Source: Culture Horizon

[Guide] The 2024 US presidential election has come to an end. Behind Trump's "quick victory", the latest developments in money politics have received widespread attention. Statistics show that in sync with Trump's victory in the presidency, 40 of the 58 congressmen funded by the cryptocurrency industry at a cost of $130 million were also declared elected. FairShake Cryptocurrency Group has become the largest super political action committee (Super PAC) in the 2024 election, raising a total of more than 200 million. Some analysts pointed out that Trump, who has shown goodwill to cryptocurrencies, has found new allies in Congress and the government. So, in this most "expensive" election, what exactly does the cryptocurrency field want to win?

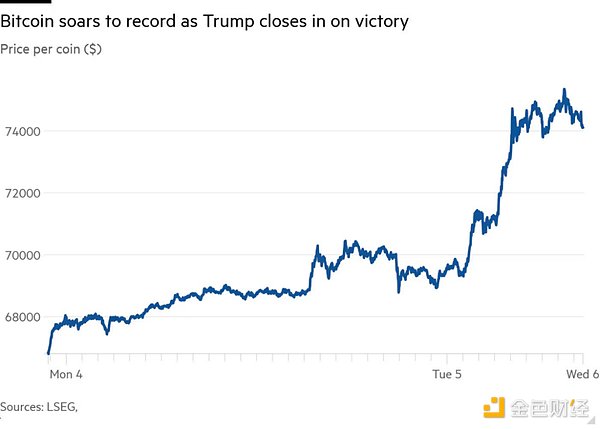

This article points out that Biden's questioning and restrictions on cryptocurrencies during his tenure have caused strong dissatisfaction in the industry. In 2022, FTX, the world's third-largest cryptocurrency trading platform, collapsed, and its founder was sentenced to prison for multiple crimes, including abusing customer deposits for high-risk betting and illegal political donations. To combat fraud, the Biden administration has imposed taxes on cryptocurrency investment gains, attempted to classify more digital tokens as securities, and initiated regulatory lawsuits through the U.S. Securities and Exchange Commission (SEC). In order to reshape the regulatory landscape, they approached Trump and 58 members of Congress. During his campaign, Trump promised to protect crypto assets from excessive regulation, proposed that industry-friendly people serve as SEC chairman, promoted Bitcoin to become a "national strategic reserve", and declared that the United States would become a global cryptocurrency center. As soon as Trump won the election, the price of Bitcoin soared to an all-time high of more than $76,000. The political tacit understanding shown by members of Congress is even more intriguing. None of the campaign ads funded by Fairshake mentioned cryptocurrency, but many of the candidates funded by it publicly stated that they would promote the development of cryptocurrency during their term and mentioned it in their 2025 plans, even though voters in the state did not care about cryptocurrency at all.

Many critics of the Democratic Party compare the risks posed by cryptocurrencies to the 2008 financial crisis. With the deregulation brought about by Trump's election, people are increasingly concerned about global financial stability. At the same time, cryptocurrencies are becoming "mainstream" around the world, so much so that some analysts believe that an "arms race" around digital currencies seems to have begun. If Trump fulfills his promise to support cryptocurrencies, the United States may accelerate the popularity of cryptocurrencies. It remains to be seen how digital assets in other countries will be affected and whether this will prompt the adoption of corresponding competitive measures.

Cryptocurrency helps Trump and allies win the 2024 election

Tony Romm, economic policy reporter for The Washington Post

"This election victory highlights the rapidly rising political influence of the cryptocurrency industry."

After the US election, the cryptocurrency industry, executives and investors were particularly happy. They believe that their political funding has not been in vain, and more importantly, they will usher in four years with almost no government regulation and review-and these four years are enough to bring about earth-shaking changes in the cryptocurrency industry.

Over the years, the elites in the cryptocurrency field have been investing political funds, especially Trump. But this does not mean that the elites of cryptocurrency have turned to the Republican Party. In fact, as long as they are congressional candidates who support cryptocurrency, they will help to run campaign ads.

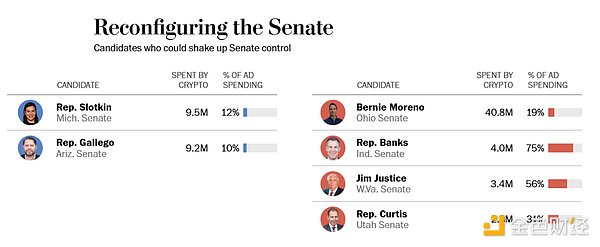

The effect of these efforts is obvious. Trump won the presidency, and 40 of the 58 members of Congress who funded it declared victory. FairShake Cryptocurrency Group has become the largest super political action committee (Super PAC) in the 2024 election. Its funds mainly come from cryptocurrency giants such as Coinbase, Andreessen Horowitz and Ripple. It has raised more than 200 million, of which 130 million US dollars were used for the campaigns of 58 members of Congress.

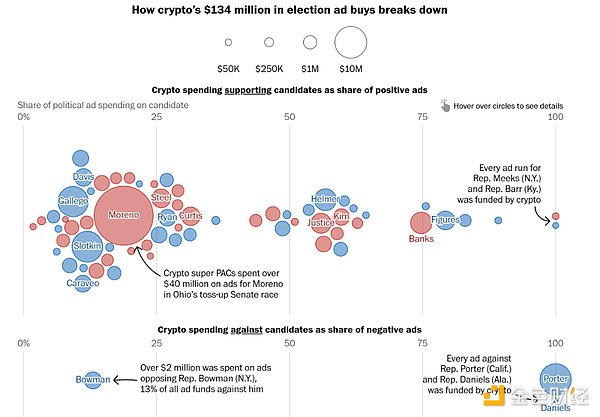

The figure shows the flow of 134 million political funds, and the names of congressmen are in the circle. As can be seen from the above figure, Moreno's expenses accounted for the largest proportion, and cryptocurrency spent a considerable amount of money to promote Brown's defeat; at the same time, they also spent money on "smearing" opposing congressmen who were skeptical of cryptocurrency.

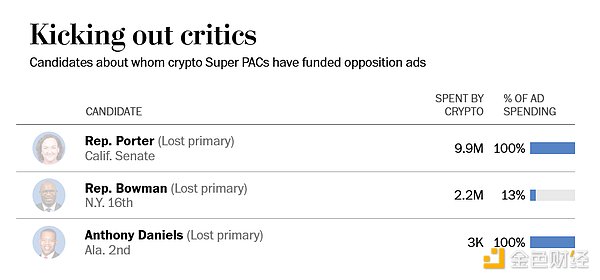

Cryptocurrency political funding has secretly changed the structure of Congress, and avatar virtualizers are opponents of cryptocurrency and are now excluded

Despite the huge amount of funding, the action strategy of cryptocurrency funders is secretive, as shown by Sherrod Brown, the current Democratic Senator from Ohio, and Bernie Moreno, the Republican Senate candidate. Moreno's race is an example. Incumbent Senator Brown is the chairman of the Senate Banking Committee, which regulates digital finance, and has always been skeptical of cryptocurrencies. In order to push him out of office, Fairshake funded his challenger Moreno with $41 million to win the election, but did not want voters to see his intentions, so its political ads focused on Moreno's contributions to immigration and employment, without any cryptocurrency propaganda.

After the election, the funders finally got the chance to reap the benefits. They hope that Trump will fulfill his promise to make the United States a "global cryptocurrency center." This expectation alone has pushed the price of Bitcoin to more than $76,000. They believe that Trump will keep his word. A few months ago, with Trump's help, a cryptocurrency company called World Liberty Financial obtained a business license. After Trump takes office, he can do more.

Bitcoin price trend as of November 5 (this Wednesday)

One of these things is the cryptocurrency-friendly legislation (FIT21). The bill was drafted and passed in the House of Representatives earlier this year, but encountered many obstacles in the Senate and was shelved. This is why Fairshake is so focused on senators in this year's election. If this legislation is passed, the U.S. Securities and Exchange Commission (SEC) will have less regulatory power over cryptocurrencies and transfer more responsibilities to the Commodity Futures Trading Commission (CFTC) - Democratic critics remind that the CFTC's regulatory power will be much smaller than the SEC.

That’s why, after the election, Coinbase Chief Legal Officer Paul Grewal announced: “Last night (the general election) was groundbreaking for the cryptocurrency industry. All elected officials should recognize that this is an industry committed to long-term development.”

