Discussion on BTC block size, transaction size, opcode quantity limit and other issues

Bitcoin has a block size limit of 1M transaction block + 3M signature block. There are size and opcode number restrictions for each transaction.

JinseFinance

JinseFinance

Author: BiB Exchange

RWA and asset tokenization have huge potential. On the one hand, they help In order to improve efficiency and shorten settlement time; on the other hand, tokenization will greatly increase the liquidity of assets. Even if it will cause new difficulties in risk control and investor protection, many mainstream institutions still have strong expectations for its future prospects. interest.

On January 13, 2024, the CEO of the world's financial giant BlackRock once said: After the Bitcoin spot ETF, the next step is stocks, bonds and all Tokenization of financial assets. How RWA and asset tokenization work, and what kind of development there is, has become a topic that everyone in the industry must be aware of.

Background and principles

According to a report by the Boston Consulting Group,to In 2030, the market size of tokenized assets is expected to reach US$16 trillion. This will account for 10% of global GDP by the end of the 2030sa significant increase from $310 billion in 2022. This estimate includes both the tokenization of on-chain assets and the fragmentation of traditional assets (ETFs, REITs).

Considering the potential market size, capturing even a small portion of this market will have a huge impact on the blockchain industry. Even at $16 trillion, tokenized assets are still a fraction of the current total global asset value, estimated at $900 trillion (less than 1.8%, and that doesn’t take into account future growth in total global asset value).

It can even be considered that the real potential market is the entire global asset market, because anything that can be tokenized can be represented as RWAs on the chain . The initial participants were Goldman Sachs, Siemens, KKR. Hamilton and other assets on the chain, Bank of China International - UBS and other institutions, passed the proposal of RWA as collateral in the form of tokenized real estate, invoices and accounts receivable.

RWA is off-chain Real World Assets (RWA) are brought to the chain through Tokenization as another source of income for the DeFi ecosystem.

Three steps of RWA:

RWA process, It can also be said to be off-chain packaging; Off-Chain Formalization (off-chain packaging), Information Bridging (tokenization conversion or information bridging) and RWA Protocol Demand and Supply (RWA supply and demand matching).

1) Off-chain packaging

In The assets are packaged off-chain to make them compliant to clarify the value of the assets, asset ownership, legal protection of asset rights, etc. The following dimensions should be noted:

Value:The economic value of an asset can be measured using the asset in the traditional financial market represented by its fair market value, recent performance data, physical condition, or any other economic indicator;

Legality: Ownership of an asset It may be established by deed, mortgage, note, or any other form.

Legal Support: There should be a clear resolution process for situations involving changes in ownership or interest that affect an asset, which typically includes Specific legal procedures for liquidation, dispute resolution and enforcement, etc.

2) Information bridging

Data On the chain, information about the economic value and ownership and equity of assets is brought to the chain after being digitized. Among them, securitization: licensing for issuing security tokens, KYC/AML/CTF, and compliance with listing trading platforms. Regulatory Technology/Securitization: For assets that require some kind of regulatory oversight or are considered securities, different regulatory technologies exist to bring assets into DeFi in a compliant manner.

3) RWA Protocol Demand and Supply

< strong>The entire process of RWA is promoted through the DeFi protocol; on the supply side, the DeFi protocol supervises the initiation of RWA. On the demand side, DeFi protocols drive investor demand for RWA opportunities. Most DeFi protocols focusing on RWA are both starting points for new RWA launches and markets for RWA end products.

Asset digitization - asset standards - on-chain asset registration - ownership confirmation, for different real assets, different RWA pricing needs to be developed. Establish a quality assessment system for RWA, and study value models for different industries and different types of data to provide a basis for RWA transactions. At the same time, it is necessary to establish a trading, circulation platform and application market for digital assets, which is actually the data element market of RWA, so that real-world assets can participate in circulation in the form of data elements.

Big narratives tend to carry larger funding and opportunities. Why are mainstream investment banks and consulting organizations in the United States providing strong endorsements to RWA? From recent Dune statistics, it is not difficult to find that the past net inflows regarding RWA have been rising in the last month of 2023.

Market Case

The stablecoin based on legal currency is the original RWA, and then it is a series of assets including: commercial real estate, Bonds, art, real estate, cars, and almost any asset that stores value can be tokenized. Of course, the most popular underlying asset class as a RWA is real estate, followed by climate-related underlyings (such as carbon credits) and public bonds. / equity base, followed by emerging market credit (primarily corporate debt) base. For an analysis of some typical RWA projects on the market, there are mainly the following important cases:

MakerDAO initially involved real estate and other assets, taking into account the default risk of the assets. Stable currency protocols such as Maker indirectly obtain income from U.S. debt by using treasury assets to allocate U.S. debt. It started with USDC, but faced the risk of de-anchoring later, most of which were U.S. Treasury bonds. MakerDAO mainly purchases U.S. Treasury bonds and does not use an asset issuance platform. Instead, it holds U.S. debt assets through a trust legal structure. MakerDAO entrusted Monetalis to design the overall legal structure, and Monetalis is based on the trust legal structure of the British Virgin Islands (BVI) to achieve on-chain and off-chain connectivity.

DAI, the U.S. dollar-pegged stablecoin issued by MakerDAO, is currently one of the most common use cases for RWA. MakerDAO is also an early DeFi protocol that has incorporated RWA into strategic planning. In 2020, it passed a proposal to use RWA as collateral in the form of tokenized real estate, invoices, and accounts receivable to expand the issuance of DAI. It currently has assets in excess of US$3 billion. MakerDAO allows borrowers to deposit collateral assets into a "vault" so that borrowers can withdraw debt in the protocol's native stablecoin DAI (based on US dollars). A vault is a smart contract that holds a borrower’s Ethereum-based collateral until all borrowed DAI has been returned. As long as the value of the collateral remains above a certain threshold, the relevant liquidation mechanism will not be triggered.

