Indonesia đóng cửa Temu để bảo vệ doanh nghiệp địa phương

Indonesia đã kiên quyết từ chối sự gia nhập của nền tảng thương mại điện tử Temu, với lý do lo ngại nó có thể gây hại cho các doanh nghiệp siêu nhỏ, nhỏ và vừa (MSME) của nước này.

XingChi

XingChi

Source: Gryphsis Academy

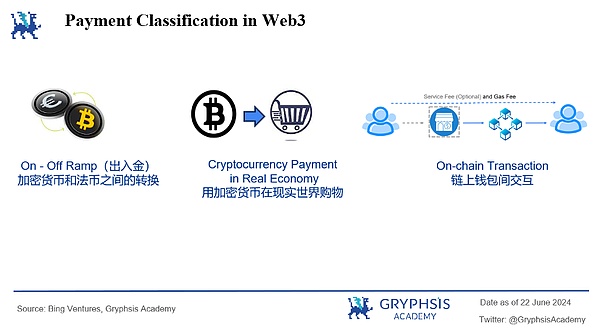

Payment is a key scenario in the cryptocurrency ecosystem, with tens of thousands of cryptocurrency payments occurring on and off the chain every day. A new cryptocurrency usually increases in value due to its actual payment use, and payment has become an important bridge connecting the Web2 world and the Web3 world.

In the Web3 payment business, some people make a fortune by providing payment channels, while others focus on building safer wallet technology. So, how exactly are funds transferred in the Web3 world? This article will take you deep into the various business scenarios and projects in the Web3 payment industry.

Last August, Paypal announced the launch of the stablecoin "Paypal USD" pegged to the US dollar for transfers, payments and other businesses; in April this year, the financial infrastructure platform Stripe said that stablecoin payments will be integrated into its payment suite within a few weeks and will start supporting USDC payments this summer; in June, Mastercard announced the first launch of the infrastructure function of peer-to-peer transactions, Mastercard Crypto Credential, so that Latin American and European users can realize cross-currency cross-border payments on the blockchain. In the past two years, giants in the traditional payment industry have entered the Web3 payment industry in a high-profile manner. Why is that?

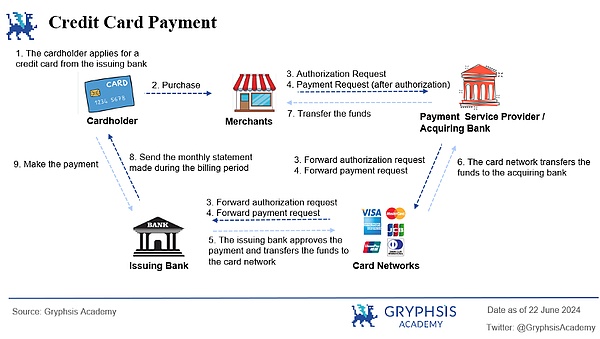

Before revealing the reason, let's first understand what payment is. The essence of payment is the flow and transfer of funds. In the traditional payment industry, users complete the flow of funds through cash payment, card/bank transfer payment, and third-party payment. The completion of a cross-border payment usually requires the support of multiple participants. We take the payment link of bank cards as an example to briefly introduce the participants and the cross-border payment process.

Cardholder (user/buyer): The user selects goods/services at the merchant and initiates payment.

Merchant: The merchant needs to access the payment gateway of the payment service provider and receive and process payments through the integrated payment gateway.

Payment service provider: Provides services such as payment gateway and payment processing. The payment information entered by the user sends a payment request through the payment gateway. Some payment service providers also provide acquiring services.

Acquirer: A bank or financial institution that cooperates with merchants. Acquirers receive payment requests and forward them to card schemes. They are also responsible for handling the clearing and settlement of transactions after authorization.

Card schemes (such as MasterCard, VISA): Global networks that process payment card transactions. Card schemes receive payment requests from acquirers, send authorization requests to issuing banks, and forward authorization responses back to the acquirers to ensure that the transaction requests are approved by the issuing banks.

Issuing banks:Issuing banks receive authorization and payment requests from card schemes, first verify user identity and account status, authorize or reject transactions, and disburse funds after successful authorization.

Settlement:The final stage of the payment process, involving the transfer of funds from the user's account to the merchant's account. Settlement is usually coordinated by acquirers and issuing banks, and the actual transfer of funds may be carried out through an interbank clearing network.

The above payment process shows the clear division of responsibilities and high maturity of traditional cross-border payments, as well as the advantages of high acceptance, relative security and large-scale transactions. However, traditional cross-border payments also have some limitations:

Long payment processing time: Due to the involvement of multiple parties, cross-border payments processed by international card organizations usually take at least T+1 day to complete, that is, at least T+1 day to reach the merchant account, and the immediacy of delivery is relatively weak

Multi-level fee structure: Due to the many parties involved in a transaction, there is a multi-level fee structure. For example, a credit card payment acquirer, bank, and card organization will charge different fees

Limited transparency and time-consuming tracing: If a bank card is stolen, it usually takes several working days to trace and query the transaction.

Dependence on traditional banks: slow technological development, the traditional banking system is not good enough in dealing with emerging payment needs

It is these limitations that have prompted technological innovation and led us into a new era of Web3 payment links.

Today, when traditional payment is relatively well developed, why are giants gradually starting to focus on Web3?

1.2.1 Considerable industry profits

Mastercard's net profit in 2023 was US$11.2 billion (about 33,400 people), while Tether, which issues stablecoin USDT in the crypto industry, had a net profit of US$6.2 billion in 2023, and the company had only about 100 employees as of last year. In contrast, the wealth created per employee is much higher than that of the traditional payment industry, and so is the return.

1.2.2 Fierce competition and high operating costs in traditional payment businesses drive the discovery of new businesses

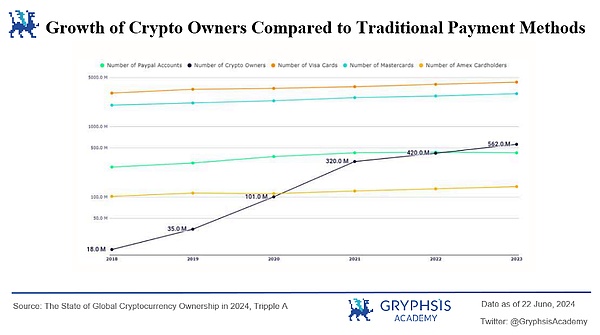

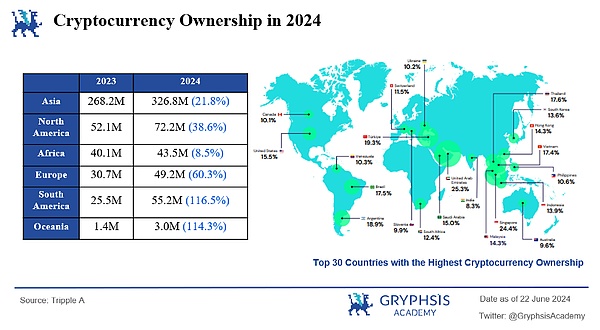

We can see from the figure that from 2018 to 2023, the compound annual growth rate of cryptocurrency ownership reached 99%, far exceeding the 8% growth rate of traditional payment methods. During the same period, the growth rate of cryptocurrency ownership exceeded that of several US payment giants.

In 2022, Paypal, facing fierce industry competition and relatively high operating costs (operating costs accounted for 70.8% of gross profit in 2022), also began to focus on cryptocurrency business. The importance of cryptocurrency business in PayPal's overall revenue is gradually increasing.

In one year, cryptocurrency-related operating expenses increased from US$800 million to US$1.2 billion, an increase of 50%, and cryptocurrency-related net profit increased from US$700 million to US$1.1 billion, an increase of 57%. The increase in new business operating expenses related to cryptocurrencies reflects PayPal's continued investment and confidence in this field, including technology upgrades, security measures, and market expansion.

The significant increase in its net profit not only shows the profitability of cryptocurrencies, but also proves PayPal's effective operating strategy in the cryptocurrency market and its optimistic outlook on the future growth potential of cryptocurrencies. Therefore, Paypal has the motivation to continue to explore new industry opportunities.

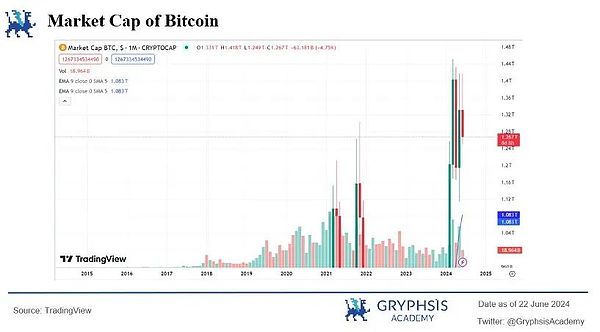

1.2.3 BTC halving and BTC ETF compliance have brought more recognition and payment demand to the crypto industry

BTC halving and BTC ETF compliance have brought more recognition and payment demand to the crypto industry. The Bitcoin halving event has attracted widespread market attention by reducing the speed of generating new Bitcoins, increasing its scarcity and value growth expectations. The launch of the Bitcoin exchange-traded fund provides traditional investors with a low-threshold and convenient investment channel, enhancing market confidence. The expected landing of the Ethereum exchange-traded fund has further sparked interest in the Ethereum ecosystem and innovative applications. These factors have jointly promoted more people to understand and participate in Web3 payments.

In addition, the increase in the demand for deposits and withdrawals has also driven the demand for conversion services between fiat currencies and cryptocurrencies (deposit and withdrawal is the conversion between fiat currencies and cryptocurrencies). The channels for providing these services include centralized exchanges, independent deposit and withdrawal payment institutions, cryptocurrency ATMs, and POS machines that support cryptocurrency payments. Through these channels, users can easily convert between fiat currencies and cryptocurrencies, thereby promoting the widespread application and popularity of cryptocurrencies.

1.2.4 Advantages of blockchain-based payments and the need for payment diversity

Microsoft began accepting Bitcoin as payment for its online Xbox store in 2014; Twitch, a leading game streaming platform owned by Amazon, accepts Bitcoin and Bitcoin Cash as payment for its services; Shopify, as a leading overseas e-commerce platform, supports Bitcoin payments by integrating with payment processors such as BitPay. The fact that leading companies in different industries support cryptocurrency payments shows that Web3 payments are bringing more possibilities.

Reduce exchange rate risk

Cross-border e-commerce often involves transactions between multiple currencies, which has a certain risk of exchange rate fluctuations. Shopping with cryptocurrency as the unit can reduce this risk because cryptocurrency does not involve exchange losses between different currencies.

Reduce transaction costs

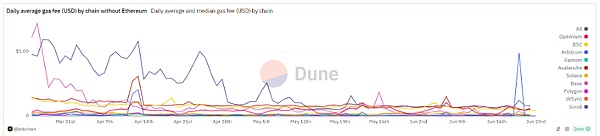

Traditional cross-border payments are usually accompanied by high transaction fees and the involvement of layers of institutions. In contrast, cryptocurrency transaction fees are usually cheaper because they eliminate the intermediary links of banks or other financial institutions. If it is an on-chain payment, only a network fee needs to be paid, which is usually relatively low. If the transaction is obtained through a payment service provider (such as Coinbase, BitPay), there is a fee. Compared with the layers of traditional payment institutions, this means that cross-border e-commerce with large transaction volumes can effectively reduce fees. For example, cross-border payments made using traditional methods may incur a fee of 3-5%, while this ratio can be reduced to less than 1% through cryptocurrency payments. Since the transaction fee of the Ethereum mainnet is relatively expensive, it has also inspired more public chains to achieve cheaper network fees through technological innovation. As shown in the figure below, since the network fee of the transaction has nothing to do with the amount, but is related to the degree of network congestion, for some large cross-border on-chain payments, only less than $0.5 in handling fees is required, which greatly reduces the payment cost of handling fees.

Source: dune @bnbchain

Enhance payment security

The decentralized and distributed ledger characteristics of blockchain technology make each transaction public and transparent, and once recorded, it cannot be changed. This reduces the possibility of fraud and hacker attacks. Due to the transparency of blockchain, merchants and consumers have increased their trust in transactions. Consumers know that their payment information is safe, while merchants reduce the possibility of fraud and chargebacks.

Opening the global market

Using cryptocurrency for payment is not restricted by the international banking system, and transactions can be completed quickly; at the same time, cryptocurrency transactions (7 * 24) are not affected by holidays and working hours. For consumers in many countries and regions, they may not be able to use traditional payment methods from cross-border e-commerce platforms, but they can use cryptocurrency instead.

1.2.5 Tax avoidance needs

Both companies and individual investors in the cryptocurrency industry will be attracted by tax incentives. For example, Portugal does not tax personal cryptocurrency gains; Singapore does not impose capital gains tax on cryptocurrencies; Bermuda has attracted token issuers, cryptocurrency custody service providers and blockchain R&D companies with its safe and transparent regulatory environment and the Digital Asset Business Act, becoming an important hub for digital assets and innovative technologies.

In addition, since 2019, the Bermuda government has announced that it can accept USDC to pay taxes, public utilities and other administrative service fees. In addition, based on the decentralized network system, Web3 transactions themselves will bypass many centralized institutions and banks and avoid conventional tax processes. Therefore, some digital asset companies will also issue bonuses in the form of stablecoins.

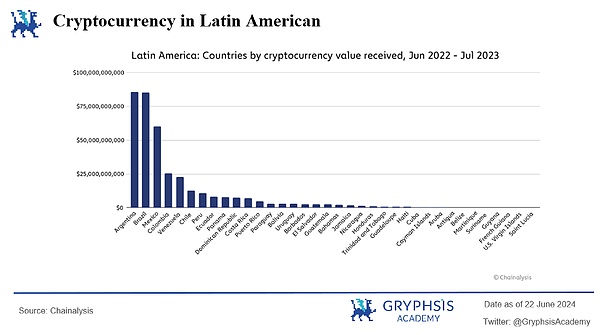

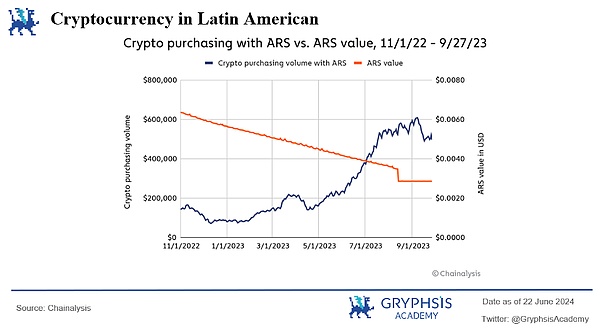

1.2.6 Demand for safe-haven funds caused by depreciation of local currency

For decades, Argentina has been facing economic difficulties. The cyclical extreme depreciation of the currency has damaged the savings capacity of residents and made daily financial activities difficult. Therefore, Argentina is also the most active place for cryptocurrencies in Latin America. In 2023, Argentina's inflation rate reached 211.4%. According to Chainalysis data, about 10.9%, or about 5 million people (with a total population of 45.8 million), use cryptocurrencies for daily life payments in Argentina.

In order to prevent the depreciation of the peso, Argentines will immediately convert their peso-denominated salaries into USDT or USDC. Almost everyone knows the exchange rate between the US dollar and the peso. Similarly, Turkey is one of the places where cryptocurrency is developing rapidly. Therefore, where laws and regulations allow, places where there is a demand for depreciation will be places where cryptocurrency becomes a "hard currency" and it is easier to develop cryptocurrency-related payment businesses.

1.2.7 Ways to achieve political needs

For the United States, cryptocurrency is a powerful tool for canvassing votes in the general election. In this US election, Trump loudly promoted his friendly attitude towards cryptocurrency and criticized the Biden administration for its hostile attitude towards cryptocurrency. Trump encouraged his supporters to make cryptocurrency donations through Coinbase Commerce, and a series of Trump-themed meme coins became popular for a time. Before the election debate at the end of June, related concept meme coins also had obvious changes.

For Venezuela, cryptocurrency is a weapon against authoritarianism. During the 2020 COVID-19 pandemic, the interim government led by Guaido decided to use cryptocurrency to provide direct assistance to the country's doctors and nurses. The reason is that the corruption of the Maduro regime and its control over banks make it difficult for international aid to be provided in normal ways. The program directly helped 65,000 doctors and nurses, at a time when the average doctor's salary was $5 per month. Each person who used cryptocurrency to pay for assistance received $100. As a result, decentralized crypto payment methods effectively supported the local democratic movement.

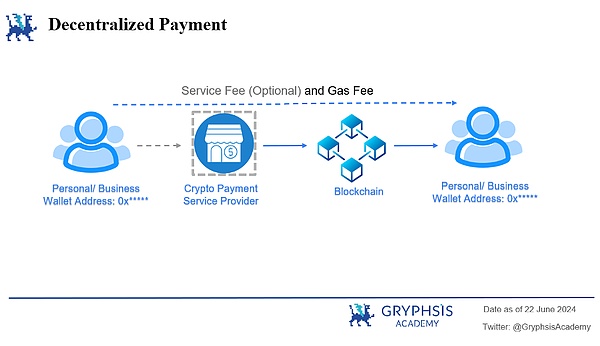

Web3 payment is based on blockchain technology. As long as the other party's "wallet address" is available, cryptocurrencies can be transferred on the blockchain network, and can be viewed and traced instantly, realizing decentralized peer-to-peer payment. This implementation path solves the problems of low transparency, long transaction arrival time, and high cost of multi-layer institution intervention in traditional payment.

With the passage of BTC ETF, BTC halving and the expected landing of ETH ETF, more and more countries are bringing cryptocurrency payments into the scope of supervision, and more personal and institutional funds are pouring into the crypto market. As of June 23, the BTC market size has reached $1.27 T, while Ethereum has reached $15.2 B.

According to Tripple A's report, by 2024, the global penetration rate of cryptocurrency will be 6.9%, and about 560 million people worldwide will own cryptocurrency, an increase of 33% from 420 million last year. Among them, Asia is the continent with the most cryptocurrency, South America and Oceania are the fastest growing places (116.5%), and Dubai's population penetration rate is 25.3%, the country with the highest proportion of cryptocurrency owners, combined with the local financial free zone, personal income tax and capital gains tax exemption advantages, which also explains why Dubai has become the headquarters of many exchanges and crypto companies in the past two years.

Therefore, whether it is the region with the highest population share or the region with the fastest population growth, the relaxation of policies and the need for real transactions will give crypto payments a good opportunity to explore and develop.

From the enterprise perspective, well-known brands in the real economy such as Starbucks, Coca-Cola, Tesla and Amazon have embraced cryptocurrencies as early as in the traditional field, and the market adoption rate and consumer familiarity of cryptocurrencies in the mainstream market have gradually increased. This year, more traditional companies have begun to accept cryptocurrencies and expand their payment methods. Ferrari has now partnered with Bitpay to accept payments in Bitcoin, Ethereum and USDC in the United States, and plans to expand this option to Europe and other regions in early 2024. In Singapore, Grab users can now use Bitcoin, Ethereum, Singapore dollar stablecoins, USDC and USDT to order rides and takeout in their daily lives. Therefore, when industry giants on the B side begin to adopt crypto payments, this is not only a recognition of the crypto industry itself, but also opens a door to cryptocurrency payments for C-side users with the credit endorsement of the B-side enterprises themselves.

From the user perspective, in 2021, Binance, the world's largest cryptocurrency exchange, had only 3 million registered users. However, by June 2024, Binance's registered users had surged to 200 million, with a daily trading volume of $189 billion. This significant growth proves that more and more people are joining the ranks of cryptocurrency users, and crypto payments are gradually becoming a vast blue ocean.

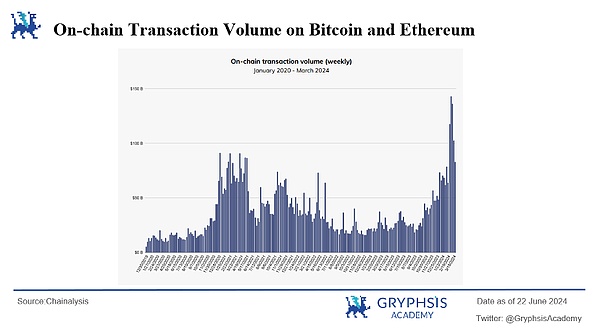

From the on-chain data, from January 2020 to March 2024, the on-chain transaction volume and transaction activity continued to grow. Driven by a series of favorable events, these indicators have repeatedly broken through historical highs and are about to break through the $150 billion mark.

In the Web3 field, many project parties and exchanges have seen the upward trend of the industry and the huge opportunities for encrypted payments. They have accelerated the application of payment licenses in various regions, expanded card issuance business and other businesses that link Web3 payments with the real economy, and accelerated the construction of exchanges and on-chain wallet settings.

Recently, Coinbase announced the launch of a self-hosted wallet platform that integrates asset and identity management, purchase, send, exchange, NFT, and transaction history, providing its users with a more convenient way to trade on the chain. This not only provides more convenience for Coinbase's user base, but also becomes an important part of the Onchain Summer event, further promoting the development of Web3 payments.

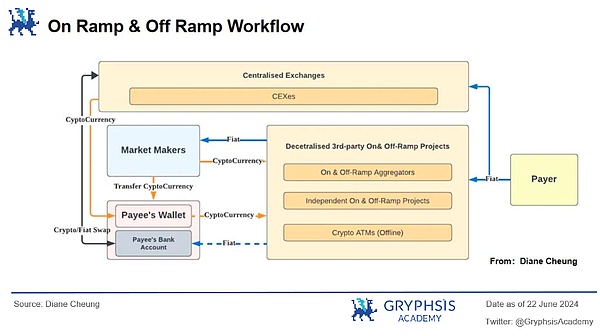

3.1.1 Deposit

Definition:

Refers to the process of converting legal currency (such as US dollars, euros, etc.) into cryptocurrency. This process is equivalent to the entrance to the cryptocurrency economy. The payer transfers fiat currency through a centralized exchange or a third-party decentralized deposit and withdrawal platform. The centralized exchange can directly convert it into cryptocurrency and transfer it to the on-chain wallet; the third-party decentralized deposit and withdrawal platform converts cryptocurrency through market makers. After receiving the fiat currency, the market maker will transfer the equivalent cryptocurrency to the payer's on-chain wallet.

The market makers here are usually crypto-friendly banks (such as the bankrupt Silvergate Bank, Silicon Valley Bank, and Signature Bank). After the bank collapsed, more stablecoin issuers (Tether, Circle) and payment service providers (BCB Group) assumed the role of liquidity providers.

Deposit methods:

Centralized exchanges: Users can create an account after completing KYC on a centralized exchange and use bank accounts, credit cards or e-wallets to purchase cryptocurrencies with fiat currency

Peer-to-peer platforms: These platforms directly connect buyers and sellers to realize the exchange of fiat currency and cryptocurrency. Trades typically involve a third party holding the funds until the buyer and seller complete an agreed-to action

Over-the-Counter Trading Desks: OTC desks facilitate large cryptocurrency transactions directly between buyers and sellers. This is usually used by institutional investors or high net worth individuals

Decentralized cryptocurrency wallets: The most common type of cryptocurrency wallet is a self-hosted wallet, where users have full control over their cryptocurrency because there is no third party involved

Subjects involved in deposits:

Centralized exchanges, third-party decentralized deposit and withdrawal platforms, banks, liquidity providers (crypto-friendly banks, stablecoin issuers, payment service providers)

Fee structure:

Payment channel fees: For example, fees charged by credit card issuers, Paypal, Apple Pay, etc.

Exchange rate fees for fiat currencies to cryptocurrencies: USD and USDT are usually not 1 (usually the middlemen who exchange them will make a profit from the difference)

Network fees (gas fees are required to transfer from a self-hosted wallet to another wallet address)

3.1.2 Withdrawal

Definition:

In contrast to deposits, withdrawal refers to the process of converting cryptocurrency back into fiat currency. Users can sell their cryptocurrency holdings, exchange them for traditional currency, and then withdraw them to their bank accounts or other payment methods. This process is equivalent to an exit from the cryptocurrency economy.

Subjects involved in withdrawal:

Centralized exchanges, third-party deposit and withdrawal platforms, banks/card merchants, liquidity providers (crypto-friendly banks, stablecoin issuers, payment service providers)

Withdrawal methods:

Centralized exchanges, peer-to-peer platforms, OTC, crypto wallets

Crypto debit cards (virtual cards, physical cards): Debit cards associated with cryptocurrency wallets or platforms can convert cryptocurrencies into fiat currencies and use them for normal consumption

Fee structure:

Transaction fee: When making a withdrawal, the service provider (exchange or third-party deposit and withdrawal platform) may charge a certain transaction fee

Exchange rate fee for cryptocurrency to legal currency: If the withdrawal involves currency conversion (such as converting US dollars to euros), exchange losses may occur

Bank fee: The bank receiving the funds may charge a fee for the deposited funds.

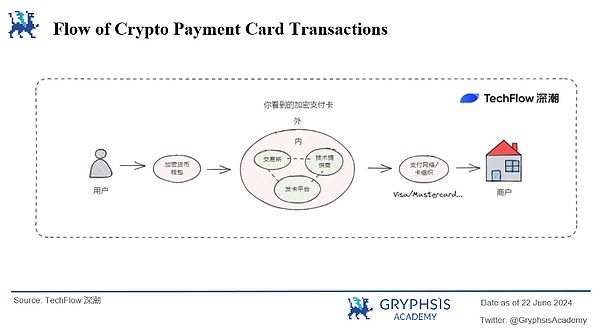

3.2.1 Independent card payment (virtual card/physical card)

Traditional payment card merchants or Web3 native payment card merchants support the consumption of cryptocurrency in the real economy. There are 4 entities to help the issuers' technical service providers, issuers (traditional card merchants, Web3 native issuers), and card organizations.

In the current market environment, the most popular ones are actually crypto prepaid debit cards: there is no need to bind an existing bank account, just convert the cryptocurrency into legal currency in advance and charge it to the card.

Entity 1: Virtual card/physical card technology service provider

Issuing credit and debit cards is the patent of banks in the Web2 world, and there are high technical and qualification thresholds to carry out this business; but in the field of crypto payment cards, this is not the case.

Card issuance technology service providers provide "issuance as a service" solutions. When users see a crypto card with a VISA logo, it is actually a cooperation model between the card issuer and the technology provider. The API of the card issuance technology provider has been integrated with payment networks such as Visa and MasterCard, and has also established cooperative relationships with upstream and downstream industries such as issuing banks to provide users with real-time transaction authorization and fund conversion services.

Card issuers only need to call the API or SaaS solution of the technology provider under the condition of compliance supervision or holding a license to issue and manage crypto credit/debit cards.

* Technology providers often hold licenses in multiple regions and provide services including: necessary security technology, payment processing systems and user interfaces to support crypto card issuance, currency conversion and payment, transaction monitoring and risk control, etc.

Entity 2: Traditional payment card merchants

Visa has partnered with Web3 infrastructure provider Transak to launch cryptocurrency withdrawals and payments through the Visa Direct solution. Users can withdraw cryptocurrencies directly from wallets such as MetaMask to Visa debit cards, and convert cryptocurrencies into legal currencies to pay at 130 million merchants that accept Visa. Therefore, the absolute advantages of traditional payment card vendors in cryptocurrency payment cards are the payment licenses, brand credit endorsement, large user and merchant entrances, and absolute financial strength.

