Author: Climber, Golden Finance

Recently, Tether, the leading project in the stablecoin market, ushered in its tenth anniversary. While recounting its own development history, great achievements and prospects for the future, the project party announced that it would launch a documentary about USDT and its impact on fighting inflation to commemorate it.

After ten years of development, Tether's current highest market value is close to $1,200, far ahead of the second-place Circle by nearly $85 billion. Tether's CEO even said that USDT will gradually become a digital dollar. However, despite its bright and dazzling achievements, this "unicorn" company still faces many challenges and hidden dangers, including pressure from supervision, justice, and competitors, especially the accusation of its information opacity from the outside world, which has raised questions about whether it may become the next FTX.

1. Remarkable achievements in ten years of development

On October 7, Tether issued a statement to celebrate the company's tenth anniversary. It stated that since its establishment in 2014, it has taken the lead in proposing the concept of USDT, a digital currency pegged to the US dollar, and provided an unprecedented solution to the volatility of the cryptocurrency market. Today, USDT is the most widely used stablecoin, with a market value of nearly $120 billion, which has completely changed the traditional financial industry and developed into a diversified technology giant.

The company's net profit in the first half of this year reached a record high of $5.2 billion. In the second quarter of this year alone, Tether's profit reached $1.3 billion, a record high.

Entering the third quarter, data from CryptoQuant showed that stablecoin liquidity grew to a record $169 billion at the end of September, an increase of 31% year-to-date. Tether's USDT accounts for 71% of the market share, while Circle's USDC, which ranks second, accounts for 21%.

Tether's revenue in 2023 was $6.2 billion, exceeding the $5.5 billion revenue of BlackRock, a major global investment company, in the same year. BlackRock has 20,000 employees, while Tether has 100 employees.

For the long-term development process of ten years, Tether officials have also made corresponding data summaries.

Global influence: With more than 350 million users worldwide, it promotes financial inclusion in emerging markets.

Cooperation with law enforcement: Assisting more than 180 law enforcement agencies to recover more than $1.8 billion related to illegal activities.

Liquidity: During the UST crisis in 2022, $10 billion in redemptions were processed in one week, proving Tether's liquidity and reliability.

Expansion beyond stablecoins: Launching Tether Data, Tether Finance, Tether Power, Tether Edu and Tether Evo to expand its influence.

Talking about the vision for the next 10 years, Tether said that although the company has made significant progress, there are still problems in regulatory transparency, scalability and the actual utility of digital currency. In addition, Tether envisions a world where digital currency payments are seamless, accessible and inclusive to everyone. Tether's next decade will focus on enhancing global financial inclusion, expanding its token issuance, and promoting innovation in areas such as artificial intelligence, energy sustainability and blockchain education.

And to commemorate Tether's first decade and its vision for the next decade, Tether announced that it will release a documentary "Stability and Freedom in Chaos", focusing on Tether's impact in countries such as Brazil, Argentina and Turkey.

Tether's success can be attributed to the following points:

1. Close relationship with the US government

Tether's CEO once said, "Tether is the best friend of the US government," and he said the company holds more US Treasury bonds than Germany and any other competitor.

As of the second quarter of 2024, Tether directly and indirectly holds more than $97 billion in US Treasury bonds. This makes Tether one of the top 20 buyers of U.S. Treasuries, surpassing the holdings of countries such as Germany, the United Arab Emirates and Australia.

2. Assisting the judiciary in fighting crime

In September, Tether assisted the U.S. Department of Justice in freezing more than $6 million in assets of a Southeast Asian fraud project, and the U.S. Attorney's Office in Washington, D.C. publicly acknowledged that Tether provided assistance. In August, Tether teamed up with the FBI to recover $5 billion worth of cryptocurrency, and the U.S. Attorney's Office for the Eastern District of North Carolina publicly commended Tether for its assistance in recovering funds related to major fraud schemes.

Tether said that it has so far assisted more than 180 law enforcement agencies in 45 jurisdictions in freezing more than $1.8 billion worth of USDT, redistributed more than $128 million of USDT to legal owners and law enforcement agencies, and voluntarily frozen more than 1,850 wallets related to illegal activities.

3. Global layout

In September, Tether partnered with Reku to launch a cryptocurrency literacy program in Indonesia. In addition, Tether has partnered with Mahidol University in Thailand to introduce stablecoins, blockchain and P2P technologies into MUIC's curriculum.

In August, Tether plans to launch a stablecoin pegged to the UAE Dirham AED. In addition, Tether announced a partnership with cryptocurrency company Xion Global to promote blockchain education in South Africa and has established a strategic partnership with the African Blockchain Institute.

4. Strengthen compliance

Tether CEO Paolo Ardoino said that the company will double its staff size in the next year to enhance its strength in areas such as compliance, and it is expected that the number of employees will reach about 200 by mid-2025.

Second, criticism, questioning, challenges, Tether is surrounded by crises

From the summary of Tether's tenth anniversary, the company has achieved very brilliant results and its profit scale is also very objective. However, it has been in trouble on the road to growth and development, and this year seems to be particularly serious.

Although Tether has a close relationship with the US government as mentioned above, there is still a view that the company may face strict scrutiny. Earlier, Ripple CEO Brad Garlinghouse said that the next target of the US government is Tether, the stablecoin company responsible for the circulation of USDT stablecoins.

Some experts believe that the statement of Ripple CEO is a very big insider report. If it really happens, there will be a very large selling pressure in the USDT stablecoin market. In this case, the value of USDT will fall sharply.

1. Business and asset transparency are in doubt

Tether's market share exceeds 75% of the entire stablecoin market, which has raised concerns about Tether's influence on the crypto industry. Cyber Capital founder Justin Bons is worried that Tether may be a $118 billion scam that is bigger than FTX. He said that Tether has no proof of reserves and has never been audited; USDT is printing counterfeit money (fraud) and has been found to forge documents, conceal identities and lie about reserves.

In addition, he also said that the background of the Tether team is worrying, and the founding members have been involved in scandals such as Ponzi schemes and gambling cheating. And Tether is closely related to Bitfinex, and Bitfinex's partner bank Crypto Capital was once seized for money laundering.

As early as 2021, Tether was fined $41 million by the U.S. Commodity and Futures Trading Commission (CFTC) for falsely claiming that USDT was fully backed by reserves.

In addition, Deutsche Bank analysts also stated that Tether's reserves lack transparency and called the company's solvency status "questionable."

The U.S. consumer protection organization Consumers' Research also issued a report warning that stablecoin issuer Tether has problems with the transparency of its U.S. dollar reserves.

2. Regulatory pressure

JP Morgan analysts previously stated in a report that Tether Tether's dominance is too strong, and increasingly stringent stablecoin regulations may pose a major challenge to its market dominance, facing the risk of a changing regulatory environment in Europe and the United States. According to the European Crypto-Asset Markets Act (MiCA), 60% of stablecoin reserves must be kept in European banks, which may force Tether to adjust its reserve management strategy.

The Wall Street Journal published an article stating that Tether is disrupting the United States' global sanctions system, and according to a United Nations report in January this year, USDT is the "first choice" for money laundering in Southeast Asia.

The US stablecoin regulation proposal reveals that Circle may be ahead of Tether, and the former is more likely to comply with the new stablecoin regulations.

The United Nations warned that Tether is becoming more and more popular among money launderers and has become the core of the fraud industry.

3. Judicial proceedings

In September this year, Swan Bitcoin accuses former employees of conspiring with Tether to steal mining operations. The lawsuit alleges that former employees stole "highly proprietary code" from Swan's Bitcoin mining monitoring software and poached the company's suppliers and business partners.

In addition, Swan accused Tether of assisting in the scheme, saying that Tether provided "legal cover" for a hostile takeover by issuing a "notice of breach." Just four days after the former employee resigned, Tether notified Swan that Proton would take over the day-to-day management of Bitcoin mining.

In the class action lawsuit against Tether and Bitfinex, plaintiffs accused the crypto companies of driving up cryptocurrency prices by creating the illusion of increased demand, prompting the use of credit and loan funds for trading. The lawsuit contains chat and testimony records from company operators, claiming that they admitted to the manipulation.

Celsius Network Limited also filed a lawsuit against Tether Limited and some of its affiliates in the United States Bankruptcy Court for the Southern District of New York through Blockchain Recovery Investment Consortium, LLC, demanding that Tether return approximately $24 100 million dollars in Bitcoin.

Previously, Caroline Hill, senior director of global policy and regulatory strategy at Circle, made comments at a hearing of the House Financial Services Committee on the topic of crypto crime, urging authorities to examine Tether's involvement in terrorist financing.

Tether co-founder Brock Pierce also got into legal trouble over his hotel project in Puerto Rico in August this year.

4. The competition in the stablecoin market is fierce

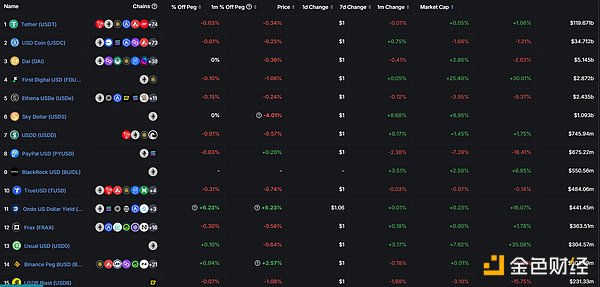

This year, the competition in the stablecoin market is particularly fierce, and latecomers are emerging in an endless stream. According to Defillama data, there are currently 14 stablecoin projects with a market value of more than US$300 million, and as many as 6 projects with a market value of more than US$1 billion.

Since January 1, 2024, USDT's market value has grown by $25.96 billion, from $91.74 billion to $172.5 billion. A representative stablecoin is First Digital's FDUSD, whose supply increased by $280 million in one day.

In addition to the above pressures, Tether is also facing the problem of declining profits due to the Fed's interest rate cut cycle. Stablecoin research company Bluechip said that for every 50 basis point rate cut by the Federal Reserve, Tether's annual revenue will decrease by $488 million and Circle's annual revenue will decrease by $144 million. As the Federal Reserve cuts interest rates, the returns that stablecoin issuers receive from U.S. Treasuries will decline, which may force them to make riskier investments to make up for the loss of income.

Summary

Tether's current leading position in the stablecoin market is unquestionable and even difficult to shake. After ten years of development, the company's market value has ranked among the world's famous companies, and its number of users and profitability are also first-class. But the saying "a tall tree attracts the wind" also applies to Tether. There have been constant speculations and doubts about it, and it has indeed failed to provide sufficient evidence. With the increasingly stringent supervision in the future, only when the strong wind of review comes can we test whether Tether is really deeply rooted.

Alex

Alex

Alex

Alex Weiliang

Weiliang Catherine

Catherine Catherine

Catherine Alex

Alex Miyuki

Miyuki Kikyo

Kikyo Weiliang

Weiliang Catherine

Catherine Kikyo

Kikyo