Recently, Cathie Wood, a star fund manager on Wall Street and CEO of Ark Investment Management, led her ARK research team to release a famous Reporting for Big Ideas 2024.

Disruptive innovative technology

In this long In the 163-page report, "Sister Mumu" continued to focus on the field of "disruptive innovative technologies" and mentioned the blockchain field many times.

This article will screen, summarize, and deeply interpret the core ideas in its report.

In the future, with the large-scale adoption of blockchain technology, all funds and contracts may be transferred to the public blockchain to verify numbers Proof of scarcity and ownership.

The financial ecosystem is likely to reset to accommodate the rise of cryptocurrencies and smart contracts.

These technologies increase transparency, reduce the impact of capital and regulatory controls, and lower contract enforcement costs.

In a world where more and more assets become like money and businesses and consumers adapt New financial infrastructure, digital wallets will become increasingly necessary, and company structures themselves may be questioned.

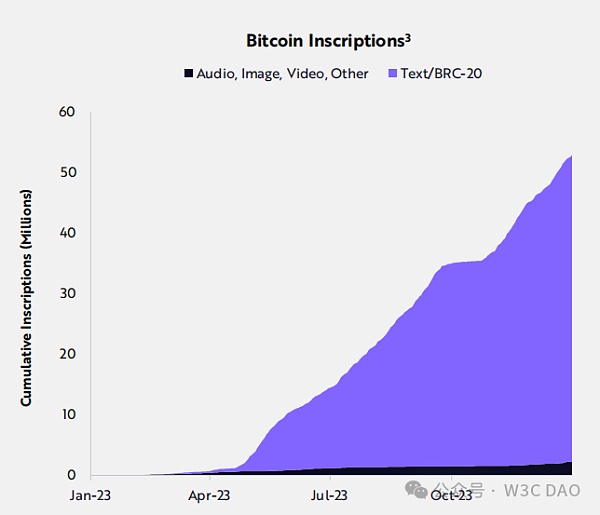

She also mentioned Bitcoin Inscription, which is a disruptive innovation by introducing a unique number for each Bitcoin Sats The system, while each Sats is identifiable and immutable, allows users to record their data, images or text.

Unlike other blockchains, Bitcoin Inscription sits at the base layer of the Bitcoin blockchain.

“In our view, this is a product of the free market and represents the healthy innovation of Bitcoin.”

In-depth interpretation

This picture is about the comparison and comparison of Bitcoin's fundamentals and network statistics in 2022 and 2023 analyze.

It highlights Bitcoin’s significant growth across various dimensions, including price, market cost basis, hash rate, Bitcoin moved one year ago Supply, Bitcoin addresses with non-zero balances, long-term holder supply and number of transactions.

The headline is "Bitcoin fundamentals haven't skipped a beat in 2022 crisis and continue to accelerate in 2023."< /p>

On the right side of the image is a chart showing the steady growth of Bitcoin’s hash rate over time, reaching its all-time high in October 2023. Hash rate is a proxy indicator of network security.

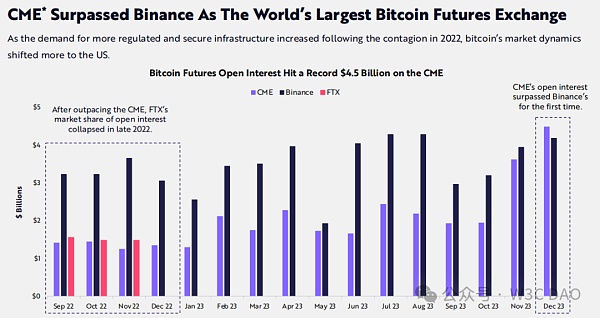

This image is about the comparison of Bitcoin futures open interest between CME, Binance and FTX.

It shows that in the future, CME will surpass Binance and become the largest Bitcoin futures exchange in the world due to more regulatory and security needs. Place.

The title of the picture is "CME will surpass Binance to become the world's largest Bitcoin futures exchange."

The subtitle explains the background: “Bitcoin’s market dynamics shift more as demand for more regulation and security infrastructure increases after the 2022 crisis The United States.” And the chart shows that “Bitcoin futures open interest on CME hit a record of $4.5 billion.”

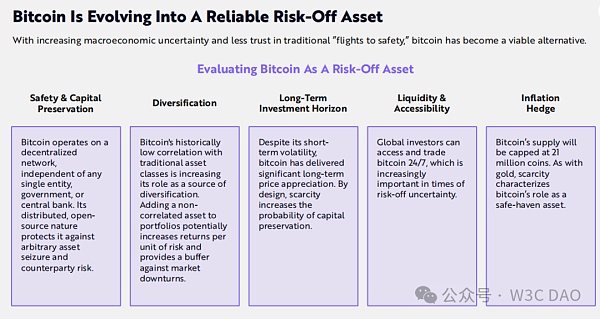

This picture is about how Bitcoin is evolving into a reliable safe-haven asset amid macroeconomic uncertainty and declining trust in traditional "safe-haven assets." It assesses Bitcoin's value as a safe-haven asset based on the following aspects:

Safety and Capital Preservation:Bitcoin Run On a decentralized network without the influence of any single entity, government or central bank. Its open source nature protects it from arbitrary asset seizure and counterparty risk.

Diversification:Bitcoin has low correlation with traditional asset classes, enhancing its role in portfolio diversification . Adding an uncorrelated asset to a portfolio may increase returns per unit of risk and provide a cushion when markets decline.

Long-term investment perspective: Despite Bitcoin's short-term volatility, it has significant long-term price growth due to its design and scarcity potential.

Liquidity and Accessibility: Investors around the world can access and trade Bitcoin 24/7, highlighting its The importance of risk aversion in times of uncertainty.

Inflation Hedge:The supply of Bitcoin is capped at 21 million coins. Its scarcity characteristics make it consistent with gold's role as an inflation hedge. .

About smart contracts

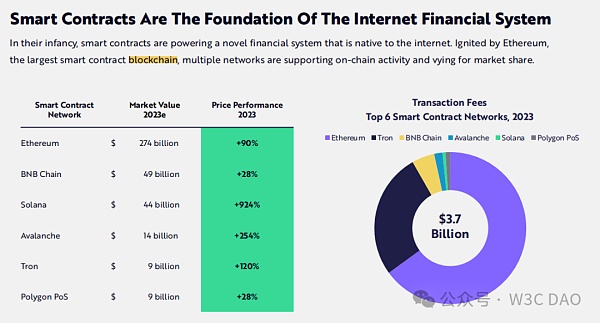

Smart contracts are deployed in public areas The blockchain provides a global, automated and auditable alternative to rent-seeking intermediaries and traditional financial infrastructure.

In the wake of the “crypto crisis” of 2022, a number of digital asset solutions have gained support, including stablecoins, tokenized treasury funds, and scaling technology.

According to ARK’s research, as the value of on-chain financial assets increases, the annual growth rate of the market value associated with decentralized applications can Reaching 32%, growing from US$775 billion in 2023 to US$5.2 trillion in 2030.

The table shows different smart contract networks, including Ethereum, Binance Chain, Solana, Avalanche, Tron, and Polygon PoS.

The table also shows their projected market capitalization and price performance in 2023. Ethereum leads the way with a market cap of $274 billion and a price performance of +90%.

On the right side of the picture is a pie chart labeled "Top 6 Smart Contract Networks in 2023". It visually represents the total transaction fees of these networks at $3.7 billion.

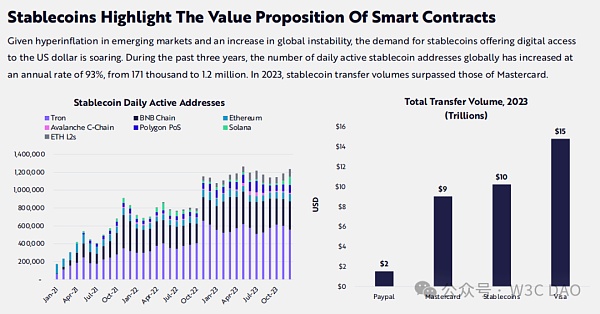

This image is a comparison and analysis of the value proposition of stablecoins in traditional financial systems.

Due to high inflation in emerging markets and increasing global instability, demand for stablecoins has surged as a way to provide digital access to the U.S. dollar.

It also shows two charts, one is the number of daily active addresses of stablecoins on different blockchain networks, from January 2021 to There was a significant increase in October; the other is the total transfer volume in 2023, in trillions of dollars, comparing PayPal, Mastercard, stablecoins and Visa. It shows that stablecoins are expected to surpass Mastercard in 2023, but still fall short of Visa’s total transfer volume.

Write it at the end

As we all know, Sister Mu, she The best investment philosophy is to choose companies that can change the world, rather than companies that will not be changed as the world changes.

It can be said that she is a loyal fan of Bitcoin and has repeatedly believed that Bitcoin is expected to reach the price target of US$1 million per coin.

As mentioned in the "Big Ideas 2024" report released by the ARK research team,in the future, all funds may be transferred to the public blockchain Layer1, The financial ecosystem is likely to be reset, and companies and social systems themselves will be affected.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance fx168news

fx168news