Author: Arthur Hayes

The dust on the earth's crust returned to Hokkaido, Japan, as scheduled. It was sunny and warm during the day, but freezing cold at night. This weather pattern creates severe snow conditions known as "crust dust." Underneath the seemingly beautiful and flawless snow, there is ice and brittle snow lurking. nausea.

As winter turns to spring and the pace accelerates, I would like to review the article "Dust on the Earth's Crust" published a year ago. In this article, I propose how to create a human-backed fiat stablecoin that exists independently of the TradFi banking system. My idea is to combine crypto long and short perpetual futures contract position hedging to create a synthetic fiat currency unit. I named it "Nakadollar" because I envisioned using "perpetual" short futures contracts on Bitcoin and XBTUSD as a way to create synthetic dollars. At the end of the article, I promise to do everything in my power to support a credible team to bring this idea to life.

What a big change in one year. Guy is the founder of Ethena. Prior to founding Ethena, Guy worked at a $60 billion hedge fund investing in specialty areas such as credit, private equity, and real estate. Guy discovered the Shitcoin problem during the DeFi Summer that started in 2020, and has been out of control ever since. He came up with the idea to launch his own synthetic dollar after reading the book Dust on Crust. But like all great entrepreneurs, he wanted to improve upon my original idea. He wants to create a synthetic USD stablecoin using ETH instead of BTC. At least at first.

Guy chose ETH because the Ethereum network provides native income. To provide security and process transactions, Ethereum network validators are paid a small amount of ETH for each block directly through the protocol. This is what I call ETH staking yield. Additionally, since ETH is now a deflationary currency, there is a fundamental reason why ETH/USD forwards, futures, and perpetual swaps trade at a continued premium compared to spot. Short perpetual swap holders can capture this premium. Combining physical ETH collateral with a short ETH/USD perpetual swap position creates a high-yielding synthetic USD. As of this week, the annual return on spot ETH USD (sUSDe) is ~50%.

If there is no team that can execute it, no matter how good the idea is, it will be empty talk. Guy named his synthetic dollar "Ethena" and has assembled a star team to launch the protocol quickly and securely. In May 2023, Maelstrom became a founding advisor and in exchange we received governance tokens. I have worked with many high quality teams in the past and Ethena's staff cut corners and did a great job getting the job done. Fast forward 12 months later, the Ethena stablecoin USDe was officially launched. Just 3 weeks after the mainnet went online, the circulation has reached nearly 1 billion (TVL is 1 billion US dollars; 1 USDe = 1 US dollar).

Let me put aside my knee pads and have a candid discussion about the future of Ethena and stablecoins. I believe that Ethena will surpass Tether to become the largest stable currency. This prophecy will take many years to come true. However, I want to explain why Tethe is the best and worst business in cryptocurrency. It is the best because it is probably the most profitable financial intermediary per employee in TradFi and cryptocurrencies. The reason it’s the worst is because Tether exists to please its poorer TradFi banking partners. Bank envy and the problems Tether creates for the guardians of America’s peaceful financial system could spell immediate doom for Tether.

To all those Tether FUDsters who have been misled, I want to make it clear. Tether is not a financial fraud and does not lie about its reserves. Additionally, I have great respect for those who founded and run Tether. However, IMHO, Ethena will subvert Tether.

This article will be divided into two parts. First, I will explain why the U.S. Federal Reserve, the U.S. Treasury, and large politically connected U.S. banks want to destroy Tether. Second, I'll dive into Ethena. I will briefly cover how Ethena is built, how it remains pegged to the U.S. dollar, and its risk factors. Finally, I will provide a valuation model for Ethena’s governance token.

After reading this article, you will understand why I believe Ethena is the cryptocurrency ecosystem’s best choice for providing synthetic USD on the public chain.

Note: Physically supported fiat currency stablecoins refer to currencies in which the issuer holds fiat currency in a bank account, such as Tether, Circle, First Digital ( Ahem...Binance) etc. Synthetically backed fiat stablecoins are coins where the issuer holds a cryptocurrency that is hedged with short-term derivatives, such as Ethena.

Envy, jealousy and hatred

Tether( Symbol: USDT) is the largest stablecoin by token circulation. 1 USDT = 1 US dollar. USDT is sent between wallets on various public chains such as Ethereum. To maintain the peg, Tether holds $1 in bank accounts for each unit of USDT in circulation.

Without a U.S. dollar bank account, Tether cannot fulfill its functions of creating USDT, custody of U.S. dollars backing USDT, and redeeming USDT.

Create: Without a bank account, USDT cannot be created because traders have nowhere to send their USD.

USD custody: If you don’t have a bank account, there is nowhere to keep the US dollars that support USDT.

Redeem USDT: Without a bank account, there is no way to redeem USDT, because there is no bank account to send USD to the redeemer.

Having a bank account is not enough to ensure success because not all banks are created equal. There are thousands of banks around the world that accept U.S. dollar deposits, but only some have master accounts with the Federal Reserve. Any bank wishing to conduct U.S. dollar clearing through the Federal Reserve to fulfill U.S. dollar correspondent banking obligations must hold a master account. The Fed has complete discretion over which banks have access to master accounts.

I will briefly explain how agent banking works.

There are three banks: Bank A and Bank B are headquartered in two non-U.S. jurisdictions. Bank C is a US bank with a master account. Bank A and Bank B want to be able to transfer US dollars in the fiat currency financial system. They applied separately to use Bank C as their agent bank. Bank C evaluates the customer base of both banks and approves it.

Bank A needs to remit $1,000 to Bank B. The fund flow is US$1,000 transferred from Bank A's account at Bank C to Bank B's account at Bank C.

Let's change the example slightly and add Bank D, which is also a US bank with a master account. Bank A uses Bank C as its correspondent bank, while Bank B uses Bank D as its correspondent bank. Now, what happens if Bank A wants to send $1,000 to Bank B? The fund flow is a transfer of $1,000 from Bank C's account at the Federal Reserve to Bank D's account at the Federal Reserve. Bank D finally deposits $1,000 into Bank B's account.

Typically, banks outside the United States use correspondent banks to wire U.S. dollars worldwide. This is because when dollars move between jurisdictions, they must be cleared directly through the Fed.

I have been exposed to cryptocurrency since 2013. Usually, the banks where cryptocurrency exchanges store fiat currencies are not banks registered in the United States, which means that it You need to rely on a US bank with a master account to handle deposits and withdrawals of fiat currency. These smaller, non-U.S. banks are hungry for deposits and crypto companies’ banking business because they can charge high fees without paying out any deposits. Globally, banks are often eager to access cheap U.S. dollar funding because the U.S. dollar is the global reserve currency. However, these smaller foreign banks must interact with their correspondent banks to handle U.S. dollar deposits and withdrawals outside of their location. While correspondent banks tolerate these fiat currency flows related to cryptocurrency businesses, sometimes certain cryptocurrency customers are kicked out of smaller banks at the behest of correspondent banks, for whatever reason. If smaller banks don't comply, they lose correspondent banking relationships and the ability to move dollars internationally. Banks without dollar liquidity are like zombies. Therefore, small banks will always dump cryptocurrency customers if asked to do so by correspondent banks.

When we analyze the strength of Tether’s banking partners, the development of this agent banking business is crucial.

Tether’s banking partners:

Britannia Bank & Trust

Cantor Fitzgerald

">Capital Union

Ansbacher

Deltec Bank and Trust

Of the five banks listed, only Cantor Fitzgerald is a bank registered in the United States . However, none of these five banks has a Fed master account. Cantor Fitzgerald is a primary dealer who helps the Fed perform open market operations, such as buying and selling bonds. Tether’s ability to move and hold U.S. dollars is entirely at the mercy of fickle correspondent banks. Given the size of Tether’s U.S. Treasury portfolio, I believe their partnership with Cantor will be critical for continued access to this market.

The CEOs of these banks would be fools if they didn't negotiate for equity in Tether in exchange for banking services. You'll understand why when I introduce Tether's revenue per employee metric later.

This covers why Tether’s banking partners are underperforming. Next, I want to explain why the Fed doesn’t like Tether’s business model and why, fundamentally, it has nothing to do with cryptocurrency and everything to do with how the U.S. dollar money market works.

Full Reserve Banking

From TradFi To put it into perspective, Tether is a full reserve bank, also known as a narrow bank. Full reserve banks only accept deposits and do not make loans. The only service it provides is money transfers. It pays almost no interest on deposits because savers face no risk. If all depositors demand their money back at the same time, the bank can fulfill their demands immediately. Therefore, it is called "full reserves." In contrast, fractional-reserve banks have more loans than deposits. If all depositors simultaneously asked a fractional reserve bank to return their deposits, the bank would fail. Fractional-reserve banks pay interest to attract deposits, but depositors face risks.

Tether is essentially a fully-reserved U.S. dollar bank that provides U.S. dollar trading services driven by a public chain. That's it. No loans, no fun stuff.

The Fed doesn't like fully-reserve banks, not because of who their customers are, but because of how these banks handle their deposits. To understand why the Fed abhors a fully-reserved banking model, I must discuss the mechanics of quantitative easing (QE) and its impact.

Banks failed during the 2008 financial crisis because they did not have enough reserves to cover losses on bad mortgages. Reserves are funds held by banks with the Federal Reserve. The Fed monitors the size of bank reserves based on total outstanding loans. After 2008, the Fed ensured that banks would never run out of reserves. The Fed achieves this goal by implementing QE.

QE is the process by which the Federal Reserve purchases bonds from banks and credits the reserves held by the Fed to the banks. The Fed conducted trillions of dollars worth of QE bond purchases, causing bank reserve balances to swell. great!

Quantitative easing has not caused wild inflation in the obvious way that COVID stimulus checks have because bank reserves remain at the Fed. COVID stimulus measures are put directly in the hands of the people to use as they please. If banks loaned out these reserves, inflation would rise immediately after 2008 because the money would be in the hands of businesses and individuals.

Fractional reserve banks exist to make loans; if banks don’t make loans, they can’t make money. So, other things being equal, fractional reserve banks prefer to lend their reserves to paying customers rather than keep them at the Fed. The Fed has a problem. How do they ensure that the banking system has nearly unlimited reserves without causing inflation? The Fed chose to "bribe" the banking industry instead of lending.

Bibbing banks to require the Fed to pay interest on excess reserves in the banking system. To calculate the amount of the bribe, multiply the total bank reserves held by the Fed by the interest on reserve balances (IORB). The IORB must hover between the lower and upper bounds on the Fed's funds rate. Read my article Kite or Board to find out why.

Loans are risky. Borrowers will default. Banks would rather earn risk-free interest income from the Fed than lend to the private sector and suffer possible losses. As a result, as QE progresses, outstanding loans in the banking system do not grow at the same rate as the Fed's balance sheet. However, success does not come cheap. When the Fed funds rate is 0% to 0.25%, the cost of bribery is not high. But now, with the Fed funds rate at 5.25% to 5.50%, IORB bribes cost the Fed billions of dollars every year.

The Federal Reserve maintains "high" policy rates to curb inflation; however, due to the increased cost of IORB, the Federal Reserve has become unprofitable. The U.S. Treasury Department and the American public directly funded the Federal Reserve to bribe banks through the IORB program. When the Fed makes money, it sends those payments to the U.S. Treasury. When the Fed loses money, the U.S. Treasury lends money to the Fed to cover its losses.

Quantitative easing solves the problem of insufficient bank reserves. Now, the Fed wants to reduce the amount of reserves banks hold in order to curb inflation. This is Quantitative Tightening (QT).

QT refers to the Fed selling bonds to the banking system and paying for them with reserves held by the Fed. Quantitative easing increases bank reserves, while quantitative tightening reduces bank reserves. As bank reserves fall, so do IORB's bribe costs. Obviously, the Fed wouldn't be happy if bank reserves were rising while it was paying high interest rates because of IORB.

The fully-reserve banking model runs counter to the Fed's stated goals. Fully-reserve banks do not make loans, meaning 100% of deposits are held as reserves at the Fed. If the Fed starts issuing full-reserve banking licenses to banks engaged in businesses similar to Tether, it will exacerbate the central bank’s losses.

Tether is not a licensed bank in the United States, so it cannot be deposited directly into the Federal Reserve and earn IORB. But Tether can deposit cash into money market funds, and money market funds can use the reverse repurchase program (RRP). The reverse repo program is similar to the IORB in that the Fed must pay an interest rate between the federal funds floor and ceiling to determine exactly where short-term rates trade. Treasury bills (T-bills) are zero-coupon bonds with maturities of less than one year and trade at a yield slightly higher than the RRP rate. So while Tether is not a bank, its deposits are invested in instruments that require interest payments from the Federal Reserve and the U.S. Treasury. Tether has nearly $81 billion invested in money market funds and T-bills. Tether goes against the Federal Reserve. And the Fed doesn't like it.

Tether confronts the Federal Reserve because Tether pays 0% interest on USDT balances, but it can earn interest that is approximately the upper limit of the Federal Reserve's funds rate. This is Tether’s net interest margin (NIM). As you can imagine, Tether was overjoyed by the Fed's rate hike, as NIM rose from essentially 0% to nearly 6% in less than 18 months (March 2022 to September 2023).

Tether is not the only stablecoin issuer fighting the Fed. Circle (ticker: USDC) and every other stablecoin that accepts USD and issues tokens is doing the same thing.

If banks abandon Tether for some reason, the Federal Reserve will not be able to help. In fact, the Fed governors' cheese will be bigger than Sam Bankman-Fried's chubby little bump on Tiffany Fong's non-marital visit.

What about "bad woman" Yellen? Does her Treasury have any issues with Tether?

Tether is too big

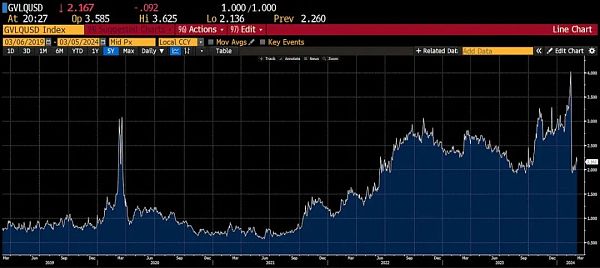

U.S. Treasury Secretary Janet - Janet Yellen needs a well-functioning Treasury market. That way she could borrow the money necessary to pay for the trillion-dollar annual government deficit. After 2008, the size of the U.S. Treasury bond market and the fiscal deficit expanded together. The larger the scale, the more fragile it becomes.

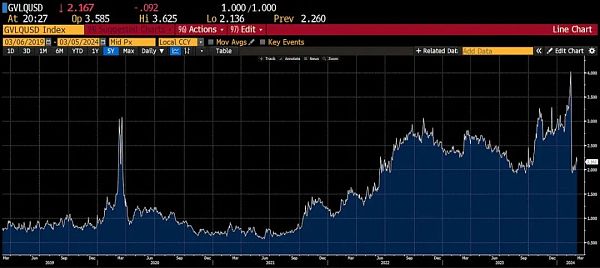

The U.S. Government Securities Liquidity Index chart clearly shows the decline in liquidity in the U.S. Treasury market since COVID (the higher the number, the worse the liquidity situation). It only takes a small amount of selling to disrupt the market. What I mean by disrupting the market is a rapid drop in bond prices or a rise in yields.

Tether is now one of the 22 largest holders of U.S. Treasury bonds. If Tether had to sell off its holdings quickly for whatever reason, it could cause chaos in global bond markets. I say global because all fiat debt instruments are priced against the U.S. Treasury curve to some degree.

If Tether’s banking partners abandon Tether, Yellen may intervene in the following ways:

Perhaps she will provide for giving Tether a reasonable amount of time to remain a customer so that it is not forced to sell assets to meet redemption requests quickly.

Maybe she will freeze Tether's assets so that it can't sell anything until she thinks the market can absorb Tether's holdings.

But what Yellen will certainly not do is help Tether find another long-term banking partner. The growth of Tether and similar stablecoins serving the cryptocurrency market poses risks to the U.S. Treasury market.

If Tether decides to buy bonds that no one wants, long-term bonds with maturities greater than 10 years, instead of short-term notes that everyone wants, Yellen Maybe on their side. But why would Tether take this maturity risk to earn less than short-term Treasury bonds? This is because the yield curve is inverted (long-term interest rates are lower than short-term interest rates).

The most powerful arm of the American peaceful financial machine would rather Tether did not exist. And none of this has anything to do with cryptocurrencies.

Tether is too rich

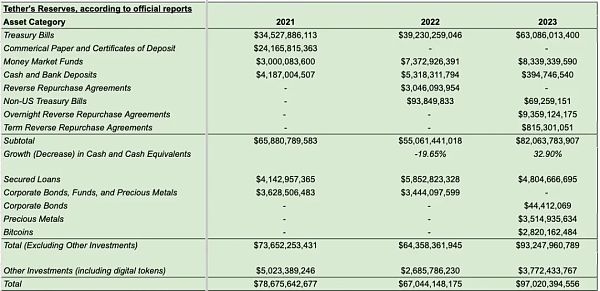

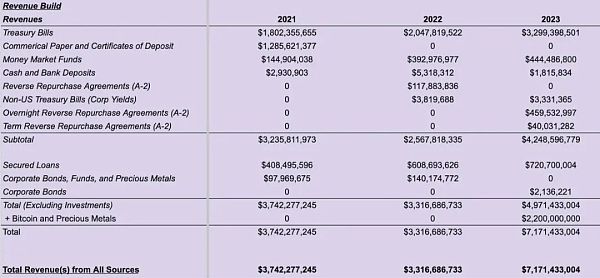

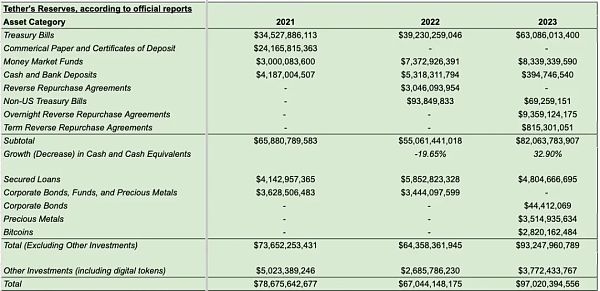

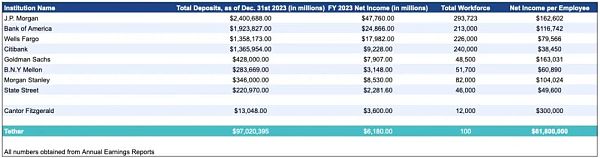

Maelstrom’s talented Analysts have produced the following speculative balance sheet and income statement for Tether. They combined Tether’s publicly disclosed information with their own judgment to produce this report.

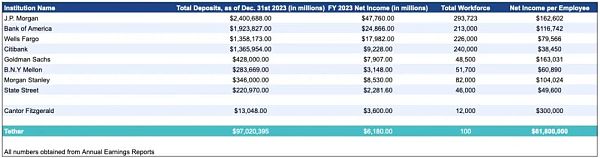

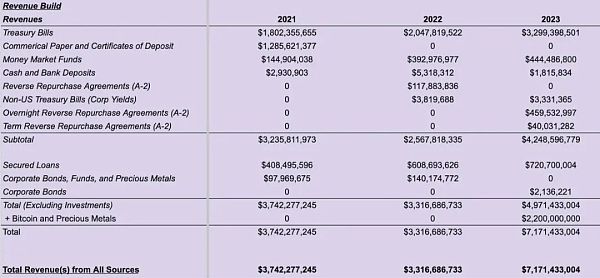

Here is a table of eight "too big to fail" (TBTF) banks that control the U.S. economy and political systems, and their net income for fiscal year 2023.

Cantor Fitzgerald is not a bank, but a primary dealer and trading house. There are only 23 primary dealer banks. Therefore, in the "Total Deposits" column, Cantor's figure represents the value of its balance sheet assets. I get Cantor's net revenue and headcount from Zippia.

Tether’s revenue per employee is $62 million. No other bank on this list comes close. Tether’s profitability is another example of how cryptocurrencies will impact the largest transfer of wealth in the history of human civilization.

Why don’t these TBTF banks offer competing fiat-backed stablecoins? Tether earns more per employee than these banks, but without these banks and others like them, Tether cannot exist.

Instead of asking Tether to unbank, maybe one of these banks could buy Tether. But why do they do this? Certainly not for technology. Due to the transparency of the public chain, the code to deploy the smart contract Tether clone is already on the Internet.

If I were the CEO of a US bank that supported the existence of Tether, I would immediately withdraw their bank accounts and offer a competing product. The first US bank to offer a stablecoin will quickly capture the market. As a user, holding JPMorgan coins is less risky than holding Tether. The former is the responsibility of the "too big to fail" banks and is essentially the responsibility of the empire. The latter is the responsibility of a private company, scorned by the entire U.S. banking system and its regulators.

I have no reason to believe that a US bank is plotting to overthrow Tether. But doing so is trivial. Why is it that the owners of Tether, all crypto puppets hanging out in the Bahamas, whose existence relies 100% on access to the U.S. banking system, can make more than Jamie Dimon in a few trading days? Things that make your heart flutter, well....

As the cryptocurrency bull market progresses, any stock related to the cryptocurrency business will soar. A U.S. bank whose stock price is slipping amid fears over bad commercial real estate loans would see its valuation boosted if it entered the crypto stablecoin market. This could be all the motivation a U.S. bank needs to finally compete directly with Tether, Circle, and others.

If Circle's IPO goes well, the banking system is expected to face challenges. Stablecoin ventures like Circle and Tether should trade at a discount to their earnings because they have no competitive moat. Circle's successful listing is a comedy in itself.

There is no higher mountain than this...

I just explained why it would be easier for the US banking system to destroy Tether than to beat Caroline Ellison at the Math Olympiad. But as a cryptocurrency ecosystem, why would we create another fiat-pegged stablecoin?

Thanks to Tether, we know that the crypto capital market is hungry for a fiat-pegged stablecoin. The problem is, the service provided by banks is terrible because without competition, banks cannot do better. With Tether, anyone with an internet connection can pay in U.S. dollars 24/7.

Tether has two main problems:

Users cannot receive any share of Tether’s NIM.

Even if Tether plays by the book, the U.S. banking system could shut it down overnight.

To be fair, users of any currency generally do not share in seigniorage revenue. Holding cash U.S. dollars doesn't entitle you to a share of the Fed's profits...but there certainly are losses. Therefore, USDT holders should not expect to receive any NIM for Tether. There is one user group that should be compensated, though, and that's cryptocurrency exchanges.

Tether's main use case is as a financing currency for cryptocurrency transactions. Tether also provides a way to transfer fiat currencies nearly instantaneously between trading venues. Exchanges as cryptocurrency exchanges give Tether utility, but they get nothing in return. There is no Tether governance token that can be purchased that provides holders with a claim to NIM. Unless the exchange somehow acquired an equity stake in Tether in its early days, there was no way to share in Tether's success. This is not a sad story about why Tether sends money to exchanges. Instead, this prompts exchanges to support stablecoin issuers, transferring the majority of NIM to holders, and provides exchanges with the opportunity to purchase governance tokens at cheap valuations in the early stages of an issuer’s development.

Quite simply, if you want to surpass Tether, you have to pay a large portion of NIM to stablecoin holders and sell cheap governance tokens to exchanges. This is how vampire squid attacks stablecoins backed by physical fiat currencies.

Ethena completely follows this gameplay. USDe holders can directly hand over USDe to Ethena for custody and earn most of the NIM. Major exchanges are investing in Ethena in its early funding rounds. Ethena’s investors include Binance Labs, Bybit via Mirana, OKX Ventures, Deribit, Gemini and Kraken.

In terms of market share held by these exchanges, they cover approximately 90% of ETH’s open interest on major exchanges.

How does it work?

Ethena is a synthetic fiat crypto dollar.

ETH = Ether

< strong>stETH=Lido-staking ETH derivatives

ETH=stETH

ETH=stETH =10,000 USD

ETH/USD perpetual swap contract value = 1 USD worth of ETH or stETH = 1 / USD value of ETH or stETH

Hook

< p style="text-align: left;">USDe is a stablecoin issued by Ethena and is designed to be pegged to the U.S. dollar at 1:1.

Ethena has various authorized participants (AP). Authorized participants can mint and burn USDe at a 1:1 USD ratio.

Coin:

Currently, stETH Lido, Mantle mETH , Binance WBETH and ETH are all accepted. Ethena then automatically sells the ETH/USD perpetual swap contract to lock in the USD value of ETH or ETH LSD. The protocol then mints an equivalent amount of USDe that matches the dollar value of the short perpetual swap hedge.

For example:

AP deposits 1 stETH, worth $10,000.

Ethena sells 10,000 ETH/USD perpetual swap contract = 10,000 USD/1 USD contract value.

AP received 10,000 USDe because Ethena sold 10,000 ETH/USD perpetual swap contract.

Burning:

To burn USDe, AP will USDe is deposited into Ethena. Then, Ethena will automatically cover part of the ETH/USD perpetual swap short position, thereby releasing a certain amount of USDe value. The protocol will then burn USDe and return an amount of ETH or ETH LSD based on the total USD value unlocked minus execution fees.

For example:

AP deposits 10,000 USDe.

Ethena bought back 10,000 ETH/USD perpetual swap contracts = 10,000 USD/1 USD contract value

AP receives 1stETH = 10,000 * 1 USD/10,000 stETH/USD, minus execution fees

To understand why stablecoins such as Curve were initially On the trading platform, USDe should be trading slightly higher than the US dollar, and I will explain why users want to hold USDe.

USDe yield

ETH pledge yield and ETH A combination of /USD perpetual swap funds equates to a high synthetic USD yield. To earn this yield, USDe holders can stake directly on the Ethena app. It takes less than a minute to start earning money.

Since sUSDe’s yield of approximately 30% at launch is very high, users who already hold USD stablecoins with lower yields will switch to sUSDe. This will bring buyer pressure and push up the price of USDe in the curve pool. When the trading premium of USDe is large enough, AP will step in and arbitrage the difference.

As you can see, sUSDe (custodial USDe) has a much higher yield than sDAI (custodial DAI) and the 1-month US Treasury note. Source: Ethena Ethena

Imagine this: 1 USDe = 2 USDT. If an AP can create 1 USDe with 1 USDT worth of ETH or stETH, they can earn a risk-free profit of 1 USD. The process is as follows:

Remit US dollars to the exchange.

Sell $1 for ETH or stETH.

Deposit ETH or stETH on the Ethena app and receive 1 USDe.

Deposit USDe on Curve and sell for 2 USDT.

Sell 2 USDT for $2 on the exchange, then withdraw the USD to your bank account.

If users believe that Ethena is safe and the rate of return is real, then in this hypothetical example, the USDT in circulation will decline, USDe in circulation will rise.

UST Yield

There is so much in the cryptocurrency space People thought Ethena would fail like UST. UST is a stablecoin attached to the Terra/Luna ecosystem. Anchor is a decentralized money market protocol in the Terra ecosystem that provides 20% annual yield to those who hold UST. People can deposit UST and Anchor will lend this deposit to borrowers.

Any stablecoin issuer must convince users why they should switch from the usual Tether to a new product. High revenue is what prompts users to convert.

UST is powered by Luna and Bitcoin purchased through the sale of Luna. Luna is the governance token of the ecosystem. The Foundation possesses a large number of Lunas. Since the price of Luna is higher, the Foundation sells Luna in exchange for UST to pay the high interest rate on UST. The interest rate is not paid physically in USD, but instead you earn more UST tokens. Although UST maintains a 1:1 peg to the U.S. dollar, the market believes that if you hold more UST, you will also hold more U.S. dollars.

As the total value of Anchor’s locked UST increases, its UST interest expenses also increase. The foundation's continued sale of Luna to subsidize Anchor's UST returns has become unsustainable. Gains only come from the market thinking Luna should be worth billions of dollars.

The death spiral for algorithmic stablecoins began when the price of Luna began to fall. Since Luna is minted and burned to maintain UST's 1:1 peg to the U.S. dollar, it becomes increasingly difficult to maintain UST's U.S. dollar peg as Luna's value declines. Once the mechanism anchoring the U.S. dollar is broken, all interest accumulated by UST on Anchor will become worthless.

Ethena Yield

USDe generates income in the same way UST is completely different. Ethena holds two income-producing assets.

Staking ETH:

ETH uses Lido (stETH) Wait for liquid pledge derivatives to be pledged. ETH is deposited into Lido. Lido runs verification nodes capitalized on ETH deposits and remits ETH paid by the Ethereum network to stETH holders.

Perpetual swap exchange:

Perpetual swap A period is a series of consecutive short-term futures contracts. The funding rate for most perpetual swaps resets every 8 hours. The funding rate is based on the premium or discount of the perpetual contract relative to the spot. If the options were in 1% premium relative to the spot during the previous 8 hours, the funding rate for the next period would be +1%. If the funding rate is positive, longs pay shorts; if funding rates are negative, longs pay shorts.

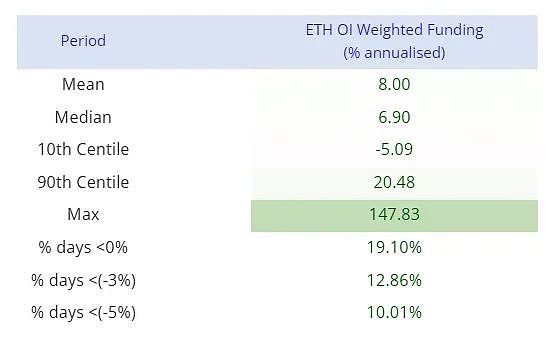

Ethena holds a perpetual swap airdrop position to lock in the USD value of its ETH holdings. Therefore, if the funds are positive, Ethena will earn interest income. If it is negative, interest will be paid. Obviously, as USDe holders, we want to believe that Ethena will earn interest, not pay interest. The question is, why is there a premium for ETH/USD forwards?

ETH is now a deflationary currency. The dollar is an inflationary currency. If ETH decreases and USD increases in the future, then the forward trading price of ETH/USD should be higher. This means that any leveraged forward derivatives, such as perpetual swaps, should trade at a premium to spot. Funds should be positive most of the time, meaning Ethena received interest. The data proves it.

What causes ETH to change from deflation to inflation? If Ethereum's network usage drops dramatically, then significantly less Ethereum gas will be burned per block. In this case, the ETH block reward will be greater than the ETH gas consumption.

What causes the US dollar to change from an inflationary currency to a deflationary currency? American politicians need to stop spending so much money just to get re-elected. The Fed must reduce its balance sheet to zero. This will lead to a serious shrinkage in the circulation of US dollar credit currency.

I think both scenarios are unlikely to occur; therefore, for most periods in the foreseeable future, it is reasonable to expect financing rates to be exactly reasonable.

USDe is not UST.

The combination of ETH staking yield and positive perpetual swap funds produces the USDe yield. The yield is not based on the value of the Ethena governance token. USDe and UST generate revenue in completely different ways.

Summary!

Ethena is subject to exchange counterparty risk. Ethena is not decentralized, nor does it attempt to be. Ethena holds a short swap position on the Centralized Exchange for Derivatives (CEX). If these CEXs are unable to pay out profits on swap positions or return deposited collateral for various reasons, Ethena will suffer capital losses. Ethena attempts to reduce counterparty risk on direct exchanges by keeping funds in third-party custodians such as Tether:

Tether’s counterparty risk is borne by TradFi Bank. Ethena’s counterparty risk is borne by derivatives CEX and cryptocurrency custodians.

CEX is an investor in Ethena and has a vested interest in not being hacked and ensuring that derivatives are paid properly. Derivatives CEX is the most profitable cryptocurrency company and they want to keep it that way. It's not good business to screw your customers over. As Ethena grows, open interest in derivatives will also grow, thereby increasing CEX’s fee income. All motivations are aligned. CEX wishes Ethena well.

Tether's products help the operation of cryptocurrency capital markets. Cryptocurrencies exist to disintermediate TradFi Bank. TradFi Bank Wants Cryptocurrencies to Fail. Fundamentally, Tether’s banking business accelerated TradFi’s demise. Incentives are inconsistent. TradFi Bank doesn’t want Tether to do well, and neither do their regulators.

Ethena is For Us, By Us, also known as FUBU.

Tether is "for us, by them", also known as "FUBAR".

LSD smart contracts and risk reduction

Ethena holds ETH LSD. It faces smart contract risks. For example, something could go wrong with Lido, rendering StETH worthless. In addition, there is the risk of bargaining. Halting occurs when an Ethereum node network validator breaks certain rules. As a penalty, the Ethereum capital held by validators will be reduced, that is, slashed.

Negative Funding

As I mentioned before, Funding rates on perpetual swaps may remain negative for extended periods of time. Funding rates could become negative, such that Ethena’s NAV is less than the issued USDe. In this way, the US dollar against the euro will break through the pledge mechanism downwards.

Ethena smart contract risks

Same as Tether, Ethena Smart contracts are also run on the public chain. There may be loopholes in the code, leading to unexpected behavior and ultimately causing losses to USDe holders. Typically, hackers will try to mint a ton of stablecoins for free and then exchange them for another cryptocurrency on platforms like Uniswap or Curve. This would result in the peg being broken, as the supply of the stablecoin increases without a corresponding increase in the assets backing the stablecoin.

However, the Ethena smart contract is relatively simple, and most of its complexity work is concentrated in off-chain engineering. The on-chain mint/redemption contract is only about 600 lines of code, and only approved participants can interact with the most sensitive contracts on the chain, which helps reduce the risk of blocking malicious unknown parties from interacting with it.

Growth limit

The circulating supply of USDe can only As large as the total open interest of ETH futures and perpetual swaps on the exchange. The circulating supply of physically-backed fiat stablecoins is approximately $130 billion. The total ETH open interest value across all exchanges Ethena trades on is approximately $8.5 billion, and the total ETH open interest value across all exchanges is approximately $12 billion. Additionally, once Ethena decides to hold BTC as collateral, they also Take advantage of the $31 billion in open interest on BTC contracts. Ethena’s total open interest in BTC and ETH is approximately $43 billion, making it impossible for Ethena to occupy the number one position under current market conditions. While Ethena starts with ETH, BTC and SOL are also easily added to their system, it's just a matter of sequencing.

While the above is true, remember that I said Ethena would be crowned king many years later. As cryptocurrencies grow as an asset class, total open interest will grow exponentially. Some believe that cryptocurrencies as an asset class will reach $10 trillion within this cycle. Given that ETH is the second-largest cryptocurrency by fiat market capitalization, it’s not ridiculous that ETH’s open interest could exceed $1 trillion at this level.

Ethena will grow with the growth of cryptocurrencies.

Insurance Fund

The role of the insurance fund is to reduce the risk of Economic losses caused by the above risks. If funding rates turn negative or the synthetic dollar depreciates, the fund will bid for dollars in the open market. The fund consists of stablecoins (USDT and USDC), stETH, and USD/USD LP positions. Currently, the capital of the insurance fund comes from funds raised by Ethena Labs and part of the earnings generated by USDe, but these earnings are not pledged. In the future, as the USDe circulation increases, the fund will be capitalized with long-term yields. As of this writing, the insurance fund is $16 million.

Neither USDT nor USDe is risk-free. But the risks are different. Tether and Ethena may eventually fail, but for different reasons.

As people begin to believe that USDe’s yield is not deceptive, more and more USDe will be in circulation.

The next step is to own a part of the kingdom. This is where the upcoming Ethena governance token comes into play.

Evaluating Ethena

Like other currency issuers, Ethena lives and dies by her monetary income. This is the difference between the cost of creating money and the actual goods that money can buy. I'd like to come up with a simple model to value Ethena based on these FX earnings. For those who might be buying Ethena’s governance token in the coming months, they should at least try to build a model to value the protocol.

Any issued USDe can be pledged and earn ETH pledge plus perpetual funding income. Currently, Ethena distributes the income generated by assets backing sUSDe, while the income generated by assets backing uncollateralized USDe is sent to the insurance fund. I estimate that the long-term distribution ratio will be: 80% of the revenue generated by the protocol goes to the staked USDe (sUSDe), and 20% of the revenue generated goes to the Ethena protocol.

Ethena protocol annual income = total income * (1-80% * (1 - sUSDe supply/USDe supply))

If 100% of USDe is pledged, that is, sUSDe supply = USDe supply:

Ethena protocol annual income = total Revenue * 20

Total revenue = USDe supply * (ETH pledge revenue + ETH perpetual swap funds)

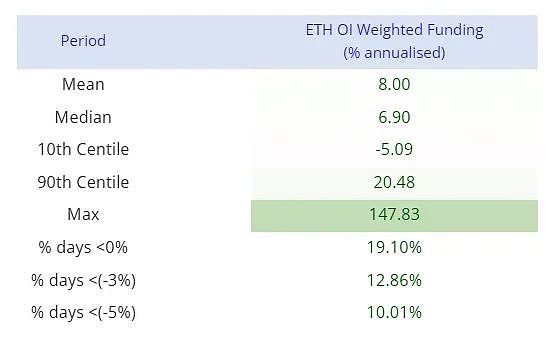

ETH pledge yield and ETH perpetual swap funds are variable interest rates. Recent history can help us understand future possibilities.

ETH staking yield - I assume the PA yield is 4%.

ETH Perpetual Swap Funding - I assume PA is 20%.

Staking Percent - Currently, only 28% of USDe is staked. I expect that to increase over time. I assume that 50% of USDe will be staked in the future.

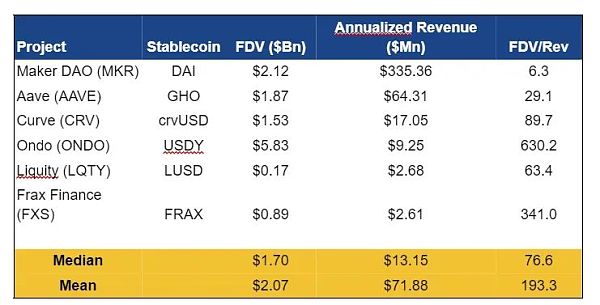

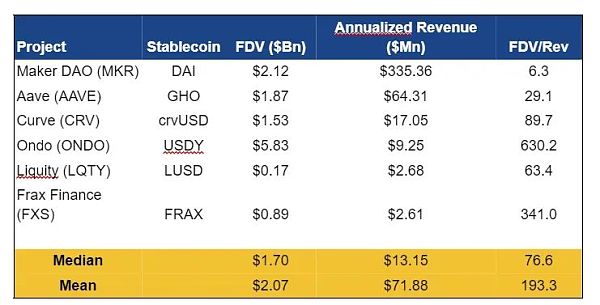

The key part of the model is that the fully diluted valuation (FDV) to revenue ratio should be used. This is always a guessing game, but I will suggest some future paths based on comparable DeFi stablecoin projects.

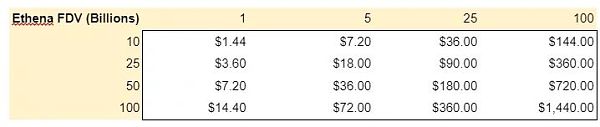

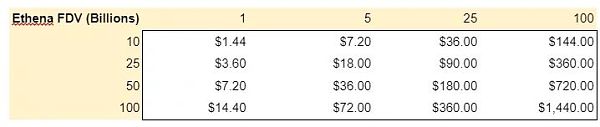

Using these multiples as a guide, I created the following potential Ethena FDV.

The horizontal axis is USDe supply in billions. The vertical axis is FDV/Rev magnification.

Ondo is the newest and most popular stablecoin. It has an FDV of about $6 billion, revenue of just $9 million, and a trading multiple of 630x. Woowzers! Can Ethena's valuation reach similar heights?

Ethena's $820 million in assets generated a 67% return this week. Based on a 50% USD/EUR supply ratio, Ethena’s annual revenue is approximately US$300 million per year. Using a valuation similar to Ondo's, the FDV is $189 billion. Does this mean Ethena’s FDV at launch will be closer to $200 billion? No, but it does mean that the market will pay a huge amount of money for Ethena's future revenue.

Yachtzee!

Story

If you remember nothing else from this article, remember this:

Ethena is For Us, By Us, Also known as FUBU.

Tether is For Us, By Them, also known as FUBAR.

It's up to you whether to go long or short USDe or the eventual Ethena governance token. I hope this article illustrates Ethena’s mission and why it is critical to the success of cryptocurrencies.

Xu Lin

Xu Lin