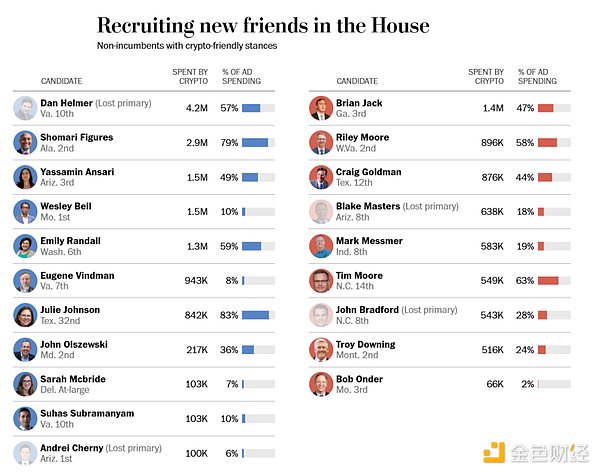

Crypto’s “new political friends”-new members of Congress, cryptocurrency has invested more than $19 million in 20 campaigns, hoping to get support after they win the election (those with clear avatars are the winners, and those with blurred avatars are the losers)

The 2024 election is not an end, but a beginning. Fairshake then announced that they had raised $78 million for the 2026 midterm elections, including funding from Coinbase. Coinbase not only supports candidates, but also reaches out to voters-the organization they funded, "Stand With Crypto," is committed to lobbying voters to accept and support cryptocurrency transactions.

In 2022, the trading platform FTX collapsed, and the Biden administration stepped up its crackdown on cryptocurrencies, sparking dissatisfaction among executives and investors in the cryptocurrency field. Since then, federal regulators have been committed to combating fraud, taxing cryptocurrency investment income, and trying to classify more digital tokens as securities for increased supervision.

Therefore, the U.S. Securities and Exchange Commission (SEC) is the main regulator, and its chairman, Gary Gensler, has filed major lawsuits against major platforms such as Coinbase, Ripple, and Binance in recent years, accusing them of violating investor protection regulations. All companies have denied the allegations.

They were unwilling to sit still and wanted to reshape the regulatory landscape through political intervention, so they found Trump - they held fundraisers for the former president in the Bay Area and met with him privately at his Mar-a-Lago estate (where he gave his final victory speech). Sponsors included PayPal co-founders David Sachs and Chamath Palihapitiya, and twin brothers Tyler and Cameron Winklevoss, founders of the trading platform Gemini. With their unremitting efforts, Trump went from being initially skeptical to being a strong supporter of cryptocurrencies.

At the 2024 Bitcoin Conference in Nashville, Trump promised to set up a committee of industry experts and promote policies that are favorable to cryptocurrencies. He also promised to make Bitcoin a "national strategic reserve" and fire Gensler, chairman of the U.S. Securities and Exchange Commission (SEC). These promises have once again sparked a warm response after Trump's victory.

Cameron Winklevoss wrote passionately on social media: "Imagine how much we will achieve in the next four years if the cryptocurrency industry no longer has to spend billions of dollars fighting the SEC, but invests these funds in the future of currency. Amazing things are coming."

The investment in the cryptocurrency industry is huge, especially the need to bet on both sides. Fairshake and its two affiliates - focusing on funding the Republican "Defending American Jobs" and supporting the Democratic Party's "Protecting Progress" - have become all aspects of the campaign when they first funded the election and are committed to becoming the main funders.

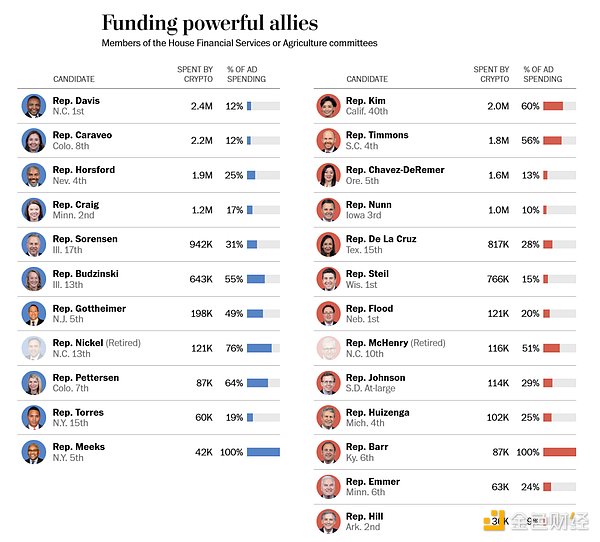

For example, they invested about $3.4 million in the campaign of Jim Justice, the current governor of West Virginia, and nearly $2.9 million in Shomari Figures, a Democrat and former Justice Department official in Alabama. They also support incumbents who serve on key congressional committees that regulate cryptocurrencies, including Tom Emmer (R-Minn.) and Josh Gottheimer (D-NJ) of the House Financial Services Committee.

Crypto has funded nearly $18.4 million in passionate ads for 23 lawmakers who hold important positions on key congressional committees that directly regulate cryptocurrencies.

Take the example of Moreno, Ohio, mentioned above, which proves the determination of cryptocurrency bigwigs to deregulate. When they funded Moreno, Moreno was 7 percentage points lower than Brown, then chairman of the Senate Banking Committee, which oversees digital finance. In order to increase his chances of winning, the political advertising can be described as "crazy". After spending 41 million, Brown was finally driven off the stage. A Fairshake spokesperson firmly stated: "Senator Moreno's reversal victory shows that Ohio voters are looking forward to a leader who values innovation, protects the economic interests of the United States, and ensures the country's technological leadership." Interestingly, none of the ads funded by Fairshake mentioned cryptocurrency, but many of the funded candidates publicly stated that they would promote rules that would help the cryptocurrency industry during their tenure and mentioned it in their 2025 plans. Kristin Smith, president of the Blockchain Association, a Washington lobbying group, said: "We are celebrating, but we are also planning how to develop and utilize this advantage. The biggest lesson in the past is that it is meaningless to oppose cryptocurrency. Any emerging industry does not want to get too involved in politics, but the "unfair" experience that cryptocurrency has suffered in the past three or four years has forced us to fight back."

Cryptocurrency hot money is pouring into Washington, and regulation is becoming more moderate-the past and present of FIT21

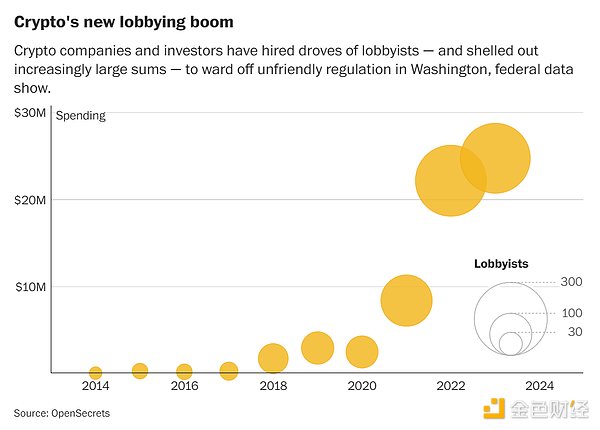

Large cryptocurrency companies are trying to change federal laws through high-cost lobbying activities, an action that touches multiple levels of U.S. politics. Over the past four years, these companies and investors have spent at least $149 million to prevent strict regulatory measures and support the election of their congressional allies, while attacking lawmakers who are seen as threats.

According to documents analyzed by The Washington Post and data provided by OpenSecrets and Public Citizen, two organizations that monitor money politics, the industry has invested more than $60 million on Capitol Hill to formulate federal policies since 2021. The lobbying campaign prompted the House of Representatives to advance the Financial Innovation and Technology Act for the 21st Century (FIT21), the first major legislation on cryptocurrency passed by both chambers of Congress.

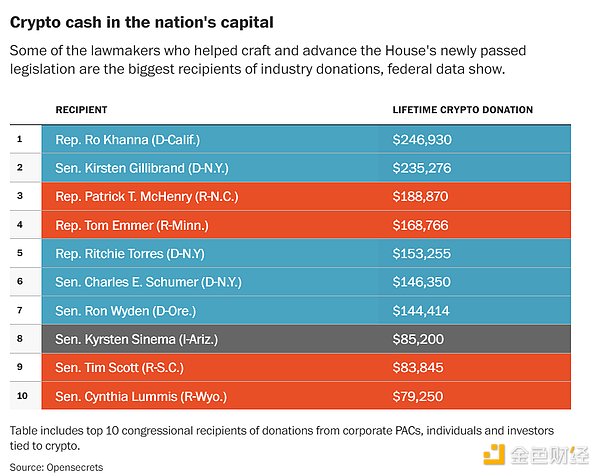

The bill transfers some federal cryptocurrency regulatory power from the U.S. Securities and Exchange Commission to the Commodity Futures Trading Commission (CFTC), which is considered less powerful, underfunded, and more industry-friendly. Analysis shows that executives, investors, and even employees in the cryptocurrency field donated as much as $90 million in political donations in the past two elections, and this spending figure may be underestimated (because federal campaign finance laws do not require some non-profit organizations to disclose their sources of income).

