Author: NP Hard Source: X, @xingpt

In the cryptocurrency industry, for technology-type projects, we often need to distinguish between short-term narrative and long-term value to identify what type of project is a hyped bubble asset and what kind of project is technically With long-term value, of course, good projects can also have both popular narratives and long-term value, and hyped bubble assets are not worthless.

This article mainly discusses the hype logic of the future Bitcoin ecology, but before that, let us first learn from Ethereum, which is the most successful on the road of hype. how to develop its narrative.

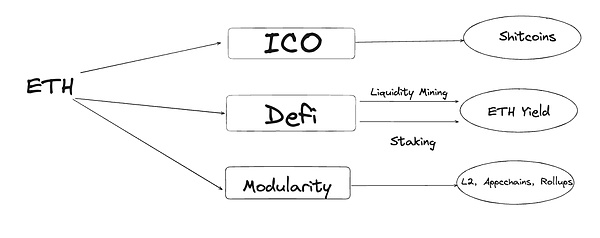

1. Learning from the narrative of Ethereum’s hype road

1. ICO - Creating fair but useless assets

When Ethereum was in its infancy, it needed to find an independent platform independent of Bitcoin and The independent positioning of derivative currencies means that they can support smart contracts to run various applications. The first type of application is ICO, which emphasizes fair token launch, that is, raising ETH and giving users the Ethereum format of the project. erc20 token,Due to the low market capitalization of the new coin, the price surged early, which led to the outbreak of Ethereum's first asset hype frenzy - the ICO boom.

Although looking back today, 99% of ICO projects have no value, the hype of ICO assets has made Ethereum a solid application launch platform The product positioning was later packaged as a cooler-sounding "world computer".

2. DeFi and NFT

After Ethereum experienced a decline in 18 and 19, the last bull market in 20-22 mainly experienced two rounds of mainstream hype:First, DeFi assets, whose underlying product logic is to use Ethereum’s native currency ETH to Be a "shovel" and provide ETH liquidity in various lending, DEX, derivatives and other protocols in exchange for project tokens. Different from ICO, ETH is no longer used as investment principal, but as collateral. The user experience is: I can obtain new tokens for free, and use the user's "free prostitution" mentality to quickly seize users.

However, the model of selling useless assets similar to ICO is still continued through the hype of NFT. NFT meets several major characteristics: " "Useless" - there is more room for speculation, "low circulation and low market capitalization" - early participants can obtain huge benefits, "fair" - everyone has the opportunity to participate except whitelist users. (Note: We will not discuss the differences in cultural communication attributes between NFT and ICO here, but only discuss the similarities in asset speculation.)

3 , Meme

Although Shib and Zoo Quotes opened up the meme gameplay, it was not until the emergence of the Pepe series that Meme became a separate track. However, the current problem with meme is that it is difficult to accommodate multiple large-market value projects. Only 1-2 leaders can achieve a market value of more than 1B. Therefore, it is not enough to drive the increase in the market value of Ethereum itself.

From the same perspective, we can also observe the reasons why this round of ETH performance is not as good as expected. There is a lack of low-liquidity assets similar to NFTs that can be sold. There is no function as a "shovel". Arb/OP/Stark, etc. will not give you the opportunity to deposit ETH to mine Layer 2 local currency. There are only exceptions like Manta and Blast, and the upper limit of coins mined by restaking cannot be reached. to the market value of public chain Layer 2, so ETH has weakened this round.

For ETH, Celestia, which has performed well, has taken the "shovel" attribute to the extreme through modular narrative. In terms of "junk" assets, Solana has also promoted Memes with huge growth such as Bonk and Wif. At the same time, many airdrops in the Sol ecosystem such as Pyth, Jupiter, and Jito have also given SOL some "shovels." Attributes.

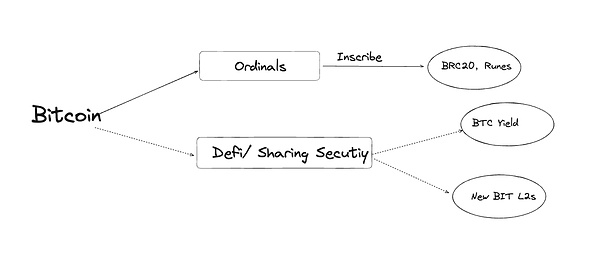

2. Conjecture on the direction of Bitcoin ecological hype

For Bitcoin ecology, the biggest change in this market cycle is the inscription , is also the first time that "junk" assets are directly issued on Bitcoin, and it has the attributes of low circulation, fair distribution, and low market value. The question is, how can Bitcoin play in the post-Inscription era?

