Author: Felix Ng Source: cointelegraph Translation: Shan Ouba, Golden Finance

One morning in May last year, Synthetix founder Kain Warwick suddenly realized: "Something went wrong. We used the wrong method."

After launching Synthetix Perps v2 at the end of 2022, Synthetix founder Kain Warwick expected this new decentralized perpetual contract exchange to be able to get a piece of the derivatives market dominated by Binance.

Six months later, Warwick woke up in the morning and realized that this would not happen, for two reasons: 1) Most traders are still reluctant to use decentralized finance (DeFi), and 2) The slogan of "build it and they will come" is extremely stupid.

“If you do things the same way and expect different results—that’s crazy. That’s the definition of crazy. So my view was, we need to change that,” Warwick recalled.

Synthetix Perps v2 launched a few days before Christmas 2022, aiming to compete with centralized perpetual swap platforms. It introduced a “first-of-its-kind” off-chain oracle system that minimized the risk of front-running attacks and significantly reduced trading fees. The exchange also touted deep liquidity, one of the bigger friction points facing DeFi.

“Volume was great, execution was great, people were getting great prices,” Warwick said, but “the ratio of volume between Binance and DeFi perpetual swaps was still 95 to 5.”

One morning in May, I woke up and was like, what the hell is going on?

That thinking eventually led to his latest crypto project, Infinex, a front-end wrapper that he hopes will mask the clunky nature of DeFi while offering all the benefits of self-custody and control.

Warwick hopes this new user-friendly layer will encourage more traders to move away from centralized exchanges and platforms, which have had a bad year in 2022.

“The history of crypto is full of examples of people losing crypto because they used someone else’s platform,” Warwick told the magazine.

The premise behind Infinex is simple: replicate the easy-to-use centralized exchange experience, but with DeFi as its backbone, like Synthetix Perps v3. Traders can get rid of clunky transaction signing and wallet setup, with just a username and password.

The idea is to give traders the benefits of DeFi and the convenience of centralized exchanges while avoiding any of the drawbacks, such as funds being “misappropriated” by “a really bad CEO.” But as Warwick points out, even users who were badly screwed by FTX haven’t jumped on the DeFi bandwagon.

The reality is that the vast majority of users are returning directly from FTX to Binance

Infinex is not yet open for public trading.

When initially announced, Infinex was expected to launch in the fourth quarter of 2023, but only a closed alpha version was released by the holiday season.

In March of this year, Infinex suddenly announced that it had “suffered a security incident,” but no users, vaults, or working group funds were at risk. Moments later, Warwick announced that he had taken over as head of Infinex’s working group.

Infinex is currently expected to launch sometime around ETHGlobal on May 2.

Warwick admitted that he was mistaken in thinking that simply building a robust decentralized trading platform with low fees would be enough to attract a large number of new traders.

“We took a very pure technocratic view: ‘We’re going to build it the right way and the world will eventually realize it’s right. We’re not wrong, the market is.’ ”

“The reality is, the market isn’t wrong; in a very real sense, it can’t be wrong,” Warwick said.

The success of the Synthetix founder’s career has been his ability to spot when things aren’t going as planned and pivot to Plan B — or even Plan C.

Geneticist ranks among B-list punk rockers

Warwick might now be known as the “father of modern farming” — a reference to his role in laying the groundwork for popularizing yield farming, leading to 2020’s DeFi summer — but it took him several major life transitions to get to that title.

Now 42, the son of Australian tennis champion Kim Warwick, he is the eldest of three younger brothers, all of whom have followed him into the crypto and Web3 space.

At 14, he made his first foray into entrepreneurship, opening a tennis racket restringing business at his parents’ tennis center.

“For a 14-year-old, it was pretty successful; I would say I was making a lot of money.”

By 16, he was helping people solve technical problems to earn extra income.

“I had this paradox of ‘love tech, love computers’ and I was building computers,” he said. “I would help people set up their networks and the WiFi that was then.”

The high school science buff dreamed of becoming a geneticist after graduation, studying genetics at the University of New South Wales.

“You know, genetics really fascinated me… science was probably my best subject in school. I always loved science,” Warwick said.

But he soon realised genetics wasn’t for him and dropped out after 18 months to join a friend’s tech start-up in Seattle. When that business didn’t work out a year later, he and a friend started a punk rock band.

The guitarist and lead singer dressed in Victorian garb for The Lie Society, a punk rock band that eventually built a decent local following.

The biggest venue we play probably seats about 1,000. So, you know, we're not going to play stadiums by any means, but we're going to do some national tours. ”

“We’ve just gotten to the point where, I think, if we really focus on it and pull it off, we might do a little bit better,” he added.

But Warwick eventually moved back to Australia and pursued a career in retail.

