Author: Climber, Golden Finance

As a star L2 project of Ethereum, Taiko has been making continuous moves recently, including the launch of the mainnet, the listing of the token TAIKO, and the launch of the Trailblazers event. According to the project party, there will be more hot spots in the future.

Taiko has attracted much attention since its birth. Vitalik has publicly praised and proposed the first block many times. At the same time, the project has also won the favor of many institutions including Sequoia, OKX, and IOSG, and raised a total of US$37 million in three rounds. Previously, the project has been interpreted by its founder and many research institutions many times, but the latest dynamic information has not yet been synchronized. For this reason, Golden Finance once again analyzed this zkRollup head project equivalent to Ethereum in an attempt to find more value.

Taiko Introduction

Taiko is a decentralized Ethereum Layer 2 blockchain protocol that uses the Zero-Knowledge Ethereum Virtual Machine (ZK-EVM), which is designed to be the most equivalent and universal ZK-Rollup (Type-1 ZK-EVM) to Ethereum.

The protocol aims to make Ethereum transactions cheaper while maintaining its core features such as censorship resistance, security, and permissionlessness. By implementing a Rollup-based architecture, Taiko can expand the functionality of Ethereum without changing the basic characteristics of Ethereum, ensuring seamless integration and use with Ethereum itself.

In addition, due to its decentralized design, Taiko is also able to support a community of block proposers, provers, and node operators.

Taiko ("drum" in Japanese) was founded in early 2022 by Daniel Wang, Brecht Devos and other well-known figures in the field. Prior to founding Taiko, the two worked at Loopring, the first zero-knowledge rollup deployed on Ethereum.

Taiko's main goal is to provide a scalable and efficient platform for decentralized application (dApp) developers and users, allowing them to leverage the power of Ethereum Layer 1 (L1) without making any changes to existing dApps.

It is necessary to add the knowledge point of ZK-Rollup here. ZK-rollup scales computing by executing, aggregating and proving off-chain transactions and relying on Ethereum for data availability and validity proof verification.

The biggest drawback of ZK-rollups currently in production is that they do not fully support general computation on the EVM, but are mostly application-specific. This breaks compatibility with existing Ethereum L1 smart contracts and dApps, and further makes it difficult to build composable, new contracts and dApps that provide the same type of composability.

Taiko, on the other hand, enables developers and users of dApps developed for Ethereum L1 to use these dApps on Taiko without any modifications. As a result, dApps can be quickly deployed to L2, while maintaining the security of Ethereum and incurring lower transaction fees than L1.

Taiko is building a "Type-1" ZK-EVM, which is designed to be fully compatible with Ethereum by merging a ZK-EVM that supports all EVM opcodes. As a Type-1 ZK-EVM, Taiko's main goal is to emphasize Ethereum equivalence rather than the speed of ZK proof generation.

These ZK-EVMs do not make any changes to the Ethereum framework, including hash functions, state trees, or gas fees. This compatibility allows for the reuse of execution clients with only minimal adjustments.

Working Mechanism

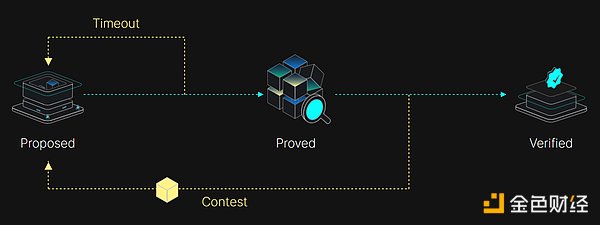

Taiko's solution is to retain the core properties of the Ethereum network while improving its scalability and reducing transaction costs. The Based contestable rollup (BCR) mechanism is designed as a solution. BCR can be understood as an abstraction of zkRollup and Optimistic Rollup. . In addition, the project also achieves this goal by combining a sorting-based, multi-proof system and a unique competition mechanism.

Here are the key components of the Taiko Protocol:

Sequencing-based: Transactions are sequenced by Ethereum L1 validators, ensuring decentralization and security without relying on a centralized sequencer.

Contestable scrolls: State transition proofs submitted by proposers enter a cool-down period during which others can challenge them, maintaining integrity through economic incentives.

Multi-layered protection system: Multi-layered proofs (including SGX and ZK proofs) allow for compound proofs and reduce the likelihood of invalid transitions, thereby enhancing security.

Decentralized governance: Future governance will be managed by a DAO, gradually handing over control to Taiko token holders, ensuring community-driven development and decision-making.

Guardians: Initially, guardian provers provide an additional layer of security, ensuring reliability in the early stages of rolling deployments.

This architecture enables Taiko to provide a scalable, secure, and cost-effective solution for Ethereum transactions, paving the way for wider adoption and use of decentralized applications.

Differentiation from Other Rollups

How Taiko differs from its competitors:

Permissionless and Decentralized: Taiko is based on Rollup and may be the first of its kind. Lacking a centralized sorter, it relies on Ethereum validators to sort transactions and blocks, promoting Taiko's permissionless and decentralized ethos.

Frictionless developer experience: Taiko leverages Ethereum's equivalent ZK-EVM (Type 1) to achieve execution-level compatibility with Ethereum, essentially providing "large-scale Ethereum".

Highly configurable: Taiko is designed to be controversially rolled up, allowing application chains to define their proof systems and adopt newer, more efficient validity proofs as technology advances, all without modifying Taiko's core protocol.

Financing Information and Token Economics

Financing Information:

In March this year, Taiko announced the completion of a $15 million Series A financing round, which was co-led by Lightspeed Faction, Hashed, Generative Ventures and Token Bay Capital, with participation from Wintermute Ventures, Flow Traders, Amber Group, OKX Ventures and GSR.

In June 2023, Taiko announced the completion of a $12 million Pre-A round of financing, with participation from Generative Ventures, Mirana Ventures, OKX Ventures, and other institutions.

In September 2022, Taiko announced the completion of a $10 million seed round of financing, led by Sequoia China (HongShan), with participation from Hash Global, IOSG Ventures, and others.

TAIKO (formerly TKO) token economics model:

The total supply of TAIKO tokens is 1 billion. The distribution ratio is as follows:

DAO Teasury accounts for 20%, Guardian Prover Bonds accounts for 2%, Grants & RetroPGF accounts for 5%, Trailblazer airdrop accounts for 10%, Protocol Guild airdrop accounts for 1%, Genesis airdrop accounts for up to 5%, Liquidity and market making accounts for 5%, Investors account for 11.62%, Taiko Labs/core team accounts for 20%, Taiko Foundation reserves account for 16.88%, Taiko official Prover Bonds account for 1.5%.

Data performance

Previously, according to media reports, Taiko had about 40 employees in March this year, but it is still recruiting to expand the team size. The number of its ecological projects has also reached 100+.

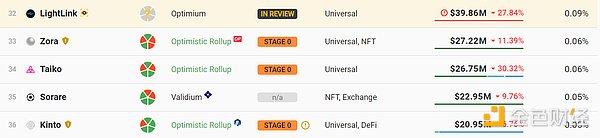

According to L2Beat data, Taiko TVL is about 26.75 million US dollars, ranking 34th.

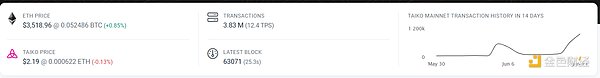

According to Taikoscan website data, Taiko's total transaction volume is also 3.83 million. And as can be seen from the above figure, since its mainnet was launched, the project's transaction volume has shown an explosive growth trend.

Taiko's project token TAIKO was listed on June 5, with a current price of $2.2 and a market value of approximately $140 million.

Main Actions

June: Officially launch the Trailblazers incentive event, with a prize pool of up to 12 million TAIKO in the first season. Among them, 10 million TAIKO will be allocated to users and 2 million TAIKO will be allocated to dApps on Taiko for a period of 3 months.

Build a bounty program to resolve BCR protocol bugs; enable permissionless sorting and proof; open the first phase of TAIKO token airdrops. On the same day, it was listed on Bitget, Upbit and other exchanges.

May: Change the token code from TKO to TAIKO; OKX Web3 wallet connected to Taiko network; Taiko launched on mainnet; launched airdrop query page.

April: Issued the Genesis NFT series Taikoons.

Conclusion

As mentioned above, Taiko network is committed to becoming the ZK-Rollup equivalent of Ethereum, aiming to provide faster and cheaper transactions without compromising the security or compatibility of on-chain projects. Its innovative expansion solution and BCR mechanism have also attracted the favor of Vitalik and a number of capitals, and the project has a promising future.

However, as an emerging project, there are still many technical risks and project operation disputes. For example, the project token airdrop dispute in May this year, the recent short downtime of the official bridge, and high fees. This shows that Taiko's success still needs to be tested by the market and time.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo JinseFinance

JinseFinance Xu Lin

Xu Lin