Author: Coin Metrics Translation: Shan Oppa, Golden Finance

Introduction

In 2009, the first block of Bitcoin was mined, announcing the birth of a revolutionary monetary system. It has been fifteen years. The birth of Bitcoin laid the cornerstone of the $1.6 trillion digital asset economy and opened the door to the first experience of the blockchain and digital asset world for many people. Now, fifteen years later, the entire industry is eagerly anticipating a pivotal moment in Bitcoin’s history: the launch of a spot ETF. As this milestone approaches, Bitcoin, the largest crypto asset and network, is entering a new stage of development. In this edition of Coin Metrics, we take a deep dive into the digital asset market structure and examine the dynamics leading us into this exciting chapter.

The road to ETF

The journey to launching a Bitcoin spot ETF has been long and challenging, but also unprecedented. In 2023, a competition known as the "Cointucky Derby" kicked off, with leading asset managers and financial institutions including BlackRock, Fidelity, and VanEck submitting 11 spot ETF applications. Complex conversations have taken place between the issuer and the U.S. Securities and Exchange Commission (SEC), delving into operational and structural details of the proposed ETF. These discussions revealed key aspects such as the selection of an ETF custodian, the decision to adopt a cash creation model for the redemption mechanism, the fee structure, authorized participants to facilitate the creation and redemption process, and consideration of initial capital injections to catalyze inflows.

As the Jan. 10 SEC deadline approaches, final amendments to S-1 filings highlight a fierce competition for fee structures. ARK lowered its management fee from 0.8% to 0.25%, making it competitive with Fidelity’s 0.39% and BlackRock’s 0.2%, while Bitwise stands out with the lowest long-term fee of 0.24%. The issuer is clearly prioritizing market share over short-term profits, suggesting inflow demand could be considerable. The industry’s expectations for spot Bitcoin ETFs are clear, with participants paying close attention to every update and issuers strategically positioning themselves in the hope of gaining a significant share of AUM.

< /p>

< /p>

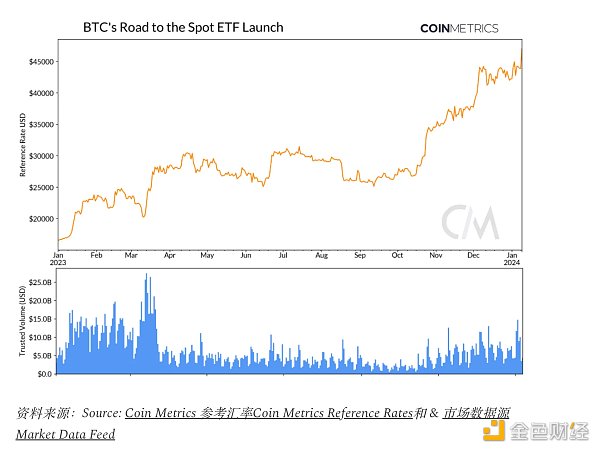

This enthusiasm is also reflected in the price of Bitcoin, which surged 156% in 2023. While trustworthy spot trading volumes picked up in the first quarter, they stalled in March following the Silicon Valley banking crisis. However, as expectations for the ETF grew, trading volumes climbed again and now average around $10 billion, but are still below pre-FTX crash levels. Bitcoin’s liquidity remains a key factor in enabling efficient trading of the asset, especially with the imminent launch of an ETF.

Spot and futures exchange dynamics

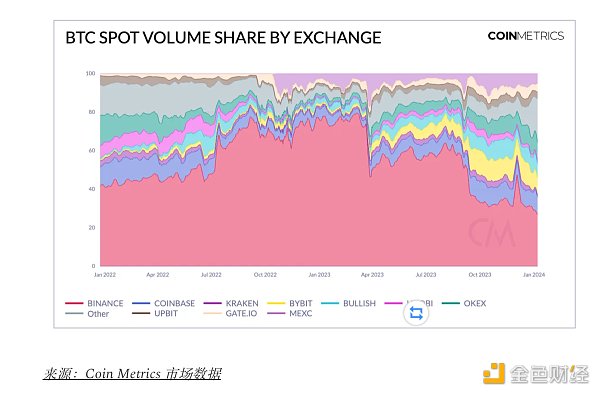

The share of BTC spot trading volume of each exchange shows that the exchange structure is becoming increasingly fragmented. This is reflected in Binance’s dominance falling from over 75% in Q1 to below 30% in January 2024. Other exchanges, such as Coinbase and Bullish, benefit from this, resulting in a more even distribution of trading volume on centralized exchanges.

There are still some lingering questions surrounding the role of exchanges Not a problem, especially given the cost-benefit structure introduced by the introduction of spot ETFs. However, investors will now have another avenue to gain exposure to Bitcoin – one that helps meet the risk tolerance of different groups. While some may seek a safe and cost-effective way to gain financial exposure to the asset, making the introduction of ETFs a huge benefit, others may prefer the ability to self-custody Bitcoin without the exchange Can serve as an important portal.

There are still some lingering questions surrounding the role of exchanges Not a problem, especially given the cost-benefit structure introduced by the introduction of spot ETFs. However, investors will now have another avenue to gain exposure to Bitcoin – one that helps meet the risk tolerance of different groups. While some may seek a safe and cost-effective way to gain financial exposure to the asset, making the introduction of ETFs a huge benefit, others may prefer the ability to self-custody Bitcoin without the exchange Can serve as an important portal.

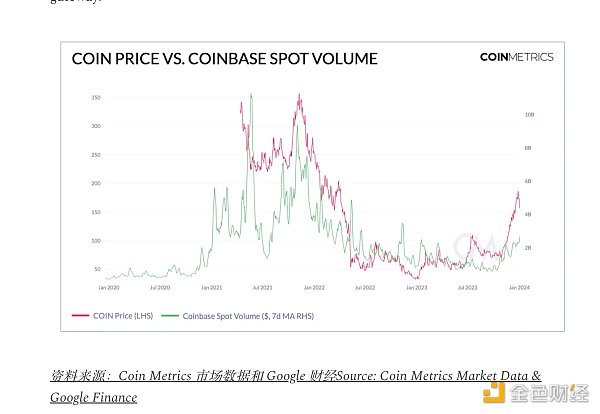

The role of onshore exchanges will also be reviewed. However, with Coinbase acting as a custodian for most applicants, the largest U.S. exchange may not only benefit from additional revenue streams from its diversified business model, but also potentially increase trading volume by expanding its pool of participants. Benefit. Join the fight. Following the recent rebound in digital asset markets, average spot trading volume on Coinbase has climbed back above $2.5B and is likely to continue to grow as market activity continues.

The role of onshore exchanges will also be reviewed. However, with Coinbase acting as a custodian for most applicants, the largest U.S. exchange may not only benefit from additional revenue streams from its diversified business model, but also potentially increase trading volume by expanding its pool of participants. Benefit. Join the fight. Following the recent rebound in digital asset markets, average spot trading volume on Coinbase has climbed back above $2.5B and is likely to continue to grow as market activity continues.

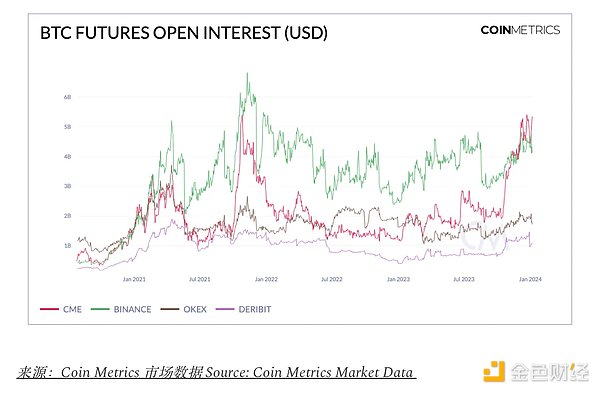

Before the birth of ETFs, the derivatives landscape was shaping the market Structural dynamics played an important role. As futures open interest on the Chicago Mercantile Exchange (CME) surged to all-time highs to $5.4B, we saw the digital asset market shift from a primarily retail drive to a more institutional playing field. This is likely to expand as a host of financial advisors, registered investment advisors (RIAs), and family offices with trillions of dollars under management increasingly incorporate Bitcoin into traditional investment portfolios.

Before the birth of ETFs, the derivatives landscape was shaping the market Structural dynamics played an important role. As futures open interest on the Chicago Mercantile Exchange (CME) surged to all-time highs to $5.4B, we saw the digital asset market shift from a primarily retail drive to a more institutional playing field. This is likely to expand as a host of financial advisors, registered investment advisors (RIAs), and family offices with trillions of dollars under management increasingly incorporate Bitcoin into traditional investment portfolios.

While the week surrounding the ETF launch is likely to see wild short-term volatility, as was the case last week with the liquidation of open positions triggered by rumors that the SEC may reject all ETF applications, the longer-term outlook It's completely different.

