Author: flowie, ChainCatcher

As of August 14, Polymarket has placed over $600 million in bets on predictions related to the U.S. election.

This massive bet has attracted the attention of U.S. regulators, and the U.S. CFTC approved a proposal in May: event contracts that intend to ban bets on political events.

On August 5, several U.S. senators and House representatives once again urged the CFTC to quickly finalize and implement this regulation to prevent the U.S. election from being commoditized.

Crypto giants Gemini, Crypto.com, Robinhood, Coinbase and other companies collectively rebelled against the CFTC this time, believing that the latter had no right to regulate the prediction market.

Behind the game between the two sides, it may be the crypto giants' favor for the online prediction market.

Currently, the total transaction volume of the crypto prediction market is about $2 billion, but there is a bigger market behind it. The global online gambling market is expected to grow from $60.63 billion in 2023 to $103.74 billion in 2028.

The feud between the prediction market and the CFTC

In 2022, Polymarket was sued by the CFTC, withdrew from the US market, and paid $1.4 million to reach a settlement.

The CFTC believes that Polymarket provides over-the-counter binary options contracts, but failed to obtain registration as a designated contract market (DCM) and a swap execution facility (SEF) in the Commodity Exchange Act (CEA).

Binary options are speculations on the changes in the price and exercise price of the underlying asset after a certain trading period, and are divided into call options or put options.

Shao Shiwei, a lawyer at Mankiw Law Firm, once wrote that, in essence, the crypto prediction market platform does provide a binary option product. Users have two options for the results of the predicted event, "yes" or "no", and this option is the option product obtained by the user.

Under the regulatory environment of the United States, over-the-counter binary options are completely prohibited, and only two major exchanges, the North American Derivatives Exchange (Nadex) and the Cantor Exchange, are allowed to provide legal binary options transactions. In addition, the United States stipulates that brokers can only choose to cooperate with payment service providers in the United States to supervise the whereabouts of funds.

The CFTC has repeatedly punished prediction platforms that provide over-the-counter binary options.

In 2012, which was also the year of the US presidential election, InTrade, an Irish economic and political gambling website founded in 1999, was the most cited gambling website in the election event. The New York Times cited Intrade's data as many as 68 times in one year.

InTrade, which gained "huge wealth" through the US election, soon ushered in a "catastrophe". At the end of 2012, InTrade was sued by the CFTC as an illegal market and was forced to shut down its business in the United States.

A year after losing the US market, InTrade announced bankruptcy and liquidation due to a shortage of $700,000 in funds.

Founded in 2013, the crypto prediction market platform PredictIt received a special exemption from the CFTC in 2014. But the condition is that this is a non-profit research in cooperation with Victoria University of Wellington, New Zealand, and the maximum investment amount in any single contract is $850. The limit on the investment amount also leads to limited trading volume.

In August 2022, the CFTC revoked the special exemption and required PredictIt to cease operations. In the end, PredictIt chose to sue the CFTC.

Founded in 2018, Kalshi, a prediction platform led by Sequoia Capital, was also banned by the CFTC from listing prediction contracts related to the US election in September last year.

Earlier this year, Kalshi and its CEO Tarek Mansour filed a complaint with the CFTC, claiming that the CFTC violated the Administrative Procedure Act and that the contract was not within the CFTC's regulatory scope.

Kalshi believes that such contracts are a classic way to hedge risks, and Kalshi asked the court to revoke the CFTC's ruling that Kalshi engaged in illegal gambling activities "against the public interest."

Regarding binary options products, lawyer Shao Shiwei said that it is not just the United States. Although most countries or regions in the world have not made a clear definition of binary options products, their regulatory attitudes are very strict and prudent.

For example, China has defined binary options as illegal financial products. The Supreme People's Court's Guiding Case No. 146, "Chen Qinghao and others suspected of opening a casino," clearly defined the operation of a binary options website as opening a casino.

The British government classifies binary options as financial instruments, and operating binary options products in the UK requires FCA authorization.

Challenging the CFTC's regulatory power

Earlier this year, after the prediction platform Kalshi sued the CFTC, it received support from Paradigm, a venture capital firm that is optimistic about the prediction market.

Paradigm believes that prediction market contracts can help companies, including crypto startups, hedge risks and have a positive spillover effect on the public.

Paradigm also said that the prediction platform may become an important killer application in the encryption field. According to 1kx analyst mikey, the total transaction volume of the encryption prediction market is currently about US$2 billion.

However, there is a bigger market behind it. According to Mordorintelligence data, the size of the online gambling market is expected to grow from US$60.63 billion in 2023 to US$103.74 billion in 2028.

In the face of huge market opportunities, crypto giants who are trying to get involved in this field openly challenge the CFTC.

Open opponents also include crypto institutions such as Gemini, Crypto.com, Robinhood, Coinbase, and investment institutions such as Dragonfly.

There are two main reasons: First, the impact of political event prediction contracts on elections is positive, and the CFTC should not choose to stifle the rights of American citizens to access these powerful markets; second, the US CFTC has no power to regulate.

Jessica Furr and Bryan Edelman, two legal counsels of crypto venture capital Dragonfly, wrote in a letter to the CFTC: "Political event contracts should not be equated with gambling games such as the Super Bowl. On the contrary, elections have significant economic impacts. These contracts are designed to play a key risk hedging function, comply with the requirements of the Commodity Exchange Act (CEA), and provide valuable forecasting data to the public."

Dragonfly participated in Polymarket's $45 million Series B financing in May this year.

Gemini founder Winklevoss believes that unlike opinion polls, experts or expert opinions, prediction markets require participants to do what they say - interests are at stake, "decentralized prediction markets are major innovations with real public utility."

Coinbase Chief Legal Counsel Paul Grewal said: "The proposal fails to recognize the public interest of the prediction market."

For stakeholders in the prediction platform, after the prediction market has been severely hit by the CFTC many times in the past, there is still the confidence to openly oppose the US CFTC this time. An important point may be that a 40-year-old Chevron Rule (Chevron Respect Rule) was overturned by the US Supreme Court at the end of June.

The Chevron Rule once allowed federal agencies to enforce regulations based on their own interpretation of sometimes vague laws. With its overturn, the authority of agencies such as the CFTC will be weakened.

Dragonfly's legal affairs also mentioned that after the US Supreme Court overturned the Chevron Rule, the CFTC must ensure that it has the power to regulate these contracts.

Coinbase said this time that the definition of gambling proposed by the CFTC was too vague. Steve Humenik, senior vice president of Crypto.com, said that the CFTC "is neither a gambling regulator nor an election regulator, and is not qualified to regulate this market."

The overturning of the Chevron Rule has brought considerable challenges to the CFTC's regulatory authority.

Polymarket's long-term and short-term concerns

According to data from Similarweb, before reaching a settlement with the CFTC, the United States' traffic share was between 34% and 54%.

After settling with the CFTC in 2022, Polymarket has announced its withdrawal from the United States. However, 25% of visitors to the Polymarket website are still from the United States.

In a recent article exposing Polymarket, Forbes said that Polymarket founder Coplan did not comment on its platform's geo-blocking measures.

Due to the surge in trading volume due to the US election and the Olympic Games this year, Polymarket's cumulative trading volume has exceeded US$1 billion. Among them, the trading volume from July 1 to 30 exceeded US$300 million.

The vast majority of trading volume on Polymarket comes from the US election, and the predicted bonus pool for the winner of the 2024 US presidential election has even reached US$600 million.

Similar to InTrade, a political and economic gambling website that became popular in the 2012 election year, Polymarket has also become a source of citation for many professional media such as Bloomberg due to its election predictions.

It is hard to say that the US CFTC's plan to promote the prohibition rules for contracts such as election predictions is not aimed at Polymarket.

Except for the United States, Polymarket essentially provides binary options products, which are strictly regulated in most parts of the world.

In addition to regulatory issues, Polymarket is also facing the question of whether the popularity is sustainable and the pressure from competitors.

Polymarket currently only has a certain amount of traffic in short-term topics that the crypto industry is more concerned about, such as the US election.

Although Polymarket's non-election market trading volume continues to grow, it still has low attention. With the end of the US election at the end of the year in 2024, how will the trading volume on Polymarket be maintained in the future?

Bhargava of General Catalyst, a Polymarket supporter, is not worried. He believes that in addition to the election, there are always major events happening, and this may be even more so in an increasingly turbulent world.

Polymarket has also recently been improving the platform's content generation capabilities and coverage by expanding channels and improving prediction accuracy.

On July 30, Polymarket's prediction market was embedded in Substack, a well-known content subscription payment platform. On August 13, Polymarket announced a partnership with AI-driven search engine Perplexity to provide users with news summaries of real-time events.

As for competitors, Web3 data platform RootData has included more than 50 crypto prediction market projects.

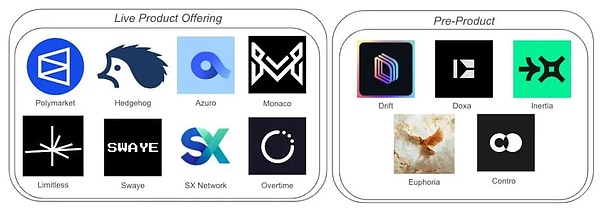

According to data analysis by 1kx analyst mikey, if the sports market is included, the transaction volume of Azuro and SX Network is closer to Polymarket from the overall transaction volume since the beginning of the year.

Some potential competitors are emerging, such as Limitless Exchange running on EVM, Hedgehog Markets of Solana ecosystem, and Drift Exchange, xMarkets, Inertia Social, Doxa, Contro and other prediction platforms that are still under development.

Image source: 1kx analyst mikey

Recently, MetaDAO, a Solana ecological governance project that can be used to predict the market, has also received investment from Paradigm.

Opponents in the traditional financial field cannot be ignored. In April, billionaire Jeff Yass's trading company Susquehanna International established an independent department to try to establish a market on Polymarket's competitor Kalshi.

Huang Bo

Huang Bo

Huang Bo

Huang Bo Cheng Yuan

Cheng Yuan JinseFinance

JinseFinance 铭文老幺

铭文老幺 Huang Bo

Huang Bo Alex

Alex Coinlive

Coinlive  Beincrypto

Beincrypto Coindesk

Coindesk Cointelegraph

Cointelegraph