Author: MATTI Source: substack Translation: Shan Oppa, Golden Finance

Recently, most of my articles have been published in the writing section of Zee Prime, and I have not been able to achieve my original goal of publishing articles here every month. Moving forward, I hope to publish articles every two months covering a variety of topics, not just cryptocurrencies.

During the past bull market, memecoins, especially Dogecoin, became a solid category in the cryptocurrency space. However, not just meme coins, but indeed any successful token has a “memetic premium.” I would even argue that any product bundled with a brand has a "meme premium."

The "meme premium" is a phenomenon in which people place a higher monetary value on an idea because of:

See other people also value this idea

Hope more people will take this idea seriously

"Meme premium" is essentially a kind of imitation (mimetic )’s Keynesian beauty contest, which never ends. This is pure speculation that has been around since before humans understood what financial speculation meant. As Durant paraphrases Plato:

"Men soon tire of what they have, and long for what they do not have, and they seldom think Want anything that doesn’t belong to someone else.”

In a world dominated by social media, speculation has become a novel way of consumption. Serious issues become entertainment, and entertainment becomes serious issues. We pollute entertainment with politics, turning war or inflation into a show. Cryptocurrencies cater to this cultural shift.

In the last cycle, despite being painted as the dark and fringe side of cryptocurrencies, “decentralized finance” fueled development throughout the cycle. JPEG images, meme coins and yield ponzi became entertainment items. Even the collapse and scapegoating incidents of Three Arrows Capital, Do Kwon and SBF were widely disseminated and consumed, and even made people feel some kind of pleasure.

While the most "serious" cryptocurrency investors are still discussing crypto infrastructure SaaS, the "decentralized finance craze" side is continuing to grow and develop . I believe we are at the point where we are about to witness the most spectacular “decentralized finance mania” the cryptocurrency space has ever seen. We're doubling down on the craziness, whether it's memecoins, SocialFi, GameFi, or restaking.

In the last cycle, the "meme premium" was more implicit, but in this cycle, it will become fully explicit. Cryptocurrency will be more of a “decentralized finance craze” than ever before. This could mean that you don’t have to buy Dogecoin to participate in the meme game, you can buy any token you want, because the truth has been revealed – every token is essentially a meme coin.

Analysis of (3,3)

I have explained before that in addition to brand and Coca-Cola stock has few fundamentals beyond subsequent customer demand. I proposed that speculating on coins is a form of consumption, just like drinking sugary drinks. Coca-Cola stock is just a sticky Lollapalooza (RIP Charlie Munger).

Munger is not a big fan of cryptocurrencies, calling them "crypto garbage" and a "crypto scam." While his endless wisdom will be greatly missed, his outdated views on things that can be bought and sold will be less so.

Anyway, I believe that if Munger were in his 20s or 30s now, his "Charlie Munger's Ghetto Almanac" would contain a chapter on "Mystery" due to premium” content.

I'm just proposing to correct some outdated wisdom with these experimental structures we have today that are worth trillions of dollars. They may be small and their chances of individual success are elusive, but they are growing. Rather than reject them outright, cynics might try to understand them better. After all, technology is the basis on which society takes place, not the other way around.

Let us strive to understand cryptocurrencies as a consumer good rather than rejecting the way they are consumed. Capitalism is driven by markets, and markets are driven by consumption.

Speculation is also a form of consumption. Every brand in the world relies on the “meme premium.” The “(3,3) narrative” that dominates OlympusDAO in 2021 clearly expresses the “meme premium.”

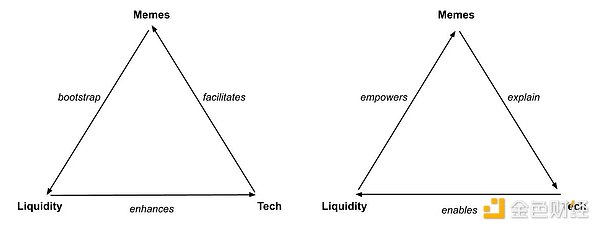

This is where we are on the cryptocurrency adoption curve: from "meme for fun" to "meme with practicality" ( That is, the transformation of SocialFi. I hope that by this point we can all agree that there is nothing wrong with all of our tokens being heavily dependent on the "meme premium".

In this cycle, "memes" will become directly monetizable, and the need for staking on meme coins will also decrease. As a coordination tool, the pricing of memes is essentially a social game. I wouldn't be surprised to see silly meme coin values transform into smaller coordinated experiments with "infinite" upside.

Our equivalent of "DeFi Summer" may be a "Summer of Memes" wrapped in a SocialFi narrative (Blast SEASON currently looks like a Xie Lin point). Instead of betting on a single outdated meme (Dogecoin) and its series of imitators, people may play various small games, and these games also have a certain "purpose."

After all, money is a coordination game and price is a signal. OlympusDAO’s “(3,3)” is a great example of a meme that combines GameFi, SocialFi, and a serious attempt at practicality. It’s more of a true meme coin than Dogecoin. Because if you just regard a meme coin as a simple meme, then the magic brought by the public's "IQ offline" is destined to be short-lived.

Learning how to price memes has always been the alchemy of finance. Memes in the Market Wizards era were different. From the invention of derivatives all the way to meme coins, finance continues to evolve as markets spread into the borderless digital world.

To fully harness the power of crypto means understanding reflexivity, not in the form of prices rising or falling, but in the form of prices transforming fundamentals. The world can change as the market changes. Meme premium is potential energy that can be converted into kinetic energy.

The late 2020s and 2030s may be the golden age of memetic value-oriented crypto hedge funds that embrace the reflexive nature inherent in digital assets. Cryptocurrency may have been in denial for a while, but its true value can only be maximized if we accept its true nature.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund Cheng Yuan

Cheng Yuan Catherine

Catherine Catherine

Catherine Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist