Author: Digital Asset Research Company ASXN; Translation: Golden Finance xiaozou

1 , The rise of gambling culture: Polymarket Overture

In the past decade, gambling culture has grown significantly, and social, technological and Economic factors are a common driver. By viewing the rise of gambling culture as a macro trend, we can better understand the rise of Polymarket.

(1) Social and cultural factors

From social and cultural factors In terms of factors, one of the most striking shifts is the normalization of gambling, especially among young people and sports enthusiasts. Part of this normalization is due to the practical benefits of this culture, where capital is at stake, more punters get involved and a sense of community develops with other punters. Simply put, when a group of people get together to watch a sports game that is being bet on, it gets a lot of attention and plenty of talk.

(2) Technological progress

The emergence of mobile technology Revolutionizing accessibility in the gaming industry. Smartphones provide a fast, convenient, and private gambling platform, spurring a surge in mobile gambling activity. This ease of use greatly facilitates impulsive betting behavior, as users can bet on virtually anything, anytime, anywhere.

(3) Rising wealth inequality and the rise of 1000x gambling culture

In recent years, wealth inequality has become a major issue of our time. The gap between rich and poor continues to widen, which has a huge impact on the economy and society. It is estimated that the richest 1% of the world's population now owns more than 50% of total global wealth. This will have far-reaching consequences, affecting everything from political stability to social mobility. Rising wealth inequality and limited social mobility have jointly given rise to the rise of 1000x gambling culture, which is the idea that ordinary people who want to achieve financial freedom must win the lottery and so on. A classic example of the 1000x betting culture is the rise of multi-betting, where bettors optimize odds by stacking conditional bets in the hope that their 527:1 bets will pay off, only to have their hopes fail.

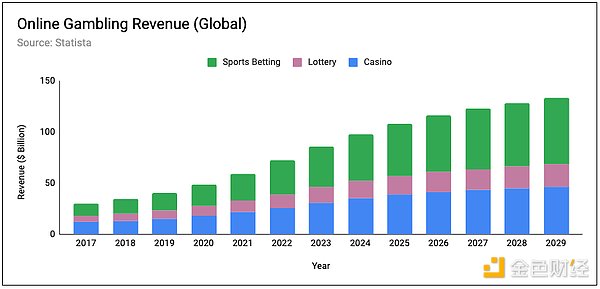

Quantification of the online gambling market - data source: Statista

· Online gambling market Revenue is expected to reach $97.7 billion in 2024.

· The expected annual revenue growth rate (compound annual growth rate from 2024 to 2029) is 6.46%, and the market size is expected to reach US$133.6 billion by 2029 .

· By 2029, the number of users in the online gambling market is expected to reach 281.8 million.

· In 2024, the user penetration rate will reach 5.9%, and it is expected to reach 7.4% by 2029.

· The average revenue per user (ARPU) is expected to reach US$450,000.

· From a global perspective, most of the revenue will come from the United States (reaching $25 billion in 2024).

From a macro perspective, it is necessary to connect the rise of gambling culture with the rise of Internet culture. Generation Z users spend more than 9 hours online every day on average, which is an astonishing number if you think about it carefully. In addition, most people in Generation Z are not yet of working age, so more than 9 hours a day online can be largely attributed to having enough time. With 56% of Gen Z and 48% of Millennials saying they are "addicted" to their phones, it cannot be overstated how ubiquitous these mobile devices are in our daily lives. Especially due to the 2019 COVID-19 epidemic and its impact on social relationships and mental health, people spend more time online.

The rise of online culture has provided fertile ground for the development of online gambling, seamlessly integrating it into daily digital life. Continued advances in technology, coupled with strategic marketing and changing social norms, indicate that online gambling will remain an important aspect of online culture.

2, Polymarket

For those who don’t know what Polymarket is yet, here is an introduction about Polymarket.

Polymarket is a prediction market platform based on encryption technology. Users can make speculative bets on the outcomes of various events in the real world through transactions in the information market. . Polymarket is based on Polygon and allows participants to buy and sell shares of event results, using the wisdom of the crowd to predict future events. Covering a wide range of topics, from politics and economics to sports and entertainment, the platform provides a transparent and accessible way for people to express their views and potentially monetize their intellectual insights.

(1) How Polymarket succeeds compared to other betting platforms

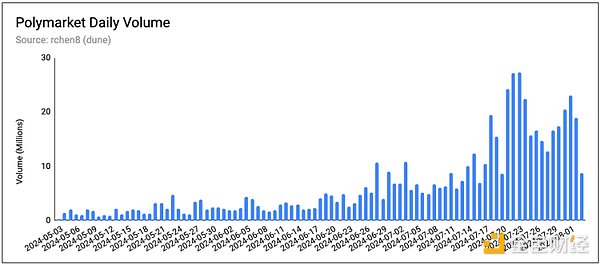

Polymarket's rise has been nothing short of spectacular, thanks to well-thought-out marketing, the growth of 1000x betting culture, and its unique features. Polymarket’s marketing has allowed it to tap into the native culture of the internet. Specifically, Polymarket X accounts have led the platform’s growth through massive postings, which resonate with the CT crypto-native community. Polymarket offers unique features to its users, two of the most interesting being the ability to trade binary outcomes as continuous variables and the ability to market-trade absurd outcomes – both of which help foster active user base. Finally, the rise of 1000x betting culture and the most unpredictable election in recent memory provide the perfect impetus for Polymarket’s growth. However, there are still some questions, such as: whether Polymarket has achieved true PMF (product market fit), and also, it will be difficult to prevent user churn once the election is over.

(2) Protocol mechanism

Polymarket operates like any regular exchange, serving as a market where buyers and sellers meet to express their views on price - in Polymarket's case, the price of an event outcome (probability) ). The trading range of the result is between 0% (the probability of the result occurring is 0%) and 100% (the probability of the result occurring is 100%). As with all markets, the price of an asset (the probability of an event occurring) is determined by the ratio between marginal dollars and available liquidity.

Polymarket provides two types of markets, one is a binary outcome market (yes/no), and the other is a multi-result market (multiple choices , but there can only be one winner).

(3) Binary Outcome Market

Ethereum The market hitting all-time highs in 2024 is a perfect example of a binary yes/no outcome market. This prediction market has a central limit order book (CLOB), and users can set market buy/sell or set limit buy/sell orders. This market is similar to almost any CEX (centralized exchange). The ETHUSDT currency pair functions exactly the same. For example, betting on whether Ethereum will reach a new all-time high in 2024 and buying $100 of "yes" (result) will generate a profit of $212 (100/47 * 100) if the result is as expected. As mentioned earlier, the novelty of this type of market is that the binary yes/no outcome can be traded as a continuous variable. This allows market participants to adjust their positioning based on new information, which also allows others to Get a feel for how other market participants' perceptions of the outcome develop.

(4)Multi-OutcomeMarket

The second type of "yes/no" market is called a multiple outcome market, as shown in the figure below. In these prediction markets, users have more than one choice. Interestingly, multi-outcome markets are priced in the same way as binary outcome markets - each outcome is priced individually, with no mechanical link between outcomes, so the total outcome is 100%. We can see that the cumulative probability of a "yes" outcome listed below is less than 100%, within the 98% range, which provides an arbitrage opportunity for market makers. Given that all "no" outcomes are priced high, the market maker can buy out all "yes" options (98% total probability) and guarantee a 2% profit after the market settles, which will drive the "yes" The result is price increases across the board. Clearly, this is an oversimplification of how the carry trade works—transaction fees, slippage, and the possibility of both Trump and Harris losing the entire election are not taken into account. This is just one example of how arbitrage can act as a "soft" link between these markets.

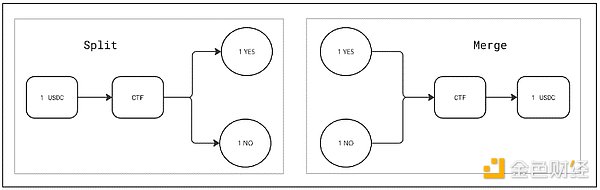

(5) Conditional Token Framework

All results on Polymarket are tokenized and automatically traded in a non-custodial manner on the Polygon network. Specifically, Polymarket’s outcome shares are binary outcomes – yes/no – and are represented using Gnosis’ conditional token framework. The Gnosis CTF contract allows "splitting" and "merging" of complete result sets. This means that for ready conditions (market) any user can split one unit of collateral (USDC) for 1 binary outcome token to match, or can merge 1 outcome token into one unit of collateral Good product. Therefore, in a correctly structured market, the market price of these tokens should always be between 0 and 1, and the sum of the prices should be 1.

To better understand splitting and merging, let’s look at specific examples of market making and order matching. When a limit order is placed on one outcome (i.e., yes), the limit order also appears on the order book for the complementary outcome (i.e., no). The specific reason is that the underlying binary market is a single, "unified" order book.

Example 1 - Bid/Ask Non-Complementary:

· Jack is down A limit order to buy 10 shares at 35 cents with a "yes" result.

· Jill placed a limit order to sell 10 shares for 35 cents with a "yes" result.

The matching calculation for this example is simple, $3.50 will be transferred from Jack's account to Jill's account in exchange for her 10 share.

Example 2 - Complementary bids:

· Jack placed a limit price Order, "Yes" result for buying 10 shares at 35 cents.

· Jill placed a limit order to purchase 10 shares at 65 cents with a "no" result.

At first glance, these orders may appear to be different, but please note that 1 USD can be split at any time into 1 "yes" and 1 " No", so the two limit orders can match. $3.5 from Jack and $6.5 from Jill ($10 total) are used to mint the full set of conditional tokens (10 shares of "Yes" and 10 shares of "No"), and then 10 shares of "Yes" are distributed to Jack , 10 shares were "no" distributed to Jill. This matching is achieved using the split operation.

Sponsored Business Content

Example 3 - Complementary asking price:

· Jack placed a limit price The order to sell 20 shares at 75 cents resulted in a "YES" result.

· Jill places a limit order to sell 20 shares at 25 cents with a "No" result.

In this scenario, matching is also possible. It works like this, 20 shares of "yes" from Jack and 20 shares of "no" from Jill are combined into $20 via CTF, assigning $15 to Jack and $5 to Jill. This matching is achieved through a merge operation.

(6)CLOB

The CLOB structure of the Polymarket order book is similar to all centralized exchanges as well as some decentralized exchanges. Polymarket CLOB is currently a hybrid decentralized outcome, with an operator providing off-chain matching/ordering services, while settlement and execution is done on-chain in a non-custodial manner and based on instructions provided by users in the form of signed order messages conduct. The bottom layer of the trading system is a customized trading contract that performs atomic exchange (settlement) between binary outcome tokens and collateral assets based on signed limit orders. The trading contract was created specifically for the binary market and supports the unification of orders so that an order can be matched with its complementary order.

(7)Resolver

When relevant events occur, the market settles and pays out. All market settlement is fully decentralized, with most markets being settled through UMA's optimistic oracle (OO) and the rest (some price markets) being settled through Python. In order to support the settlement of the CTF market through OO, Polymarket has developed a customized adaptation contract called UmaCtfAdapter, which allows the two contract systems to be connected.

(8) Market Making Incentive Program

Any one For the market to function smoothly, it needs sufficient liquidity. Deep liquidity promotes efficient price discovery, reduces volatility, and lowers transaction costs—a lack of deep liquidity affects user experience and harms platform adoption. To increase liquidity, Polymarket borrowed from dYdX’s successful incentive program and adapted it to its own platform features. The differences between the two platforms are Polymarket binary market liquidity (a bid for A is equivalent to an ask for A), the lack of a staking mechanism, slightly modified order utility, and the fact that the reward amounts for each market are isolated from each other. Market makers that issue limit orders are eligible to participate in the Polymarket incentive program. Rewards are a function of uptime and quote tightness (vs midpoint), with the order book randomly sampled every minute.

3, some thoughts

( 1) How accurate are prediction markets?

It is common to find US national news outlets citing Polymarket odds as predictions of truth - which raises the question of how accurate Polymarket's price results are ? The accuracy of the resulting market can be interpreted through the perspective of "wisdom of crowds":

"Swarm wisdom refers to the ability to solve problems, make decisions, innovate, and predict. “The collective wisdom of a large group of people is wiser than that of a single expert.” What this means is that individual opinions are inherently biased, and taking an average of the opinions of a group of people can remove bias or noise, resulting in a clearer and more coherent result. result. ——Investopedia

The "wisdom of crowds" framework suggests that the accuracy of predictions is related to the nominal amount of bets. According to Jordi Alexander, once the trading volume of the prediction market exceeds 9 figures, the quote probabilities will be reasonably and effectively priced. However, he also points out that there are inefficiencies when pricing a low-probability outcome, which results in an overly large tail—i.e., pricing an outcome with a 1% probability at 4%. This is a capital cost function associated with betting on a “no” outcome—risking 99 cents and waiting a certain amount of time to earn 1 cent. Given how unattractive the 99-cent "no" option is, the market will ultimately fail to price efficiently. When pricing low-probability outcomes over a reasonable time horizon, the implicit threshold rate of return is the risk-free rate of return (5.5%), so low-probability outcomes may be priced very high due to the high opportunity cost of capital that is effectively priced .

(2)PolymarketLean right?

Some people worry that the results on Polymarket are skewed to the right due to participation bias - crypto-native users use Polymarket, and crypto-native users are skewed to the right. While these concerns are legitimate and the reasons are defensible, there will always be those willing to weigh in and take the opposing side if the outcome is mispriced. Participants are always driven by profit rather than expressing political views, so the political outcome market may shift to the right, but mispricing is limited.

(3) Product Market Fit (PMF)?

Another question that has emerged in popular discourse is whether Polymarket has achieved PMF, or whether its success depends heavily on the U.S. presidential election. If we look at historical elections, we tend to see one or two dominant prediction markets – this is a function of network effects and liquidity.

Intrade (2000s to early 2010s) received significant attention during the 2008 and 2012 US presidential elections. However, it faced regulatory scrutiny from the U.S. Commodity Futures Trading Commission (CFTC) and eventually ceased operations in 2013 due to legal and financial issues.

Predictit (2014-present) is a very popular prediction market platform launched in 2014 that allows users to buy and sell shares of the outcomes of political events, including elections. . Predictit has been widely used in several recent elections, including the 2016 and 2020 U.S. presidential elections.

Betfaire (2000-present) is a large online betting exchange that supports a wide range of markets, including political events. It has been an important platform for predicting elections, especially in Europe. Betfair has been used for election predictions, including the Brexit referendum and various elections in the UK and US. It remains one of the largest and most active prediction markets in the world.

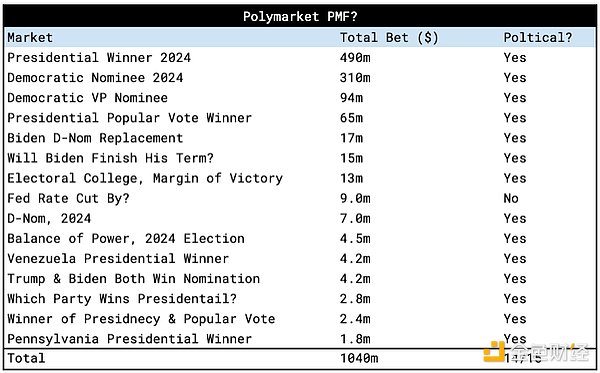

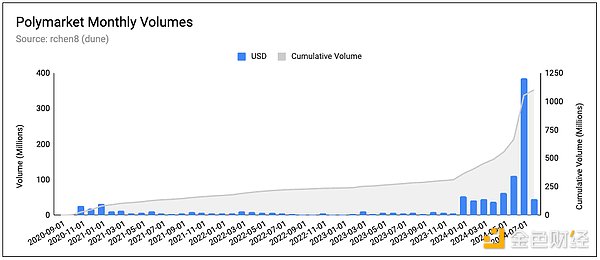

This brings us to Polymarket and their assessment of their PMF. If we look at the top 15 prediction markets by trading volume, 3 indicators stand out:

· 14 of the 15 markets with the largest trading volume Is the political market

· 99.2% ($1.031 billion of $1.04 billion) of trading volume occurs in the political market

· The cumulative transaction volume since its inception (2020) is US$1.1 billion, with two-thirds of the transactions occurring in the past 6 months.

After seeing this data, the question of whether Polymarket achieves PMF becomes increasingly important. Data shows that the vast majority ofPolymarket usage is focused on political markets and the U.S. election—This makesPolymarket a“ Shiny new toy”.

Multicoin Capital’s Kyle Salami made an interesting point in his tweet, stating that prediction markets and their success are truly What matters is regularity. The irregular nature of political events means that while these markets are able to attract significant user engagement and media attention, they occur too infrequently to sustain ongoing user activity and revenue. This irregularity limits the ability to extract consistent lifetime value (LTV) from users, which is critical to justifying high customer acquisition costs (CAC). Looking at the data, the logical conclusion is that without elections, the platform may struggle to maintain the continued user engagement necessary for a thriving prediction market platform.