They support the bill's designers and advocates, including House Financial Services Committee Chairman Patrick Timothy McHenry. The day before the House bill was passed, McHenry admitted in an interview with reporters that cryptocurrency companies are "mature" in many ways in Washington, and this new dynamic of "knowing the times" is an important reference for congressional legislation.

Two years ago, FTX, the world's third-largest cryptocurrency trading platform, collapsed. After the collapse, many lawmakers warned that a wider collapse of cryptocurrencies could threaten the entire economy. FTX was once worth as much as $32 billion. In March of this year, Sam Bankman-Fried, the former leader of FTX, was sentenced to 25 years in prison by a federal court for abusing customer deposits for high-risk bets and illegal political donations, causing FTX to go bankrupt and customers to demand a refund.

The collapse of FTX made the cryptocurrency field feel politically "threatened", and the number of political lobbying groups quickly increased from 58 in 2020 to more than 270 by the end of 2023. The Commodity Futures Trading Commission (CFTC), the regulatory agency they requested to transfer, not only has little power, but was originally responsible for regulating corn and grain futures. They believe that such "unprofessionalism" will be relatively friendly to the cryptocurrency field.

The political lobbying investment in the cryptocurrency field has doubled over time

Although FIT21 was proposed by the House of Representatives, cryptocurrency lobbyists and lawyers, mostly from the legal departments of cryptocurrency companies, admitted that they were deeply involved in the drafting of the bill. They simplified or even deliberately ignored many legal procedures for companies in the industry, including the appropriate relaxation of financial disclosures that had to be provided to customers earlier, and shortened the time for investors to appeal to a very short range. These clauses protect the rights and interests of companies, but put investors at greater risk when trading.

The amount of political funding from cryptocurrencies received by officials involved in drafting and promoting House legislation

The close proximity of the cryptocurrency industry and the government has aroused the vigilance of consumer regulators. They are worried about regulatory loopholes and even more worried about how many opportunities these loopholes provide for financial institutions, including cryptocurrencies. Maxine Waters, the Democratic leader of the House Financial Services Committee, warned that FIT21 puts the cryptocurrency field completely under a "privileged" structure and "will allow cryptocurrency companies to completely ignore many compliance regulations that other companies must comply with."

Despite the controversy, lawmakers passed the measure by 279 votes to 136, marking the latest victory for the industry. In addition, Congress voted this month to restrict other SEC policies, and the House of Representatives voted to block the Federal Reserve from issuing digital dollars.

Many Democratic critics compare the current situation to the 2008 financial crisis, when Congress failed to prevent several large banks from underwriting risky mortgages. The financial crisis and subsequent recession caused about 6 million people to lose their homes, and the U.S. government spent trillions of dollars to help the country out of trouble.

Senator Elizabeth Warren said: "Before the 2008 financial crisis, I have always emphasized that we did not have enough regulation on banks. I feel the same way today. If we do not put in place adequate regulatory measures and allow cryptocurrencies to enter our economy more deeply, the final outcome will be terrible."

Crypto companies strongly oppose this comparison, believing that members of Congress do not understand this new and fast-paced industry. In order to further consolidate their support on Capitol Hill, they have set their sights on this year's election. As enumerated in the previous article, more than half of the members of Congress have received political funding from the cryptocurrency field.

It is worth mentioning that in West Virginia, State Treasurer Riley Moore won the Republican nomination for Congress and quickly gained support from the cryptocurrency industry - they put an ad for him about how Moore revitalized the manufacturing industry, created jobs, and took a "tough" stance on China, and pushed the ad to the televisions and mobile phones of more than 10 million Americans. In order not to deceive voters, he also added a small tofu block on his campaign website about "cultivating the emerging industry of cryptocurrency." West Virginia is one of the poorest states in the United States, and the people there don't care about cryptocurrency at all.

Alex

Alex

Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo