Source: MiaoTou APP

"Hawkish rate cut" is coming.

In the early morning of December 19, 2024, the Federal Reserve announced a 25 basis point rate cut, lowering the target range of the federal funds rate from 4.5%-4.75% to 4.25%-4.5%. This is also the third consecutive rate cut by the Federal Reserve after September and November, and the cumulative rate cut for the whole year has reached 100 basis points.

Although the rate cut is in line with market expectations, the "hawkish" remarks of Federal Reserve Chairman Powell have made the market "ice and fire".

Powell pointed out that the FOMC statement has added wording about "adjusting the rate and timing of interest rates", which means that the Federal Reserve is or will soon slow down the pace of rate cuts. The updated Federal Reserve dot plot shows that among the 19 FOMC members, 10 support two rate cuts next year, and the other 3 support one or three rate cuts. In September, the market generally expected the Fed to cut interest rates four times in 2025.

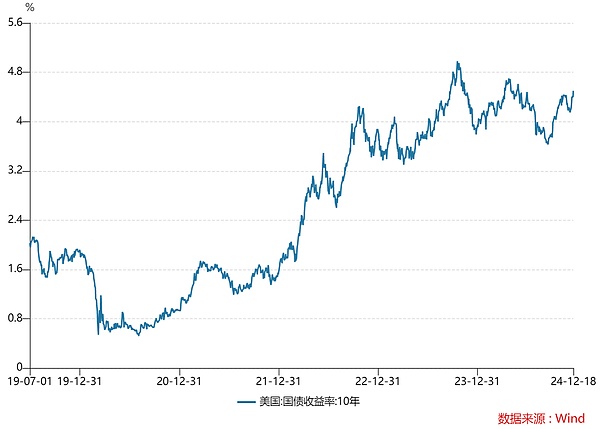

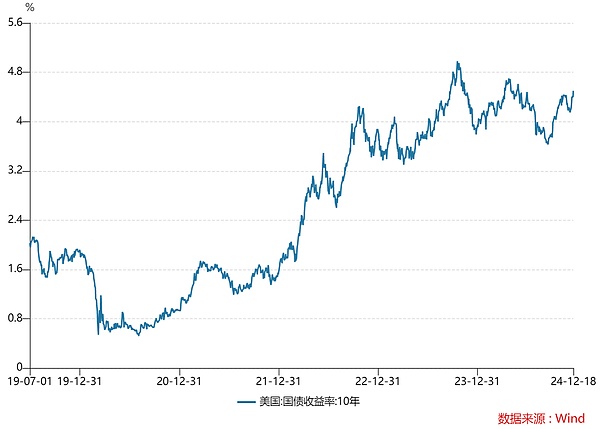

This "hawkish rate cut" triggered violent market fluctuations. The three major U.S. stock indexes plunged across the board. As of the close, the Dow Jones Industrial Average, the S&P 500 and the Nasdaq Composite Index fell by 2.58%, 2.95% and 3.56% respectively; precious metal prices plummeted, and spot gold fell by 2%; at the same time, the U.S. dollar index rose sharply, reaching 108.28 at one point, setting a new high in 2023; the 10-year U.S. Treasury yield also rose in the short term.

Looking back on Powell's leadership over the past four years, he cleverly used words and policy signals to not only successfully guide market expectations, but also effectively reduce market uncertainty and violent fluctuations, and can be called a "master of expectation management." Therefore, his remarks are more about guiding market expectations rather than making final decisions.

Based on the following analysis, we believe that Powell's drama will not last too long, and the Federal Reserve is likely to continue to implement loose monetary policy, which will provide greater operating space for my country's monetary policy and bring positive benefits to the A-share market.

On December 9, the Political Bureau of the CPC Central Committee sounded the clarion call for economic policies in 2025, clearly proposing to implement a more active fiscal policy and a moderately loose monetary policy. The expression "moderately loose monetary policy" appeared again in high-level documents after 12 years - this is no small matter, and it means that the policy tone is undergoing an important change.

And this change requires the support of the Federal Reserve's loose monetary policy.

But the question is, why do we think Powell has to cut interest rates? All this needs to be answered from the current high debt level and increasingly severe fiscal deficit problems in the United States.

#01 Borrowing new debt to repay old debt

There is a serious problem with the current fiscal situation in the United States - borrowing new debt to repay old debt. Simply put, the government repays the principal of old debts due by issuing new bonds, which is essentially similar to a "Ponzi scheme". Although this method can maintain fiscal operations in the short term, in the long run, this debt-dependent model is extremely unstable.

If the Fed chooses not to cut interest rates or even raises them, the US fiscal deficit will further deteriorate, which will not only increase the government's debt burden, but may also put tremendous pressure on the stability of the US economy, and eventually trigger a series of chain reactions.

Since the 1980s, the scale of US debt has continued to soar. In 1990, the total US government debt was about 3.2 trillion US dollars, which increased to 5.62 trillion US dollars in 2000 and further exceeded 13.5 trillion US dollars in 2010. In 2020, the total debt has reached 27.7 trillion US dollars, and in 2023 it will exceed 34 trillion US dollars. As of December 17, 2024, the total US federal government debt reached 36.19 trillion US dollars, breaking the 36 trillion US dollar mark, setting a record high.

The culprit for the growing debt in the United States is the division of the American party system, especially the game between the two parties on fiscal policy.

The American party system is based on a two-party system, mainly the competition and cooperation between the Democratic Party and the Republican Party. Due to the large differences in the concepts and priorities of the two parties in economic policy, social policy and fiscal management, their game on fiscal policy often affects the efficiency and consistency of decision-making.

The game between the two parties often leads to solving fiscal problems by increasing debt in the short term, but lacks long-term fiscal reforms and deficit control measures. This situation has exacerbated the expansion of US debt and may eventually affect the country's fiscal sustainability.

The process of accelerated debt expansion itself is not new, but the problem is that if market interest rates rise or the Federal Reserve raises interest rates, the government's new debt interest will be higher than before. As of the end of September 2024, the weighted average interest rate on outstanding U.S. federal debt was 3.32%, about the highest level in 15 years.

For example, especially after the epidemic, U.S. interest rates were at a historical low at the end of 2021, with the yield on 10-year Treasury bonds at about 1.5%. Low interest rates allow the U.S. government to issue new bonds at low cost and easily deal with rolling debts. But in 2023, as the Federal Reserve raised interest rates, the yield on 10-year Treasury bonds soared to 3.5% or higher. The interest cost of new debt has risen accordingly, which means that the government faces heavier debt repayment pressure.

The consequence of this situation is that the burden of increased government spending, debt rolling and interest payments has increased, while the economic recession and the implementation of a series of tax cuts have caused fiscal revenue to continue to decline. This contradictory situation has led to a continuous expansion of the fiscal deficit.

In order to make up for this deficit, the government can only choose to fill the fiscal gap by issuing bonds, and these new debts bring higher interest expenses, which makes the United States fall into a "vicious cycle of debt" and may eventually fall into the dilemma of "never being able to repay".

The question is, since the US dollar is the global reserve currency, why doesn't the United States directly print money to solve the debt?

#02Why not print money directly?

The main financing methods of the US government include issuing treasury bonds, issuing additional US dollars and tax revenue. Why does the US government prefer to issue bonds rather than directly print money to finance? There are two main reasons:

On the one hand, the issuance of US currency is the responsibility of the Federal Reserve, not directly controlled by the US government.

The US monetary policy is the responsibility of the Federal Reserve, while fiscal policy (such as taxation, government spending, etc.) is formulated by the US government (through Congress and the President). Although the chairman of the Federal Reserve is nominated by the President and confirmed by the Senate, the operation of the Federal Reserve is completely independent of the daily control of the President and Congress.

The U.S. government does not have the power to directly intervene in the Federal Reserve, which means that the Federal Reserve usually does not directly choose to cut interest rates or print money because of fiscal pressure, because the monetary policy goals of the Federal Reserve are mainly to achieve price stability (control inflation) and maximize employment, rather than directly responding to the government's fiscal pressure.

However, if the U.S. fiscal situation deteriorates, it may trigger problems such as economic slowdown and financial market volatility, which will indirectly affect the Fed's policy.

On the other hand, printing money is not a "panacea", but a double-edged sword that may put the United States in deeper trouble.

As the world currency, the U.S. dollar gives the United States a powerful "coinage privilege". Thanks to the global demand for the U.S. dollar, the United States can not only easily finance, but also purchase almost all goods in the world through the U.S. dollar-after all, 60% of global foreign exchange reserves and 40% of global trade settlements rely on the U.S. dollar.

However, this does not mean that the Federal Reserve can "print money" at will-the widespread circulation of the U.S. dollar is not equivalent to unlimited currency over-issuance. If the Fed prints too much money, the additional dollars will eventually flow back to the United States, which will inevitably increase the domestic money supply and push up inflation.

This inflationary pressure will lead to the depreciation of the US dollar, and may even turn the US dollar into "waste paper", accelerating the process of "de-dollarization" worldwide.

At the same time, with more US dollars in the market, investors' concerns about risks will also increase. In order to cope with inflation, investors will demand higher returns, which means that future debt issued by the United States will face higher interest rates. The increase in debt interest burden will not only fail to alleviate the United States' fiscal difficulties, but will make the debt problem worse and enter a "vicious cycle".