Following the above logic of using Bitcoin as a "shovel", here are a few conjectures.

1. Staking Bitcoin to earn interest

Bitcoin Ecology One of the leading projects, Babylon, provides BTC Staking, and wants to implement Slashing on the Bitcoin network to ensure the security of the issued Cosmos public chain by staking Bitcoin permissionlessly. The two narratives of using Bitcoin as the underlying interest-earning asset and using the Bitcoin network to ensure the security of the public chain are attractive enough. Therefore, Babylon has dominated the primary market and is sought after by major VCs, but in reality For Bitcoin to play the role of a shovel, two conditions are needed:

First, the value of Po S coins mined using the Babylon protocol is high enough and the quantity is large enough;

Second, the Bitcoins pledged through the Babylon protocol also meet a certain volume. If the TVL is too low, the narrative of Bitcoin network security will not be established.

Both conditions require top-level BD resources to promote, and they need to be in BitTorrent at the same time. It is not easy to work together on both the currency ecology and the Cosmos ecology. Projects that want to imitate Babylon need to carefully consider whether they have the ability to raise more than 100 million US dollars.

2. Staking Bitcoin for mining

Staking Bitcoin mining is a cold start method used by many emerging Bitcoin Layer 2, such as BSquare, MerlinChain, etc.;But for Bitcoin holders, there are two significant problems, First, security Safety,Bitcoin is deposited into the second-layer network through a cross-chain bridge, which requires trust in the security of the second-layer network contracts and nodes. Compared with the security of the Bitcoin network, it is significantly degraded;Second, it is inconvenient to operate,< /strong>Unlike Celestia, which is a Cosmos-based chain, users who pledge TIA once can get multiple project airdrops, while Bitcoin’s second-layer mining requires users to jump between different protocols, which is not a good experience for users. Friendly, but with a lot more operational risks.

Another challenge is also the issue of income. The value of the chain dug out by the shovel is also worthy of consideration. If there is no year If the income is 10% or even 20% or more, it is difficult to attract Bitcoin majors to take risks to mine the tokens of the new chain.

Therefore, the project side of this model needs to pre-emptively seize the limited number of high-risk Bitcoin investors as early as possible (which is not a high percentage), and it is necessary to increase the value of the local currency as much as possible, including listing on exchanges, launching ecological projects, etc., which are more beneficial to projects with experience in entrepreneurship or asset operation in the currency circle.

3. Use Bitcoin as financing to issue "junk" assets

The reason why "junk" assets seem "useless" but people pay for them is because of their very innovative narrative methods. The narrative of Inscription is about the revival of Bitcoin, and NFT is about cultural out-of-circle.

Currently, Runes has the most complete foundation. The founder is Casey from Ordinals, and various community games similar to RSIC continue to play. Appear. The BRC420 blue box once issued by Merlin's project partner RCSV can be said to be a typical example of a story that starts from the issuance of new assets, focuses on hype assets, and finally returns to larger infrastructure.

Other new Bitcoin second-tier public chains and cross-ecological public chains like Babylon may not only need to think about how to make a more decentralized For a safer second-layer public chain (as the narrative basis of orthodox projects), before launching the chain, we should also plan how to create new asset classes and how to distribute assets more innovatively and fairly, rather than just absorbing the Bitcoins in the hands of users to airdrop So simple.

So how to “package” a perfect Bitcoin ecological infrastructure project?

First of all, we hope to allow Bitcoin users to stake trustlessly In our protocol, there is no need to use cold wallet fund transfers, and it uses underlying verification logic similar to Bitcoin's native, similar to Bitcoin Convenant, DLC, etc.;

Secondly, we hope that the interest or new assets obtained from staking can be exchanged for Bitcoin in some way, which will generate a very attractive annualized return from the perspective of Bitcoin standards;

For degens, newly issued assets have a relatively fair way to participate, which can relatively limit the financial advantages of large households and reward early community core users of small groups. This I also explained the topic in my previous article (https://www.noweb3.ai/p/dapp).

Finally, participate in the construction of open source communities as much as possible, contribute basic development tools and documents of Bitcoin, reward open source communities, etc. , giving back to the community is an important non-technical means of gaining legitimacy, even more important than the technical means themselves.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Bernice

Bernice JinseFinance

JinseFinance Bitcoinworld

Bitcoinworld Cointelegraph

Cointelegraph 链向资讯

链向资讯