Coinbase today launched an ad campaign targeting American voters to promote cryptocurrency as a cheaper way to remit money. Coinbase's chief policy officer noted that the ad hopes to remind voters and potential customers that using cryptocurrency can make overseas transactions cheaper and more convenient. Many families believe that the traditional financial system is not suitable for them, and cryptocurrency is gradually becoming a topic of discussion in the family. Products such as USDC transfers and Coinbase Wallet are popular because they provide cheaper and more convenient options. This reflects the core of economic freedom and is why many people turn to cryptocurrency.

There are a lot of dynamic news about stablecoins this week. Aiying can also deeply feel that the advancement of this field is proceeding in a devastating manner. The following are some phenomena and data observations of Aiying on the stablecoin market in the past two weeks:

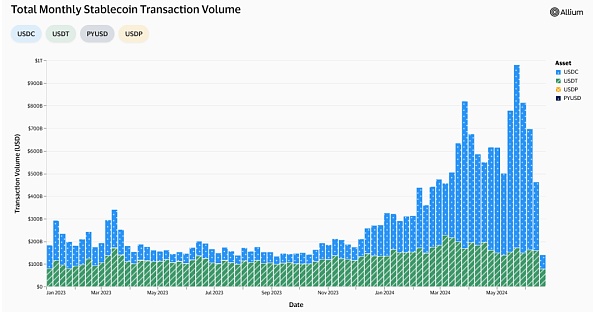

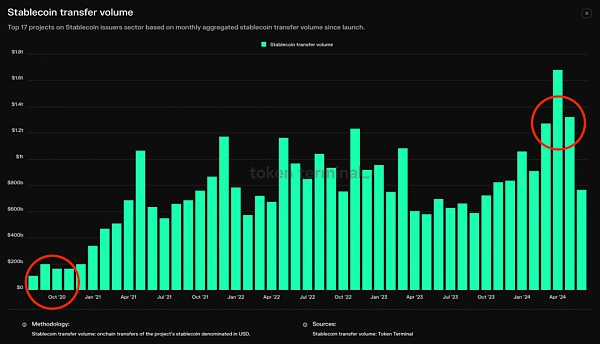

1. Stablecoin transfer volume soared

From the data of Token Terminal, we can see that in the past four years, the monthly stablecoin transfer volume has increased tenfold, from US$100 billion per month to US$1 trillion. On June 20, 2024, the total transaction volume of the entire cryptocurrency market was US$74.391 billion, and stablecoins accounted for 60.13%, or about US$44.71 billion. Among them, USDT (Tether) is the most used, with a market value of $112.24 billion, accounting for 69.5% of the total value of all stablecoins. On June 20, USDT's trading volume reached $34.84 billion, accounting for 46.85% of the total trading volume on that day.

2. Large investment banks and financial institutions are also promoting stablecoins

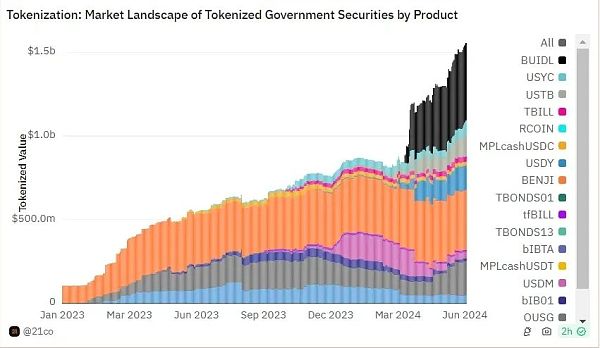

1. Large investment bank asset management joins

This week, some financial giants began to tokenize assets, showing their optimism about the future of stablecoins. For example, BlackRock, the world's largest asset management company, manages $10.5 trillion in assets. They launched the BUIDL fund, a tokenized fund based on U.S. Treasuries, which currently has a size of over $460 million, making it one of the largest tokenized funds on a public blockchain.

At the same time, Franklin Templeton, whose FOBXX fund has also been tokenized, manages $346 million in assets. Recently, they announced the use of the USDC stablecoin as an entry and exit channel for the fund, which means that investors can buy or sell fund shares with USDC around the clock

2. Fintech companies promote stablecoin payments

Financial technology companies actively promote stablecoin payments. PayPal has launched its own stablecoin, PayPal USD (PYUSD), which has a market value of over $400 million and has been used on multiple public blockchains. PYUSD has been integrated into the decentralized finance (DeFi) ecosystem, including decentralized exchanges and lending platforms. PayPal said PYUSD aims to reduce friction in virtual payments, facilitate rapid value transfer, and support personal remittances and international payments.

As one of the world's largest payment networks, Visa is also experimenting with stablecoin payments. Cuy Sheffield, head of Visa encryption, said they are using stablecoins such as USDC and global blockchain networks such as Solana and Ethereum to increase the speed of cross-border settlements. Visa is also conducting a real-time pilot project to enable Visa card payments to be settled with USDC.

