Author: Owen; Source: The SeeDAO

First Impression of Japanese Cryptocurrency

When I first started learning about Bitcoin, I liked to watch some English documentaries about Bitcoin. I was impressed by a Youtube documentary called "Bitcoin Big Bang: Mark Karpeles", which you can still search for today. The film mainly tells the story of Mt. Gox, an online trading website for Pokémon cards, which was founded in 2010 and was originally nicknamed Mentougou. In 2011, it was acquired by Frenchman Mark Karpelès and transformed into a Bitcoin exchange. With the popularity of Bitcoin, Mt. Gox quickly became the world's largest Bitcoin trading platform, once responsible for 70% of Bitcoin's global trading volume. In February 2014, Mt. Gox announced that about 850,000 Bitcoins (valued at about $473 million at the time) were stolen and suspended all Bitcoin withdrawals. On February 28, 2014, Mt. Gox filed for bankruptcy protection. The rapid rise and fall of Mt. Gox was my first impression of the Japanese crypto industry. I don’t know if it was a coincidence or fate, but this year’s Tokyo EDCON (Community Ethereum Development Conference) was also held in Shibuya, Tokyo, where Mt. Gox was located. Out of curiosity, I was fortunate enough to apply for an EDCON volunteer and went to Tokyo to learn about the development of Japan’s crypto industry ten years after the collapse of Mt. Gox.

The Macro and Micro of Japan's Crypto Industry

Before leaving for Japan, I saw two recent major news in the Japanese Web3 industry on the news. One was that Japanese technology giant Sony acquired Amber Japan's exchange and entered the crypto trading service industry. The other was that Metaplanet Inc (stock code 3350: JP), a listed company on the Tokyo Stock Exchange, CEO-Simon Gerovich, said that he would imitate Microstrategy, a US-listed company, to issue low-interest bonds and purchase and establish a Bitcoin-based listed company asset reserve. Watching the big "players" enter the market gave me a feeling. It seems that after ten years of ups and downs in the crypto industry and market education, the local people in Japanese society have a high degree of awareness and acceptance of Bitcoin and crypto assets.

When I arrived in Tokyo, I did find that many offline shared office spaces or bars here would carry the word "Crypto". There are also many World coin offline Orb iris authentication outlets in Tokyo and Osaka. My friends and I visited a crypto-shared office space called "Centrum" in the heart of Shibuya. It is located in a hidden corner on the 4th floor of the mall. You need to find a door covered with murals to enter the space. It is easy for ordinary mall shopping tourists to miss it. It is like a "test" and only those who want to jump into the crypto rabbit hole will find it.

After entering the space, we found that there were not many people working and it was very quiet. The store guy was very enthusiastic to introduce to us that he was helping World coin to do real-person account authentication here, but he needed to make an appointment in advance on the App. There are many leaflets of various cryptocurrencies and information pages for offline gatherings in the store.

Based on my experience of living in Tokyo for about a week, I found that crypto payments are not yet available in Japan. Because almost everyone in Japan will apply for a transportation card, such as Suica or Pasmo. With this stored-value card, it is very convenient to take the bus and shop. When the money in the card is used up, you can go to a 7-11 or FamilyMart convenience store to recharge at any time. The cash register system in the store is connected to the world's major UnionPay system. Web3 stable currency encrypted payment obviously cannot compete head-on with these traditional Japanese financial giants.

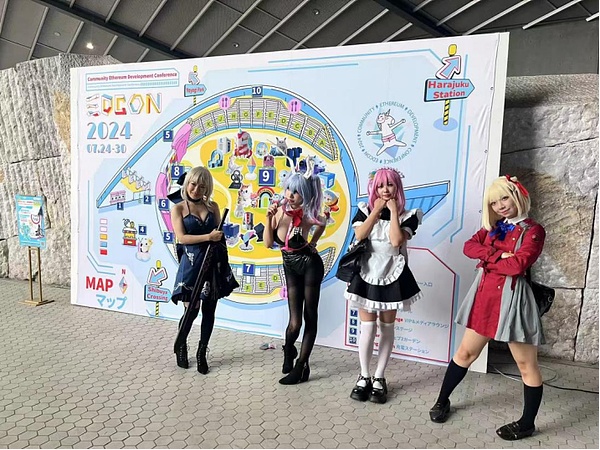

Let's talk about my impression of the EDCON venue in Tokyo. First, the local Japanese people don't care about cryptocurrencies. The locals who come to visit EDCON may only account for 20%-30% of the total number of people, including many elderly people who come to the venue to grab free peripherals. Second, I didn't see any well-known Japanese Web3 project parties participating in the exhibition. Because the venue for this EDCON conference was provided free of charge by the Shibuya District Government, the Shibuya District Government also took the initiative to recommend some projects to participate in the exhibition, such as the well-known anime IP, Ghost in the Shell. The exhibition team members frankly said that they were "required" by the government to participate in the exhibition and promotion, and the project had nothing to do with Crypto and Web3. The highlight of the EDCON conference is that Japanese crypto venture capital VCs are relatively active. Honda Keisuke, a former star player of the Japanese national football team, started a local venture capital fund after retiring. He spoke as a heavyweight guest at the EDCON conference and expressed his hope to support more Japanese SMEs and entrepreneurs. There are also two professional crypto exhibition organizations in Japan, IVS (Infinity Ventures Summit) and WebX. They also hold blockchain week activities in Japan every year, and also have many contacts with Korean crypto VCs, such as Hashed.

Japanese DAO Organizations and Crypto Social Networking

I met active members of the Nouns Japan community at the EDCON venue. Their booths were all at the entrance of the venue, which was very conspicuous. At the same time, they also brought a lot of merch peripherals, such as sunglasses and T-shirts to sell on site.

In addition, there is only DAO TOKYO, an organization that holds Web3 gatherings in the name of DAO. Last year, Professor Wang Chao wrote "These DAOs are Changing Japan", which made me look forward to seeing more local Japanese DAO organizations. From the actual EDCON venue, the speech panel did not set up a separate DAO theme discussion and exchange, and not many people talked about and cared about DAO.

Someone once told me that only by going to an izakaya at night can you see the true side of the Japanese. I didn't go to the izakaya, but I went to the offline party held by Arweave/AO at Crypto Lounge GOX in Tokyo with my friends. It was indeed different from the serious atmosphere of the EDCON venue during the day. As soon as you enter the door, there are 3 crypto slot machines, and the neon colors of punk aesthetics are in sight. There are several computer monitors hanging on the wall to display the currency price, full of amusement park & casino atmosphere.

A group of us sat around under the projection screen, and the host and speaker on the stage were actively sharing the latest developments about Arweave/AO. Free snacks, drinks and beverages were provided on site. The participants were organized to play an ice-breaking game of scanning QR codes, and the overall game atmosphere was very good. Japanese people don't like to make loud noises when socializing offline. They like to sit together and whisper to each other, and they value privacy. I once read a report saying that 50%-60% of the people who invest in cryptocurrency in Japan are middle-aged men in Tokyo. Judging from the crowd at this gathering, I think it is credible.

Japanese-style encryption road

A quick trip to Tokyo allowed me to see that a large number of industry builders are working hard to explore the development direction and path of Japan's encryption industry. There is not only the Shibuya District Government's strong support for small and medium-sized startups, but also the financial support of active local encryption VCs, as well as the cross-border exploration of DMM Group and Sony's traditional technology giants. The project owners of various overseas public chains also attach great importance to developing local communities in Japan, and believe that the Japanese market and potential should not be underestimated. For example, Zksync held a large number of peripheral activities and workshops at the EDCON venue.

On the other hand, I also see that in Japan's sophisticated and efficient society, it is still too early for cryptocurrencies and virtual assets to find a scenario that can be generally accepted by the public, and there is still a long way to go. The Japanese who have experienced the bubble economy in the 1990s and the collapse of the Mentougou Exchange are generally skeptical, wait-and-see and conservative about the speculation of crypto assets.

Overall, the development of the Japanese crypto industry gives me a strange feeling. It is neither a wild way of speculating on Meme and issuing air coins, because the government has strict supervision on virtual assets. But it will not blindly follow the command route of some overseas public chain foundations. It has its own thinking and development pace.

On August 21, 2024, the Mentougou Exchange Bankruptcy Committee began to repay debts to some creditors in the form of BTC and BCH through some designated cryptocurrency trading platforms. This symbolizes that the Japanese crypto industry has revived from the previous collapse and ruins and continues to follow the Japanese-style crypto development path.

Weatherly

Weatherly