Author: Felix Ng, CoinTelegraph; Compiler: Deng Tong, Golden Finance

Crypto markets are regaining their footing after South Korean President Yoon Suk-yeol rescinded martial law, less than six hours after it was imposed.

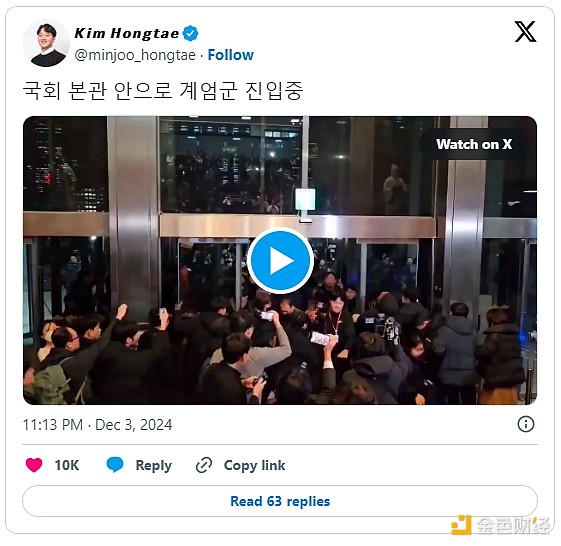

According to local reports, the announcement was rescinded during a cabinet meeting around 4:30 a.m. local time. About 190 of the country's 300 lawmakers voted against martial law.

"I will accept the request from the National Assembly and cancel it," Yoon Suk-yeol said, according to The Washington Post.

Under South Korean law, the government must lift martial law if a majority of parliamentary votes require it.

Yun's abrupt announcement on live television on Tuesday reverberated on the global stage, prompting a response from the White House expressing "grave concern about the developments we are seeing in South Korea."

Yun said he declared martial law in response to what he called "the threat posed by the communist forces in North Korea" and to "eliminate anti-state elements."

Yun Seok-yeol had earlier said: "This is an inevitable measure to ensure the freedom and security of the people, guarantee the sustainable development of the country, and resist the riots caused by these subversive, anti-state elements."

The prices of cryptocurrencies such as Bitcoin, Ethereum and XRP dived after the emergency declaration, but have since recovered some losses, recovering 2.4%, 3.3% and 9.2%, respectively, according to CoinMarketCap.

"We are relieved that President Yoon has changed his course on declaring martial law and respects the vote of the South Korean National Assembly to end martial law," a White House spokesperson told CNN.

Just a day earlier, on December 2, South Korea's retail cryptocurrency trading volume reached its second-highest level this year, with traders frenzying over a range of "high-momentum" altcoins.

XRP saw more than $6.3 billion in volume in South Korea that day. Dogecoin came in second with $1.6 billion, followed by Stellar ($1.3 billion), ENS ($900 million), and Hedera ($800 million).

Weiliang

Weiliang