Sky Endgame: Community considers rebranding to Maker

Two months ago in August, Maker changed its name to Sky as part of the Endgame reform, but it also encountered some resistance.

JinseFinance

JinseFinance

Real-world assets exist off-chain, and asset owners can obtain expected benefits from them. Related ownership benefits are regulated by the legal system and are rooted in our social contract. For "Code is Law" on-chain DeFi, how to adapt the off-chain governance system and legal structure to help crypto capital capture off-chain assets safely and compliantly is a problem that currently needs to be explored and solved.

Following the previous combing of the path of off-chain assets to the chain through Centrifuge, this article will sort out the centralized on-chain protocol capture off-chain through the DeFi perspective of MakerDAO Asset governance system, legal framework and practical path. I hope it will be helpful to project parties and builders who are engaged in RWA, and you are welcome to communicate with us at any time.

The content of this article will cover the more mature RWA projects in MakerDAO, such as New Silver Restructuring, BlockTower Credit, BlockTower Andremeda, Montalis Clydesdale, and the transaction provided by Centrifuge for Aave architecture.

1. Why does DeFi need tocaptureoff-chain real-world assets< /p>

The narrative of RWA can also be said to be the narrative of MakerDAO’s DeFi. It is very necessary to look at the significance of RWA to the DeFi world from the perspective of MakerDAO.

MakerDAO is a decentralized autonomous organization (DAO) designed to manage the Maker protocol running on Ethereum. The protocol provides the first decentralized basic stable currency DAI (which can be simply understood as the US dollar on Ethereum) and a series of derivative financial systems. Since its launch in 2017, DAI has remained pegged to the U.S. dollar.

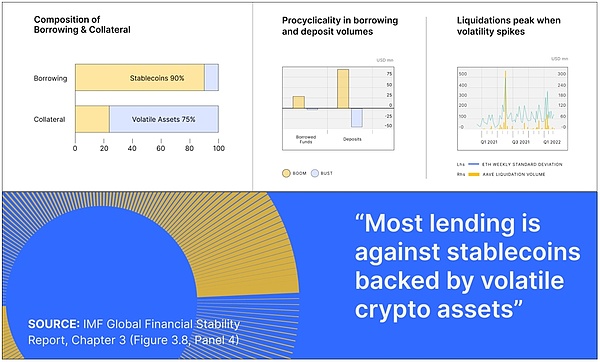

In the DeFi Summer of 2021, many unsustainable DeFi yield products have appeared, which has brought about a big collapse of the encryption market and the spread of credit default contagion. Every corner. Although crypto-native assets are a key component and long-term value differentiator of DeFi, current real-world needs cannot match long-term development value.

Due to the high volatility of the cryptocurrency market, relying on a single collateral asset can lead to massive liquidations. For amegalending protocol like MakerDAO, a key consideration is: The value of the collateral is stable. We have seen that MakerDAO’s previous collateral contained cryptocurrencies with unstable values. This unstable and volatile factor created risks for lending and seriously limited the development space of MakerDAO.

Therefore, MakerDAO or DeFi urgently needs a more stable base layer level of collateral (a Baselayer Level of Collateral) to Support the large-scale adoption of stable currency DAI in the crypto world and build a sustainable and scalable path.

(Centrifuge & Maker: A Partner's View of Real-World Assets)

RWA is one of the most important issues of MakerDAO and is constantly discussed by the community ,verification, is regarded as an important solution. In the Endgame plan released by MakerDAO in May 2022, MakerDAO also emphasized that one of the key parts of MakerDAO building a decentralized stable currency is to use RWA as collateral.

The benefits of RWA include: (1) Improving the transparency of market risks and asset usage; (2) Providing DeFi composability; (3) Improve accessibility to underbanked and underbanked populations; and (4) capture value from larger and more stable traditional financial markets.

For MakerDAO, RWA has two important characteristics-stability and scale. Furthermore, DAI can expand the scope of use by anchoring assets that are free of cryptographic volatility risks, stable interest-earning, and scalable, especially in today's market environment where crypto-asset yields are low and U.S. bond yields are high. Through RWA’s value capture, MakerDAO can continue to scale and grow during bear markets and be fully prepared for the next bull market cycle.

Most importantly, RWA can help MakerDAO realize its grand vision: allowing a credit-neutral, decentralized channel to serve people's daily lives and businesses development needs to increase utility. A new open DeFi financial market will be realized through an open on-chain, community-driven, programmable, and decentralized protocol.

However, it is not easy to put real-world assets on the chain. This will involve new product architecture design challenges, financial, legal compliance and technical risks. , and the unknown unknown.

2. How DeFi captures off-chain real-world assets

After clarifying the need for DeFi to capture real-world assets, it is necessary to build a governance system and legal structure suitable for on-chain protocols or DAO organizations. Of course, some people will say that this operation is not necessary. It is enough to directly purchase tokenized U.S. bonds issued by a third party, saving time and effort.

For example, we have seen that Solv Protocol, a very successful on-chain fund project on the market, launched two RWA funds in its V3 version, with Solv RWA as the The fund manager currently manages a total of 2 million US dollars worth of TVL assets. Qualified users who have passed KYC/AML can deposit stable coins and enjoy the benefits of U.S. debt. The RWA fund’s underlying assets are tokenized U.S. Treasuries provided by Red Cedar Digital. Ltd., according to its press release.

(Solv V3's Milestone Achieved: The First Ever RWA Fund Launch)

For projects with small funding volume and where the risks are controllable/affordable Under the premise, you can directly purchase tokenized U.S. bonds provided by third parties without any problem. But we still need to think about several questions: (1) How to ensure that the counterparty (Red Cedar Digital. Ltd.) that provides the underlying assets will not go bankrupt and run away? Think about FTX, which was at its peak; (2) Furthermore, after the counterparty goes bankrupt, how can such an on-chain agreement without legal entity go to court as a creditor to participate in asset liquidation/reorganization?

Although it may be costly for DeFi projects to build their own governance systems and legal structures, but this is a hedge against risks. In any case, this does not prevent us from exploring and studying successful RWA cases on the market to make a choice that suits us.

2.1 The necessity of DeFi legal packaging

As a few MakerDAO, which has a RWA capital of one billion US dollars, has taken into account the currently identifiable risks, both in terms of fund security and legal entity qualifications. These risks come from:

Counterparty risk. Imagine the case where the counterparty goes bankrupt/runs away. What MakerDAO needs to ensure is that no third party (including fund managers/investment advisors) has the ability to directly control, dominate, or transfer its huge funds;

Subject qualification certification. On-chain protocols or DAO organizations are unable to complete the customer identification verification (KYC/AML) required to legally hold assets, resulting in the inability to legally purchase and hold off-chain assets. In the same way, it cannot hold its own IP assets;

Qualification for bankruptcy liquidation. Once there is a default, bankruptcy, or liquidation of off-chain assets, since the on-chain agreement or DAO is not a legal subject, it cannot immediately interact with courts and liquidation agencies in the real world. Then it is necessary to ensure that MakerDAO has the ability to exercise its right to dispose off-chain assets in a timely manner through the governance system and legal structure.

Therefore, it is very necessary to use legal wrapper to build governance for on-chain protocols or DAO organizations. System and legal structure, and through the connection between DAO governance and legal entity governance systems, DeFi’s governance and control of off-chain assets can be achieved.

(The DAO Legal Wrappers and why you need them)

2.2 How to carry out legal wrapping in DeFi

Legal Wrapper is a legal framework or a collection of legal entities specifically for on-chain protocols or DAO organizations, which provides on-chain protocols or DAO organizations with the necessary information in relevant jurisdictions. recognized legal status. Its essence is to "package" the on-chain agreement or DAO organization within a legal framework, or "subordinate" it to a legal framework, thereby connecting the real-world interaction so that the on-chain agreement or DAO organization can interact with the traditional legal system. connect.

Legal packaging is not absorbed or replaced. The on-chain agreement or DAO organization continues to run on the chain, but only transfers some of its functions and responsibilities to the legal person of the DAO Entities that are able to obtain legal protection in relevant jurisdictions, manage tax and regulatory obligations, enter into contracts, own assets, make legal payments, and participate in real-world interactions. DAO and multi-signature wallets retain direct control over smart contracts, vaults, and any on-chain assets, and only fund their legally wrapped entities when needed.

From the perspective of RWA, we can "set up" the corresponding legal entity specifically for the special purpose of the on-chain protocol or DAO organization. Capture the value of off-chain assets.

Related reading: Why DAO needs legal wrapper (Legal Wrapper)

2.3 How DeFi governs off-chain legal entities

We will further explain using the practice of MakerDAO, which currently has the largest RWA asset volume.

