Author: Paopao; Source: World Chain Finance

1、PYUSDbecame the world's sixth largest stablecoin

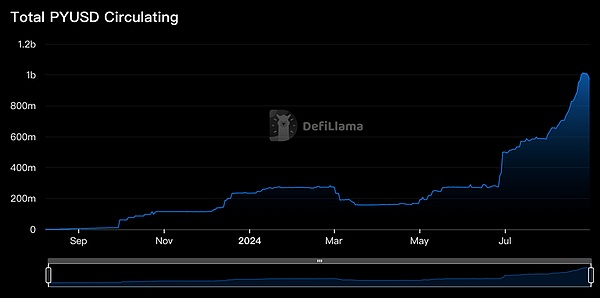

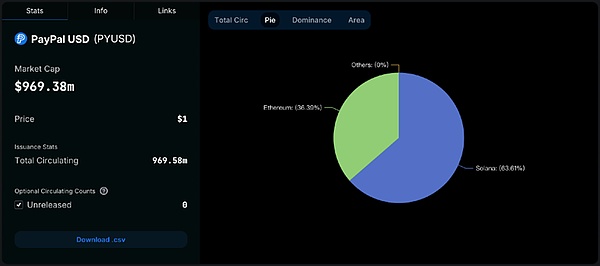

The market value of PYUSD, a US dollar stablecoin issued by global payment giant Paypal, has exceeded the 1 billion US dollar mark.

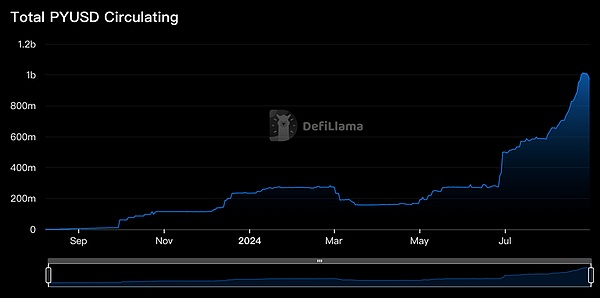

At the beginning of 2024, the market value of PYUSD was only 234 million US dollars, and on August 27, the market value exceeded the 1 billion US dollar mark. In just over 7 months, the market value of PYUSD has increased by 327%, which is a very rapid growth rate.

What does a volume of 1 billion US dollars mean in the stablecoin market?

According to the data of the defillama platform, in the stablecoin market value ranking, PYUSD ranks sixth after stablecoins such as USDE and FDUSD.

According to the recent growth rate, it is not impossible for PYUSD to be among the top 3 stablecoins by the end of this year.

2、The growth of PYUSD comes from real money subsidies

From the growth trend data of PYUSD, its market value growth mainly comes from the last two months. In the last two months, what factors have caused the surge in the market value of PYUSD?

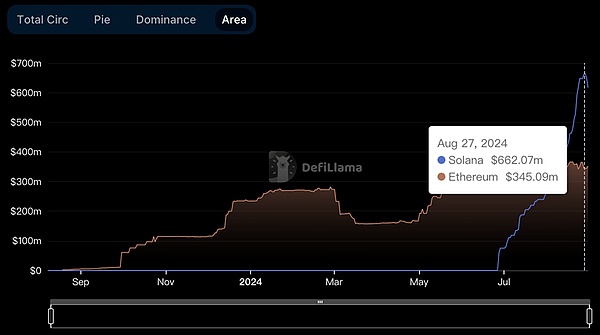

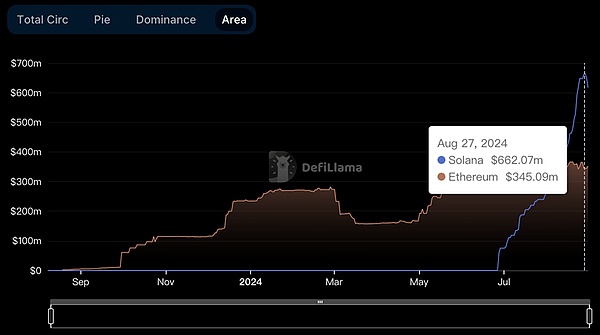

From the time point of view, the last two months are also the time point from the issuance to the rapid growth of PYUSD on the Solana chain.

The reason why PYUSD's market value has grown so fast is mainly due to the high incentive strategy recently launched by PYUSD on the Solana public chain, that is, the rapid growth of PYUSD comes from real money subsidies and the expansion of application scenarios.

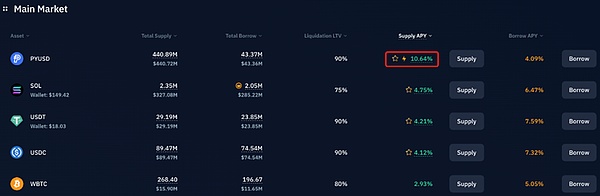

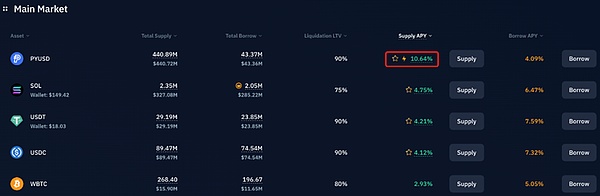

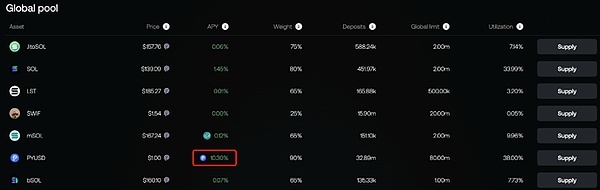

For example, the annualized return (APY) of PYUSD in Kamino, a Solana ecological staking project, can currently reach more than 10%.

