Original: Liu Jiaolian

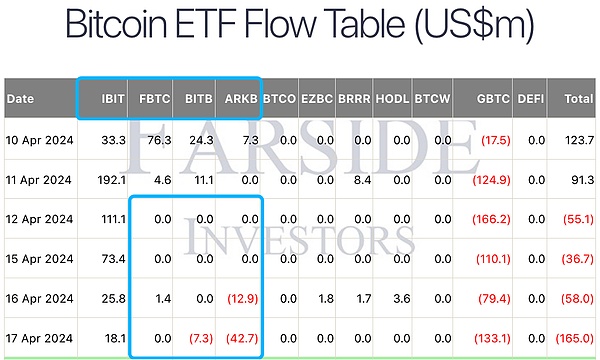

It can be said that most retail investors, even some institutions, chase the rise and sell the fall. This can be seen from the inflow data of spot Bitcoin ETF. BTC (Bitcoin) has fallen continuously in recent days. In just 10 days, it has dropped from 72k to 62k by 10,000 dollars, and once broke through the 60,000 dollar mark. With the downward trend of prices, three of the "four major" spot Bitcoin ETFs have directly stalled, and BITB and ARKB have even reversed to net outflows. Only one cylinder of this four-cylinder engine, BlackRock, is still working hard, so the power is naturally much weaker.

To be honest, the current position of about 60,000 is really safe. Crossing 2025 and arriving at the end of 2026, even if the situation of breaking through the "previous high" at the end of 2022 occurs more than two years later, the minimum is 70,000 dollars. In other words, 70,000 dollars at the end of 2026 is equivalent to 16,000 dollars at the end of 2022. This also means that if your funds can hold still for three years (both subjectively and objectively), then crossing the bull and bear markets, even if there is no so-called "escape from the top", holding BTC until the end of 2026, there is a high probability that there will be no loss.

Know where the bottom line of your position is. Knowing the bottom line will not lose money. This is the basis and capital for pursuing higher returns. Many people blindly pursue high returns and get rich quickly because they don't understand the bottom line, and end up losing everything.

Buffett said that the most important thing about investing is not to lose money.

Both Zhang San and Li Si started with a capital of 1 million. Zhang San steadily increased by 40% every year. Li Si made a big profit of 200% in one year and lost 60% in another year, and so on. After 10 years, how big is the gap between the two?

Zhang 30 years later: 1 million x (1 + 40%)^10 = 28.92 million

Li 40 years later: 1 million x (1 + 200%)^5 x (1 - 60%)^5 = 2.49 million

Answer: The difference in their net worth is 10 times.

What if the time is extended to 30 years? The numbers may surprise you.

Zhang San 30 years: 1 million x (1 + 40%)^30 = 24.2 billion

Li Si 30 years: 1 million x (1 + 200%)^15 x (1 - 60%)^15 = 15.4 million

Now the two are no longer in the same wealth class. It is meaningless to compare the difference in their net worth.

And if you compare how the two have spent the past 10 or 30 years, you may feel more emotional.

Zhang San in the past 10-30 years: hoarding BTC and holding it. Spend time educating children, accompanying family, doing what you like, traveling, keeping fit, exercising, writing books, etc.

Li Si has spent the past 10 to 30 years: selling high and buying low, adding leverage, always nervously watching the market, paying close attention to new coins and new projects, buying local dogs, taking advantage of airdrops, and getting wool; being liquidated, having coins stolen, and being PUA by the project party; not caring about children's studies, lover's feelings, and elderly parents; no time and mood to exercise, and health is getting worse and worse; nerves are numb, and I don't know what hobbies I have besides speculating in coins, and I can't get interested in doing any down-to-earth work to make money slowly; I always watch the market when I travel, my mind can't be emptied, and my body and mind can't relax; etc.

My child has to read extracurricular books in elementary school, so I gave him a book "38 Letters from Rockefeller to His Son" for him to read. He reads it every day after class and during breaks, and exchanges his thoughts with me after school. Yesterday he told me that the latest article he read said that people should be the masters of money, not the slaves of money.

Yes. Investment is a personal practice. Investment is nothing more than a part of one's life. Before answering the question of what kind of investment we should make, we must first think clearly about what kind of life we want to live. Otherwise, we will forget our original intention and become slaves to money.

