Author: Dave Hendricks, Vertalo CEO Translation: Shan Ouba, Golden Finance

< p style="text-align: left;">

Although "tokenization" is the hottest trend in the crypto field, especially in the DeFi field, it is actually just another form of "security token" . Although it is theoretically possible to transfer traditional assets to the chain, the actual operation is far more difficult than people imagine. "Tokenization," specifically the tokenization of "real world assets" (RWA), has recently been hyped as the next step in the crypto space. A disruptive trend. What most people don’t realize, however, is that this trend is actually another form of security token, a term that has rarely been mentioned since 2018 (and not without reason).

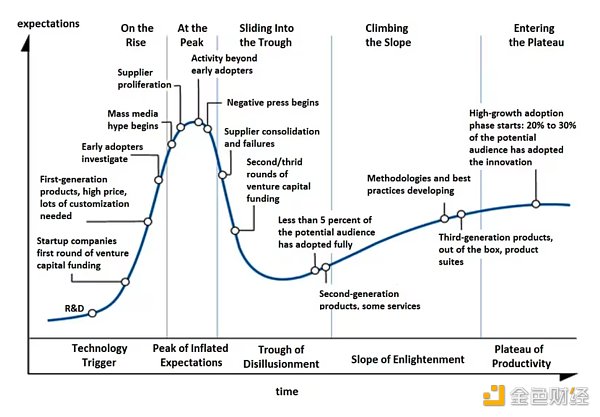

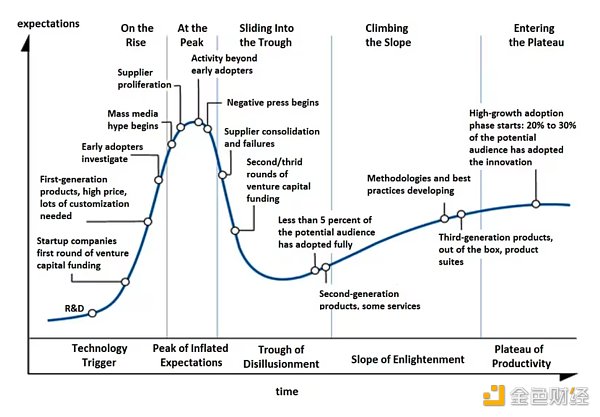

People who advocate tokenization are mostly wrong, but their starting point may be good. It’s no one’s fault for something becoming a trend. However, if "security tokens", "tokenization" and RWA all belong to the same technological evolution path, then according to Gartner's "hype cycle" theory, another bubble burst may be coming.

p>

Many of the current tokenization advocates actually fled from the former hype hot spot "decentralized finance" (DeFi).

Some influencers and CEOs in traditional finance view tokenization as a natural evolution of finance—for example, BlackRock CEO Larry Fink believes that the recently launched The Bitcoin ETF is the “first step” in moving all things on-chain. However, tokenizing “all financial assets” is much more complex and is widely misunderstood by both proponents and opponents.

The real asset tokenization (RWA Tokenization) industry is about to enter its eighth year, which can be traced back to the end of 2017. My company, Vertalo, launched a fully compliant Reg D/S equity tokenization project in March 2018, one of the first in the industry. Despite many challenges (too many to list here), we have transformed from our original role as a “tokenized equity issuer” to a “gold mining tool” enterprise software company dedicated to “connecting and supporting the digital asset ecosystem” .

Non-fungible tokens (NFTs) and decentralized finance (DeFi) have experienced expansion and growth since we started tokenizing real assets. ensued massive shrinkage. NFTs and DeFi are tokenized technology applications that are more user-friendly. For example, on easily accessible marketplaces like OpenSea, you can buy computer-generated art with tradable tokens.

If I were to map the development process of NFT to Gartner's hype cycle, I would place it in the peak period, and it is rapidly sliding towards the "trough of disillusionment" ”. For example, OpenSea investor Coatue wrote down its $120 million investment to $13 million as the exchange's fortunes dwindled.

Similarly, the once-hot DeFi market has cooled down - many projects now appear to be rebranding and refocusing on real-world assets. These include DeFi giants MakerDAO and Aave.

Teams touting RWA's credibility now count large traditional financial institutions as customers or partners, which makes sense since many DeFi founders are moving into jobs at Wall Street banks All came to prominence at Stanford University or the Wharton School of Business.

The DeFi movement is tired of the quantitative work that powers bond salespeople and stock traders, but is fascinated by the volatility and volatility that decentralization brings. Work-life balance, they are very familiar with the global financial world (and currencies) but less interested in its rules, regulations and rigor.

As keen trend observers, smart DeFi founders and their engineer-mathematicians saw the writing on the wall and exited governance tokens in 2022 Airdropping the game and starting to realign their marketing and strategies to create "something new and new", namely tokenization. result? Massive migration and adoption of RWA names, and a rapid move away from anything that looks like copy-paste, are signature moves and risks in the unpopular DeFi world of 2020-22.

MostRWA projectsusually manage assets and collateral mainly stablecoins, rather than actual hard assets.

Tokenization is not a quiet riot. If you mapped the current RWA market onto the hype cycle, it would probably fall right into the “vendor surge” spot today. Nowadays everyone wants to get into the RWA business and wants to get in as soon as possible.

Tokenization of RWA is actuallya good idea. Today, ownership of most private assets (the asset class targeted by RWA) is tracked through spreadsheets and centralized databases. If an asset is restricted from being sold—such as public stocks, bearer bonds, or cryptocurrencies—then there is no reason to invest in technology that is easier to sell. Antiquated data management infrastructure in private markets is a function of inertia.

According to RWA proponents, tokenization solves this problem.

Can tokenization really solve this problem?

There is some truth to this little white lie, but the absolute truth is that while tokenization alone does not solve the liquidity or legality issues of private assets, But it also brings new challenges. RWA tokenization advocates conveniently sidestep this issue, and they do so easily because most of the so-called real-world assets that are tokenized are simple debt or mortgage instruments that do not comply with the regulatory requirements of regulated securities. Same compliance and reporting standards.

In fact, most RWA projects use an old process called "rehypothecation", where the collateral itself is crypto with less regulation currency, while the product is a form of loan. This is why almost all RWA projects have money market type yields as their attraction. Just don't look too closely at the quality of the collateral.

Lending is big business, so I wouldn't count on the future and long-term success of tokenization. But it’s not accurate to say that you bring real-world assets on-chain. It is simply a collateral for a crypto asset represented by a token. Tokenization is only a small piece of the puzzle, and an important one.

When Larry Fink and Jamie Dimon talk about tokenizing "every financial asset" They are not talking about crypto-collateral RWA, they are actually talking about the tokenization of real estate and private equity and eventually public equity. This cannot be achieved through smart contracts alone.

Firsthand experience

Building a number over seven years Transfer Agent and Tokenization Platform, which has tokenized nearly 4 billion units representing the interests of nearly 100 companies, the reality of tokenizing mass financial assets is much more complex.

First of all, tokenization is just a small step in the entire process, and it is relatively simple and unimportant. There are already hundreds of companies that can tokenize assets, making tokenization itself a commoditized business with fairly limited profit margins. From a business model perspective, competition in the tokenization space will ultimately turn into a “fee-down race” that can quickly turn into a pure commodity due to too many vendors offering the same service.

Second, and more importantly, there is a fiduciary duty when tokenizing and transferring real assets (RWA). This is the key part and where blockchain technology comes into play.

Distributed ledgers bring real benefits to the tokenization of financial assets by providing immutability, auditability and trustworthiness. This provides the basis for provable ownership and enables all transactions to be recorded immediately and without errors. Without this, finance using tokens will be revolutionized.

The trust created by the ledger will allow financial professionals and their clients to support the rhetoric of Larry Fink and Jamie Dimon, but do so in a way that DeFi and crypto The tricky and technological world of money is easier to adopt.

So before jumping into the hype cycle, take a look at what came before, and what comes next. Don’t end up in the wrong cycle or you’ll end up in NFT version two.

JinseFinance

JinseFinance