Author: Olga Kharif, Emily Nicolle, Paige Smith, Bloomberg; Translated by Wuzhu, Golden Finance

Companies from Robinhood Markets Inc. to Revolut Ltd. are considering launching stablecoins, betting that tighter regulation in Europe and elsewhere will eventually weaken Tether Holdings Ltd.'s control over the rapidly expanding $170 billion digital asset sector.

Robinhood and Revolut, two of the most valuable financial technology companies, are trying to issue their own stablecoins, but the companies may still choose not to proceed, people familiar with the matter said.They asked not to be named discussing confidential information.

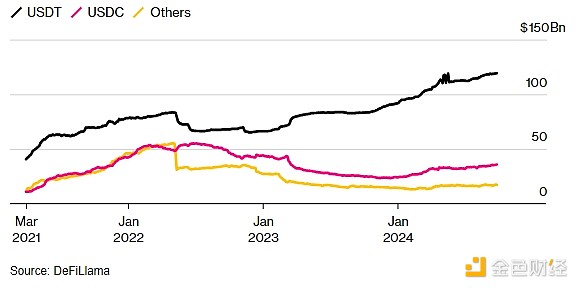

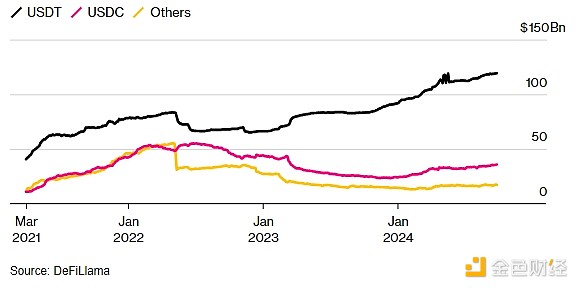

For years, upstarts have tried to compete with Tether's USDT, but most have come to nothing. The circulation of stablecoins, a type of token designed to maintain a constant value, has swelled to nearly $120 billion, accounting for more than two-thirds of the market. The second-largest USDC has a market value of $36 billion, according to CoinGecko data, and other stablecoins have much smaller market caps.

Tether's USDT dominates the stablecoin market

But as the European Union prepares to fully adopt broad cryptocurrency rules by the end of this year, Tether faces increased uncertainty. Under the MiCA regulations, cryptocurrency exchanges operating in the EU may be forced to delist stablecoins from issuers that do not have appropriate licenses, such as Tether.

Circle Internet Financial Ltd., the issuer of USDC, has already obtained the required EU license. The company said in January that it had confidentially applied for an initial public offering in the U.S.

Tether Chief Executive Officer Paolo Ardoino has repeatedly expressed concerns that EU rules pose too many risks if stablecoin issuers face large redemptions. Ardoino said in an emailed statement that the company does not have an e-money license in the EU and is developing a "technology-based solution" to serve the EU market.

A spokesman for Robinhood said the company has "no plans to launch the product in the near future." A spokesman for Revolut said the company plans to "further develop" its suite of crypto products but did not confirm a future stablecoin.

Profitable reserves

The financial incentives are huge. Tether's profits, mainly from the reserves that back it, reached $5.2 billion in the first half of 2024 as the value of USDT in circulation rises in tandem with interest rates, according to Tether. The company said it had about 100 employees at the end of the period.

“A lot of businesses have looked at companies like Circle and Tether and the numbers they publish,” Thomas Eichenberger, chief product officer at Swiss crypto bank Sygnum, said in an interview. “It sounds like a great business model and there are a lot of people who might want to copy it.”

There are also early signs that stablecoins, which have so far been used primarily as a tool to move money in and out of cryptocurrency exchanges, are becoming more widely used for payments. Russian companies, for example, use USDT to pay for imports, thereby bypassing a banking system affected by sanctions.

In emerging markets such as Brazil, Indonesia, Turkey, India and Nigeria, nearly half of cryptocurrency users are buying stablecoins to save dollars, according to a survey this month by Castle Island Ventures, Brevan Howard Digital and Artemis. Nearly 40% use stablecoins to pay for goods or services, while more than a fifth receive or get paid in such tokens.

Everyone wants in

As more issuers enter the market, the result could be “high fragmentation of stablecoins,” said Nuri Chang, head of product at BitGo, which announced its own token in September. Different financial applications could run their own stablecoins, and swapping between tokens would become so seamless that end users wouldn’t even notice, he said.

“Mainstream retail brands, neobanks and exchanges will consider issuing stablecoins. The same goes for credit card companies,” said Christian Catalini, founder of the Massachusetts Institute of Technology’s Cryptoeconomics Lab. “People are coming to realize that Tether and Circle have a huge amount of power in this market.”

USDT has proven resilient over the years in the face of various challengers. PayPal Holdings Inc. launched a stablecoin last year in an attempt to cement its dominance in digital payments. The token’s circulation peaked at $1 billion in August, but has since fallen about 30%, according to CoinGecko.

Under the first phase of MiCA, EU rules governing stablecoins came into force at the end of June. They require stablecoin issuers to have an e-money license in an EU member state and hold up to two-thirds of the assets backing their tokens at an independent bank, among other criteria.

The regulatory implementation period for all other crypto platforms in the EU, from exchanges to funds, is up to 18 months and will begin at the end of 2024. This two-phase implementation approach allows for the formation of a compliance grey area where stablecoin rules are in effect but exchanges don’t necessarily need to remove non-compliant tokens before getting their own MiCA licenses.

Exchanges including OKX, Uphold and Bitstamp have already partially delisted stablecoins from Tether ahead of the upcoming deadline. Chris Harmse, chief commercial officer at crypto payments business BVNK, said the platforms are now at a “competitive disadvantage” and that the company intends to keep Tether on its EU platform until the regulatory landscape becomes clearer.

SG-Forge, owned by Societe Generale, is one of the companies that sees an opportunity. The company said in July that it had received an e-money license and had expanded its stablecoin to the retail market.

“We think the stablecoin market — certainly in Europe, but also potentially around the world — will be reshaped by MiCA,” Stenger said. “The demand for clean products is very high now.”

Huang Bo

Huang Bo