Subject 3: Web3 payment card vendors

Onekey and Dupay, which make hardware wallets, launched virtual cards and physical cards last year, providing mainland users with the possibility of purchasing OpenAI ChatGPT. The business model is mainly to earn card opening fees and transaction fees, and different levels of cards have different limits and fee standards. In addition to Web3 native payment card vendors, major exchanges have also launched business models other than earning fees and card opening fees in combination with their own business forms.

For example, Binance's encrypted payment card consumption can get a certain amount of BNB cash back, similar to the real "cash back", and Crypto.com's encrypted payment card can obtain a certain amount of card opening fee exemption and other payment rights by staking different amounts of platform tokens CRO. Based on its own user traffic and brand endorsement, as well as the natural consumption scenario of post-transaction withdrawal, the exchange attempts to expand more C-end payment scenarios with the card issuance business.

The business logic is that the exchange itself has a payment scenario of post-transaction withdrawal, and compared with traditional payment card vendors, exchange users have lower education costs for using crypto payment cards; from the perspective of use, the user's exchange app borrows the original transaction product matrix and can interact directly with the card, greatly improving the user's experience of switching between different platforms for transfers, recharges, etc.

Entity 4: Card Organization

VISA and Mastercard authorize the network to technology service providers and obtain more profits through cooperation with technology service providers. The more crypto payment card transactions and overseas transactions, the more handling fees they receive, the larger the amount, and the higher the revenue; therefore, they do not need to issue cards themselves, and can earn this "authorization fee" by relying on their own payment network and credit card brand endorsement.

Evaluation:

Although the roles of the card issuance business chain are different, each participant has his own logic and advantages in doing card issuance business. For example, the business that virtual card/physical card issuance technology service providers are targeting is SaaS. Once the license and technology are opened up and the transaction channels of the Web3 ecosystem are aggregated, then this business model can be replicated and effortless. Its audience is very wide. It can not only provide services to Web3 native card issuers, but also expand its scope of payment business to other payment businesses with compliance and technical advantages; native Web3 card issuers can earn transaction fees for buying and selling cryptocurrencies or card payments through the outsourcing technology model, which makes it easy to reach more Web3 native communities and have lower customer acquisition costs for users who are used to using cryptocurrencies; traditional card merchants or traditional payment giants have capital accumulation, the widest user base and strong brand endorsement. If card issuance is easier to obtain the recognition of virtual card payment users, the recognition of non-encrypted users, and earn B-side authorization fees from payment service providers, etc.

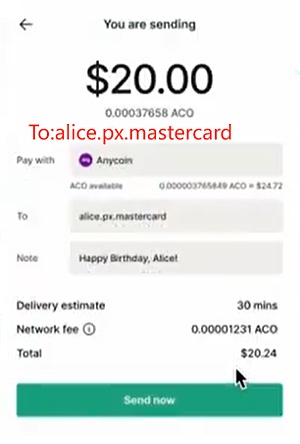

3.2.2 Third-party payment platform

Traditional/Web3 related third-party payment platforms expand deposit and withdrawal and crypto payment businesses to realize the use and consumption of cryptocurrencies in the real economy. The following two platforms have their own advantages: Revolut app supports fiat currency exchange, card payment, etc. in traditional payment, and it is also a cryptocurrency and fiat currency exchange platform. Binance Pay is backed by the largest crypto exchange Binance, and naturally has consumption needs, forming a closed loop of cryptocurrency deposit, transaction, withdrawal and consumption.

Revolut: Fintech company and global neobank Revolut was established in the UK in 2015, providing transfer, payment and other services, with more than 40 million users worldwide. The company launched Revolut Ramp in March 2024, a service that allows Revolut users to buy cryptocurrencies in their wallets and trade between the platform and Revolut accounts without paying additional fees or restrictions, in partnership with MetaMask developer Consensys. At the same time, traditional payment apps link Revolut cards to users' cryptocurrency accounts, and when making payments, Revolut automatically converts the cryptocurrency into the purchase currency for payment.

Binance Pay: The shopping platform allows users to choose from a variety of cryptocurrencies to purchase gift cards (ranging from dozens to hundreds) for different retail brands and games according to their preferences, thereby spending in the real economy. For example, Coinbee:

Source: @Coinbee

On-chain payment is also based on the needs of a certain payment scenario in the Web3 world, usually derived from the payment needs when participating in project activities and transactions.

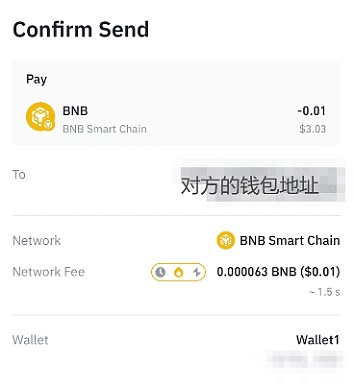

Payment and transfer: Web3 wallets (taking Binance Web3 wallet as an example) provide point-to-point payment and transfer functions. As long as you have the other party's wallet address, you can transfer money across space. Usually, you only need to pay a network fee (Network Fee / Gas Fee) and you can receive it within a few minutes. Users can easily transfer assets quickly and at low cost around the world.

Source: @binance

DeFi / NFT: Users can interact with DeFi applications through Web3 wallets to perform operations such as deposits, loans, and liquidity mining of cryptocurrencies. Users also purchase and trade digital assets such as NFTs.

DEX: Web3 wallets support users to trade cryptocurrencies on DEXs, which do not rely on centralized order books, but instead use smart contracts to match transactions.

Cross-chain interaction: Multi-chain wallets support users to transfer assets between different blockchains, enabling interoperability between different blockchain ecosystems.

GameFi: In GameFi, Web3 wallets can be used to purchase virtual goods, land, or other in-game virtual assets.

Social Networks and Content Creation: Web3 wallets support users to create and monetize content on decentralized social platforms, as well as receive tips and payments.

In August 2023, PayPal launched its first stablecoin PYUSD, issued by Paxos, which regularly provides proof of reserve assets. The stablecoin PYUSD is issued on Ethereum (currently available on Solana). PYUSD maintains a 1:1 value with the US dollar and can be exchanged through the PayPal ecosystem. The stablecoin PYUSD is backed by US dollar deposits, short-term US Treasury bonds, and similar cash equivalents to ensure its stability without being affected by the volatility of other cryptocurrencies.

Use scenarios:It is mainly used for games, remittances, and as a payment medium in Web3 platforms and decentralized exchanges; currently PYUSD is only available to users in the United States, and Coinbase provides PYUSD trading pairs. Due to the limited public chains and regions supported, the scope of use of this stablecoin needs to be expanded.

Transfer:Users can use PYUSD for zero-fee transfers

Payment:PYUSD is used for payment when goods are settled

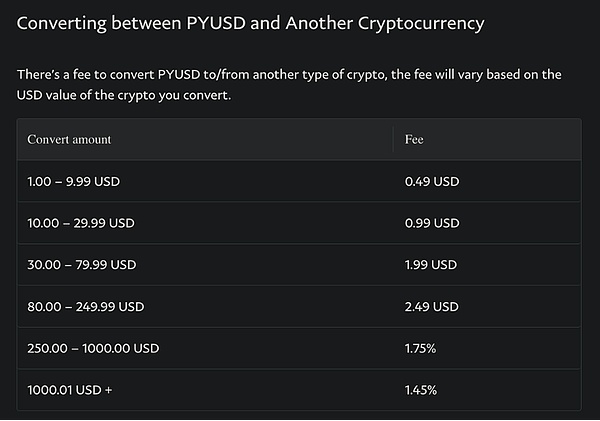

Convert cryptocurrencies:PYUSD can be converted to other cryptocurrencies supported by Paypal. The handling fee varies depending on the amount of conversion, ranging from 1.45% to 4.9%, and the handling fee is relatively high; and since it currently only supports the Ethereum chain, the network fee for transferring stablecoins will be very expensive.

Source: @Paypal

Market value:Currently, the market value of stablecoins issued by Paypal is $270.37 M, ranking 13th in the stablecoin market value. The total market value of stablecoins is $170.2 B, of which the stablecoins issued by Paypal account for 0.15%, and Tether has the highest market share of 65.9%. From this, we can understand that even if payment giants enter the encryption industry, it is difficult to quickly take the lead in the encryption market due to late entry, fewer public chains involved, geographical restrictions, and limited usage scenarios. But Paypal is also working to expand its application scope. Solana has been launched. The development goal of PYUSD is to log in to major exchanges, form a higher circulation, and aim to be compatible with the systems of Web3 and Web2 ecosystems.

source: @Defilama

Mastercard launched the Mastercard Crypto Voucher, the first peer-to-peer pilot transaction in cooperation with an exchange. Its feature is that aliases are used instead of lengthy blockchain addresses when transferring money. This new system aims to simplify cryptocurrency transactions for exchange users and provide a more user-friendly peer-to-peer transfer method.

Pilot scope: Mainly Europe and Latin America, specifically Argentina, Brazil, Chile, France, Guatemala, Mexico, Panama, Paraguay, Peru, Portugal, Spain, Switzerland and Uruguay users will be able to make cross-border and domestic transfers across multiple currencies and blockchains. These locations were chosen for the pilot mainly because the cryptocurrency environment in these countries is relatively relaxed, and there is a huge demand for cryptocurrency in Latin America due to currency depreciation.

Cooperating exchanges: Bit2Me, Lirium and Mercado and other exchanges have enabled real-time trading functions

Source: @Mastercard

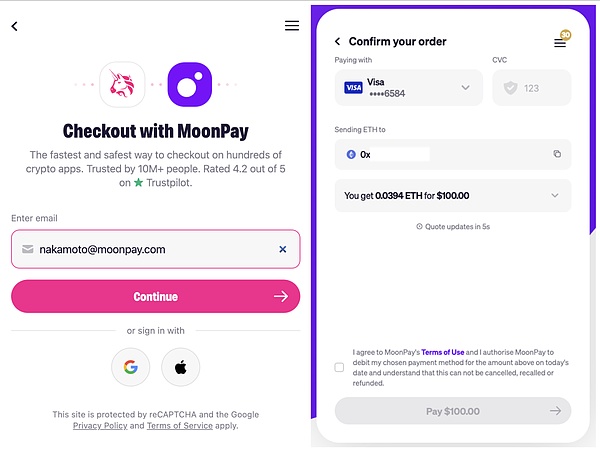

Usage steps: The exchange first conducts KYC according to the Mastercard Crypto Credentials Standard. At this point, users will be given an alias to send and receive funds between all supported exchanges. When a user initiates a transfer, the Mastercard Crypto Voucher verifies that the recipient's alias is valid and that the recipient's wallet supports the digital asset and the associated blockchain. If the receiving wallet does not support the asset or blockchain, the sender will be notified and the transaction will not proceed, protecting all parties from potential loss of funds. Finally, enter the amount to transfer, and enter the mobile verification code to complete. 4.3 Project 3: Deposit and Withdrawal Payment Infrastructure Moonpay Founded in 2019, MoonPay is positioned as PayPal for Web3. MoonPay is now one of the few companies licensed and compliant in all states in the United States through the MTL license. In short, it is a cryptocurrency service provider whose main business is deposit and withdrawal.

MoonPay provides APIs and SDKs, allowing developers to integrate its services into Web3-related applications, connect with centralized exchanges and wallets, and provide deposit and withdrawal services.

Users can also purchase digital assets such as NFTs on the MoonPay application or through various Web3 exchanges such as Coinbase, OpenSea, MetaMask, and Bitcoin.com. It has currently served more than 15 million individual users.

The latest news shows that Moonpay has now been integrated into PayPal, and users in the United States can use existing PayPal balances and bank cards to purchase more than 110 cryptocurrencies.

Financing History: The first round of financing raised $555 million, led by Tiger Global Management and Coatue Management. Valuation: $3.4 billion valuation. That group also includes Justin Bieber, Maria Sharapova and Bruce Willis, for a total of 60 investors.

Login channels: Moonpay platform (KYC), cooperative centralized exchanges and wallet service providers (including Metamask, Bitcoin.com, OpenSea, Uniswap, Sorare, etc.)

source: @Moonpay

Business scope

○ Deposit and withdrawal:MoonPay provides individual users with the function of buying or selling cryptocurrencies with legal currency. Provide deposit services for 126 cryptocurrencies and withdrawal services for 22 cryptocurrencies in 34 fiat currencies in 100+ countries. Support local payment methods such as credit and debit cards, EUR/GBP/USD bank transfers, PIX and Yellow Card

○ Cryptocurrency Trading Platform:MoonPay provides a secure non-custodial cryptocurrency trading platform that enables users to exchange different cryptocurrencies without paying fees. Users can connect crypto wallets to MoonPay for cross-chain exchanges; as of April 2024, MoonPay supports wallets such as Trust Wallet, Ledger, MetaMask, Rainbow, Uniswap and Exodus. In terms of deposits and withdrawals, MoonPay focuses more on establishing connections with large projects (such as exchanges and wallets) to obtain user traffic by establishing traffic portals on these platforms, while Alchemy Pay's deposit and withdrawal services focus more on expanding different local payment channels and strengthening the ability to localize the product itself.

○ Enterprise-level cryptocurrency payments:MoonPay supports multiple payment methods for enterprise-level cryptocurrencies. Users can embed APIs into the company's applications, and payment methods range from credit cards such as Visa and Mastercard to wire transfers, bank transfers to Apple Pay. MoonPay has an anti-money laundering monitoring system, fraud engine, and anti-fraud stack composed of more than 50 people to handle business issues such as credit card refunds, fraud, or disputes for corporate customers.

○ NFT product-related services:

MoonPay Concierge Service: Provides advanced services for NFT purchases and custody for high-net-worth customers. MoonPay has close relationships with partners such as Yuga Labs, helping to promote blue-chip NFTs such as BAYC and CryptoPunks through concierge services and sell them to celebrity customers.

NFT Checkout: Moonpay provides buying and selling NFT services through cooperation with platforms such as OpenSea, Magic Eden, ENS and Sweet.io. Users can use credit or debit cards, as well as payment methods such as Apple Pay and Google Pay to purchase NFTs without having to buy cryptocurrency first.

HyperMint: Self-service infrastructure platform and Web3 API provided through a no-code platform, the main users are creators and brands. Users can:

i. Write, design and deploy smart contracts

ii. Create, manage, mint and sell tokens to end users

iii. Channel funds, royalties and distribute NFTs at scale

Moonpay's business model:

○ Fees, service fees, NFT minting/concierge fees: MoonPay makes money by taking a percentage of the total transaction. The main transaction types are buying and selling cryptocurrencies and buying and selling NFTs. For concierge services, service fees and transaction commissions, NFT minting fees are charged. The company charges a 4.5% fee for buying and selling cryptocurrencies via credit cards and a 1% fee for bank transfers (minimum $3.99), so it is not friendly to users with small and frequent deposits and withdrawals. For NFTs, it charges a 4.5% fee, with a minimum of $0.50; high-net-worth users of NFTs will also have high service fees, etc.

○ Exchange rate difference: MoonPay earns revenue through the exchange rate difference when users deposit and withdraw funds, and buy or sell cryptocurrencies.

○ API integration fees: MoonPay provides APIs that enable third-party platforms and developers to integrate cryptocurrency purchase functions into their applications. MoonPay may charge these partners integration fees or subscription fees to access its APIs and utilize its services.

Founded in Singapore in 2017, Alchemy Pay is a crypto payment gateway that provides services to businesses and individual users. It supports payments in 173 countries and regions, with the main service area being Southeast Asia, which is also the difference between its service scope and Moonpay. Due to the different economic levels of Southeast Asian countries, each country supports different mainstream payment methods, which puts higher requirements on the types of payment methods aggregated in different countries. Alchemy Pay provides a one-stop solution for payment.

Recently, Alchemy Pay invested in LaPay UK Ltd and obtained an authorized payment institution license regulated by the FCA. The company also cooperated with Hong Kong Victory Securities to provide virtual asset trading and consulting services, especially for new Bitcoin and Ethereum spot ETFs. It can be seen that Alchemy Pay is more able to respond to market hotspots to expand corresponding services.

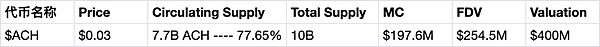

Financing background: Alchemy Pay completed a $10 million financing with a valuation of $400 million, with DWF Labs participating in the investment.

Alchemy Pay's business:

a. Deposit and withdrawal of legal currency and cryptocurrency:

Provide channels for deposit and withdrawal and purchase of cryptocurrency. Currently, the cryptocurrency sold can be remitted to bank accounts of more than 50 legal currencies. Compared with Moonpay, which is more popular in the European and American markets, Alchemy Pay needs to integrate more payment channels in Southeast Asia and Latin America, where e-wallet payments are more popular, in order to more actively explore the business in developing countries and improve user experience. B Customer business is mainly to integrate APIs for Dapp to achieve deposits and withdrawals.

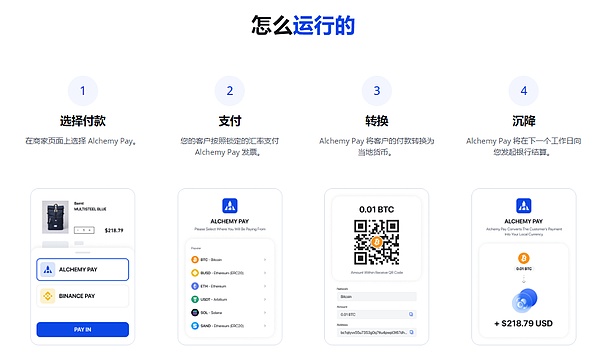

b. Payment Gateway:

Enterprise-level payment gateway: Alchempy Pay provides online payment and banking solutions within the regulatory framework, allowing traditional enterprises and Web3 enterprises to manage multi-fiat currency accounts on the platform and facilitate conversions between fiat currencies and cryptocurrencies. Users on both the payer and receiver sides can choose to use cryptocurrency/fiat currency as a means of payment. At the same time, Alchemy Pay also provides customized cryptocurrency collection services for large enterprises.

Source: @Alchemy Pay

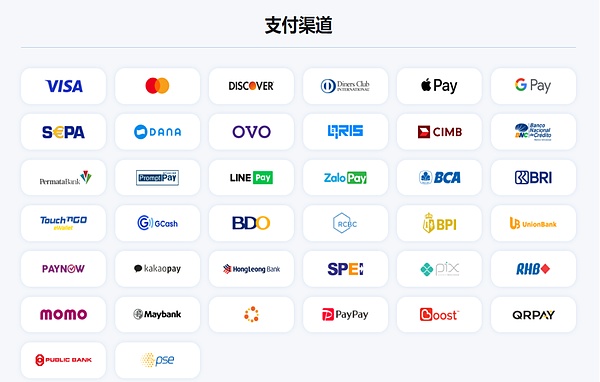

Personal Payment:Pay all popular global and local payment methods. Including debit cards, credit cards, bank transfers, mobile wallets, etc.

Source: @Alchemy Pay

c. Crypto card issuance technology solution:

Alchemy Pay virtual card is a MasterCard pre-paid card. Users can use a variety of cryptocurrencies to directly recharge US dollars into the issuer's virtual card

Currently supported currencies: USDT, USDC, ETH, BTC, and merchant platform tokens

Supported networks: Trc20, Bep20, Erc20, Sol, Bitcoin, Polygon

Currently supported cards BIN: 558068 (MasterCard), 531847 (MasterCard), 404038 (Visa)

Source: @Alchemy Pay

Cooperation model:Card issuers cooperate with Alchemy Pay, and Alchemy Pay generates customized brand credit cards for merchants. Users can use USDT and platform coins to directly top up US dollars for consumption, and can instantly exchange the remaining amount to a cryptocurrency wallet.

Usage scenarios:Can be used on all online platforms that support MasterCard consumption around the world (such as Amazon, eBay, etc.), and can be linked with Apple Pay to meet offline store payment scenarios.

Alchemy Pay's business model

○ Transaction fees for deposits and withdrawals for individuals and enterprises, exchange rate differences for fiat currency and cryptocurrency conversion

○ Integration service fees for APIs provided to entities and Web3 enterprises

○ Card issuance technology service fees

○ Profits from platform tokens: $ACH

Project evaluation

In 2024, in terms of business, Alchemy Pay will mainly strengthen the promotion of deposit and withdrawal services, crypto card services, launch innovative Web3 bank accounts, and obtain necessary regulatory licenses.

In terms of license acquisition, Alchemy Pay expects to submit and obtain more than 20 licenses worldwide this year, so as to expand its business horizontally and deeply. Alchemy Pay has gradually expanded from the initial Southeast Asia region to Europe. Currently, it has applied for licenses in Singapore, Hong Kong, the United States, the United Kingdom, South Korea, Indonesia, Australia and other places, and is seeking compliance certification in more regions through acquisition or application.

Therefore, for payment service providers, the relaxation of global supervision, the gradual compliance of BTC, and the active acquisition of different business licenses in different regions by project parties are very beneficial and important. Once a payment service provider obtains a license in the early stage, it opens the user entrance of a region, making it easier to obtain the most original and extensive B-end resources (not only for enterprises, but also for banks) and the accumulation of C-end user cognition in the region. With more resources and accumulation, it is easier to cooperate with more traditional industries and Web3 projects that need on-chain transactions, and develop more forms of payment derivative services based on the accumulation of resources and users.

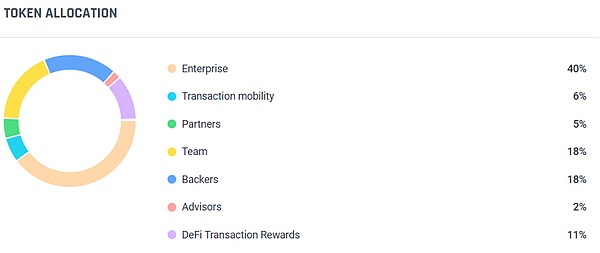

Token Economics

Source: @Alchemy Pay

Token Usage:

Alchemy Pay's token $ACH is a utility token with related uses such as payment fees, corporate network fees, participation in Defi services, governance, etc.

Payment Fees:Users can enjoy fee discounts when using $ACH payment transactions, and users can also earn rebates, discounts, or other forms of rewards through payment networks.

Enterprise Payment Network:Enterprises can earn enterprise transaction rewards based on the size and transaction volume of their network.

DeFi Rewards:DeFi participants can earn rewards through staking and other DeFi services

Governance:ACH holders can obtain voting rights on key business decisions and protocol changes based on their holdings; ACH token holdings can be used to facilitate non-governance voting scenarios, such as polls and promotions

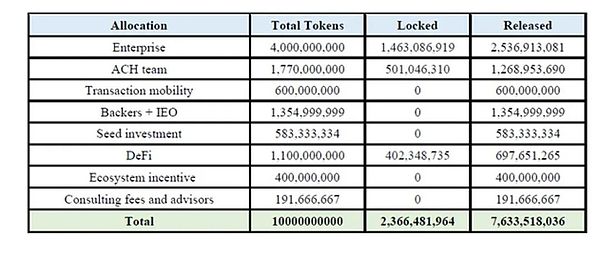

Token Economics Evaluation:

We can see from the economic token diagram that currently about 77.7% of the total tokens have been released. Although there is no token release speed chart, according to the token distribution chart, we found that the seed round, Backers and IEO parts have all been released, which shows that institutions in the private placement round (18%) may be concentrated in holding very low-priced chips; at the same time, 40% of the tokens for early participants are allocated by paying for mining, which is a double-edged sword. The high proportion will encourage participants to join, and it may also cause a certain amount of selling pressure in the future.

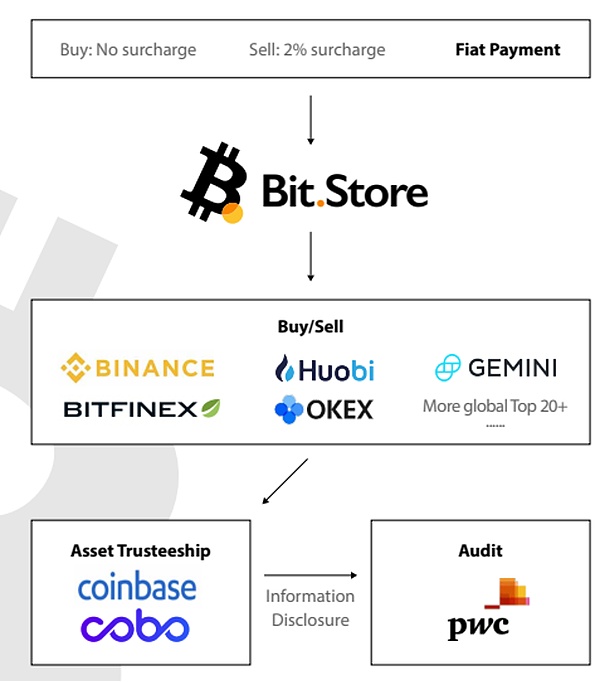

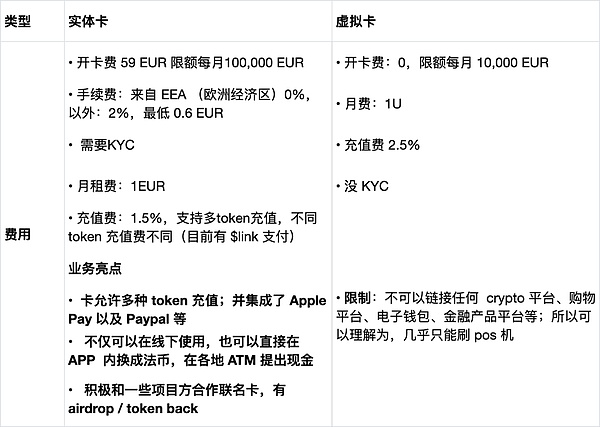

4.5 Project 5: Card Issuer Bit.Store

Bit.Store is a crypto payment card infrastructure solution. In the early days, Bit.Store was mainly a cryptocurrency exchange platform in the Southeast Asian market. It can be understood that they have connected with many large centralized exchanges to buy and sell tokens on the platform. Not long ago, Bit.Store launched crypto payment cards, including virtual cards (denominated in US dollars) and physical cards (denominated in euros). These cards are supported by Mastercard or Visa, and the payment technology service provider is Alchemy.

Licenses: Currently holds Hong Kong MSO license; US MSB license; European EMI license; Canadian MSB license; Indonesian trade license / South American trade license and other licenses. Its payment technology service provider Alchemy Pay also holds business licenses in many places, which can help it carry out payment business in many places. In addition, Alchemy Pay acquired 15% of Bit.Store's equity. Its main goal is to "check for deficiencies and fill in the gaps" and expand Alchemy Pay's payment business in North America, Europe, South America and other regions, which was originally accumulated in Southeast Asia, by acquiring "shared licenses".

Bit.Store physical card & virtual card:Many card dealers are more likely to launch virtual cards. The highlight is that physical cards can be used to withdraw cash at offline ATMs.

Source: @Bit.Store

In the case of Bit.Store, we can see that he develops his own business model by earning transaction fees, card fees, exchange rate differences, etc. Its advantage lies in that in the direction of Web2 payment channels, with multiple types and multi-regional licenses, his physical cards are connected to the most extensive traditional online payment channels (Apple Pay, Paypal, etc.), and its offline payment has achieved physical card withdrawal services that many card merchants cannot do; in Web3 Direction, he not only backed by large exchanges and custody platforms to provide them with sufficient cryptocurrency liquidity, but also actively cooperated with project parties in innovation, and launched co-branded cards for different projects by using hot narratives.

Rippl is a financial technology company. Its innovative blockchain protocol Ripple aims to solve the challenges faced by the traditional banking system in processing global transactions by establishing a decentralized ledger, Ripple Net, allowing banks and financial institutions to trade various assets quickly and cheaply around the world. Ripple Net is a distributed ledger that provides transparency, immutability and instant settlement of transactions. Its token is $XRP.

Why is Ripple Net needed: Problems of traditional banks in handling cross-border transactions

In the traditional banking system, each bank has its own internal ledger that records the creditor-debtor relationship with its customers. Transfers between customers within the same bank are relatively simple and fast, but transfers between different banks become complicated and need to be completed through trust relationships or third-party intermediaries, which leads to slow transactions, high costs, and prone to errors.

Example: Suppose customer A deposits $100 at Bank A in the United States and wants to transfer $50 to customer B at Bank B in Indonesia. In the traditional banking system, this transaction may need to be completed through multiple intermediary banks, involving high fees and several days of settlement time. With the Ripple ledger, Bank A in the United States can directly issue an IOU representing $50 on the Ripple network and transfer the funds to Bank B in Indonesia quickly, cheaply, and promptly through the Ripple ledger network.

Solutions based on Ripple Net ledger innovation

a. xCurrent : xCurrent allows banks to send messages to each other in real time, confirm payment details, and track payment progress, thereby achieving end-to-end instant settlement.

b. xRapid : xRapid is like a "liquidity assistant" for banks and payment providers. When funds need to be quickly converted between different currencies, xRapid helps them obtain the target currency at a low cost and extremely fast speed. It reduces the need to set up currency accounts in various places in advance by leveraging XRP's liquidity.

c. xVia : xVia will handle the rest of the complex process.

In short, xCurrent is a bridge for interbank communication, xRapid is an accelerator for liquidity, and xVia is an interface that simplifies the payment process. These three products together constitute Ripple's payment ecosystem, which aims to reduce the number of intermediaries in global payments, make payments faster, reduce payment costs, and make the decentralized network based on it safer and more transparent. Currently, more than 100 banks, payment providers, exchanges and enterprises around the world have joined Ripple Net, using real-time remittances and international P2P payments, electronic invoices, global currency accounts, real-time cash pools and other services.

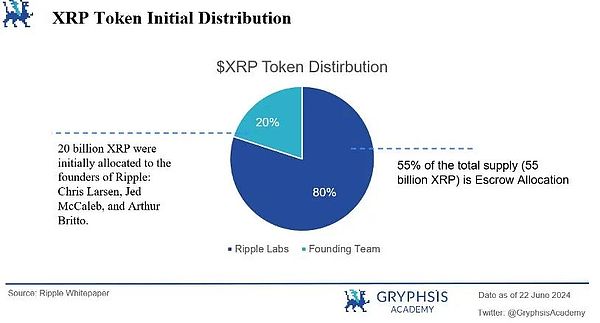

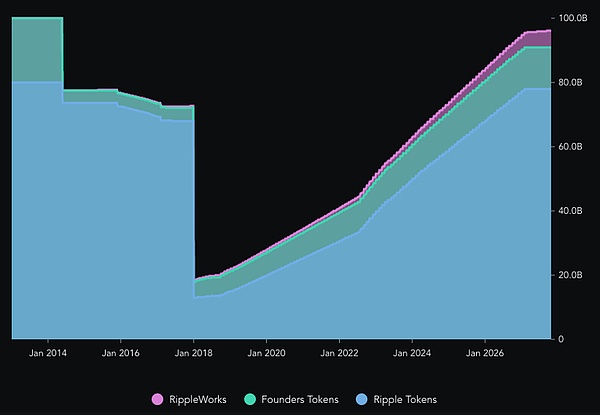

Token Economics:

The supply of XRP is fixed at 100 billion tokens, 20% owned by the token founders and 80% owned by Ripple itself, i.e. 80 billion tokens. Ripple's initial allocation of 25 billion XRP was distributed and sold, and another 55 billion XRP was deposited into 55 smart contract escrow accounts, each containing 1 billion XRP tokens.

These contracts systematically release 1 billion tokens to the market every month, with a total period of 55 months. At the beginning of the next unlock, unused XRP will be put back into the escrow account. For every transaction on XRPL, some XRP will be used as transaction fees and destroyed, creating deflationary pressure, but since the fees themselves are very low, the deflationary pressure is small.

Source: TokenInsight

Token Usage:

a. Wallet Reserve:

In the Ripple network, each account needs to hold a certain amount of XRP as a "wallet reserve". This is to prevent network congestion and junk transactions and ensure the smooth operation of the network. The amount of wallet reserves is calculated based on the activity of the account. For example, the more IOUs (i.e., debt certificates representing other currencies) an account holds, the more wallet reserves are required.

b. Trust Line:

A trust line is a debt relationship established between accounts in the Ripple network that allows one account to borrow assets (such as US dollars, euros, etc.) from another account. This borrowed asset exists in the form of IOUs in the Ripple network. The setting of a trust line requires the consent of both parties and is usually not related to XRP, but XRP can be used as an asset in a trust line.

c. Transaction Fees:

When transacting in the Ripple network, transaction fees need to be paid, which are paid in the form of XRP. Transaction fees are used to maintain the operation of the network, including the verification and recording of transactions. The transaction fees on the Ripple network are relatively low, usually less than 1 cent per transaction, and the transaction speed is very fast, with an average transaction time of about 3 to 5 seconds. A portion of the transaction fees will be equivalent to the destruction of tokens.

Comment:

The project's economic token distribution model and release speed chart are not very healthy. First, the founders account for a very large part of the token release chart, about 20%. Second, a large part of the total supply is concentrated in the top 100 wallets, and the concentration is very high.

According to the economic token release chart, the token is released very quickly, the fluctuations are large, and its deflation mechanism for burning transaction fees is not effective. Another factor affecting the price of XRP is its ongoing legal dispute with the U.S. Securities and Exchange Commission. The lawsuit accuses Ripple Labs of conducting an unregistered securities offering, which brings great uncertainty and risk to investors.

Despite some rulings in favor of Ripple, the pending status of the case continues to affect investor sentiment and market FUD; when its legal risks are resolved, the actual use of the token is put into operation, and there are better ways to solve its less effective token deflation mechanism, the value of its token can be better realized.

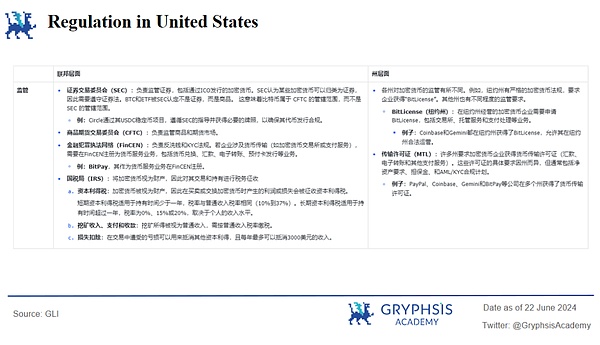

Crypto regulation in the United States is composed of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) at the federal level, as well as the regulations of the states. The United States has very strict requirements for AML, KYC and investor protection, and has frequently taken legal actions against cryptocurrency companies in recent years. Although facing the complexity of federal and state-level regulation, with the approval of ETFs, cryptocurrencies are gradually clarifying the regulatory path and moving to the center of the narrative.

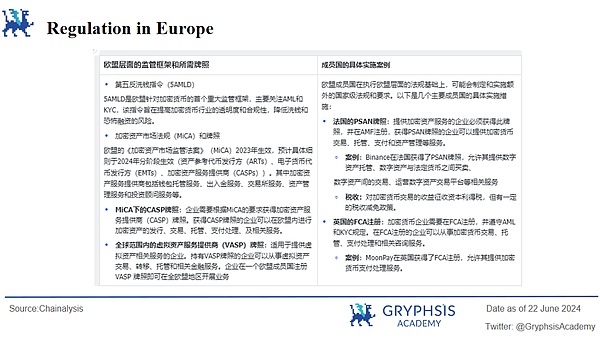

The EU has achieved unified supervision of 27 member states through the Market on Crypto Assets Regulation Act (MiCA). All crypto asset service providers (CASPs) need to obtain licenses stipulated by MiCA and can operate throughout the EU through the "passport mechanism", directly forming a large crypto asset market that radiates to 27 countries and 450 million EU population.

Since a VASP license registered in an EU member state can conduct business in the entire EU, Lithuania, a region with the most relaxed cryptocurrency regulatory policy in the EU, has obtained the registration of many centralized exchanges and payment institutions.

Hong Kong's cryptocurrency regulation is jointly managed by the Hong Kong Securities and Futures Commission and the Hong Kong Monetary Authority. The main types of licenses in Hong Kong include:

a. Virtual Asset Service Provider (VASP) License:

The VASP license is mainly applicable to virtual asset trading platforms.