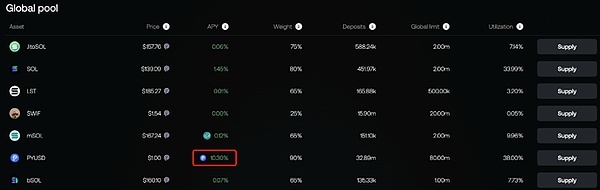

On the marginfi platform, the annualized return (APY) of PYUSD's staking has also exceeded 10%.

If we estimate based on the current TVL and APY of PYUSD on the chain, PYUSD needs to pay users up to several million dollars in interest every month because of incentive activities.

Who pays this huge interest?

Some people think it is of course the Solana Foundation, because for the development of the SOL public chain ecosystem, they can try their best to get PYUSD issued on the Solana public chain, but this is not the case.

The relevant person in charge of the Solana Foundation and Kyle, the managing partner of Multicoin, have made it clear that the Solana Foundation did not pay any incentives, so the interest expenses of this PYUSD incentive activity certainly came from Paypal, the issuer of PYUSD.

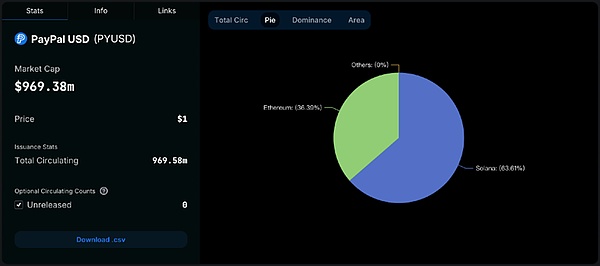

Such a high APY income also allowed PYUSD on the Solana public chain to surpass the Ethereum public chain in mid-August, becoming the largest public chain issuance platform for the PYUSD stablecoin.

3. Reasons for PYUSD to choose Solana public chain

Currently, PYUSD is only issued on Ethereum and Solana public chains. Among them, PYUSD began to be issued on Ethereum in August last year, and on Solana public chain on May 31 this year. Although the Solana public chain is 9 months late, the Solana version of PYUSD currently accounts for 63.61%, nearly twice the market share of the Ethereum version of PYUSD.

The reason why PYUSD chose Solana as the main public chain issuance platform is mainly related to the advantages of Solana public chain. For example, Solana public chain gas fees are very low, and the transaction confirmation speed is much faster than Ethereum public chain. Solana public chain also provides many extended functions suitable for today's Web2 business environment.

For example, compared with Ethereum public chain, Paypal also introduced some new features to provide a better user experience when deploying PYUSD on Solana.

Such as confidential transfer (merchants can choose the confidentiality of transaction amounts), transfer hooks (similar to plug-ins), and notes fields (users can note transaction information when paying).

These functions not only serve as icing on the cake, but also are more in line with the payment scenarios in the current business environment, which is conducive to promoting the large-scale commercial application of PYUSD.

In fact, the stablecoin PYUSD and the Solana public chain are still quite related.

According to Wu, PayPal had prepared to cooperate with FTX in 2022 to issue PYUSD on Solana first. The two parties had originally signed a relevant cooperation agreement, but then suspended it due to the collapse of FTX.

4、The strategic significance of Paypal's issuance of stablecoins

With the continuous development of blockchain technology and the advancement of global compliance of cryptocurrencies, Web3 payment will be a major trend in the future. It can bring people closer to the realization of their payment wishes: fast, cheap, and global payment. This will be a new generation of financial/payment infrastructure. Payment platforms can use the stablecoin payment function to allow everyone to pay according to their wishes.

Moreover, in the cryptocurrency ecosystem, issuing stablecoins is a highly profitable business, with profits far higher than most cryptocurrency trading platforms. The revenue earned by Tether, the issuer of USDT stablecoin, from the issuance of USDT in one year has exceeded the revenue of many technology giants. Therefore, more and more financial giants are beginning to deploy crypto stablecoins, and Paypal is one of them.

As a global payment giant, Paypal has a large market share in the Web2 payment field. Paypal's issuance of PYUSD is not only based on the consideration that stablecoins can bring huge profits, but more importantly, it is a strategic layout. As a payment giant, Paypal must not only continue to expand its market share in the Web2 payment field, but also expand its influence in the Web3 payment field in the future. In the Web3 payment field, Paypal has currently taken the lead.

Unlike stablecoin issuers such as Tether, Paypal is already a huge business empire in the Web2 world, with a global user base of 400 million. PayPal currently supports 200 countries and 25 currencies around the world, and has a wide range of commercial application scenarios.

Paypal can use its resource advantages to quickly expand the application scenarios of stablecoin PYUSD, such as e-commerce payment, which will greatly promote Paypal's seizure of the Web3 payment market. Moreover, the widespread application of PYUSD stablecoin can also promote the large-scale application of blockchain technology.

Currently, PYUSD is only issued on Ethereum and Solana public chains, and will be issued on more public chains in the future.

Blockchain technology has been born for more than ten years, and cryptocurrency payment has reached a critical moment in history, just like the Internet in 2000, full of potential and opportunities.

As a global payment giant, Paypal has brought payments to the Internet, and now Paypal wants to bring payments to the chain, thus leading payments into a new era of blockchain.

Anais

Anais