Volatility and Return Characteristics

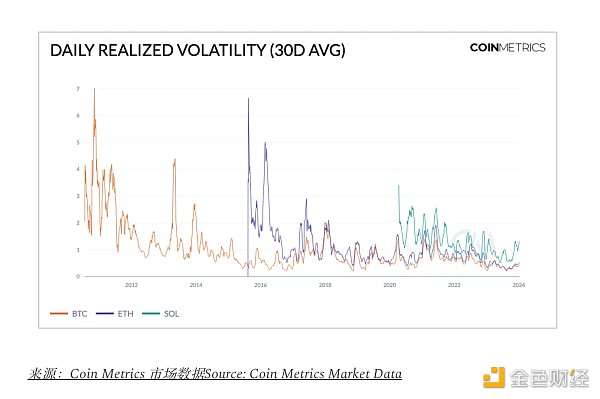

The historical volatility of BTC and other crypto-assets has been a point of criticism from people who view them as high-risk investments. While this is true in their early stages, BTC’s average realized volatility has been trending downward over the long term, suggesting it has developed into a more mature asset. The chart below shows a similar trend for ETH and SOL, which entered the market later and exhibited greater volatility relative to BTC. In the world of cryptoassets, it is clear that these assets exhibit varying degrees of volatility and maturity, thereby impacting their overall market structure and role in investment portfolios.

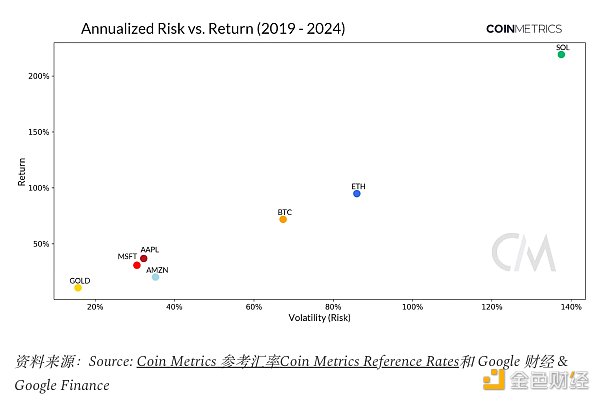

In 5 years, the digital assets will be Risk and return are placed alongside other assets in the investable universe, revealing interesting insights into their role in a portfolio. Traditional assets like gold have the lowest risk and reward potential, giving them safe-haven status and placing the commodity in an alternate universe to big tech stocks like Apple ( AAPL ), Microsoft ( MSFT ) and Amazon ( AMZN ). They all exhibit similar characteristics. On the other hand, the digital assets shown in this chart display unique characteristics. The pioneering and largest digital asset, BTC is less volatile than ETH and SOL but offers greater return potential than tech stocks, demonstrating its evolution into a mature and growth-oriented asset. Additionally, its largely uncorrelated nature further highlights its role in investment portfolios value in diversification and enhances its appeal to investors seeking uncorrelated returns.

In 5 years, the digital assets will be Risk and return are placed alongside other assets in the investable universe, revealing interesting insights into their role in a portfolio. Traditional assets like gold have the lowest risk and reward potential, giving them safe-haven status and placing the commodity in an alternate universe to big tech stocks like Apple ( AAPL ), Microsoft ( MSFT ) and Amazon ( AMZN ). They all exhibit similar characteristics. On the other hand, the digital assets shown in this chart display unique characteristics. The pioneering and largest digital asset, BTC is less volatile than ETH and SOL but offers greater return potential than tech stocks, demonstrating its evolution into a mature and growth-oriented asset. Additionally, its largely uncorrelated nature further highlights its role in investment portfolios value in diversification and enhances its appeal to investors seeking uncorrelated returns.

Taken together, these characteristics solidify BTC as the premier, largest And its status as the most liquid digital asset, with the possibility of access to spot ETF instruments, is a testament to its market maturity. Since ETH exhibits similar characteristics, it is expected to be the next currency to follow.

Taken together, these characteristics solidify BTC as the premier, largest And its status as the most liquid digital asset, with the possibility of access to spot ETF instruments, is a testament to its market maturity. Since ETH exhibits similar characteristics, it is expected to be the next currency to follow.

Conclusion

Bitcoin’s journey is about to reach new heights, transforming from a novel digital currency into a globally recognized network and asset class. The emergence of spot ETFs marks the arrival of this critical moment. It is the pinnacle of ten years of exploration and an important turning point in the evolution of the market. As we enter a new phase as the world's largest crypto-asset, Bitcoin will not only solidify its place in the digital asset ecosystem, but also shine on the global financial stage.

XingChi

XingChi

XingChi

XingChi Miyuki

Miyuki JinseFinance

JinseFinance JinseFinance

JinseFinance Joy

Joy Finbold

Finbold Finbold

Finbold Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph