Author: Liu Jiaolian

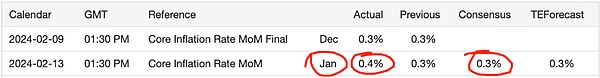

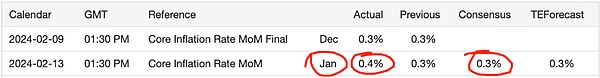

At 1:30 pm local time on February 13, U.S. Bureau of Labor Statistics (BLS) released the latest core inflation data for January.

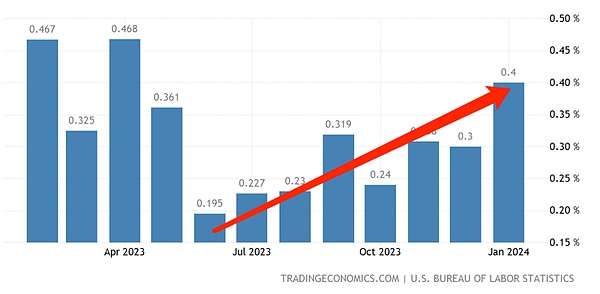

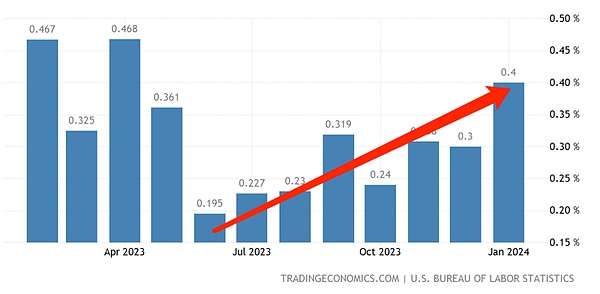

In January 2024, U.S. core consumer prices excluding volatile items such as food and energy increased by 0.4% month-on-month, an increase from the previous value of 0.3% accelerated, higher than market expectations of 0.3%. That marked the biggest rise in core consumer prices since April 2023, challenging the U.S. economy's gradually deflationary trend and reinforcing the case for hawks at the Fed's rate meeting.

This increase is mainly attributable to housing costs (0.6% vs. 0.4% in December 2023) and transportation service costs (1% vs. previous value 0.1%), thus pushing up the consumer price index for services excluding energy services (0.7% vs. 0.4% previously). This offset slower inflation in goods such as used cars and trucks (-3.4% vs. 0.6%), clothing (-0.7% vs. 0%) and healthcare goods (-0.6% vs. -0.1% )’s CPI has declined.

As a result, the inflationary pressure that originally seemed to be gradually easing has suddenly turned into a steady growth trend for more than half a year since June 2023. See the picture below:

This is not good!

This not only reverses the confidence that the Federal Reserve does not have to worry about inflation when the BLS lowered the December inflation data on the 9th, but also makes people more skeptical about the previous downward revision. There are some doubts about whether the revision of December data just reflects the rebound in inflation in January.

Sponsored Business Content

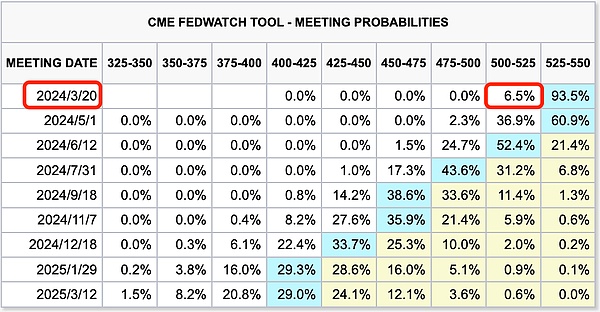

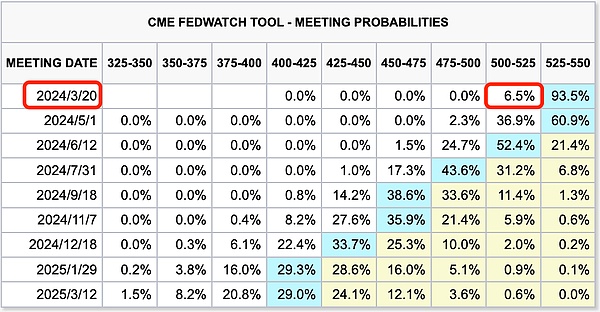

The market is worried that the rebound in inflation data will make the Federal Reserve nervous again, thereby further delaying the pace of interest rate cuts, and will be even less willing to respond to the market's call for an early end to quantitative tightening. .

The probability of an interest rate cut in March, which was once as high as more than 50% last month, has dropped to less than 10%. The probability of an interest rate cut in May has also dropped significantly.

U.S. stocks, which were once soaring and had just exceeded a historic new height of 5,000 points, suddenly plummeted after hearing the news and quickly fell below 5,000 points.

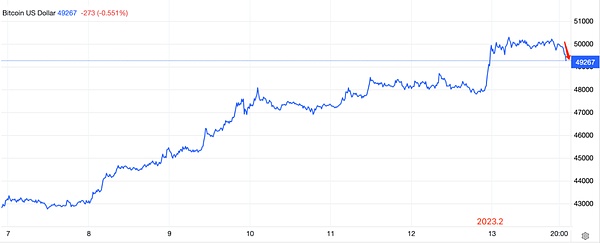

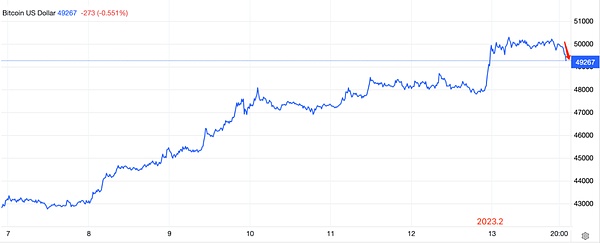

Bitcoin, which had just exceeded $50,000, also dropped by $50,000, losing ground again.

Will the Spring Festival market, which was launched as people in the currency circle go home for the New Year and attract people to join the market, will be ended by the Federal Reserve like this? :)

JinseFinance

JinseFinance