Author: Arjun Chand, guest author of Bankless; Compiler: Sharon, BlockBeats

Editor’s Note: Recently, the full bloom of the Solana ecosystem has also led to more concerns in the Ethereum community. Discussion of ecological development and blockchain expansion. With less than a month until the Cancun upgrade, Ethereum expansion is already a clear and visible future. Bankless guest author Arjun Chand revisits the development path of Ethereum Rollup in this article. BlockBeats compiles the original text as follows:

The expansion of Ethereum has always been an important issue in the encryption field. One of the most controversial topics. After much speculation, the community has finalized the Ethereum development roadmap centered on Rollup. But why did you choose this path?

With blockchain chains like Solana gaining momentum in their comeback, it’s time to revisit why the Ethereum community chose Rollup and modularity, and use it to realize global scale opportunities.

Today’s article focuses on the key concepts and developments that guide Ethereum’s expansion efforts toward a Rollup-centric roadmap. Let’s discuss it in depth together.

Ethereum’s decentralized expansion vision

Ethereum’s ultimate goal is to become a global Coordinated financial layer. To achieve this, it must support different types of applications and be accessible to all types of users.

In 2020, Vitalik pointed out a pressing problem with the Ethereum network: When he bet on Augur, he had to pay $17.76 in gas fees. These high fees indicate that Ethereum is struggling to scale in the face of increasing demand. As a result, it became a platform "for a niche rather than for the world" and deviated from its original goals.

The problem is obvious, Ethereum needs to be able to process more transactions at a lower cost. However, the solution may be more complex as many factors must be considered and balanced.

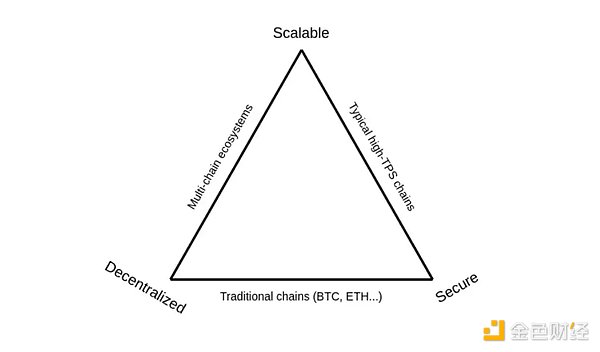

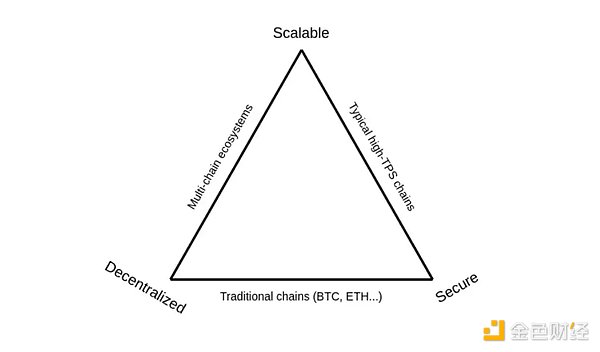

A major consideration is optimizing three properties: decentralization, security, and scalability. These three together form the "scalability trilemma", which is the "impossible triangle" dilemma faced by any blockchain.

The scalability trilemma can be understood as a balancing act—an improvement in one attribute often means a trade-off in another.

Over time, many blockchains labeled as "Ethereum killers" have been dealing with the trilemma, often in the pursuit of reliability. While scalability, decentralization and security aspects are sacrificed.

However, compromising decentralization has never been an option for the Ethereum community. This is also because it is closely related to security and gives Ethereum properties such as network neutrality, censorship resistance, and permissionless, which are equally important as properties in the scalability trilemma.

In the Ethereum demand hierarchy, if decentralization, security and scalability form "physiological" needs, then neutrality, censorship resistance and permissionlessness can be said to form "security" requirements. These two levels can be called the "basic needs" of the Ethereum network.

In recognizing these priorities, the Ethereum community has adopted a long-term development approach that may sacrifice scalability in the short to medium term. certain aspects, but enabling Ethereum to be “big enough to help all of humanity.”

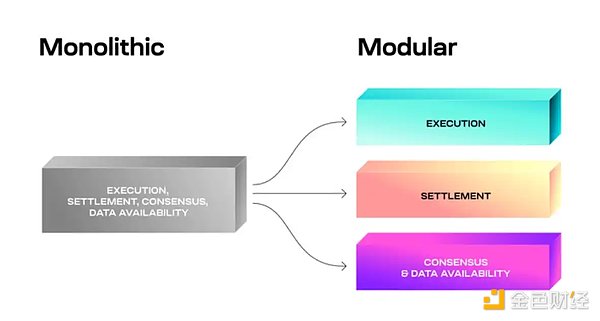

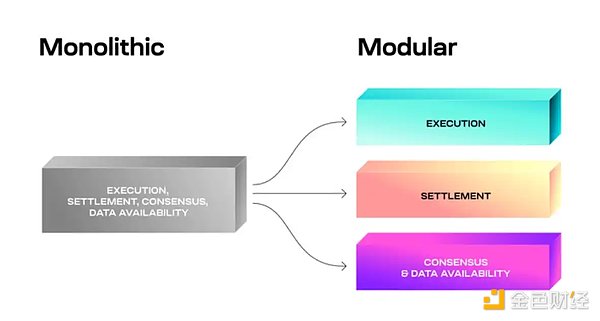

This strategy is the modular blockchain theory. It involves executing transactions on an L2 scaling solution, also known as Rollup. Since these transactions occur outside of Ethereum, they can be faster and cheaper. However, because their data is returned to L1, they inherit Ethereum's extensive security.

Why choose Rollup to expand Ethereum?

By the end of 2020, the Ethereum community basically reached a consensus and adopted Rollup as the main expansion solution in the short and medium term future, forming an Ethereum development centered on Rollup. route map. The key factors that make Rollup the preferred solution are:

Sponsored Business Content

1. Forward compatibility with Eth2 (PoS) - the companies behind Rollup such as Arbitrum and Optimism respectively Launched in 2018 and 2019. At that time, Ethereum still used the PoW consensus mechanism, and PoS was in the proposal stage. Rollup is compatible with both PoW and PoS, giving the Ethereum developer community the flexibility it needs when it comes to the timeline of key network upgrades, such as switching from PoW to PoS.

2. Technical feasibility - By 2020, Rollup has achieved substantial development. As Vitalik noted in his forum post, OptimisticRollup teams such as Optimism and Arbitrum launched their testnets back in early 2020 and released roadmaps for a mainnet launch in 2021.

Meanwhile, zkRollup like zkSync and Loopring are already live and have users on their mainnet, albeit with limited functionality. This progress gives the Ethereum community confidence in the maturity of Rollup technology and its potential to effectively scale Ethereum starting in 2021. In comparison, other scaling solutions, such as performing sharding, still take years.

The urgency to adopt Rollup is further heightened by the state of the Ethereum mainnet during the previous bull run. Gas fees hit new highs, costing users tens of dollars per transaction. Additionally, some apps, especially those with non-financial uses, were forced to shut down due to high fees.

These factors combined have influenced the Ethereum community to firmly embrace Rollup as a scaling strategy for the foreseeable future, recognizing its immediate impact and long-term potential.

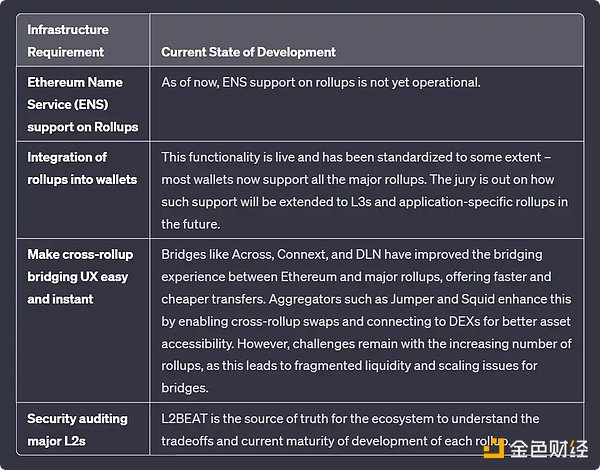

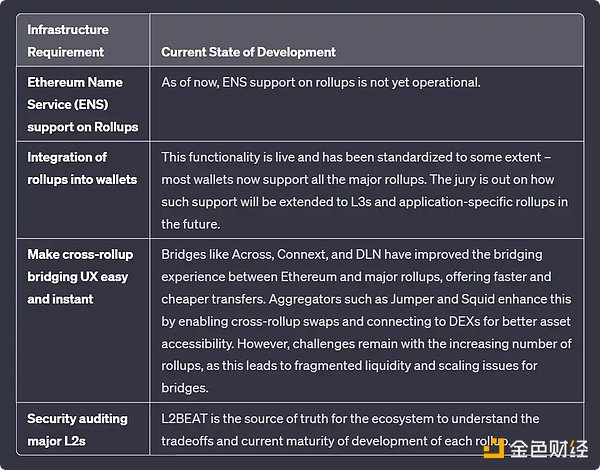

While the direct benefits of Rollup are clear, a multi-Rollup ecosystem also poses some challenges. Taking a user perspective as a starting point, the Ethereum community has raised some key issues. The following is an overview of progress in solving these issues.