So, although printing money can avoid high interest burdens in the short term, it will lead to currency depreciation and economic instability in the long run, while issuing bonds can raise funds from the international market at low cost. Countries around the world generally use the US dollar in international trade, and many countries and companies hold the US dollar as a reserve currency, which provides the United States with the advantage of low-cost financing, especially by issuing US Treasury bonds to raise funds.

However, it is worth noting that although over-reliance on debt financing can temporarily alleviate short-term funding needs, in the long run, this strategy of "borrowing more money" will undoubtedly aggravate the fiscal crisis. On the one hand, the government needs to face the growing debt burden, and on the other hand, it has to rely on debt financing. This situation may lead to increasingly serious financial problems.

If the Fed does not cut interest rates or even raises interest rates, it may cause the US fiscal deficit to continue to deteriorate, which may eventually affect the stability of the US economy and lead to a decline in global trust in the US dollar, and even the United States may face fiscal bankruptcy.

#03 The Fed has to cut interest rates

To break this vicious cycle, there are two theoretical ways out: increasing federal revenue or reducing fiscal spending. However, in reality, the implementation of both is full of difficulties-Trump's tax cuts will further reduce revenue, and considering the United States' global military strategic position and domestic political pressure, it is almost impossible to cut the defense budget.

In this case, the Fed may choose to cut interest rates to reduce the government's debt burden. Although interest rate cuts cannot fundamentally solve the debt problem, they can temporarily ease some of the pressure of interest payments and give the government more time to deal with the huge debt burden.

But the impact of interest rate cuts goes far beyond this. In fact, it is also highly consistent with Trump's "America First" policy. One of Trump's core policies is to promote the return of manufacturing. He hopes to improve the competitiveness of domestic production in the United States, especially in terms of price, through measures such as tax cuts and deregulation. Interest rate cuts will lead to a weaker dollar, making American goods cheaper in the international market, thereby enhancing the global competitiveness of American manufacturers.

Of course, new problems will also follow from interest rate cuts.

The biggest motivation for global investors, including central banks and institutional investors, to buy U.S. debt is based on the "golden credit" of the dollar and the fiscal endorsement of the U.S. government. However, as the U.S. fiscal deficit continues to expand, the risk premium of U.S. debt has begun to rise. In other words, investors may demand higher returns (i.e. interest rates) to compensate for possible risks.

At this time, if the interest rate of US debt falls instead of rising, the attractiveness of US debt will inevitably decrease significantly, which may greatly reduce the demand for US debt by investors, especially in the context of the gradual decline of the credit of the US dollar, the willingness to buy US debt will be further weakened.

In fact, many countries holding US debt have begun to reduce their holdings. After 2022, the top six countries that reduced their holdings of US debt include China, Japan, Poland, Vietnam, Iraq and the Czech Republic. These countries once purchased US debt through trade surpluses to provide financial support for the US economy, but now this "capital chain" is gradually breaking.

(Image source: Huayuan Securities)

In this case, the Fed was forced to buy "unsellable" Treasury bonds, which directly led to the expansion of its balance sheet, which is a typical "balance sheet expansion" behavior. Since the outbreak of the epidemic, facing the economic shock, the Fed has rapidly increased its asset purchases, causing its balance sheet to expand sharply in the short term. As of early 2024, the total size of the Fed's balance sheet has reached about 8.5 trillion US dollars.

The Fed's continued "balance sheet expansion" has increased market liquidity. If the economy recovers, consumer confidence rebounds, and market demand picks up, excessive money supply may eventually lead to high inflation. The Trump administration may increase production costs by increasing tariffs and implementing tough immigration policies, which will further increase inflationary pressure. This situation will obviously increase the pressure on the Fed to continue to cut interest rates.

The Fed is in a dilemma - although interest rate cuts can ease debt pressure, under the trend of "de-dollarization", low interest rates will further weaken the attractiveness of US debt, forcing new debt to rely on the Fed's balance sheet expansion, which may trigger high inflation; while interest rate hikes will help maintain the operation of the "borrowing new debt to replace old debt" model, but this will increase the risk of US fiscal collapse and even affect the overall economy.

But choose the lesser of two evils.

As we mentioned before, although the risks of economic confrontation between China and the United States are accumulating, this confrontation is not without a ceiling, but has certain boundaries and constraints. Once this boundary is broken, the situation faced by the Fed will be more severe. Therefore, high inflation may not erupt as expected.

In short, the Fed has almost no choice but to embark on the path of continuous interest rate cuts, and Powell's "expectation management" will not work for a long time. This is not only an inevitable choice for the United States, but also provides greater room for operation for my country's monetary policy. At the same time, this once again supports our previous view that in the long term, the US dollar is down and gold is up.

Alex

Alex