Source: Bitcoin Magazine; Compiled by: Song Xue, Golden Finance

Bitcoin halving event is coming

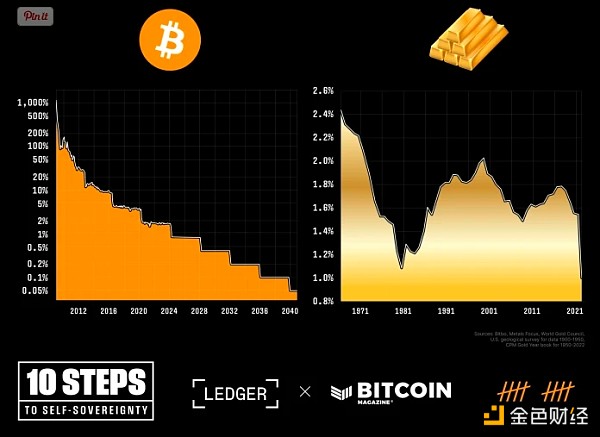

For the first time since its birth, Bitcoin's annual inflation rate is lower than that of gold, a typical means of value storage. When the Bitcoin block height reaches 840,000, Bitcoin's annual supply will be reduced by half, causing its annual inflation rate to drop from 1.7% to 0.85%. In contrast, gold supply is expected to increase by 1-2% each year, depending on technological changes and economic conditions.

To date, Bitcoin has undergone three halving events:

November 28, 2012: Bitcoin's block subsidy was reduced from 50 BTC per block to 25 BTC per block.

July 9, 2016: Bitcoin's second halving reduced the block subsidy from 25 BTC per block to 12.5 BTC per block.

May 20, 2020: Bitcoin's third halving reduced the block subsidy from 12.5 BTC per block to 6.25 BTC per block.

The upcoming fourth Bitcoin halving is expected to occur on April 20, 2024 at 11:35 EST, and with it the new supply of Bitcoin per block will decrease from 6.25 BTC to 3,125 BTC. Over this period (210,000 blocks or approximately 4 years), Bitcoin’s supply will increase by 164,250 BTC (from 19,687,500 to 20,671,875), leaving it only 328,124 more Bitcoins away from the maximum supply limit of 21 million.

Gold Throughout the Ages

A benchmark often used to emphasize the store of value function is that the value of an ounce of gold matches the price of a “gentleman’s suit” over time. This principle, known as the “gold to decent suit ratio,” dates back to ancient Rome, where a top-notch robe was said to cost the same as an ounce of gold. 2,000 years later, the value required to purchase a high-quality suit still approaches the price of an equivalent ancient Roman toga.

While gold has for many years been highly consistent with the expectations of purchasing a men’s suit for its holder, the lustrous yellow metal has its challenges.

For example, the cost of verifying or analyzing gold requires that it be dissolved in solution or melted. This is certainly a challenge for those who want to purchase everyday household items with a hard-earned store of value.

In addition, the cost and onerous nature of transporting and storing gold itself arguably led to the demise of the gold standard. While certificates of deposit were historically redeemable for gold, the underlying commodity was often rehypothecated, leading to the United States’ permanent abandonment of the gold standard in 1971, resulting in the infamous “Nixon Shock.”

That’s not to mention the risks associated with obtaining physical gold, whose physical nature reaffirms the risks and responsibilities of its function as money. I’m reminded of Executive Order 6102, where then-President Franklin Delano Roosevelt prohibited “hoarding of gold coin,” highlighting the unique challenges of adequately and privately insuring precious metals of great value.

Bitcoin from Speculation to Safe Haven

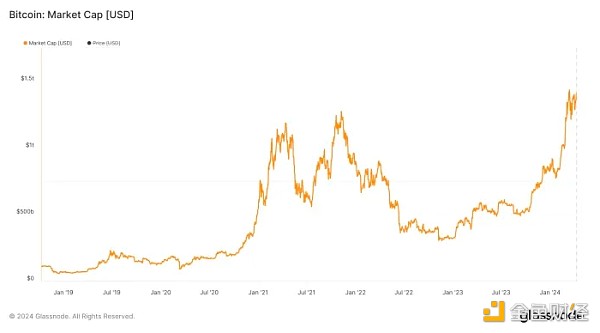

Originally viewed as a speculative asset due to its early price volatility, Bitcoin is increasingly viewed as a store of value. Today, investors recognize its underlying value and superior qualities as a monetary asset. Bitcoin offers digital scarcity characteristics while providing a range of use cases that go far beyond precious metals.

As a result, Bitcoin has become a significant force in the economy in just 15 years—with a market cap of $1.4 trillion as of March 13, 2024.

While this growth cannot be attributed solely to Bitcoin fulfilling the requirements of a store of value better than gold, it is certainly promising. The “magic internet money” continues to rise rapidly against gold’s market cap of approximately $15.9 trillion.

Bitcoin’s Perfect Monetary Qualities

Scarcity:Bitcoin has a limited supply of 21 million coins, making it resistant to arbitrary inflation that plagues traditional currencies as well as market-driven precious metal supplies.

Persistence:Bitcoin is a purely data-based, immutable form of money. Its digital ledger system uses proof-of-work and economic incentives to resist any attempt to alter it, ensuring it remains a reliable store of value over time, barring unforeseen catastrophic risks.

Immutability:Once a transaction is confirmed and recorded on the Bitcoin blockchain, it is extremely difficult, though not impossible, to alter or reverse. This immutability, derived from the geographical distribution of the Bitcoin network of nodes and miners, is a key feature. It ensures that the integrity of the ledger is maintained and transactions cannot be tampered with or forged. This is especially important in an increasingly digital world, where trust and security are paramount concerns.

Conclusion

Bitcoin’s rise as a monetary commodity — predictable, immune to terminal inflation, and easily transferable — has earned it acceptance as a store of value among holders. With the halving just around the corner, its scarcity will surpass that of gold for the first time and could serve as a wake-up call for market participants seeking to avoid the drag of currency debasement.

While there are no certainties in life, especially not in investing, Bitcoin’s ability to maintain the integrity of its 21 million supply cap through its decentralized nature is close to certainty.

Gold has performed well. However, with the halving just around the corner, now is Bitcoin’s time to shine.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Nansen

Nansen Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph