Source: Liu Jiaolian

Stop talking and look at 6 pictures.

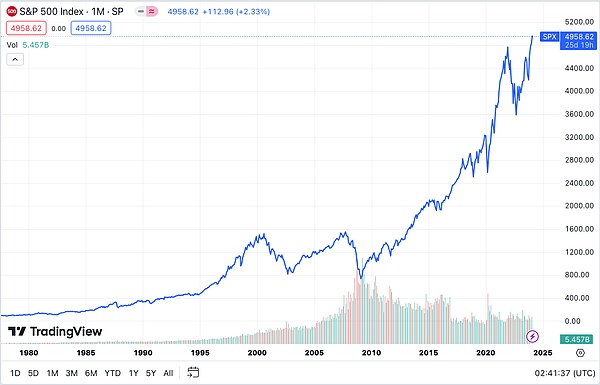

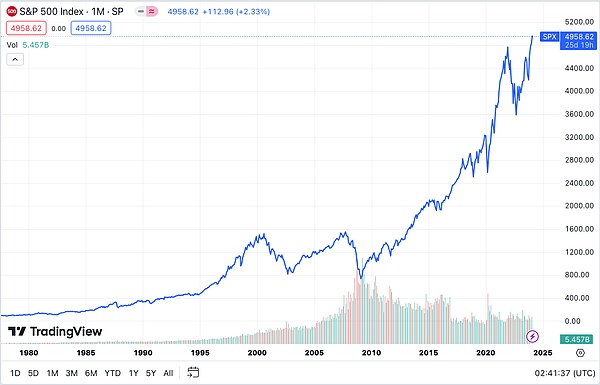

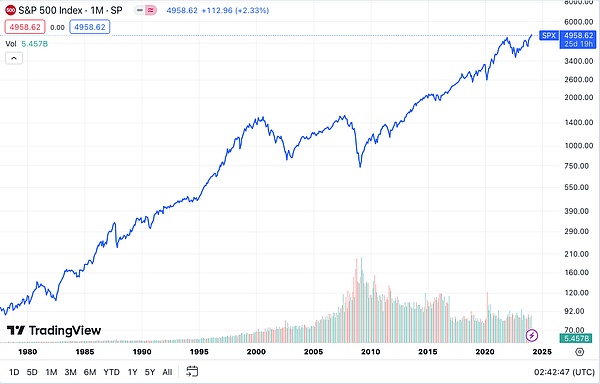

The first picture is the trend chart of the S&P 500 in the past 40 years, linear coordinate system.

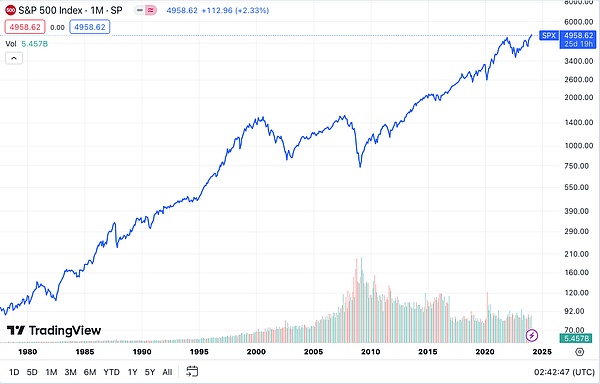

The second picture is the S&P 500 trend chart over the past 40 years, logarithmic Coordinate system (Y axis).

The third picture, the Shanghai Composite Index trend chart in the past 30 years, linear coordinate system .

The fourth picture, the trend chart of the Shanghai Composite Index in the past 30 years, logarithmic coordinates system (Y-axis).

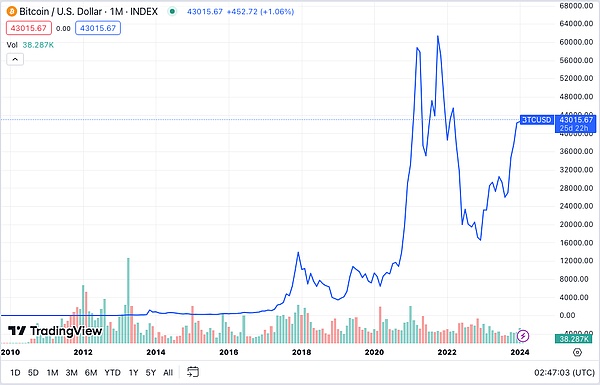

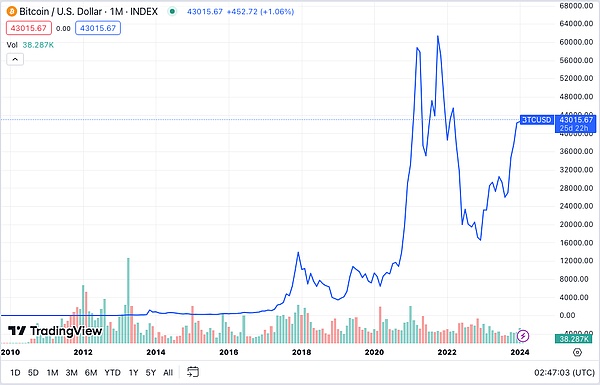

The fifth picture, the trend chart of BTC (Bitcoin) in the past 15 years, Linear coordinate system.

The sixth picture, the trend chart of BTC (Bitcoin) in the past 15 years, Logarithmic coordinate system (Y-axis).

Finally, the above graph is formed by connecting the monthly closing prices and has been hidden. The ups and downs of the month. Taking BTC as an example, the price on the graph in December 2017 was 13,888 knives. However, in fact, the highest price that month once reached 19,800 dollars. A long upper shadow line, and countless touching stories of liquidation and high-level takeovers behind it, were all blown away by the rain and wind.

Sponsored Business Content

Financial markets do not understand the joys and sorrows of individual human beings. The subject of speculation is creatures living in logarithmic space-time. Humans are creatures living in linear time and space. For the former, going from 1 to 10, or from 10 to 1, is nothing more than going from 1 to 2, or from 2 to 1 in the eyes of the latter.

Having the ultimate power to control additional issuance bears the moral responsibility of stabilizing the market (rescuing the market). Those who sit in the banker trap money and make guaranteed profits without losing money. Speculators make money and call for bailouts when they lose money. The main body responsible for rescuing the market was forced by public opinion to issue additional currency to rescue the market. In essence, it means that all people, including those who have not participated in the financial market game, pay for the harvest of bankers and the profits of speculators.

U.S. stocks are radical. The SEC is responsible for controlling the gate of securities financing, and the Federal Reserve is responsible for shouldering the responsibility of rescuing the market. Listed companies in the U.S. stock market are in the driver's seat, U.S. stock investment institutions are making profits, and the Federal Reserve has issued an excessive amount of U.S. dollars to rescue the market. Everyone seems to be making money, so who is losing money? In fact, all the listed companies and investment institutions that have made money will harvest all the poor people in the world who cannot participate in the US stock market but cannot get rid of the US dollar.

Bitcoin (BTC) is conservatism. Satoshi Nakamoto gave up the power to control the issuance of BTC and used the PoW (Proof of Work) mechanism to ensure that no one can monopolize this power. Therefore, no one, including Satoshi Nakamoto, bears the moral responsibility and pressure to rescue the market. Every time BTC crashes, it will fall by a huge margin of 70% to 90% in just one year, often exploding tens or tens of billions of dollars in leverage, causing countless currency speculators to lose their money. How many investment figures are there? Currency companies go bankrupt, but no one will save them—Satoshi Nakamoto won’t save them, and Bitcoin won’t save them either. Scrap the bones and cure the poison, blow up all the leverage that can be exploded, and make all the positions that can lose money lose money. The more thorough the deleveraging is, the fairer the market will be.

Zhang San went to 3x leverage. Li Si only invested the income from his labor. The market rose by 1 times, John Si only earned 1 times, while Zhang San earned 3 times. Why? Some people say that because Zhang San took greater risks, the extra profit was the reward for the risk. Then, a risk that cannot occur is nothing but a risk, just like a missile that cannot hit the enemy's home and kill the enemy is just a decoration. The best way to reflect 3 times the risk is for the market to blow up Zhang San’s position. Other than that, it's all bullshit.

Even for spot positions, if you invest more money than you can objectively or psychologically bear, it is also a kind of soft leverage. When the market decline exceeds the objective endurance or psychological endurance, it will lead to a mental breakdown and exit the market. Then, the market must also fall below the biggest pain point, causing the most people to fall into despair, and floating losses will turn into real losses.

From a conservative perspective, calling for a bailout is a hooliganism. Satoshi Nakamoto knew that all the leeks who lost money were giant babies, and they would try their best to find someone to take responsibility for their losses. Their demands have long been divorced from the justice principle of "the wrongdoer deserves his debtor," and they only care about their own profits. Therefore, the bailout they are calling for is to harvest more innocent people and pay for their gambling losses.

The way of man is to give more than you can lose. The essence of artificial bailout is to harvest more and poorer people to subsidize the financial investor group whose living standards are far higher than the social average; indirectly, it is to rob the poor and give to the rich, and harvest the top group of listed company controllers in the entire social subsidy pyramid. .

Satoshi Nakamoto will not save the market, and Bitcoin will not save the market. The stages of scraping the bones and treating the poison spread in the crypto market are as follows:

The first step is to kill retail investors. The second step is to kill the whales (big players). The third step is to kill the organization. The fourth step is to kill the miners (increase issuers). The fifth step is to kill the exchange. The sixth step is to clear the leverage. The seventh step is to kill another wave of bargain hunters. Then, confirm the bottom.

If you are somewhere between U.S. stocks and Bitcoin, on the one hand you must have the power to control the market’s issuance and expansion, but on the other hand you cannot assume the responsibility of responding to public opinion and actively rescuing the market, then you can As you can imagine, the situation will definitely be more embarrassing. The vast majority of people who are losing more and more are scolded by Liucai every day. As the market falls deeper, the scolding becomes more and more unpleasant. It is absolutely inevitable.

Marx said that weapons of criticism (slogans and documents) cannot replace weapons of criticism (bullets). In the face of real money losses, even die-hard Austrian supporters have to give up the concept of non-intervention in the free market and call on centralized power agencies to step aside and save their positions. In fact, almost all beliefs in liberalism are pseudo-liberalism that only wants the benefits of freedom but does not want the price of freedom.

In the financial market, as long as you are not the strongest, the meaning of freedom is almost equal to the freedom of being harvested.

Catherine

Catherine