Status of the Ethereum Rollup Roadmap

We are in a multi-rollup ecosystem, and many rollups have achieved significant development.

In this case, Ethereum scales with Rollup, which acts as the base layer for clearing and data availability. All Rollups inherit the security of Ethereum and use it to confirm transactions and store data.

In terms of security, Ethereum is undoubtedly one of the most secure blockchains in the ecosystem. Over 33.5 million ETH have been used to secure the network, giving the network over $67 billion in economic security at the current ETH price (1ETH = $2,000).

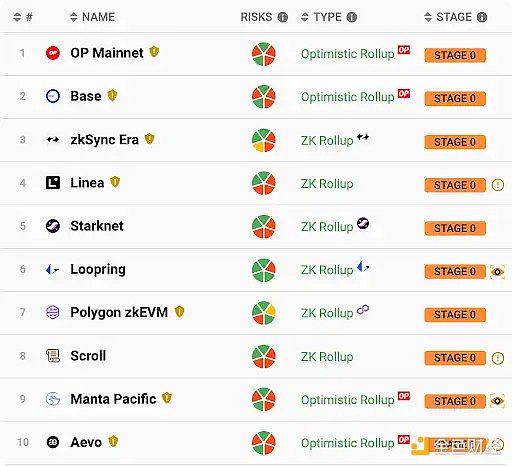

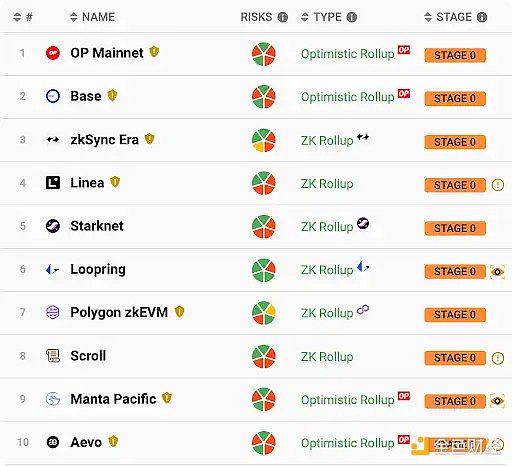

However, as TVL in L2 has exceeded $16 billion, collateral has reached an all-time high, the community is centralizing the Rollup sequencer and operators extracting MEV Some concerns were expressed. While there are quite a few Rollups attracting large numbers of users, most of these systems are still in their early stages of development, as L2BEAT’s analysis of Rollup maturity shows.

Another key area of active development is enhanced data availability. A key part of this effort is Danksharding, a key feature in the “surge” phase of the Ethereum roadmap. Danksharding aims to significantly reduce the cost of Rollup validating transactions on Ethereum, thereby driving the network’s ability to scale. To this end, several innovative projects, such as Celestia and EigenDA, focus on providing a cheap and decentralized data availability layer for Rollup.

The Ethereum community is working on proto Danksharding, known as EIP-4844, as an intermediate step before Danksharding is fully implemented. This step introduces some Danksharding concepts, such as blobs, in a simplified form. It is expected that proto Danksharding will be implemented soon, while full Danksharding is still several years away.

Conclusion

The goal of expanding Ethereum into a global financial layer is still out of reach. But we are getting there gradually. What’s most exciting is that the community is aligned on a roadmap and vision, and some of the best thinkers are working together to make this vision a reality.

Looking ahead, the potential for thousands of specialized Rollups to emerge, each fulfilling unique use cases and driving innovation, is incredible. This evolution will enable Ethereum to become the global financial layer it aspires to be, supporting a wide variety of applications and users. All of these Rollups will pay fees to have their data settled and secured on Ethereum, thereby increasing Ethereum’s cryptoeconomic security.

JinseFinance

JinseFinance