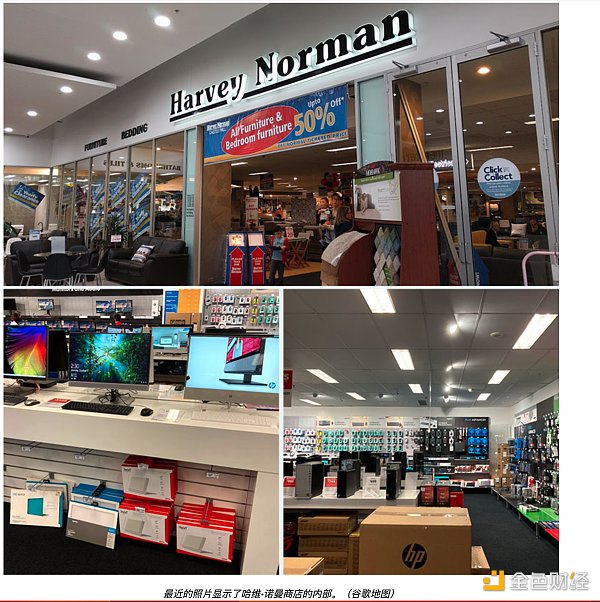

Try mining bitcoin at Harvey Norman

“My first exposure to cryptocurrency was a Slashdot post, a very famous Slashdot post,” Warwick said.

At the time, around 2010 or 2011, he was working for Harvey Norman, an Australian electronics retailer that sold computers, furniture, washing machines, fridges and other household goods – definitely not your idea of an origin story for a cryptocurrency entrepreneur.

This article, which detailed an early upgrade to Bitcoin, ended up on the front page of Slashdot. It was seen as one of the first articles to alert the wider tech community to Bitcoin.

“I had been on Slashdot for years by then, and that was the post that launched Mt. Gox,” Warwick said.

Warwick even tried to install bitcoin mining software on a row of display computers in his store to take advantage of the free electricity.

“We had an IT guy at Harvey Norman who was a very active guy [...], and one day in 2011 I walked into Harvey Norman and said, ‘We should run Bitcoin mining on this thing (display PC). .’”

He ultimately failed to get the IT guy to change his mind, something they’re probably kicking themselves for today after Bitcoin hit nearly $74,000 in March.

By 2015, Warwick was deep into Bitcoin. He started his own online retail payments company, Blueshyft, which allowed customers to pay cash over the counter for digital goods and services, including Bitcoin. The service is still up and running today.

I still have this BTC-maxi mentality of “Bitcoin is the most valuable thing here,” and I don’t really care about anything else. Like, I think Ripple is a scam. ”

But more than a year later, Warwick had a change of heart. While on paternity leave after the birth of his daughter, he got bored and started delving into a “rabbit hole” of “old Vitalik posts” about Ethereum possibilities — prediction markets, stablecoins, and Maker.

That’s when I thought, ‘Wow, this is something in Ethereum that everyone thinks is possible, and that’s Maker.’”

Warwick ultimately borrowed Maker’s core stablecoin idea and launched the Havven initial coin offering in 2018, which became Australia’s largest ICO, raising $30 million. It sold out in just 90 minutes, thanks to help from early pre-sale investors.

The band failed to gain traction in the trough of the bear market that year, and the market responded again. He transformed Havven into Synthetix, which retained the idea of a collateralized minted stablecoin (SUSD) but added the concept of synthetic assets.

Living up to his nickname

Synthetix is a decentralized network built on Ethereum (now Optimism and Base) for issuing and trading synthetic assets (or "synths") that track the value of real-world assets. The platform’s Synthetix Network Token (SNX) is used to collateralize and issue synthetic assets, and SNX holders are incentivized to stake as much as possible by receiving a portion of synthetic transaction fees and extremely high inflation rewards. Liquidity provided on Uniswap and Curve is also rewarded, which became the catalyst for the “DeFi summer” of 2020 driven by degen food farms. Still, Warwick is not so sure he deserves all the recognition.

“It’s all inextricably linked,” he said.

“Like, even back then, you had what they called transaction mining. That was another early form of liquidity mining — centralized exchanges were basically issuing their own tokens through wash trading, which was not that different from liquidity mining.”

Compound’s COMP token is also credited with sparking the liquidity mining craze.

“So, you know, my point is, these things always start something. It’s just that it was the first one that really worked, and it locked things in and gained momentum, so people remember it.”

Habitual Scams

When asked if he took any responsibility for the rug pulls, Ponzi schemes and outright scams that followed, Warwick said it was an ugly but necessary part of innovation.

“Overinvestment is a cost we have to bear as a society. When you overinvest in something, you get scammed. However, the alternative is underinvestment, and if you underinvest, you don’t have any innovation.”

Similarly, Warwick argued, the ICO boom was a “net positive” for cryptocurrencies, even if there were a large number of ICO “pump and dump” scams.

“If you look at all the big projects that have come out of そこから (soko kara -そこから literally means "from there" but here it can be translated as "out of that"), I think the hit rate of ICOs is better than traditional venture capital. Yes, of course, there are scams and things that go to zero, or stupid things and things like that. That’s a symptom of overinvestment,” Warwick said.

“But then again, the alternative is underinvestment, and underinvestment will kill you as a society. You need to overinvest in innovation, not underinvest.”

JinseFinance

JinseFinance

JinseFinance

JinseFinance Weiliang

Weiliang Cointelegraph

Cointelegraph