From the available evidence, it is undeniable that Polymarket's recent success is almost entirely the result of the election, but there are also Think Polymarket has the tools to turn adoption into a sticky user base. As emphasized at the beginning, the rise of 1000x gambling culture and the socialization of gambling culture will only become more and more common, and Polymarket is ready to capture the capital flow downstream of this trend. The ability to trade binary outcomes as continuous variables is a new primitive that has not received enough attention, and we believe it is a significant upgrade to the static probabilistic status quo. Polymarket’s user onboarding process is abstract enough that non-crypto-native users will encounter few obstacles during the login process, which at least puts it on par with competitors such as Betfair. Additionally, they are essentially Web3 protocols, which makes them the most popular protocols in a market dominated by players with gambling tendencies. Last but not least, they have successfully raised a total of US$70 million so far. Just recently, the company announced it would close a $45 million Series B round in May, with investors including Peter Thiel's Founders Fund and Vitalik Buterin. This track should allow them to stay afloat while adjusting their business model.

4, market maker’s perspective

We have The protocol mechanism of Polymarket has been studied in depth, but the betting market is a two-sided test. It helps us understand the people who provide us with the liquidity to place our bets. To do this, we interviewed an anonymous person.

Q: Can you tell me how you view fair value in pricing outcomes? And poison flow/adverse selection?

A: The first thing I want to say is that I do market making manually, in a way that extracts value from Polymarket, rather than building a sustainable Algorithms make money by providing liquidity. The markets I make generally have reference markets with good liquidity. So fair value is usually the volume-weighted average of the exchange's trading volume.

Q: What are your input variables? Or can you tell me about your market-making mechanism?

A: My main focus is on the historical high levels of daily rewards, trading volume and order book liquidity to calculate reward returns. Based on this, I made an educated guess as to how much would be lost in providing liquidity.

Q: How do you choose a market? How do you see the difference between single markets and multiple outcome markets?

A: What I mainly choose is the sports market or the market that can be arbitraged, such as "Will Biden withdraw from the election?" "Will Biden and Trump withdraw from the election?" Winning nominations at the same time? “Multiple outcome markets simply provide more inputs to fair value, making it harder to market. Price discovery can occur in any outcome market, and other markets need to take this factor into account as well.

Q: How do you absorb external information (Bayesian inference), and how do you change your strategy/liquidity based on this?

Answer: Usually an all-or-nothing strategy. If there's a clear enough advantage, I'll take it. If the advantage disappears because I can't easily take into account new information in the market, I stop providing liquidity.

Q: What is the difference between market making on Polymarket and market making on a centralized exchange (CEX)?

Answer: CEX market making is real market making. Polymarket has spreads of more than 10% and more serious poisonous flows. The only way for market makers to feel good is to pursue incentives. Traditional market makers compete for profits in high-volume markets like the presidential election market - these firms, like SIG or other similar large market makers, profit through structural advantages. Specifically, they are connected enough to be able to hedge their order books off-exchange. One more thing, I once marketed CS:GO skins. The Polymarket experience is very similar to that of a real market maker.

Q: What is the biggest challenge you face?

Answer: There is a lack of profit and loss opportunities to establish actual quantitative models. Sports betting had the same problem early in its market structure. Professional companies are not involved in market making, so their efficiency is very low, so manual market makers and less mature market makers can make reasonable profits and losses on small order books.

Q: Is there any other relevant information that I haven’t asked you that you would like to share with us?

A: Another thing I probably should have mentioned but didn't is that "market makers" are likely using similar strategies to take advantage of dYdX v3 liquidity incentives, but I haven't looked into this because I don't really care that much. All optimal order book liquidity is equal, so algorithmic traders participating in more liquid markets (such as the Trump vs. Harris presidential election) are able to earn rewards without taking on greater P&L risk . The general strategy is to quote the tightest spread available, usually 1p (1-3%, depending on odds), and refresh your order when the next price in the queue is executed. This way you always provide the best order book liquidity, but you are always last in line for the best order book quotes, so your orders are never affected. I'm too lazy to do it, but this strategy alone could result in a P&L of hundreds of thousands of dollars per year.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance XingChi

XingChi JinseFinance

JinseFinance JinseFinance

JinseFinance Medium

Medium Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph