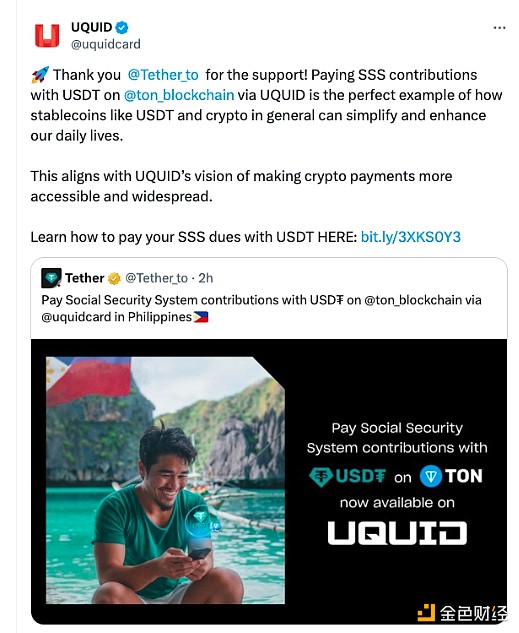

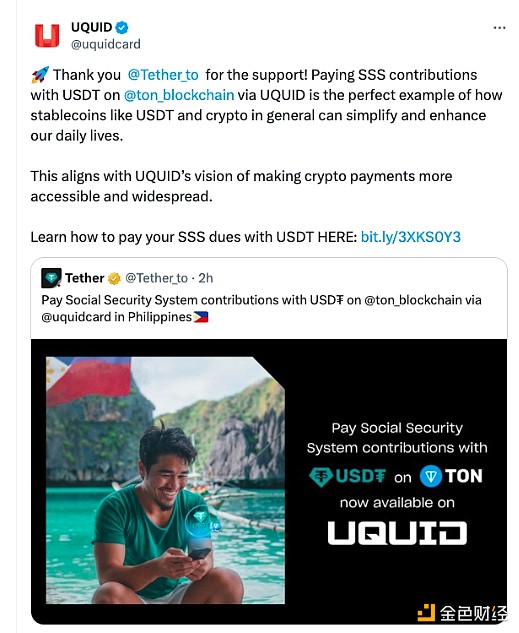

Tether has partnered with Web3 shopping and infrastructure company Uquid to allow Philippine citizens to pay SSS contributions with Tether on the open web blockchain. Uquid said that the partnership with Tether highlights how stablecoins such as USDT and "cryptocurrencies in general can simplify and improve our daily lives."

Uquid is a leading decentralized business infrastructure platform that provides crypto payment options using decentralized finance and blockchain technology. The platform supports merchants and customers across markets and has built a user base of over 260 million over the past eight years.

Tran Hung, CEO of Uquid, said the partnership with Tether is an important milestone in their journey to bridge the gap between digital currencies and everyday transactions and make crypto micropayments viable. He added that the latest move, backed by Tether, sets a new benchmark for convenience and accessibility in digital shopping.

Rising Demand for Stablecoins

Demand for stablecoins has been rising over the past few years, with cryptocurrencies becoming increasingly popular among the mainstream, with stablecoins dominating the market. Stablecoins initially served as an entry tool for centralized exchanges, but have evolved into major liquidity providers for centralized and decentralized markets.

Mainstream payment platform PayPal launched its native stablecoin PayPal USD, while Ripple also announced plans to launch its own stablecoin in early 2025 to meet growing demand. Stablecoins are also actively used for cross-border payments at the institutional level.

WenJun

WenJun