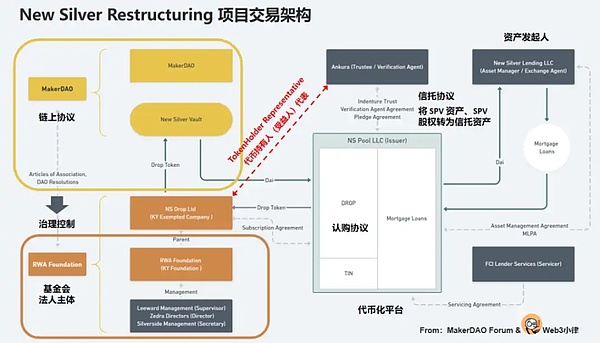

Here we need to emphasize the typical project of MakerDAO - New Silver. Founded in 2021 as the first official Real World Asset (RWA) project in MakerDAO, it has a debt cap of $20 million. The underlying assets of the project are mortgage assets sponsored by New Silver, which are financed on the Centrifuge tokenization platform through New Silver's issuer SPV.

In November 2022, the community proposed an upgrade and reorganization of the 2021 New Silver project, adopting a foundation + SPV transaction structure. This upgrade fully complies with the transaction structure, giving MakerDAO full control of the project at the legal entity governance level. In the transaction structure of New Silver Restructuring's upgrade and reorganization, the main participants include:

RWA Foundation: Established in 2021, it operated the previous HunTINgdon Valley Bank (HVB) project. Controlled by MakerDAO governance, the Director of the Foundation is required to make resolutions or exercise any rights in accordance with MakerDAO Resolutions. Through on-chain and off-chain governance systems, MakerDAO is able to achieve complete control over the project.

NS DROP Ltd: is a wholly-owned subsidiary of the RWA Foundation and is the execution entity of the transaction. Participate in the subscription of DROP tokens initiated by Centrifuge for financiers and provide funds. As a representative of token holders (DROP/TIN), exercise the relevant rights entrusted by MakerDAO Resolutions. Instructs the trustee Ankura Trust to conduct asset operations in accordance with the trust agreement.

Ankura Trust: Established to ensure the independence of the issuer's SPV assets and the security of MakerDAO funds. According to the trust agreement between the SPV and the trust company, the mortgage of the SPV's credit assets and the pledge of the SPV's equity are stipulated to ensure the integrity of MakerDAO's assets and to deal with defaults in full and in a timely manner, thus providing guarantee for the safety of MakerDAO's funds.

Ondo Finance has launched a tokenized fund as a DeFi protocol on the Polygon network Its OUSG token allows stablecoin holders to invest in bonds and U.S. Treasuries. Ondo Finance currently supports four investment funds - U.S. money market funds (OMMF), U.S. Treasury bonds (OUSG), short-term bonds (OSTB), and high-yield bonds (OHYG). These investment funds are marked as RWAs (called " Fund Token"). Once users pass the KYC/AML process, they will be able to trade fund tokens and use them in licensed DeFi protocols.

The Ondo Finance team also developed Flux Finance, a decentralized lending protocol that invests exclusively in BlackRock’s iShares Short-Term Treasury ETF (SHV). The protocol offers a variety of tokens available for lending, such as USDC, DAI, USDT, and FRAX, with OUSG being the only collateral asset.

Flux Finance allows OUSG holders to pledge OUSG to lend stablecoins. As a stablecoin provider in the Flux Finance lending pool, you can indirectly obtain income from investing in U.S. bonds without KYC.

In In order to lower the investment threshold, Matrixport launched T protocol, an unlicensed U.S. debt investment protocol. Matricdock, the on-chain bond platform launched by Matrixport, chose the path of establishing a Special Purpose Vehicle (SPV) as an issuer to purchase and hold U.S. Treasury bonds.

Matricdock launched Short-term Treasury Bill Token (STBT), a product based on U.S. Treasury bonds, accepting the short-term Treasury Bill Token STBT issued by Matrixdock as collateral. Start low-risk borrowing using U.S. Treasury securities as collateral. Through the pool, users can deposit stablecoins to earn lending interest, which is expected to be around 5%. Users who deposit stablecoins into the pool will receive the loan voucher token rUSTP. In accordance with compliance regulations, it still requires customers to conduct KYC and register addresses as whitelists, with a minimum investment requirement of 10USD.

After investors deposit stable coins into T Protocol, T Protocol mints TBT. When 100,000 USDC is accumulated, the partner is entrusted to purchase STBT. TBT is anchored at US$1 and can be redeemed through the protocol to release U.S. bond yields in the form of rebase. There is also a non-rebase way of wrapping TBT called wTBT. Behind TBT is the protocol to purchase S T B T and the USDC reserve that has not yet been purchased STBT. T Protocol is equivalent to an intermediary between non-Matrixdock users and Matrixdock. TBT is also a potential competitor of stablecoins.

Frax Finance has also been Explore the use of RWA assets such as U.S. Treasuries. Frax Finance and MakerDAO had a similar predicament before, that is, over-reliance on USDC as collateral. At the beginning of this year, USDC was unanchored, causing both DAI and Frax to fall below $0.9, further forcing Frax Finance to strengthen its reserves and reduce its reliance on USDC. .

Aave’s native stablecoin GHO, an over-collateralized stablecoin backed by multiple crypto assets, has launched a testnet. Subsequently, lending protocol Centrifuge proposed bringing RWA to Aave and using it as collateral for the native stablecoin GHO. Centrifuge serves as the RWA provider for Aave, and its RWA marketplace enables Aave savers to earn yield against real-world collateral while Centrifuge asset originators can borrow funds from Aave.

