Source: Beosin

With the global popularity of cryptocurrencies and the rapid growth of crypto users in Southeast Asia, on-chain fund flows in the region have become increasingly frequent and complex. In order to deeply understand the flow characteristics of funds on the chain in Southeast Asia, potential financial risks, and connections with illegal industries,Beosin is based on 10,000 blockchain address samples sampled from 2020 to the present (such as Southeast Asian personal wallets/Southeast Asian exchange users etc.), conducted this in-depth analysis. By tracking and labeling different types of risky capital flow paths, we found that the degree of risk involved in the circulation patterns of crypto assets was greater than expected. This report not only reveals the risks of cryptocurrency use in Southeast Asia, but also explores the reasons behind the phenomenon from a macro level and makes relevant recommendations.

Overview of the Southeast Asian Cryptocurrency Market

In recent years, the acceptance and popularity of cryptocurrency in Southeast Asia has increased significantly.

As an emerging market, Southeast Asia has unique characteristics in terms of economic structure, policy environment and user behavior. The following aspects are particularly obvious:

1. Rapid user growth :The high proportion of young people in Southeast Asia, coupled with the popularity of mobile Internet, has caused the number of crypto users in the region to grow rapidly. It is estimated that there are tens of millions of crypto users in the region.

2. Strong demand for cross-border payments: There are a huge number of cross-border workers in Southeast Asia, and cryptocurrency provides them with a convenient cross-border payment method, so it is widely used .

3. Different regulatory environments: Southeast Asian countries have mixed regulatory policies on virtual currencies. Some countries support the legalization of cryptocurrency, but most areas have not yet formed clear regulations. framework, resulting in certain compliance risks in capital flows.

Sample analysis and main findings

Chart: Fund flow diagram

Chart: Fund flow diagram

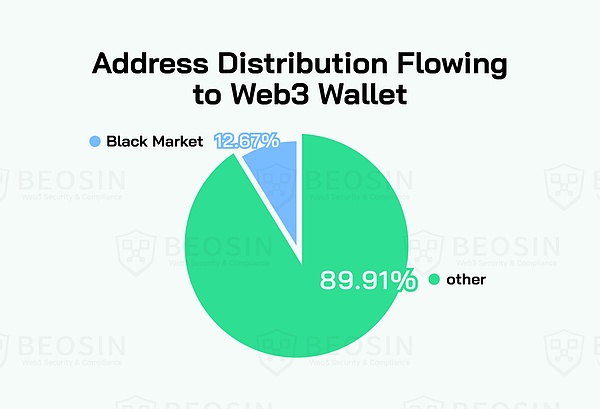

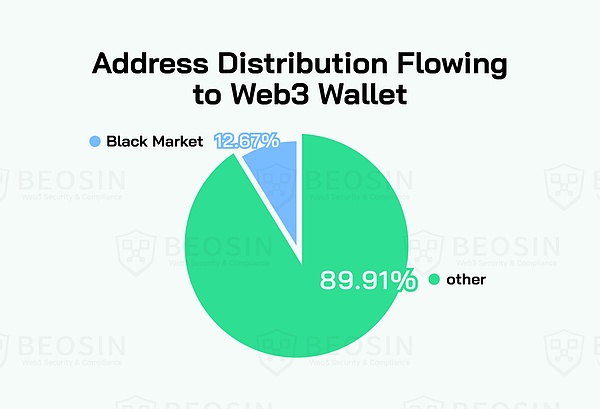

Chart: Address distribution to Web3 wallets

Chart: Address distribution to Web3 wallets

1. Funds Free circulation situation

Among the 10,000 blockchain addresses analyzed this time, about 45.23% of the funds circulate freely on the public chain through decentralized wallets, showing high liquidity and decentralization. Centralized features. The total amount of freely flowing funds is as high as 1.484 billion U.S. dollars, indicating that decentralized trading methods have become mainstream among Southeast Asian users.

2. Connection with the black and gray industry

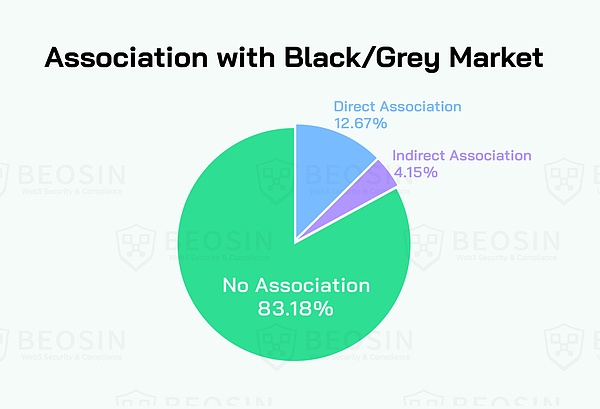

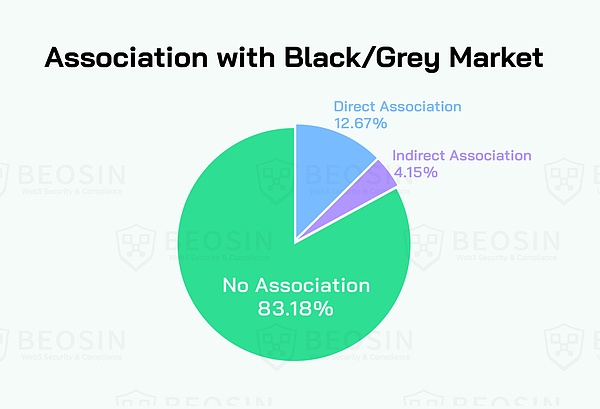

Among these addresses, more than US$110 million in funds flowed directly to addresses related to the black and gray industry, accounting for more than 12%. After further tracking the capital flow of the remaining addresses, it was found that through secondary or multiple transactions, some addresses were also indirectly connected to the black and gray industry, which increased the proportion of risky addresses related to the black and gray industry to 16.82%. This means that among the tens of millions of crypto users in Southeast Asia, there may be millions of users who are at risk of financial transactions indirectly or directly with the black and gray industry.

Chart: Relationship with the black and gray market

Chart: Relationship with the black and gray market

Fund flow and risk analysis of the black and gray industry

1. Typification of black and gray industry addresses

Beosin divides addresses closely related to the black and gray industry into 3 major categories and 44 subcategories through risk labels. The high-risk categories involved mainly include:

●Coin mixing service: mainly used to anonymize capital flows

●Underground banks: used for cross-border illegal fund dispatch and money laundering

●Fraud platform: involving false investments and Ponzi schemes , killing foreigners, killing pigs, etc.

These high-risk address types involve more than 240 specific black and gray industry entities.

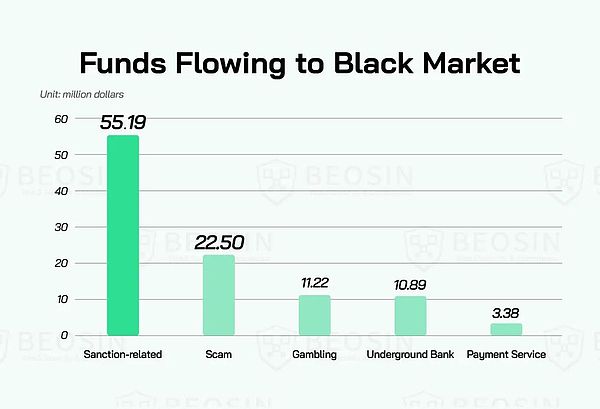

2. The phenomenon of high-risk capital flows

The research results show that certain types of capital flows are particularly significant:

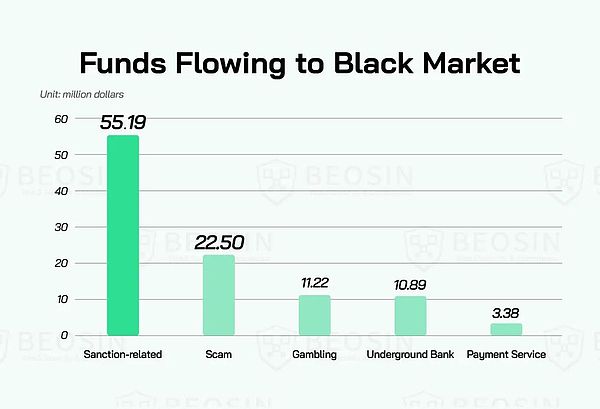

●There are more than 10 million U.S. dollars. Funds flowed directly into addresses related to underground banks, and the cumulative number of transactions reached thousands.

●About 11 million US dollars of funds clearly flowed to online gambling platforms.

●More than 22 million US dollars of funds were introduced into the fraud platform.

Such capital flows reveal the complexity and concealment of black and gray industry activities. Especially due to the anonymity and cross-border characteristics of cryptocurrency, criminals are able to frequently carry out illegal fund transfers and money laundering activities.

Chart: Funds flowing to the black market

Chart: Funds flowing to the black market

Fund inflows to sanctioned platforms

1. Ratio of capital inflows to sanctioned platforms

About 53.49% of the funds directly related to the black and gray industry flowed to sanctioned platforms. The number of related transactions was even twice that of underground banks, with a total value of more than 55 million US dollars, indicating that sanctioned platforms are still high-risk. The main source of capital inflows.

