Author: revelointel Source: substack Translation: Shan Ouba, Golden Finance

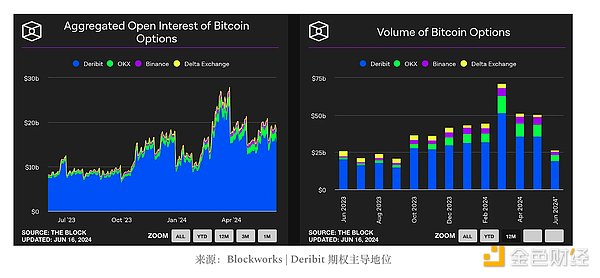

Options trading in the crypto market is dominated by centralized exchanges (CEXs), especially Deribit. The 24-hour trading volume of Bitcoin options alone exceeds $500 million, and futures trading volume exceeds $240 million. This far exceeds any decentralized alternative established in the field. DefiLlama shows that the notional 24-hour trading volume of cross-chain options trading is about $270,000. In the early days of the industry, new protocols are more likely to emerge than in the more mature DeFi field. This is especially true because there may be an incentive to disperse activity, and it cannot be healthy for one exchange to account for almost all options trading volume, especially considering that Deribit is a CEX.

Stryke is a newly branded version of Dopex, but the vision remains the same and the focus has not changed. The team is still focused on options trading, just giving themselves a fresh start and shedding some of the baggage associated with the previous protocol. Unlike protocols like Aevo, which made a name for themselves through its perpetual trading and pre-market trading options, options became an afterthought. With the move to Stryke comes new tokens, with new charts, something that has proven successful many times in DeFi, from AEVO to MNT and more.

Overall, the DeFi market could be ready for more options activity as more institutions enter the space. Prediction markets are gaining traction, with popular markets like Polymarket operating as binary options. Especially with event-driven catalysts like elections, the vibrancy of writing crypto options is evident; the challenge is building a good enough product to convince traders to go on-chain and take on smart contract risk instead of using Deribit.

Stryke Background

Stryke is a decentralized options exchange built on the foundation of Dopex, focused on enhancing options trading and liquidity provision in DeFi. It introduces innovative tools like centralized liquidity automated market makers (CLAMMs) to make on-chain options trading intuitive and seamless. Stryke's platform design facilitates cross-chain options trading and is designed to maximize liquidity, minimize losses for option writers, and passively maximize returns for option buyers. Overall, this improves capital efficiency for the underlying ecosystem.

The project was rebranded as Stryke in 2024, formerly Dopex. Tztokchad, the founder of Dopex, became interested in options protocols after experiencing platforms like Deribit and found many deficiencies such as low liquidity, wide bid-ask spreads, and harsh margin requirements. In response to these challenges, the development of the protocol began in 2019.

At the time, only a few players were addressing this market segment, providing an opportunity to create a user-friendly solution that could outperform centralized exchanges (CEXs) and decentralized protocols. During the initial development phase, decentralized exchanges (DEXs) faced many liquidity-related issues, including unfair pricing for buyers, liquidity providers (LPs) running out of assets during volatility, and difficulty taking advantage of arbitrage opportunities due to Ethereum’s high gas fees. In addition, there was significant slippage when options rolled to different strikes or prices.

After the initial ideation period, the project began to realize its vision by building a protocol that could provide the following features:

Options pools with automatic rolling, enhancing liquidity and ease of use for participants.

European options, to conduct arbitrage activities with CEXs by exploiting specific market dynamics.

Deployed on Ethereum layer-2 solutions to mitigate the impact of Ethereum’s high gas fees on arbitrage.

Options swaps to minimize slippage, enabling users to execute trades and manage their positions more efficiently.

Despite the rebrand to Stryke, the vision remains the same: to be a major player in DeFi innovation, focused on developing cutting-edge options products that cannot be offered off-chain.

The transition is designed to provide higher value to token holders, streamline operations, and provide users with better options products. By consolidating efforts under the Stryke brand, the project aims to streamline operations and create a more user-friendly and efficient options platform.

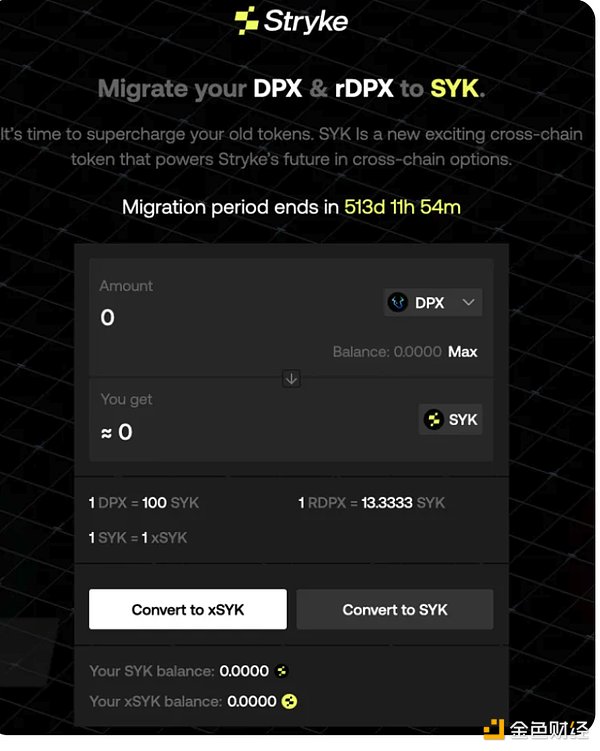

The rationale for the rebrand is to provide higher value to token holders and focus on providing top-tier options products. By moving from the dual-token model used by Dopex ($DPX and $rDPX) to a unified single token system ($SYK), Stryke aims to improve governance and cross-chain functionality while streamlining operations.

Please note that this transition represents the end of legacy products in order to streamline operations and focus resources on core products. This includes the decommissioning of SSOVs (monthly and weekly), $rDPX V2 Bonds, Perpetual Put Pools, and rtETH-WETH LP.

Stryke’s CLAMM (Centralized Liquidity Automated Market Maker)

CLAMM merges the concepts of liquidity provision and options trading into a single, unified platform. Inspired by Uniswap V3’s innovation in liquidity management, CLAMM enhances options trading by combining it with a centralized liquidity provision mechanism.

CLAMM Features

LP Range Selector: This feature allows users to select a deposit range in a single transaction. This significantly simplifies the liquidity management process by eliminating the need to manually select each price tier. The barriers associated with token ratio balancing and manual price tier selection are eliminated, improving liquidity management efficiency and the options trading experience.

Liquidity Reserve System: In other systems, LPs need to actively monitor their liquidity to ensure that it is not being used for active options contracts. With the Liquidity Reserve System, LPs can reserve the liquidity they provide. Once an option is exercised or expires, liquidity will be reserved and extracted from the option LP, kept in Uni V3 LP, and can be withdrawn at any time. This liquidity cannot be purchased or locked by anyone.

Multiple DEX Support: In line with Stryke's broader vision of cross-chain compatibility, this feature aims to deepen liquidity and bring large market makers and strategic DEX partners into the LPDfi space. With multi-DEX support, CLAMM's liquidity will be available on-chain and in different DEXs.

CLAMM Hooks: Current option users are limited by predefined strategies and lack flexibility and customization. The "Hooks" feature allows custom logic to be integrated into trading activities, allowing personalized control of trading strategies and adapting to personal needs and market conditions. For example, users can set to avoid trading on weekends when volatility is lower, or create their own time frames.

Native $USDC Support: While $USDC.e (cross-chain bridge) is still used in traditional pools, the platform is fully compatible with native $USDC, allowing cross-protocol compatibility.

American Options: American options allow settlement to be made to the pool rather than to individual counterparties. This setup ensures that traders can exercise their options based on the liquidity in the pool rather than relying on potentially less predictable market values. This settlement method improves price predictability, especially in markets with low option liquidity.

Granular Strike Prices: V3 DEXs operate on a tick basis, which means that LPs can provide liquidity over a multiple tick range of their preference. Buyers, on the other hand, can be very specific in choosing their strike price.

Fully Backed Options: Each option is backed by the pool itself where the exchange takes place. There is no additional counterparty risk that could affect option trading.

$SYK Token Economics

SYK is the native token of the Stryke platform, introduced as part of a strategic shift to consolidate the previously used DPX and rDPX tokens into a more efficient token system. This transition is intended to simplify the token structure and improve economic operations within the Stryke ecosystem, facilitating transactions, governance, and incentives.

The xSYK token is a custodial version of SYK, designed to promote long-term holding and governance participation by holders. Staking SYK to obtain xSYK allows users to participate more deeply in the ecosystem, influencing decisions such as reward distribution and protocol updates. The xSYK staking structure is designed to incentivize continued participation and platform stability.

The conversion rate is 1:1, meaning that for every SYK user, one xSYK can be obtained. The xSYK framework has a unique redemption mechanism that balances immediate liquidity needs with long-term ecosystem interests.

xSYK holders who choose to lock their tokens will receive a yield. Redemption of xSYK requires a vesting period. Stryke offers two options. Holders can choose to lock their xSYK for a minimum of 7 days or a maximum of 6 months. The goal of xSYK is to reward long-term participation in the project and increase governance participation. To achieve this, xSYK holders are incentivized through multiple forms, including governance, enhanced lock-up rewards, reward measurement, and other community-driven benefits.

The migration to SYK involves transitioning from DPX and rDPX tokens to SYK according to a predefined conversion ratio to ensure a seamless transition for existing stakeholders. The conversion ratio is as follows:

1 $DPX = 100 SYK

1 $rDPX = 13.333 SYK

This process is implemented through smart contracts, allowing for the automatic minting of SYK tokens. The migration contract will be open to all DPX holders for 1.5 years after deployment to convert their tokens.

Stryke has set up a simple process for previous DPX and rDPX holders to migrate their tokens to the new ecosystem. The process has been carefully designed so that previous holders keep the same value of their tokens while the team realizes its new vision by providing better value and token utility to users.

Cheng Yuan

Cheng Yuan

Cheng Yuan

Cheng Yuan JinseFinance

JinseFinance Huang Bo

Huang Bo Cheng Yuan

Cheng Yuan Huang Bo

Huang Bo Alex

Alex Bitcoinist

Bitcoinist cryptopotato

cryptopotato Coindesk

Coindesk Ftftx

Ftftx