RWA The tokenization method is achieved by launching a compliant fund based on short-term U.S. debt, recording the fund's transaction data on the chain, and "tokenizing the fund shares." Traditional financial institutions’ fund shares operate in the form of tokenization; Compound’s on-chain bond company, Superstate’s fund, will invest in “ultra-short-term government securities,” including U.S. Treasury bonds, government agency securities and other government-backed instruments.

The requirements for holding fund token shares are the same as those for investing in funds. Holders of fund share tokens need to register their address as a whitelist of the fund. The addresses on the list will not be executed for transactions. Investors basically need to be residents of the United States. It only supports legal currency transactions and does not support transactions with cryptocurrencies such as stablecoins.

The rest of the cases

Of course the following Tron for RWA is also included Pledge products stUSDT, Securitization/Tokenization, StrikeX (STRX), INX Crypto Trading Platform (INX), Curio Group (CUR), etc. are also typical cases of RWA tokenization. Synthetix and Mirror Protocol are decentralized synthetic asset protocol chains. The stock trading was initially based on synthetic assets, carbon credit certificates KlimaDAO and Toucan, precious metal Pax, L1's Polymeth, real estate tokenization LABS Group, multi-asset tokenization Paxos, TradFi Polytrade. The current market capital volume is small, so this No further details will be given.

RWA does not represent funding Instead of flowing out of Defi, the money in the currency circle is trying to get Tradfi, which involves a whole set of mechanisms for both lenders and borrowers. Here will be a detailed breakdown of MakerDAO’s RWA models:

The custody fee for the institution's USDC custody to Coinbase Prime account is 0, and rewards are also given on a monthly basis. Coinbase promises not to lend, pledge or re-pledge customer custody assets in the account, with the promise that customers can freely mint, destroy, withdraw and settle USDC almost instantly (<6 minutes).

Because the reserve assets of USDC issued by Coinbase and Circle are invested in U.S. debt, the Coinbase Prime plan is not for direct profit, but for the benefit of the entire USDC ecosystem. Development and grabbing market share (equivalent to dividing a part of the reserve asset U.S. bond proceeds to large investors, USDT does not have such benefits. The same is true for Gemini's GUSD, even simpler, there is no need to be entrusted to Gemini, only the money is needed MakerDAO’s contract vault will give you 2% interest.)

The proposal mentions two operating processes at the same time, and it may be necessary to analyze the contract to determine which one is ultimately used.

Operation method (1):

(i) Mortgage RWA014-A to cast DAI, The stable rate is 0% and the mortgage rate is 100%.

(ii) Use DAI to exchange for USDC in PSM at a 1:1 ratio.

(iii) Deposit USDC to the account opened by MakerDAO on coinbase prime

Operation method ( 2): Directly use the contract owner permission to transfer the USDC in the PSM pool to the account opened by MAKERDAO in coinbase prime.

ConsolFreight uses Tinlake (the bottom layer is the Centrifuge protocol, which basically simulates traditional financial small and medium-sized enterprise credit) to package his receivables into NFT assets and put them on the chain. Tinlake will divide the entire NFT claims into The priority token DROP (fixed interest rate) and the inferior token TIN (floating interest rate) are sold for financing. MakerDAO uses DAI to purchase DROP tokens and acts as a senior creditor. The off-chain part is basically taken care of by the Centrifuge protocol, and most of MakerDAO's RWAs adopt this model.

MakerDAO and New Silver released the first RWA002Vault through Centrifuge as early as February 2021. Since then, the introduction of RWA on a larger scale has been based on the SPV tokenization path. The implementation path of MakerDAO Centrifuge's RWA business model is as follows:

The Asset Originator establishes a legal entity for each pool, that is, SPV. The purpose is to isolate financial risks and provide funds for specific RWA as the basic asset of a specific Centrifuge pool;

The borrower will tokenize off-chain assets through AO (underwriter) Turn into NFT and use it as collateral on the chain;

The borrower signs a financing agreement with the SPV and requires the AO to lock its NFT in the Centrifuge bound to the SPV in the pool;

After the NFT is locked, DAI is extracted from the Centrifuge reserve and transferred to the SPV wallet. The SPV wallet then converts DAI into US dollars and passes The bank transfers to the borrower's bank account;

The borrower repays the financing amount plus financing fees on the NFT maturity date. The repayment method can be directly using DAI to repay on the chain, or it can be transferred to the SPV in US dollars. The SPV converts USD to DAI and pays it to the Centrifuge pool. After full repayment, the locked NFT will be returned to AO and destroyed.

3.3 Model based on trust and asset securitization companies RWA001, RWA008, REA009

The asset securitization company divides the long-term lease financing bonds into priority and subordinate tranches. The priority class borrows DAI from the Maker protocol in the form of claims, and the subordinate tranches are composed of other external investors. . DAI is minted to the ETH address of a TFE (a tax-advantaged entity) and then transferred from the TFE to a jurisdiction-specific “trust” account (or its equivalent). From there, when called by LendCo, DAI is borrowed from the trust, eliminating the custody risk of DAI (it is understood that the trust company was also established by the MAKERDAO team). LendCo is responsible for the exchange of fiat currencies into DAI at broker-dealer over-the-counter trading desks.

Monetalis provides a complete set of solutions and reports to MakerDAO periodically, mainly investing in short-term bond ETFs (mainly Blackrock Fund's Treasury Bill ETFs). This model is basically similar to the third one and also needs to follow the trust model and funding process of Proposition 21, but the trust part is provided by a third party Monetalis. First, you need to use the generated RWA tokens to mortgage DAI, with a stability fee of 0%. Then use DAI to exchange it for USDC/USDP in MakerDAO's PSM pool, and then give it to Monetalis to purchase U.S. debt. The interest is paid manually by Monetalis. Asset allocation strategies, collateral value assessment, and the authority to initiate liquidation are all in MakerDAO.

DeFi native application ideas There are generally two ideas for developing RWA business: one is to build a project directly based on RWA income, and the other is to indirectly introduce RWA income as agreement income. The largest RWA asset currently held by MakerDAO is Monetalis Clydesdale. The purpose of MIP65 is to use some of the stablecoins held by MakerDAO to obtain more stable income by investing in highly liquid, low-risk bond ETFs.

Monetalis Clydesdale’s RWA business model implementation path is as follows:

MakerDAO delegates Monetalis after passing the vote As the executor, it reports to MakerDAO regularly;

Monetalis, as the project planner and executor, designed a complete set of trust structures based on BVI (as shown below) to open up Synergy between on-chain and off-chain;

All MKR holders of MakerDAO are overall beneficiaries and issue instructions for the purchase and disposal of trust assets through governance;

Coinbase provides USDC and USD exchange services;

Funds are used to invest in two types of ETFs : Blackrock’s iShares US$ Treasury Bond 0-1 yr UCITS ETF and Blackrock’s iShares US$ Treasury Bond 1-3 yr UCITS ETF;

U.S. Bond ETF income Owned by MakerDAO, MakerDAO then distributes the protocol income to DAI holders by adjusting the deposit interest rate of DAI.

This type of token It is a new security that represents the economic rights and interests of the underlying assets. The asset issuer issues and registers the assets in a system other than the blockchain. After the third party purchases the assets, tokens are issued according to the corresponding proportion. The counterparty risk is the asset issuer (asset issuer) and the token party (asset- backedtoken issuer). Backed Finance is a regulated institution headquartered in Switzerland. Under the Swiss DLT Act, it can put real-world securities on the chain in the form of packaging, giving economic rights to the tokens.

Backed Finance purchases the corresponding assets through a third-party institution, and after being hosted by a licensed custody institution, the corresponding tokens are issued through Backed Finance. Each token The currency tracks the price of underlying assets through on-chain and off-chain data, but does not involve other rights and interests such as stock voting rights. The assets it currently issues include assets such as Coinbase stocks and Blackrock iShares ETFs. The asset issuer is the issuer corresponding to the underlying asset. For example, for Coinbase stocks, the issuer is Coinbase and the token issuer is Backed Finance. Here is There are at least two levels of counterparty risk, one from Coinbase and one from Backed Finance. Backed Finance is a typical project that uses an asset-backed model to issue corresponding tokens. It also clearly states in its legal documents that the token only tracks the price of the underlying asset (tracker of the underlying) and does not hold other rights and interests in securities. .

What projects are there about RWA? In fact, most of the time we are RWA in the narrow sense of crypto-related sectors. RWA is not only reflected in simple national debt, but also has RWA projects in many industries and levels. Through the figure below, we can see the current carbon energy projects and consumption. Projects, cryptocurrency exchanges, fintech, real estate, automation projects, etc. all have lending happening.

First of all, traditional institutions Franklin Templeton and Wisdomtree are traditional financial institutions. They are trying to use blockchain technology to change the traditional financial business model by conducting treasury bond tokenization experiments on the public chain Stellar. The project involves the tokenization of treasury bonds, which converts traditional treasury bond assets into digital tokens. Stellar was selected as the public chain platform for the experiment. Stellar provides fast, low-cost transactions and handles asset issuance and exchange in a decentralized manner. Although conducted on a public chain, the project mainly uses centralized equity registration. This means that token ownership and transaction records may be registered and managed at a centralized entity, possibly a financial institution.

This experiment may be a step for traditional financial institutions to gradually accept and integrate blockchain technology. There may be more attempts in the future, and it is also possible that greater decentralization will gradually be achieved in terms of technology and regulation. The Treasury tokenization experiment conducted by Franklin Templeton and Wisdomtree on Stellar shows that traditional financial institutions are exploring blockchain technology, although they currently prefer to adopt a centralized equity registration approach. This partly reflects the regulatory and risk considerations that the financial industry faces when adopting new technologies.

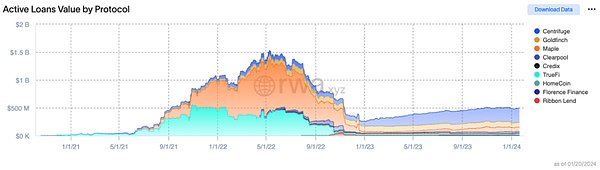

We can clearly see from the graph above and the table data below that at the end of 21 and the beginning of 22, the volume of the entire RWA caused a huge explosion, and then it developed steadily. Today, RWA has formed A pattern in which multiple institutions are advancing hand in hand.

Centrifuge As the earliest RWA One of the DeFi protocols and the technology provider behind head protocols such as MakerDAO and Aave, it is an on-chain credit ecosystem designed to provide small and medium-sized business owners with a way to mortgage their assets on the chain and obtain liquidity. Centrifuge Prime includes a compliant legal framework specifically built for DAO and DeFi protocols, a sophisticated tokenization and issuance platform, decentralized and objective credit risk and financial reporting, and diverse asset classes and issuers to solve There are a lot of questions about KYC and legal recourse. Each asset initiator on Centrifuge needs to establish a corresponding independent legal entity for the capital pool, that is, a special purpose vehicle (SPV).