The picture above shows the structure of the Foundation + SPV established specifically for the RWA project based on the MakerDAO MIP58 proposal. It aims to control the governance of the foundation's legal entities. Realize value capture of underlying RWA assets.

First of all, MakerDAO established the RWA Foundation #1 foundation under the Cayman legal framework (the Foundation Company Law of the Cayman Islands 2017). The foundation can provide On-chain protocols or DAO organizations provide a flexible governance framework.

As a legal entity, the foundation does not require any registered capital or shareholders/ The member role makes the foundation a single-purpose independent orphan legal entity; the foundation can also be similar to a trust, designating MakerDAO or its members as beneficiaries (Beneficiary); at the same time, the foundation can also achieve bankruptcy isolation (Bankruptcy-Remote), even if MakerDAO or the foundation "Go Dark" will not affect each other.

As a legal entity, the foundation can (1) interact with off-chain entities, such as signing contracts and providing services etc.; (2) Legally hold off-chain assets/IP through KYC/AML; (3) Protect the limited liability of DAO members; (4) Perform a series of off-chain operations on behalf of the DAO according to the resolution of the DAO.

Secondly, foundation legal entities can be organized according to articles of association (Articles of Association), company registration certificate (Memorandum of Association), etc. document, tailor-made governance system for MakerDAO. For example, in the articles of association, it is limited to only implement the resolutions made by MakerDAO, and it will not make any resolutions and implementations; it designates Supervisors and Directors who are appointed by MakerDAO and have fiduciary duties (Fiduciary Duties) according to the foundation organization. Document/granted authority (Power of Attorney) is managed to ensure that MakerDAO can achieve full control at the legal entity governance level.

Finally, according to the resolution of MakerDAO, Foundation #1, as an independent orphan holding company, holds the equity interests of the subordinate SPV #1 legal entity. SPV #1 is established in the local jurisdiction based on the attributes of the off-chain assets and captures the off-chain assets with the foundation’s contribution. For example, if the off-chain assets are located in the United States, you can set up a Delaware LLC as an SPV to hold the off-chain assets, and the funds come from the loan agreement signed between Foundation #1 and MakerDAO.

Although we can also see the governance system and legal structure of SPV + trust in some other projects, theoverall principles are: (1) Ensure the governance control of the on-chain protocol or DAO organization; (2) the DAO organization/Tokenholder is the beneficiary; (3) the packaging legal entity can dispose of assets legally, effectively, and in a timely manner.

3. MakerDAO’s RWA practice case

MakerDAO has been exploring a set of RWA paths suitable for DeFi through step-by-step practice since it participated in the Solar Value capture, the transaction structure is ever-changing and remains the same.

The following are several of MakerDAO's more successful RWA projects for reference, including New Silver Restructuring, BlockTower Credit, BlockTower Andremeda, Montalis Clydesdale, and Centrifuge for Aave Transaction structure provided.

3.1 MakerDAO——New Silver Restructuring (Credit Asset RWA)

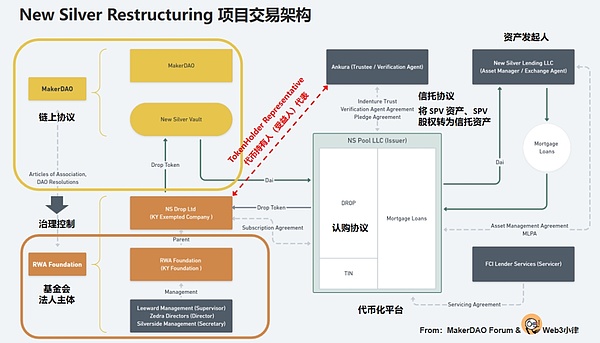

New Silver should be MakerDAO's first formal RWA project. It was established in 2021 with a debt ceiling of US$20 million. The underlying assets are mortgage assets (Mortgage Loan) sponsored by New Sliver. Through New Sliver, The issuer SPV raised capital on the Centrifuge tokenization platform.

The community proposed an upgrade and reorganization of the 2021 New Silver project in November 2022. This upgrade and reorganization fully adopted the above Foundation + SPV transaction Architecture can be described as a textbook practice.

In the transaction structure of New Silver Restructuring's upgrade and reorganization, the main participants include:

RWA Foundation, which was established in 2021 and operates The previous HunTINgdon Valley Bank (HVB) project was controlled by MakerDAO governance - it was agreed in the governance document that the Foundation Director needs to make any resolution or exercise any rights based on MakerDAO Resolutions. Therefore, through the system of MakerDAO on-chain governance + foundation off-chain governance, it is guaranteed that MakerDAO can achieve complete control at the level of legal entity governance.

NS DROP Ltd, as a wholly-owned subsidiary of the RWA Foundation, is the execution entity of this transaction and participates in the subscription of the DROP agency initiated by Centtifuge as the financier. Tokens and provide funds; as a representative of token holders (DROP/TIN), exercise the relevant rights entrusted by MakerDAO Resolutions; instruct the trustee Ankura Trust to conduct a series of asset operations in accordance with the trust agreement.

Ankura Trust is to ensure the independence of the issuer's SPV assets and the safety of MakerDAO's funds. According to the trust agreement between the issuer's SPV and the trust company, the credit assets of the SPV are agreed upon. The pledge of mortgage and SPV equity ensures the integrity of MakerDAO's assets and the timely and full disposal of defaults, providing a guarantee for the safety of MakerDAO's funds.

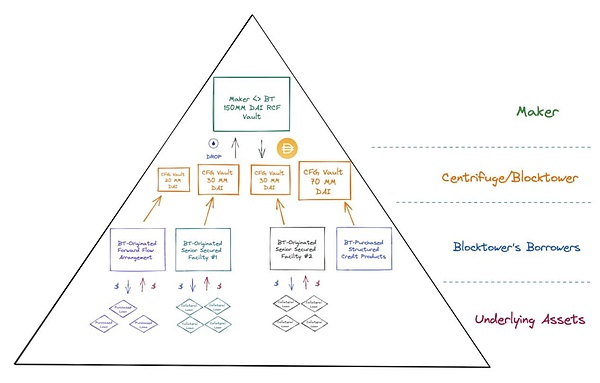

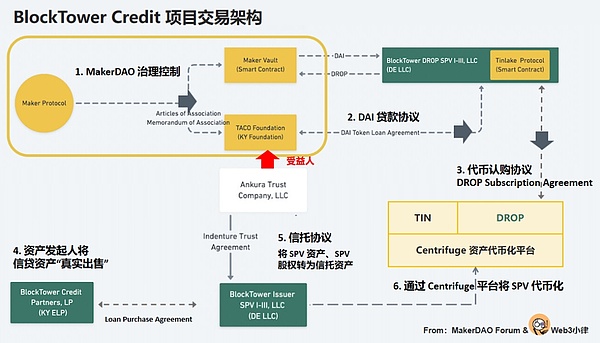

3.2 MakerDAO——BlockTower Credit (Credit Asset RWA)

BlockTower Credit is a credit asset tokenization project initiated by BlockTower Capital. It will be implemented in November 2022. The entire project has a debt ceiling of US$150 million and is divided into 4 asset pools. BlockTower Credit, as the asset originator, raises funds on the Centrifuge tokenization platform through its affiliated issuer SPV.

(BlockTower Credit - Commercial and Legal Risk Assessment - Part I)

BlockTower Credit's transaction structure is similar to New Silver Restructuring. We further split it into two parts: the operation of the capital side, that is, how to secure the assets on the chain. Compliance is converted to off-chain and is still controlled by MakerDAO; the other part is the operation of the asset side, that is, how to tokenize off-chain assets and obtain MakerDAO funds.

From the DeFi perspective of MakerDAO:

1. MakerDAO first achieves governance through governance Control of the TACO Foundation (the TACO Foundation, like the RWA Foundation, is governed and controlled by MakerDAO);

2. Signed with the Blocktower DROP SPV through the TACO Foundation The loan agreement provides MakerDAO's DAI funds and uses DROP tokens as collateral;

3. This part of the funds is used to subscribe for DROP on the Centrifuge platform ;Token, which is issued by the issuer SPV that holds the underlying assets of Blocktower.

From an asset financing perspective:

4. BlockTower Credit Partners is initiated as an asset Originator, loads the credit assets into the issuer's SPV through "real sale";

5. In order to ensure the independence of the issuer's SPV assets and the security of MakerDAO's funds , the issuer SPV will sign a trust agreement with Ankura Trust, stipulating the mortgage of SPV credit assets and the pledge of SPV equity. The beneficiary will be the holder of the DROP/TIN token (i.e., the TACO Foundation) to ensure the assets of MakerDAO The completeness and timely and full disposal of defaults provide guarantee for the security of MakerDAO funds;

6. The issuer SPV is issued through the Centrifuge asset tokenization platform. There are two types of tokens, DROP and TIN , of which DROP is a priority token, subscribed by TACO through the above channels; TIN token is a junior token, subscribed by BlockTower Credit Partners.

3.3 MakerDAO——BlockTower Andremeda (U.S. Debt RWA)

BlockTower Andremeda is currently one of MakerDAO's largest RWA projects, with a debt ceiling of US$1.28 billion and current assets exceeding US$1 billion. This is a U.S. debt RWA project initiated by BlockTower Capital and executed through the TACO Foundation, aiming to diversify treasury funds and invest in off-chain U.S. debt.

In the project structure of BlockTower Andremeda, the main participants include:

TACO Cayman Foundation, which was established in 2022 and has operated previous BlockTower S3/S4 credit asset RWA project with an asset management limit of US$150 million. Like the RWA Foundation, the foundation is controlled by MakerDAO governance. According to Article 4.16 of the Foundation Articles of Association, the Foundation Director needs to make any resolution or exercise any rights based on MakerDAO's governance vote (MakerDAO Resolutions).

BlockTower Capital, as the investment consultant for this project, signed an investment consulting contract with TACO Foundation and is responsible for managing the funds in each account of TACO Foundation and making investment decisions; Coinbase and Galaxy Digital serve as deposit and withdrawal service providers; Celadon Financial Group serves as a broker and executes the investment decisions of the investment advisor; Wedbush Securities Inc. serves as the fund custodian; Ankura Trust serves as the payment agent.

In this structure, MakerDAO uses the TACO Foundation more as a legal person contracting entity to perform off-chain investment related matters, and will The separation of investment decision-making and asset custody in traditional finance ensures risk control and compliance.

Comparing the BlockTower Credit project, we see the same point: at the DAO governance level, MakerDAO on-chain governance + foundation chain are used The governance system ensures that MakerDAO can achieve full control at the legal entity governance level.

The difference is: at the level of underlying asset value capture, Andremeda invests funds directly through deposits and withdrawals, investment consultants, investment brokers, fund custody, and payment agents. For U.S. debt assets, it is realized in the form of the TACO foundation; and the BlockTower S3/S4 project, due to different underlying assets, has joined the structure of the foundation and SPV. The SPV is specifically used to capture the underlying tokenized through the Centrifuge platform. assets.

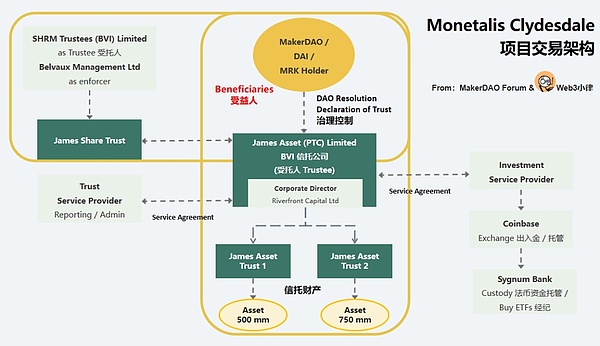

3.4 MakerDAO——Monetalis Clydesdale (U.S. Debt RWA)

Although we have seen that several Blocktower projects are operating very successfully on MakerDAO, some members still express concerns about the excessive concentration of counterparties. For example, Blocktower plays multiple important roles in the project, such as investment consultants and asset sponsors. wait.

Therefore, the Monetalis Clydesdale project initiated by Monetalis founder Allan Pedersen aims to explore a safer RWA path. The project was proposed in January 2022, passed and implemented in October 2022. The initial debt limit of the project was US$500 million, and it was completed in May 2023. The debt ceiling was raised to $1.25 billion in March, and assets were invested in U.S. bond ETFs.

In the transaction structure of Monetalis Clydesdale, it is crucial to the operation of the capital side, that is, how to convert the security and compliance of on-chain assets to off-chain, and still control them in the hands of MakerDAO:

The establishment of a property trust. First, a BVI trust company named JAL was established, which established the James Asset Trust through a Declaration of Trust. JAL holds the DAI/ETF trust assets provided by MakerDAO as a trustee, and MakerDAO MKR token holders are the beneficiaries. It controls the trustee through trust governance documents and instructs the purchase and disposal of trust assets.

MakerDAO's governance control: According to the Declaration of Trust (Declaration of Trust), the trustee JAL must take any action based on the MakerDAO Resolution; And any action taken must be approved and agreed by the transaction manager on the MakerDAO Resolution; the trustee JAL shall not take any action unrelated to the MakerDAO Resolution.

The establishment of equity trust. After handling MakerDAO's governance control over trustee JAL's trust property, it is necessary to use the equity of trustee JAL as trust property to establish James Asset Share Trust, with SHRM Trustees (BVI) Limited as trustee, Belvaux Management Ltd as enforcer, and MakerDAO MKR Token holders are the beneficiaries.

Thus, MakerDAO has achieved control over JAL trust assets on the one hand (corresponding to the DAI trust assets provided by MakerDAO), and It also achieved equity control over JAL (corresponding to the trustee JAL). In this case, any operation needs to pass/verify MakerDAO Resolution, and the flow of funds is not controlled by any third party (MakerDAO Vault - JAL Trust Property Escrow Account - Sygnum Bank Escrow Account).

Under such a trading structure, MakerDAO achieves: 1) Less or no counterparty risk, that is, third parties or investment managers have no ability to change legal terms , and cannot have access to relevant funds; 2) Barrier-free on-chain and off-chain governance structure; 3) Guarantee through trust that MakerDAO MKR token holders have the ability to promptly handle default relief and liquidation risks of underlying assets; 4) Clear fund fixation purposes, and there is no risk of misappropriation, etc.

The next asset investment by trustee JAL is relatively simple. Withdraw DAI into USD through Coinbase, and conduct fund custody and management through Sygnum Bank. ETF Trading.

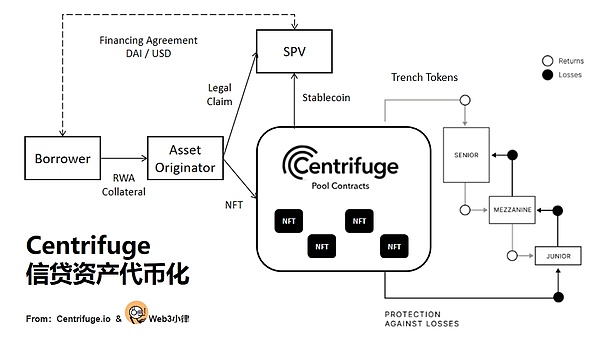

3.5 Centrifuge——RWA Roadmap (US Bond RWA)

Centrifuge has participated in multiple previous credit asset RWA projects of MakerDAO in the early stages, such as the above-mentioned New Silver Restructuring and BlockTower Credit. The specific process will not be discussed here. Those who are interested can read our previous article analyzing Centrifuge - Looking at the decentralized asset financing protocol Centrifuge from the essence of RWA.

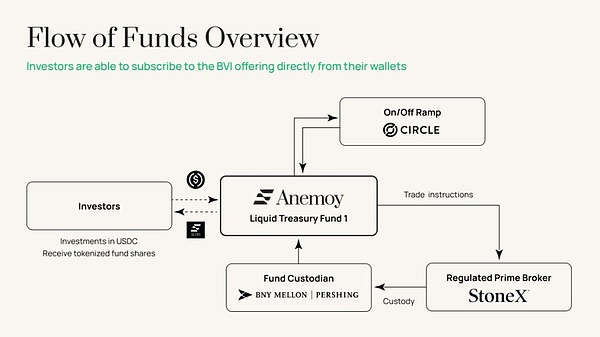

What I want to talk more about here is the Centrifuge Prime service, which is designed to help crypto capital/DeFi protocols/DAO treasury capture the return value of real-world assets (such as U.S. debt risk-free returns). Previously, the Aave community proposed on August 8, 2023, to capture the 5% risk-free return based on U.S. bond RWA by partnering with Centrifuge to invest stablecoins in the Aave vault into RWA assets.

(POP: Anemoy Liquid Treasury Fund 1)

The Centrifuge Prime service pictured above is divided into two parts:

The first step: Legal Wrapper needs to be carried out for the DeFi protocol on the chain, such as setting up a special legal entity for Aave - the Cayman Foundation. On the one hand, this legal subject can replace the unlimited liability of DAO members. On the other hand, it can also serve as an independent subject that implements RWA value capture. It is governed and controlled by the Aave community and serves as a bridge between DeFi and TradiFi.

Step 2: Centrifuge will set up a dedicated asset pool for Anemoy Liquid Treasury Fund 1. Different from the underlying credit assets of previous asset pools (load the assets into SPV, generate NFT and mortgage them into the corresponding Centrifuge asset pool), this time the underlying assets of the Anemoy Liquid Treasury Fund 1 asset pool are U.S. bonds, and you need to hold U.S. bonds Assets of the Anemoy LTF Fund are directly tokenized.

(Anemoy Liquid Treasury Fund 1)

Anemoy LTF is a fund registered in the BVI. The fund is first tokenized through the Centrifuge protocol; then, Aave Invest the treasury funds in the Centrifuge asset pool corresponding to Anemoy LTF, and generate fund token certificates; then, the Centrifuge asset pool allocates the assets invested by the Aave treasury to the Anemoy LTF fund through the agreement; finally, the Anemoy LTF fund uses deposits and withdrawals, Custodians and brokers buy U.S. Treasury bonds to realize the return of U.S. debt on the chain.

In the same way, Centrifuge helped the stablecoin project Frax Finance’s US$20 million to capture off-chain asset returns through the above method.

4. The combination of RWA and DeFi does not require permission

We have seen that most of the RWA projects on the market, including the projects covered in this article, are only for a single/limited funding party, or only for qualified investors, and retail investors cannot participate. This is because due to regulatory compliance and local Securities Law requirements, if retail investors participate, they will face the same issuance costs as an IPO. So, not all RWA platforms will be open to all users after putting assets on the chain.

In our previous research report "RWA Wanzi Research Report: Dismantling the current implementation path of RWA and exploring the development logic of RWA-Fi in the future 》, we can still see that some projects can find a path that does not require permission and retail investors can participate by combining with DeFi.

For example, the DeFi lending path of Ondo Finance & Flux Financ, Matrixdock & Lending pool, retail investors can deposit stable coins into the DeFi lending pool and obtain income from lending rates. In addition, there are interest-bearing stable currency paths of Ondo & USDY, MatrixDock & USDV, which use restricted Tokens required by qualified investors as collateral to issue stable coins, and retail investors can deposit stable coins in exchange for interest-bearing stable coins.

It is self-evident that DeFi can be combined. We have also seen Pendle connect RWA assets to realize interest rate swaps before. We are also actively exploring the combination of RWA and DeFi, and are currently building a U.S. debt RWA platform to explore the infinite possibilities of RWA.

5. Write at the end

Currently on the market The project can be called RWA version 1.0, which addresses more of the financing needs on the off-chain asset side (whether through Security Token Offering or mortgage lending) and the investment needs on the on-chain capital side (how to capture risks Real-world assets that are low, stable interest-bearing, scalable, and independent of crypto volatility are key).

RWA will also develop versions 2.0 and 3.0 that are more integrated with the real world in the near future. Before that, plan ahead.

Two months ago in August, Maker changed its name to Sky as part of the Endgame reform, but it also encountered some resistance.

JinseFinance

JinseFinanceSky, Maker, Stablecoin, Can Sky Carry Maker's Ambition of Stablecoin? Golden Finance, The Deep Meaning Behind MakerDAO's Name Change to "Sky".

JinseFinance

JinseFinanceIt seems obvious that the real-world asset tokenization space has huge growth potential in the future. But what exactly is this trend, why is it attracting so much attention and hype, and how can you make the most of it?

JinseFinance

JinseFinanceAave sparked a debate over Maker’s growing USDe collateral.

JinseFinance

JinseFinanceLending protocols play a big role in Maker's vision, but US users are being left behind?

JinseFinance

JinseFinanceA thorough guide to Milady Maker NFTs, including project overview and data analysis.

JinseFinance

JinseFinance Coinlive

Coinlive Millions of people are using the opportunity of the crypto collapse to buy into projects at lower prices than their all-time highs.

Bitcoinist

BitcoinistRune Christensen has envisioned the final form of Maker governance, and it includes MetaDAOs, new governance tokens, and a new version of Synthetic Ether.

Cointelegraph

CointelegraphThe digital finance market has been down and most cryptocurrencies are going red. Before the crash, the total crypto market ...

Bitcoinist

Bitcoinist

Please enter the verification code sent to