2. Case analysis: Tornado Cash

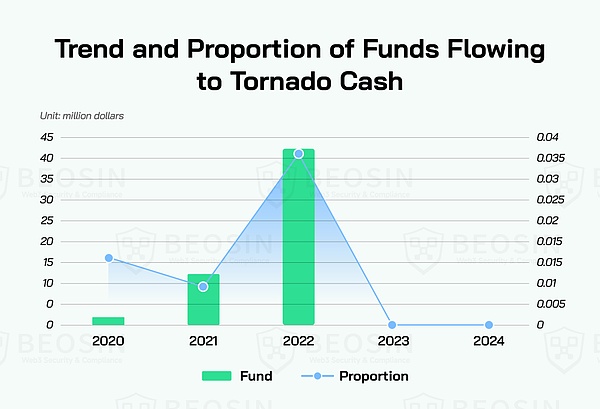

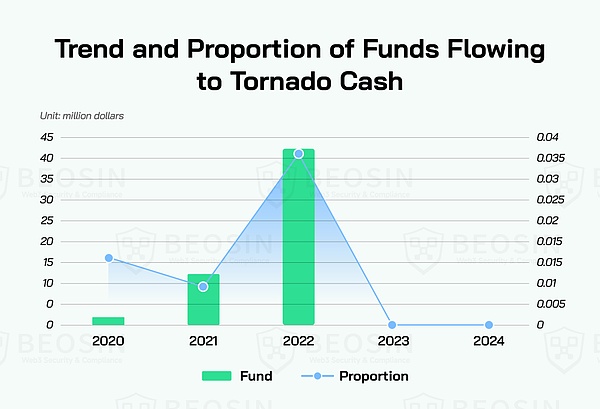

As a commonly used currency mixing tool, Tornado Cash received more than 54 million US dollars in funds in this study, accounting for 10% of all sanctioned 97.84% of the platform’s capital inflows. However, since the U.S. Treasury Department added Tornado Cash to the list of sanctioned entities in August 2022, its trading volume has dropped significantly, showing the effective inhibitory effect of sanctions on its capital inflows.

Chart: Trend and proportion of funds flowing to Tornado Cash

Chart: Trend and proportion of funds flowing to Tornado Cash

Macro risk analysis and discussion of causes

1. Anonymity and high risk of cryptocurrency Liquidity: The anonymity of cryptocurrencies makes it difficult to trace illicit funds as they move on the chain. Even if there are technical means to mark risky addresses, the flow of funds can still be concealed through technical means such as currency mixing, thus facilitating money laundering activities.

2. Lack of regulatory system in Southeast Asia: Cryptocurrency regulatory measures in Southeast Asian countries are not yet complete, leading to increased risks in cross-border flow of funds. Some regions still have a wait-and-see attitude towards cryptocurrencies and have not taken active regulatory measures, providing space for capital flows in the black and gray industries.

3. Social and economic environment: The level of economic development in some Southeast Asian countries is low and the gap between rich and poor is large. This has led to many scammers and online gamblers using this place as a base, mainly attracting foreigners to participate.

4. Technical supervision difficulty: Due to technical and architectural limitations, cryptocurrency exchanges, wallet service providers and decentralized platforms often find it difficult to effectively monitor and investigate the risks behind transactions. Decentralized platforms in particular lack direct control over transaction data and cannot promptly identify risks such as malicious behavior or money laundering. Although some centralized platforms try to strengthen monitoring through KYC and AML measures, cross-chain transactions and anonymity technologies still complicate tracking of fund flows and increase security risks.

Conclusions and Recommendations

Analysis of on-chain capital flows in Southeast Asia shows that there are high security risks in the use of cryptocurrency in the region. In order to effectively reduce the risk of illegal capital flows on the chain, Beosin recommends taking the following measures:

1. Strengthen regulatory mechanisms: Governments of various countries should formulate and implement comprehensive cryptocurrency regulatory policies and combat illegal activities on the chain through transnational cooperation. For financial activities, a clear regulatory framework for virtual currencies should be introduced based on different national conditions.

2. Improve users’ risk identification capabilities: Increase anti-fraud education for ordinary users to make them understand the risks on the chain, and enhance their ability to identify and prevent black and gray industry funds.

3. Promote technological innovation: actively develop and apply on-chain tracking and anti-money laundering technologies, and accurately identify and combat high-risk capital flows through big data analysis, artificial intelligence and other technical means.

4. Establish a multi-party collaboration mechanism: Encourage cryptocurrency exchanges, wallet service providers and related institutions in Southeast Asia to work together to strengthen information sharing and joint risk prevention, and improve on-chain security.

As one of the regions with the greatest potential for cryptocurrency development, Southeast Asia will still face the challenge of capital flow risks in the future.

Anais

Anais