In summary, the relationship between asset initiators, issuers, investors and Centrifuge, as well as the specific investment and financing process are as follows:

(i) The borrower finances on the chain through real estate mortgage

(ii) The asset originator is the fund The pool establishes an SPV (a capital pool may have multiple mortgages from different borrowers)

(iii) The asset initiator initiates and verifies the RWA and mints the NFT

(iv) The borrower signs a financing agreement with the SPV, mortgages the NFT in TIinlake, and the Tinlake pool mints DROP or TIN tokens.

(v) Centrifuge and Securitize collaborate to help investors complete KYC and AML processes. Securitize is an SEC-licensed institution that provides qualified investor verification services

(vi) Investors sign an investment agreement with the SPV corresponding to the Tinlake pool, which includes: Investment structure, risks, terms, etc., then use DAI to purchase DROP or TIN tokens.

(vii) When an investor provides DAI liquidity for the corresponding capital pool, the SPV converts DAI into US dollars and transfers the money to the borrower's bank account .

(viii) Investors can request to redeem their DROP or TIN tokens at any time, but they must ensure that the DROP tokens are better than the TIN token redemption, and TIN tokens cannot fall below a set minimum ratio.

(ix) The borrower pays the financing amount and financing fees when the NFT matures, and the NFT is returned to the asset originator.

Clearpool is a decentralized credit protocol that provides unsecured loans to institutions. Users can borrow and lend using multiple currencies such as BTC/ETH/OP, and lenders can only provide liquidity to institutional pools they are invited to join. CPOOL is Clearpool's governance token. Its main function is two-fold: on the one hand, holders can vote on the whitelist of new borrowers. Another aspect is to obtain income from the Clearpool oracle. In addition to normal USDC interest, borrowers can also receive double rewards paid in CPOOL.

Main features and transparent and automated lending governance with the help of blockchain and smart contracts. The variable interest rate changes according to the dynamic supply and demand of the market, and the interest rate rises when the gap is high. For decentralized ratings of users, this platform uses algorithmic rating models and external rating APIs to assess user risks.

Goldfinch mainly provides loans to debt funds and financial technology companies, providing borrowers with USDC credit lines and supporting conversion to Fiat currency to the borrower. Goldfinch's model is much like a traditional financial bank, but with a decentralized pool of auditors, lenders and credit analysts. Goldfinch auditors auditing borrowers must own the staking governance token GFI. It mainly has the following characteristics:

Decentralized P2P lending platform - allows borrowers and lenders to lend directly on the platform without intermediaries. Lending pools and credit scoring: Debt funds provide credit ratings to borrowers through assessment and scoring algorithms to provide them with appropriate lending terms. Riskier borrowers are required to pay higher interest rates and collateral. Rely on decentralized auditors and governance processes to ensure the security and sustainability of the protocol. Reduce the role of centralized institutions. Collect interest/fees from the borrower. A portion of the profits is distributed to governance token holders. Its innovation combines traditional credit with decentralized finance/blockchain technology. More efficient and transparent P2P lending. Providing wider financial access and inclusion.

Maple Mainly for institutional accounts, non-full mortgage loans or even unsecured loans, Maple will appoint professional credit reviewers , Strictly audit the borrower’s credit. Institutional borrowers, lenders, pool validators. The lender provides funds for lending, and the institution serves as the borrower. The verifier will review the borrower's qualifications, and the borrower needs to pass compliance requirements such as KYC and AML, and the verifier needs to have certain credit practices or qualifications. To ensure the efficiency and safety of lending.

Thus Maple, corporate assets that are "combined" into crypto assets through real asset mortgage loans are audited and rated, and converted into RWA tokens for circulation on the chain. Provide enterprises with new channels for on-chain mortgage financing. By introducing institutional investors to reduce corporate financing costs, it provides investors with new mortgage crypto assets. However, following the storms of Three Arrows Capital, FTX, etc., Maple suffered $52 million in bad debts, and was controversial because it required KYC for borrowing and was not centralized enough.

In November 2023, the DeFi credit market Credix Finance announced that it had received US$60 million in credit facilities. The company focuses on asset-based lending opportunities and manages US$3 billion. portfolio. Supports different categories such as personal loans, business loans, invoice loans, etc. The more interesting project is based on the popular browser wallets Phantom and Solflare on Solana. For borrowers, it is also a multi-signature wallet. Relatively speaking, this platform is more inclined to blockchain projects and has a platform to issue fixed income products.

TrueFi is an unsecured credit protocol powered by on-chain credit scores. Since launching in November 2020, TrueFi has originated more than $1.8 billion in loans to more than 30 borrowers and paid more than $40 million in interest to protocol participants. Borrowers include leading cryptocurrency institutions, as well as fintech companies, credit funds and traditional financial companies.

TrueFi introduces an uncollateralized lending model in which borrowers do not need to provide traditional collateral, but instead have their credit risk assessed through the platform's trust system. This is an innovation compared to the need to provide physical collateral in the traditional financial system. TrueFi’s two products: TrueFi Lend allows users to provide funds in order to earn interest; TrueFi Borrow allows users to borrow by pledging crypto assets. The TrueFi platform uses TrustToken (TUSD) as its base currency, a stablecoin pegged to the U.S. dollar. I believe everyone is familiar with this topic, especially the recent TUSD de-anchoring incident.

Of course there are other projects, including the well-known Aave, which is not only a decentralized lending protocol on Ethereum, but also a RWA to some extent The project supports deposits and borrowings of multiple digital assets. In terms of RWA, Aave has explored the possibility of introducing real-world assets such as real estate into its protocol, and has also continued to experiment with tokenizing many real-world assets.

