Article author: arnaud710 Article translation: Block unicorn

Market makers are the unsung heroes who ensure smooth trading. They are like stage managers on the trading floor, maintaining market liquidity and seamless trading, while balancing countless factors to maintain stability. Building an efficient market-making system is like building a high-performance car - every part needs to work perfectly to provide top performance.

What is market making?

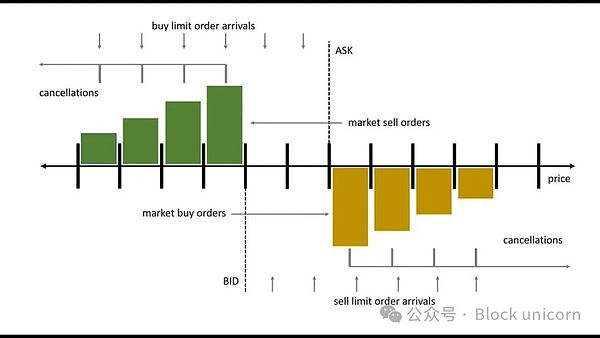

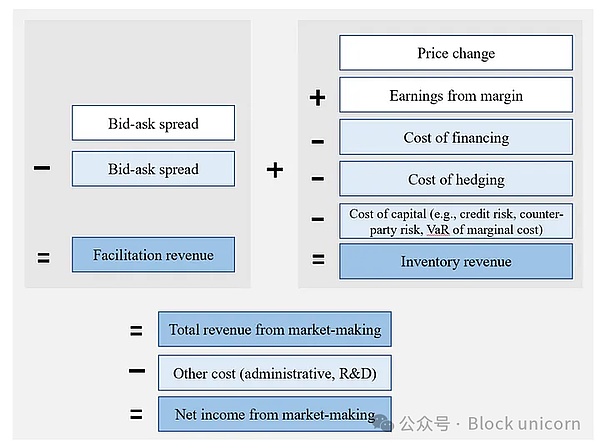

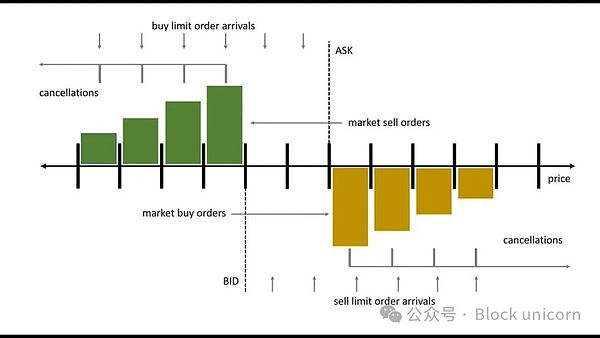

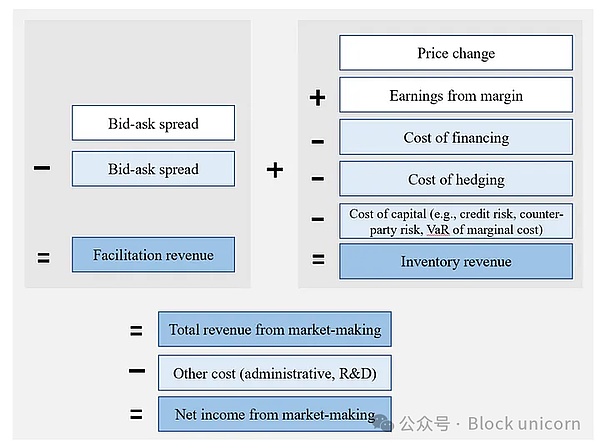

The core of market making is to provide liquidity to financial markets and provide trading opportunities for securities by continuously quoting bids (Bid) and asks (Ask). Market makers make profits through the bid-ask spread - the difference between the bid and ask prices. You can think of them as friendly local shopkeepers who always have goods to sell and are also willing to buy back goods to ensure that buyers and sellers do not go home empty-handed.

Ask-ask spread: the core of market making

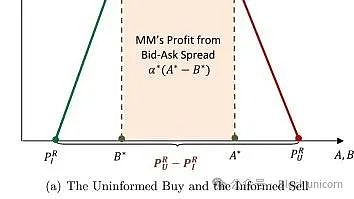

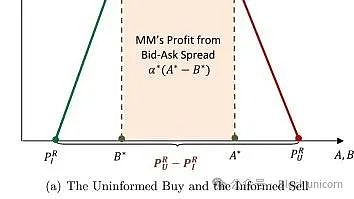

Ask-ask spread is the key to market makers’ profitability. It not only covers the risks and costs of holding inventory and facilitating transactions, but also determines whether market makers can attract traders.

The key is to find a "sweet spot" - too wide a spread and your inventory will be unsaleable; too narrow a spread and your profit will be minimal. A well-adjusted spread helps market makers cover their costs while remaining competitive.

Inventory Holding Premium (IHCi): The Art of Balancing

Market makers hold a certain inventory of securities to facilitate trading

The cost of holding inventory: comes from two main aspects

1. Opportunity cost of funds

Holding inventory ties up funds that could have been used for other investments. If the security price is higher, the required spread will also be larger to cover this cost. Think of this as higher-end products requiring higher pricing because they require more resources to produce.

2. Risk of price volatility

Securities markets are highly volatile, and price changes can result in losses. If market prices change in an unfavorable direction, market makers will suffer losses. To protect against this risk, market makers will typically widen the spread to provide a buffer against adverse price changes.

This approach accounts for the interaction between security prices, volatility, and holding time, and ensures that premiums can adjust with market conditions.

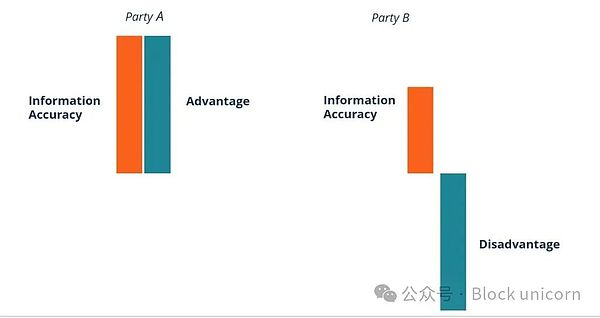

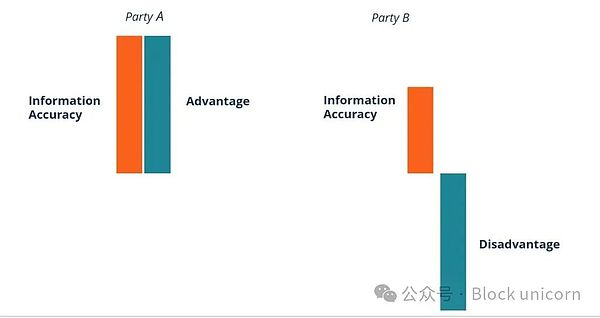

Adverse Selection Costs (ASCi): Guarding Against Traders with Information Advantages

Adverse selection refers to the situation where traders have certain superior information about the future performance of a security, but market makers do not. To protect against potential losses from these information advantage traders, market makers need to adjust their spreads.

For example: if someone knows that a stock is about to surge, they may buy it at the ask price, and if the stock price does not rise as expected, the market maker may suffer heavy losses. By incorporating ASCi into the spread, market makers can mitigate these risks caused by asymmetric information.

Probability of Trading on Information (P_I): Assessing Risk

Assessing the likelihood of facing an information-advantaged trader is a complex task that requires analyzing patterns and market data to determine whether a trade is based on inside information. Factors such as trading frequency, volume, and historical price trends will affect this judgment.

Competition proxy (H′): Measuring market competition

Competition among market makers affects the width of the spread. The more intense the competition, the narrower the spread is usually because market makers need to attract traders. H′ can be calculated by the market concentration of market makers for a specific security:

Higher H′ values indicate less competition, higher concentration, and wider spreads; while when competition is intense, spreads tend to be narrower.

Use vivid metaphors to easily understand the core principles of market making

Opportunity cost: Imagine your funds are your best salespeople. If you keep them busy making cold calls all day instead of taking high-value orders, you will miss out on huge profits. By properly allocating funds and using them where they matter most, ensuring that your "money-making experts" are focused on doing the right thing, you can widen the spread and earn more profits.

Volatility: Imagine volatility as a person jumping on a trampoline. You can never predict the height or direction of the next jump. Market makers must hold steady and not be thrown off by these ups and downs.

Adverse Selection: Adverse selection is like going to a football game, and some spectators secretly know the outcome of the game. Market makers need to set spreads accurately to prevent being led by these cunning "insider spectators" and avoid falling into their trap.

Building a complete market-making system is much more complicated

In summary, the art and science of market makers play a key role in ensuring market liquidity and smooth trading.Building an efficient market-making system is a technical job that combines art and science. It requires both deep technical knowledge and precise strategy adjustments, as well as rapid adaptation to rapidly changing market dynamics.

Through careful operations, market makers ensure that financial markets always remain liquid and efficient, providing important support for the stable development of the entire market ecosystem.

Xu Lin

Xu Lin