Case:On May 26, 2024, OKX withdrew its application for a VASP license in Hong Kong and will stop providing centralized virtual asset trading services to Hong Kong users

b. Virtual Asset Trading Platform (VATP) License:

These platforms usually allow users to buy, sell, exchange virtual assets and other trading services. Compared with the VASP license, the functions of this license are more focused on the functions of the transaction itself (trading matching and market making, order types, advanced trading tools, etc.).

Case: Gate.HK and OKX withdrew their applications for the license this year. The withdrawal of these exchanges' applications reflects the exchanges' decision to deal with Hong Kong's strict regulatory environment and adjust their business strategies.

c. Stablecoin issuance license:

Regulated by the Hong Kong Monetary Authority, stablecoin issuers must hold reserve assets equal to the face value and provide regular reserve reports.

Dubai has attracted international exchanges, blockchain technology companies and companies providing payment services through its financial free zone and tax-free policies. Local cryptocurrency regulation is managed by the Virtual Asset Regulatory Authority and the Dubai Financial Services Authority respectively. The licenses mainly include VASP licenses, investment tokens and crypto token licenses, payment service licenses, etc.

a. Virtual Asset Service Provider (VASP) License:

Applicable to companies that provide virtual asset-related services. The business mainly involves trading, custody, payment, lending, etc., including the safe custody of customer assets, internal control, AML and KYC compliance, regular reporting, etc.

Case:Binance obtained a VASP license to provide a variety of services including spot trading, margin trading and staking products in Dubai.

b. Investment Token and Crypto Token License:

Regulated by the DFSA, it covers the issuance and trading of investment tokens and crypto tokens, ensuring compliance and transparency.

Case:Ripple's $XRP is approved for cryptocurrency services in the Dubai International Financial Center.

c. Payment and Remittance Services License:

Mainly used for the reception, transmission or transfer of virtual assets.

In different tracks of the crypto payment industry, the competitiveness of leading enterprises is reflected in the following aspects:

a. Deposit and withdrawal services:

In the field of deposit and withdrawal services for cryptocurrencies, especially with the strictness of withdrawal compliance and the improvement of anti-money laundering standards, the acquisition of regional cryptocurrency licenses has become particularly critical. For deposit and withdrawal service providers, it is not only necessary to find crypto-friendly cooperative banks and stable liquidity providers, especially after the collapse of banks such as Silvergate Bank, but also to build a strong compliance system.

Given the regional characteristics of license acquisition, those companies that obtain local operating qualifications faster through strategic cooperation, those that already have a payment license foundation, and those that have established in-depth cooperative relationships with crypto-friendly banks often show stronger competitive advantages. In addition, service providers who enter the market early also have the opportunity to enjoy the dividends brought by the market's first-mover advantage.

b. Using cryptocurrency to purchase goods or services in the real economy:

The competitiveness of businesses that use cryptocurrency to purchase goods or services in the real economy is mainly reflected in whether the enterprise has a strong brand influence, a wide network of payment partners, and deep integration capabilities with merchants and payment platforms. Enterprises with a broad user base, especially those that have established brands in the traditional payment field, such as Visa and Mastercard, are more likely to win the trust of non-cryptocurrency users with strong brand endorsements, technical processing capabilities, and high-volume transaction processing capabilities.

However, in the early stages of cryptocurrency payments, more people use this payment method than Web3 native crypto users. Therefore, improving the awareness and trust of these users through education and marketing activities is crucial to leveraging the huge non-crypto user base. This also provides an opportunity for native crypto payment companies.

c. On-chain payment

The competitiveness of on-chain payment mainly comes from innovative blockchain technology and its applications. For example, on-chain identity aggregation technology enables users to freely verify and use identities across different platforms by improving user privacy protection and security. Fund flow technology enables the real-time flow of funds, providing an innovative payment model for demand-driven and time-sensitive services.

The NFT Checkout service lowers the threshold for users to enter the NFT market through a simplified payment process, further promoting the popularity of crypto payments. Therefore, native on-chain payment companies are more focused on improving payment efficiency, reducing on-chain transaction costs, and enhancing user-friendly functional innovations.

a. Complex global regulatory environment

Cryptocurrency regulations vary significantly from country to country, and companies need to comply with legal requirements in different regions. Regulations in the cryptocurrency field are still evolving rapidly, including new tax policies, anti-money laundering regulations and market behavior rules, high difficulty and slow speed in license applications, etc., which increase the difficulty and cost of corporate compliance. For example, the EU's MiCA regulations and the federal and state regulations in the United States have different compliance requirements for companies, requiring a lot of compliance resources.

b. Macroeconomic impact risk, systemic risk, liquidity risk

○ Macroeconomic impact

In some emerging markets and low-income regions, the widespread adoption of cryptocurrencies may weaken the effectiveness of monetary policy, which may lead to capital outflows and currency fluctuations in the local banking system, and thus affect the stability of the financial system.

○ Cybersecurity and technological innovation

Cryptocurrency trading platforms and wallets face the risk of cyber attacks. The complexity of blockchain technology and the irreversibility of transaction processing increase the difficulty of technical management. Once an error or hacker attack occurs, it is very difficult to recover the loss. The data security of the block network still requires a lot of resources and advanced technology.

○ Market volatility and liquidity risk

After the collapse of exchanges such as FTX, the crypto-friendly bank Silvergate Bank suffered a serious outflow of funds due to the bank's over-reliance on cryptocurrency deposits, most of which are uninsured and non-interest-bearing. This over-concentrated and rapidly expanding business model brings multiple levels of financial risks. The collapse of FTX Exchange triggered a crisis of confidence in the entire cryptocurrency market, and a large amount of funds were withdrawn from cryptocurrency-related financial institutions. However, with the halving of BTC and the passage of ETF spot, more regulators and funds are pouring into the market, which will help ease market volatility.

c. Fierce industry competition and financing

For traditional payment companies, user education will be a big problem. Many users have insufficient knowledge of cryptocurrency and lack the necessary knowledge to safely use cryptocurrency payment services. For Web3 native companies, they need to make good use of their community foundation and native crypto users with low education costs, and continue to use innovative technologies, interesting narratives, and good services to maintain market competitiveness. If they can win investment from well-known investment institutions, they will naturally bring more attention and traffic.

In recent years, traditional payments have deployed Web3 payments and launched products such as stablecoins and peer-to-peer transaction infrastructure. The driving forces behind this trend include the high profit potential of the cryptocurrency industry, the fierce competition and high operating costs of traditional payment businesses, and the payment advantages brought by new technologies.

Web3 payment scenarios are diverse, from the fiat and cryptocurrency deposit and withdrawal services that individuals can achieve through MoonPay and Alchemy Pay, to the global fast and low-cost transactions that financial institutions can conduct on RippleNet, to low-cost and diverse on-chain payments that everyone can participate in. These innovations not only improve the transparency and efficiency of payments, but also meet users' needs for payment diversity and cross-border transactions.

Looking forward, as more countries begin to regulate and legalize cryptocurrency payments, the popularity of crypto payments will further increase. The development of blockchain technology and applications will further promote the convenience, efficiency and security of Web3 payment services.

As users and businesses become more accepting of crypto payments, we can foresee that Web3 payments will become part of daily payment methods as the crypto industry develops, driving the global financial system towards a more decentralized, transparent and efficient direction.

Indonesia đã kiên quyết từ chối sự gia nhập của nền tảng thương mại điện tử Temu, với lý do lo ngại nó có thể gây hại cho các doanh nghiệp siêu nhỏ, nhỏ và vừa (MSME) của nước này.

XingChi

XingChiThông qua sơ đồ chữ ký ngưỡng, DingPay có thể giảm thiểu rủi ro do mất hoặc rò rỉ khóa riêng trong khi vẫn đảm bảo tính bảo mật cho khóa riêng của người dùng.

JinseFinance

JinseFinancePump.fun sẽ không biến mất nhưng sẽ kiếm được nhiều tiền hơn trong chu kỳ này

JinseFinance

JinseFinanceCác công ty tiền điện tử vẫn đang phải cắt giảm nhân sự.

Beincrypto

BeincryptoCác quốc gia trên toàn thế giới đang dần tiến tới việc xây dựng một bộ luật dứt khoát cho loại tài sản này.

Beincrypto

BeincryptoTrên CT (Crypto Twitter), các tin đồn đang lan truyền về các vấn đề bị cáo buộc tại sàn giao dịch tiền điện tử lớn nhất thế giới Binance.

Bitcoinist

BitcoinistBybit và Swyftx là những nạn nhân mới nhất của sự lây lan tiền điện tử đang lan rộng, cả hai công ty đều thông báo cắt giảm việc làm sau sự sụp đổ của FTX.”

decrypt

decryptTác động môi trường của việc khai thác bitcoin từ lâu đã là một chủ đề tranh luận lớn trong cộng đồng.

Bitcoinist

BitcoinistBức thư của Warren kêu gọi OCC hợp tác với Fed và FDIC để phát triển một phương pháp tiếp cận tiền điện tử thay thế “để bảo vệ đầy đủ người tiêu dùng cũng như sự an toàn và lành mạnh của hệ thống ngân hàng.”

Cointelegraph

CointelegraphNhìn lại tuần diễn ra Diễn đàn Kinh tế Thế giới và tiền điện tử có thể đã đánh cắp chương trình như thế nào.

Cointelegraph

Cointelegraph

Please enter the verification code sent to