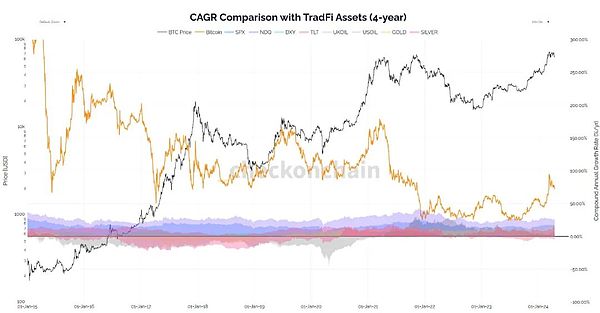

So, the technical question is, is it difficult to achieve a 40% annual return rate by hoarding BTC? The following figure is the CAGR (compound annual growth rate) of Bitcoin in a 4-year cycle, and a comparison chart with some other traditional assets.

The orange curve in the figure is the 4-year CAGR of BTC, and the corresponding value is on the right Y axis. It can be seen that except for the two years from January 2022 to January 2024, the 4-year CAGR is between 25-50%, and the rest of the time is above 50%. Since March this year, as BTC has risen to 60,000-70,000 dollars, the 4-year CAGR has risen back to more than 72%.

However, most people make money while investing, so they will continue to increase their positions at various points in the four years. In this case of fixed investment, the advantage is that some volatility will be smoothed out, and the disadvantage is that the actual CAGR of the position will be much lower than the CAGR of the one-time investment at the starting point. It's about half lower. In this way, if BTC's 4-year growth is equivalent to a CAGR of 80%, then the CAGR of fixed investment can be about 40%, which is very good.

Now with BTC's retracement, if the 4-year CAGR is equivalent to 72%, the fixed investment CAGR is about 35%.

Teaching chain real disk, in the past 6 years from 2018 to now, the eight-character formula insists on fixed investment and adding positions when the market falls, and the CAGR is about 28%. There are three reasons for the low value: First, in 2018, the investment was tentative, and there was no heavy position, but it was still counted as 1 year, which lowered the value; second, the bull market in 2021 was on the rise, and the investment was increased in the high range, resulting in top-heavy; third, the increase in funds in 2023 was restricted by objective factors, and the investment amount was low. In short, the theory is full, and the reality is very skinny. In actual operation, it is difficult to achieve perfection if you can persevere subjectively for many years and objectively not drag your feet (such as not losing your job, not reducing your salary, not getting sick, and not spending a lot of money).

Many people have no concept of the compound interest power of CAGR.

Back in 2021, Jiaolian said that it would be great if BTC could achieve a CAGR of 40% in the last two cycles. This goal is not impressive, but it is relatively possible to achieve.

Two cycles are 8 years. With a CAGR of 40% in 8 years, 1 million will become 1 million x (1 + 40%)^8 = 14.75 million.

On the other hand, earning 13.75 million in 8 years is equivalent to earning 140,000 per month and 1.7 million per year. With a monthly salary of 140,000 and an annual income of 1.7 million, even if it is placed in a first-tier city, it can be regarded as a high-income group, right?

Predict the enemy with leniency. Considering that the actual operation will not be so ideal, and the growth rate will definitely decline, then it is better to use a CAGR of 20%. This is roughly equivalent to the level of Mr. Buffett.

8-year CAGR 20%, 1 million x (1 + 20%)^8 = 4.3 million.

Converted to a monthly salary of 34,000, an annual income of 410,000. The income level of white-collar workers in first-tier cities.

Just think of it as a kind of savings. Or like paying insurance premiums every year. Saving BTC is like giving yourself an insurance policy for your life.

A little bit adds up to a lot, and a little bit adds up to a tower. Soon, the power of the compound interest effect will be revealed.

In addition to BTC, do you think other currencies have long-term compound interest varieties? To be honest, I really can't see it. "Saving money" in those things is purely "giving money" and "burning money".

There is an old saying that if you want to make a little money, everyone can do it with hard work, but if you want to make big money, it depends on your fate.

But in this market, many people are unwilling to make a few tens of millions of small money a year, and they have to gamble their lives in an attempt to make a big bet. If you win, you will be financially free, but if you lose, you will be heavily in debt. From the perspective of probability and the way of heaven, 99.99% of people are destined not to get rich quickly.

If it is destined to happen, it will happen, and if it is not destined, don't force it. The result of forcing to get rich quickly is often not a good ending.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Finbold

Finbold Beincrypto

Beincrypto