2. Practical application of stablecoins in financially underdeveloped regions

1. Nigeria: The demand for USDT is very large

Nigeria is a country that is particularly interested in cryptocurrencies, especially in areas where banking services are not well developed, USDT (Tether) has become everyone's first choice.

In Katsina and Borno states in northern Nigeria, USDT is widely used. Residents in these places find USDT more stable and reliable than local currencies.

Bitcoin and Dogecoin are also popular in different regions. For example, in areas with developed financial services such as Delta State, Bitcoin is very popular. In the conservative northern states, however, Dogecoin has gained the favor of many users because of its low transaction fees and ease of use.

2. Argentina: Paxos International launches the yield-based stablecoin USDL

Argentina is another country with a high demand for stablecoins, mainly because of economic instability and severe inflation, and many people hope to find a more stable means of storing value.

UAE Axos International launched the USDL stablecoin, which allows Argentine consumers to earn overnight returns, and holders can earn overnight returns through short-term, low-risk U.S. government securities and cash equivalent assets, which are managed by the Financial Services Regulatory Authority (FSRA) of the Abu Dhabi Global Market (ADGM) in accordance with security protection and custody requirements. This reserve structure is similar to other 1:1 backed U.S. dollar stablecoins issued by Paxos. USDL is issued without permission on Ethereum and pays returns to token holders every day in a programmatic manner.

Fourth, global regulation is becoming increasingly clear-cut

1. The EU's MiCA regulation is about to come into effect

The EU's Markets in Crypto-Assets Regulation (MiCA) is about to come into effect, which will be an important step in the comprehensive regulation of stablecoins and other crypto assets.

The MiCA regulation aims to ensure the transparency and stability of the cryptocurrency market, requiring issuers to provide detailed information disclosure and meet strict reserve and capital requirements.

These new regulations will have a significant impact on the issuance and use of stablecoins, especially ensuring the security of users' funds and the stability of the market.

2. Hong Kong's regulatory framework and "sandbox" program

The Hong Kong government is constantly improving its stablecoin regulatory framework to adapt to the rapidly changing market environment.

The Hong Kong Monetary Authority (HKMA) has launched a "sandbox" program to allow companies that intend to issue stablecoins in Hong Kong to test their operating plans in a controlled environment.

This sandbox program not only helps companies understand and comply with Hong Kong's regulatory requirements, but also promotes communication and cooperation between regulators and companies to ensure the healthy development of the stablecoin market.

3. US policy

Both the United States and the European Union are actively formulating and implementing new stablecoin regulatory policies to ensure the healthy development of this market.

The U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are conducting strict scrutiny on the issuance and trading of stablecoins to prevent market manipulation and protect the interests of investors.

This week in the United States, consumer protection organizations launched a multi-million dollar advertising campaign focusing on the business practices of Tether (USDT). Through television ads, billboards and other publicity methods, this advertising campaign reminds the public of the possible risks of Tether, especially its reserve audit issues. This public appeal and warning not only promotes the review of Tether and other stablecoins, but also promotes the introduction of stricter regulatory measures to protect consumers from potential financial risks.

V. Future Trends

As more countries introduce stablecoin regulatory policies, this will further promote the standardization and maturity of the stablecoin market and attract more institutional and individual users. Stablecoins are not only popular among individual users, but also play an important role in corporate payments, cross-border remittances, and decentralized finance (DeFi) applications. Companies can use stablecoins for faster and lower-cost international payments, while DeFi platforms provide financial services such as lending and trading through stablecoins. Not only are they widely used in developed countries, but they have also gained rapid popularity in developing countries. Stablecoins provide users in these countries with tools to combat inflation and economic instability.

Circle's boss Jeremy Allaire predicts that stablecoins could account for 10% of global economic currency in the next decade or so. Although this prediction sounds a bit exaggerated, he mentioned some factors that could lead to the rapid popularity of stablecoins in the next decade or so.

Allaire noted in a June 19 post that some of the world's largest payment companies are using the technology and are exploring how to expand its use as the advantages of public chains and stablecoins become increasingly apparent.

He said the market has huge potential and could reach "billions". By using a digital dollar on the blockchain, the promise of providing banking services to the unbanked, reducing remittance costs and enabling seamless cross-border trade can be fulfilled. In addition, he noted that stablecoins are becoming an increasingly popular form of digital currency, and by the end of 2025, stablecoins will account for a "larger and larger portion" of the global $100 trillion electronic currency market.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Hafiz

Hafiz JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin Miyuki

Miyuki JinseFinance

JinseFinance Coinlive

Coinlive  Bitcoinist

Bitcoinist Beincrypto

Beincrypto