Currently, RWA is sold directly B2B, using RWA assets to be directly sold to B-end users such as institutional investors. The actual B2B2C model is actually used by C-end users. As the underlying mortgage asset of structured DeFi products, RWA is sold to C-end users through the DeFi platform Angle Protocol (the underlying asset is Backed Finance bC3M), USDV (the underlying asset is MatrixDock STBT), TProtocol (the underlying asset is MatrixDock STBT), Mantle mUSD (can be exchanged for Ondo Finance USDY) and Flux Finance (collateral is Ondo Finance OUSG).

This model accelerates the promotion of RWA assets in DeFi and provides users with more diversified product choices. We will not list them one by one here, but currently most of these projects are projects based on traditional financial assets, and we need to explore other forms of innovative projects.

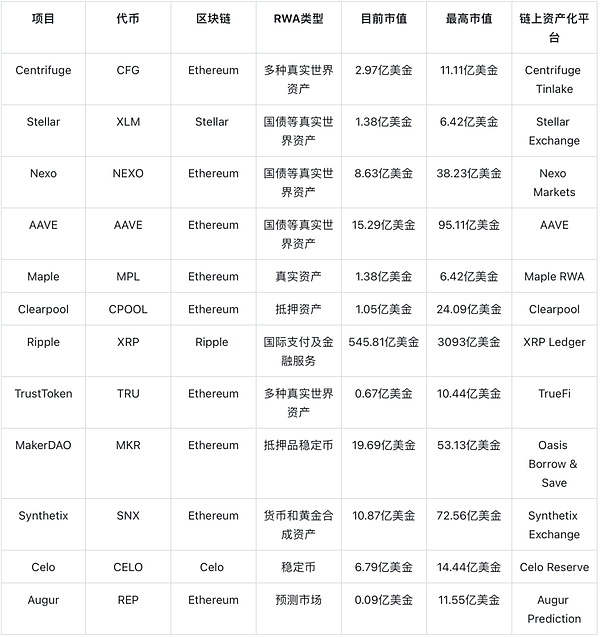

Since it is an investment in the currency circle People, we may be more concerned about the investment value of these RWAs on the market, what emerging projects are worth investing in, and what kind of ecology does RWA have? First, let’s take a look at the summary of the entire RWA combining CMC and non-small numbers.

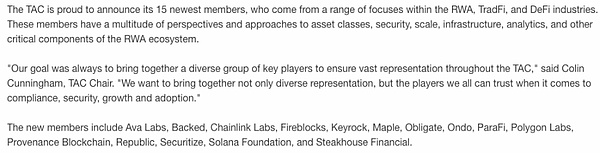

TAC Tokenization Industry Alliance

First of all, we need to focus on the establishment of the Tokenization Industry Alliance, which is composed of Coinbase, The Tokenized Asset Alliance (TAC) jointly launched by Circle, Aave and other companies shows the crypto industry’s common interest in RWA tokenization. The alliance is committed to promoting the popularity of RWA globally and considering the development of compliant principles to promote the adoption of blockchain technology, including Base, Centrifuge, Credix, Goldfinch, RWA.xyz, etc. We can take a look at some of the promising new additions to the roster.

Through this list, especially the 15 institutions or projects that recently joined on January 16, 2024, we can find that there is actually a particularly interesting phenomenon: that is, many public chains and well-known projects, including the well-known Chainlink , Polygon Labs, Solana Foundation, etc. are also rushing to join this alliance. What does this reflect? It shows that projects native to the blockchain are also gradually joining traditional finance and continuously strengthening cooperation with real-world assets.

New projects in new tracks

Secondly, we need to pay attention to projects emerging in different tracks, including real estate, multi-asset, traditional Finance (TradFi), Layer-1 Blockchain, Climate/Renewable Energy Finance (ReFi), Agriculture, Identity Verification, Private Equity, Public Equity, Private Fixed Income, Public Fixed Income, Emerging Markets, Security Tokens, and more. Referring to public information, the following table classifications are compiled. It is not difficult to find that there are many high-quality projects that have not yet issued tokens, such as Credix based on the SOL chain. Such high-quality projects are worthy of attention.

RWA is ultimately an on-chain securitization of offline assets, so for It is subject to relevant supervision of offline assets, so we cannot ignore the implementation of relevant supervision in traditional financial markets. Especially for digital asset center innovation, it seems easy, but in fact there are strict restrictions.

1) Singapore Legal Punishment

Singapore has gained a reputation for supporting cryptocurrencies due to its early industry regulatory initiatives and the regulator's consultative approach. But while Singapore may be all-in on asset tokenization, it’s not actually “crypto-friendly” at all. That's basically what Singapore's financial regulator said. Last year, Ravi Menon, managing director of the Monetary Authority of Singapore, delivered a speech titled "Supporting Digital Asset Innovation and Opposing Cryptocurrency Speculation." In 2023, he went further and said that cryptocurrencies "failed the test of digital currencies."

The first is the issue of Singapore’s recognition of cryptocurrency. For example, in April 2023, the Algorand Foundation sought to liquidate the Three Arrows Capital Singapore entity and claimed 53.5 million USDC In the case, the Singapore High Court ruled that cryptocurrencies were not recognized as currencies and ultimately rejected Algorand’s liquidation application.

At the same time, Singapore’s supervision of cryptocurrency is particularly strict, even if the source of third-party funds is traced. In September 2023, after Singapore uncovered the largest money laundering case in recent years in August, 10 people including Xinbao Investment founder Su Baolin were arrested, involving money laundering activities worth more than S$2.4 billion in assets. At least one international bank is closing the accounts of customers with citizenships of Cambodia, Cyprus, Turkey and Vanuatu. Other banks in Singapore have begun evaluating whether to accept new funds from customers with similar backgrounds on a case-by-case basis, a process that takes longer.

At least 10 local and international banks in Singapore have been implicated in the high-profile money laundering scandal, raising questions about their efforts to crack down on illicit profits. Efficiency concerns. Singaporean MPs raised more than 30 questions in Parliament this week, covering issues such as the rigor of their vetting process, suspicious transaction reporting and the impact on Singapore's reputation as a wealth hub.

2) Hong Kong has high barriers to entry

June 2023 Hong Kong’s Securities and Futures Commission (SFC) has begun accepting applications for cryptocurrency exchange licenses. On the surface, Hong Kong appears to be more friendly to cryptocurrency trading than Singapore. For example, Hong Kong regulators are urging banks to accept more cryptocurrency exchanges as clients. But again, this kindness comes with a lot of conditions. Hong Kong still has only two licensed exchanges, with only spot trading and a limited token list. 98% of the exchange’s assets must be held in cold wallets. The exchange must also set up a legal entity in Hong Kong for custody. Running an exchange in Hong Kong is neither simple nor cheap, as getting approval requires a team of lawyers, consultants and insurance providers. So far, only two institutions, OSL and HashKey, have passed. In August 2023, the two platforms announced on the same day that they had received approval from the Securities Regulatory Commission to complete the license upgrade and can provide virtual asset trading services to retail customers.

We once consulted through the grapevine to apply for Hong Kong’s blockchain license VASP, and the quoted prices were very high, and a special intermediary quoted even as high as 100 million US dollars. , because the whole process requires various institutions and a large number of company and personal qualifications. The process is complicated and the time cycle is long. Even a wealthy institution like Binance was frustrated when applying for this license. In the end, it stopped applying in anger. Only Bxx Exchange took a unique approach and directly purchased the shares of BC companies that qualified for this license.

3) Japan’s high taxes

Japan’s crypto industry Monetary supervision has shown a relatively active stance and has taken some measures to ensure the transparency and security of the industry. However, high taxes and strict issuance standards can become challenges for businesses growing in the country. Japan’s ruling Liberal Democratic Party has made it clear that it wants to make Japan a Web3 capital. A major obstacle to Japan becoming a destination for cryptocurrency entrepreneurs may be high taxes.

After the Coincheck hack in early 2018, Japan's regulators adopted a very strict attitude towards cryptocurrencies, causing some to worry that the local industry was in crisis. Worry. After FTX collapsed in November 2022, Japan’s regulatory approach was considered a major victory. Japan requires cryptocurrency exchanges to separate exchange and customer assets to help users truly recover their funds. Japan was one of the first major economies to implement stablecoin regulation, but set high standards. Only banks, trust companies and funds transfer services are allowed to issue stablecoins, and they must adhere to strict requirements, including that 100% of assets are held in trusts in Japan and can only be invested in domestic bank accounts.

4) Diversified attitudes in the United States

Cryptocurrency advocacy Economists have often criticized the U.S. government, especially U.S. Securities and Exchange Commission Chairman Gary Gensler, for being unfriendly to cryptocurrencies. The bigger problem is not that regulation is too strict, but that people are still debating what is a security and what is a commodity. The U.S. Securities and Exchange Commission (SEC) has filed multiple complaints. Many in the industry are watching the Ripple court decision, hoping it will set a clarifying precedent. Cryptocurrency-related businesses may be subject to U.S. Treasury Department anti-money laundering compliance regulations.

SEC Regulation: The U.S. Securities and Exchange Commission (SEC) regulates RWA programs involving securities. If the RWA relates to securities, such as raising funds through tokenization, token offerings considered securities offerings, ICOs (Initial Coin Offerings) then the related offerings may be subject to SEC securities regulations.

CFTC Regulation: The Commodity Futures Trading Commission (CFTC) regulates RWA projects involving commodities. Certain real assets, such as commodities, may be regulated by the CFTC.

State-level regulation: Some states may have independent financial regulators that may also regulate RWA projects. Regulations may vary in each state.

Therefore, the supervision of real assets on-chain (RWA) and blockchain in the United States is diversified, involving different levels of regulatory agencies and regulations . Blockchain technology and crypto-assets involve the attention of multiple regulatory agencies. Multiple agencies such as the SEC, CFTC, and the U.S. Department of the Treasury may be involved in the regulation of blockchain and encrypted assets.

5) EU standards framework

I have to talk about it here To the EU’s MiCA policy on cryptocurrencies. The MiCA Act is a regulatory framework proposed by the European Union to provide clear legal provisions and regulatory standards for crypto-assets on the market. The bill is the EU’s first comprehensive regulatory framework for digital assets and cryptocurrencies. The MiCA Act covers a range of cryptocurrency-related matters, including the definition of crypto-assets, registration and regulation of market participants, rules for the issuance of crypto-assets, compliance reporting requirements, etc.

The MiCA Act stipulates that any market participant providing crypto-asset services in the EU needs to register with the European Securities and Markets Authority (ESMA) and obtain relevant Authorization. This includes crypto exchanges, digital asset wallet providers, and entities that issue or offer crypto assets. The plan is mainly to strengthen investor protection. It sets out transparency requirements for investors to ensure they understand the nature and risks of their investments. In addition, the bill also provides for certain advertising and marketing rules.

The MiCA bill sets a series of rules for entities that issue crypto assets, including transparency, information disclosure, white paper requirements, etc. These rules are designed to ensure that issuers provide sufficient information to enable investors to make informed decisions. The MiCA Act requires crypto asset service providers to comply with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations to ensure that their platforms are not used for illegal activities. The MiCA Act advocates EU and international cooperation to ensure consistency in the regulation of crypto-assets globally and prevent regulatory arbitrage and compliance loopholes.

Of course, there are also skeptics For example, in the article "Expression" by Arthur Hayes, Arthur Hayes favors decentralized and code-based solutions, criticizes the complexity and potential risks of the RWA project, recommends being cautious when investing in governance tokens, and Emphasizes the importance of owning Bitcoin to preserve value in the face of devaluation of fiat currencies. The specific criticisms of RWA are as follows:

Decentralization and dependence on the state

Arthur Hayes believes that crypto tokens that rely on national legal existence will not succeed at scale. It is believed that decentralized blockchain is expensive because it does not rely on the state. Questioning why blockchain tokenization should be chosen when centralized options like real estate investment trusts (REITs) already exist and are managed by experienced companies.

Estate Division

When it comes to especially Millennials and older generations have the lofty goal of owning real estate. Several challenges arise for RWAs, including the desire for an actual structure rather than a digital token, the uniqueness of the properties hindering liquidity, and the fact that traditional securities like REITs already exist and are liquid.

Debt-based tokens

Discussed the benefits of representing The popularity of tokens that yield debt ownership, particularly tokens related to U.S. Treasuries.

Supports competition among USD-pegged stablecoins, but criticizes investments in governance tokens as speculative bets on USD interest rates. Alternative options are proposed, such as shorting ETFs holding Treasury bonds, to gain similar exposure to interest rate movements without using crypto governance tokens.

Bitcoin Spot ETF

For traditional asset management companies The potential impact of entering the Bitcoin ETF space. Concerns have been raised about a possible future scenario where large asset managers hold all the Bitcoins, causing Bitcoin trading to grind to a halt, threatening the viability of the network. The current huge sell-off in BTC prices and Grayscale has led to the recent market downturn, which also proves this point.

Fiat Currency Debasement and the 2024 Elections

Predictions Due to Due to political motivations for re-election, global currency printing will surge in 2024. This is also inevitable. In the case of large-scale water release, the value of currencies will all shrink. The historical tendency of fiat currencies to depreciate over time. Bitcoin is therefore encouraged to be viewed as a hedge against fiat currency devaluation and inflation.

Trust Challenge An incentive structure that minimizes the risk of fraud, but unlike fully collateralized lending protocols, it still requires a level of trust. Both the up-chain and off-chain of RWA involve three parts: law, finance and technology. Financial and technical logic has been widely practiced at present. For example, MakerDAO's purchase of U.S. Treasury bonds essentially involves financial and technical operation guidelines, but are there any Eligibility to purchase treasury bonds is an overlooked issue. DAO is not a legal entity in most countries and regions.

Facing regulatory policy challenges; The previous article also talked about regulatory issues. The underlying assets of most equity markets can be traded in traditional The financial market carries out transactions and is equipped with strict supervision and full support for the ownership of the underlying assets of each RWA. For most regions, there are no established regulatory requirements.

Technology Maturity Challenge; Although DID, ZK, and oracle technologies are becoming increasingly mature, so far, there are still problems such as code in the DeFi field There are serious security issues such as vulnerabilities, price manipulation, MEV, and private key leaks. DeFi itself still faces certain challenges.

Stability challenges of off-chain asset custody; Due to the market type and the basic asset type represented by RWA, both are showing increasing The more diversity there is, the greater the risk of non-insurance in diverse assets. For example, some people in Asia even use houses in Shenzhen Bay to conduct RWA, but in fact, investors don’t know whether there is any physical mortgage endorsement.

This article once again elaborates on RWA. On the one hand, it wants to draw everyone's attention to the RWA ecology, and on the other hand, it also provides some essential basic homework for participating in this track. Looking ahead to RWA, we can see continued growth in this area within the blockchain and decentralized finance (DeFi) ecosystem. The tokenization of RWA provides a powerful bridge to bring traditional real assets into the crypto world, providing investors with a wider and more flexible portfolio of assets.

The successful development of RWA requires deeper integration with the traditional financial system and the real economy, especially an important step for people to truly move from Web2 to Web3. The tokenization of RWA marks the convergence between financial and physical assets, providing more options for global investors. BiB Exchange will work with everyone to continue to focus on regulatory compliance, ecological integration, technological innovation, social impact, risk management and community participation, which will help to more comprehensively understand and participate in this emerging field, while promoting its sustainable development.

Bitcoin has a block size limit of 1M transaction block + 3M signature block. There are size and opcode number restrictions for each transaction.

JinseFinance

JinseFinanceThe market for T-RWA and Hong Kong compliant RWA lacks RWA guidance funds to promote development.

JinseFinance

JinseFinanceWith the development of high-performance blockchain technology, the true value of PayFi will expand and scale rapidly.

JinseFinance

JinseFinanceThe popularity of AI continues and the concept of RWA emerges. These two tracks that are most closely related to DePIN will become the mainstream of Web3 in the second half of the year.

JinseFinance

JinseFinanceRecommended readings tonight: 1. Can MegaETH, supported by Vitalik and led by Dragonfly, make ETH great again (MEGA); 2. Who is behind the Solana spot ETF? 3. From trust to doubt, the seven sins of genius Pacman;

JinseFinance

JinseFinanceThis report takes cues from the performance of Bitcoin spot ETPs to forecast demand for Ethereum ETPs. We estimate that spot Ethereum ETPs will see net inflows of approximately $5 billion within the first five months of trading.

JinseFinance

JinseFinanceIt seems obvious that the real-world asset tokenization space has huge growth potential in the future. But what exactly is this trend, why is it attracting so much attention and hype, and how can you make the most of it?

JinseFinance

JinseFinanceApril is hot, and various Web3 conferences are gathering in Hong Kong, the Pearl of the Orient. Among the vertical fields discussed by many big names, RWA has become a focus of attention.

JinseFinance

JinseFinanceThere has been a lot of discussion recently about increasing the gas limit for Ethereum blocks.

JinseFinance

JinseFinance Coinlive

Coinlive