Written by: HTX Ventures

Since its debut, Bitcoin has become a key issue in the US election in 2024 after three election cycles. As the Bitcoin concept expounded by Satoshi Nakamoto in the white paper has gradually gained popularity, its supporters have formed a voter group that cannot be ignored in US politics. This article analyzes the multiple factors behind the increased importance of Bitcoin and cryptocurrencies in the election, including the erosion of real wages by inflation, the challenge to the global status of the US dollar, the growth of US voters' interest in cryptocurrencies, and the current government's regulatory strategy for the crypto industry.

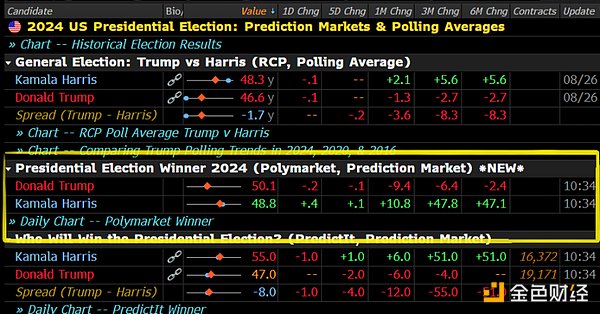

This article was written by the research team under HTX Ventures. The article further explores the different positions of presidential candidates on cryptocurrencies and how these attitudes shape future policy directions and market expectations. At the same time, the article also discusses the role of prediction markets, especially Polymarket, in elections and the possible innovative development directions of prediction markets, as well as how the general election will affect the cryptocurrency market in terms of macroeconomic liquidity.

Finally, the article predicts the possible impact of the election results on cryptocurrency companies. If Trump wins, a clearer and more relaxed regulatory environment is expected, which will help incubate and grow cryptocurrency startups, and even open up channels for cryptocurrency companies to go public, provide guarantees for the exit of traditional investment institutions, enhance the wealth effect, and improve the financing environment. It will also accelerate DeFi's entry into the mainstream financial market and promote innovation and development in the BTCFi field.

Background of cryptocurrency becoming an important election issue

The significance of Bitcoin to the United States

Strengthening demand for hedging inflation

A survey by Forbes magazine shows that after removing inflation, the real wage level of Americans has hardly increased significantly since the mid-1980s. After adjusting for inflation, the purchasing power of the average hourly wage in the United States today is almost the same as in 1978. This has exacerbated the widening gap between the rich and the poor: the upper class has seen a sharp increase in wealth due to holding a large amount of fixed assets, while the wealth of the working class has continued to shrink.

Since the 2008 financial crisis, Bitcoin has been increasingly seen as a potential tool to combat inflation and economic uncertainty, especially offering hope for economic independence to the middle class. Bitcoin's decentralization and limited supply make it an alternative asset to government and central bank intervention. Although the U.S. dollar remains the world's reserve currency, as investors' demand for value-preserving assets continues to increase, Bitcoin's appeal is growing and is considered an effective tool to combat inflation, especially for the increasingly pressured working class.

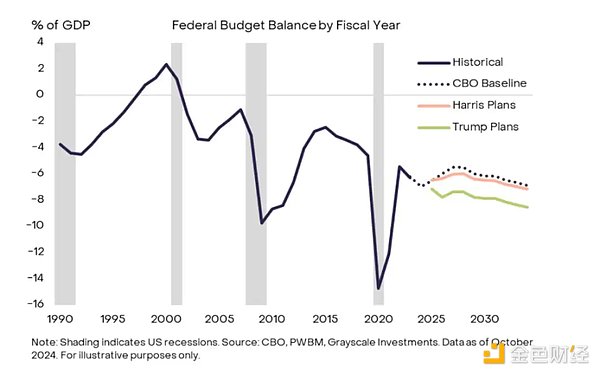

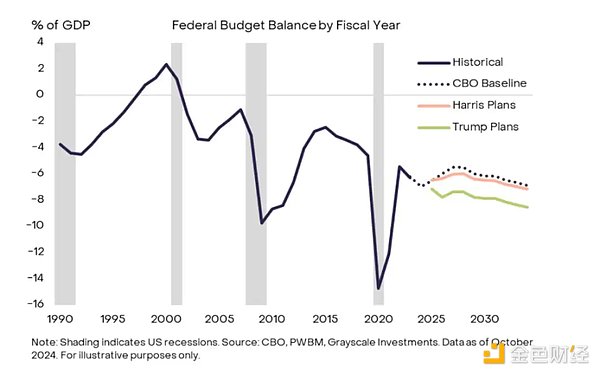

Whether Trump or Kamala Harris wins the presidential election in the future, U.S. fiscal policy is likely to lead to larger budget deficits. According to the Congressional Budget Office's forecast, the U.S. federal budget deficit will average 6.2% of GDP over the next 10 years. If Trump continues his 2017 tax cuts and further reduces tax rates, the deficit could climb to 7.8% of GDP. In contrast, Harris plans to raise the corporate tax rate to 28%, but her other reform proposals could still leave the deficit at 6.5% of GDP.

https://www.grayscale.com/elections

Over the past 25 years, the U.S. federal debt has risen sharply from 40% to 100% of GDP, and it could climb to 124%-200% in the next 10-30 years. The upcoming presidential election could trigger the so-called "Minsky moment," in which the bond market realizes the severity of the debt problem and demands higher returns to compensate for the financing risk. Such a moment could cause the bond market to collapse and trigger a financial crisis.

Both Trump's tax cuts and Harris' tax increase plans are likely to further exacerbate the US deficit and debt burden and increase the risk of financial market turmoil. There are limited ways to solve this high debt, and diluting debt through inflation may become the only way for the US government to deal with this dilemma. However, the negative impact of inflation will compress the purchasing power of the working class and aggravate wealth inequality.

It is worth noting that the Bitcoin bill currently awaiting approval by Congress may provide a new solution to the US debt problem. The bill aims to incorporate Bitcoin into the broader financial system, which may help stabilize the US debt structure by attracting a large amount of private and institutional capital, and even bring a certain degree of stability to the global financial system. As a decentralized and scarce asset, Bitcoin can provide governments and investors with a tool to hedge against inflation and avoid risks, especially in dealing with debt and inflationary pressures. It has potential strategic significance.

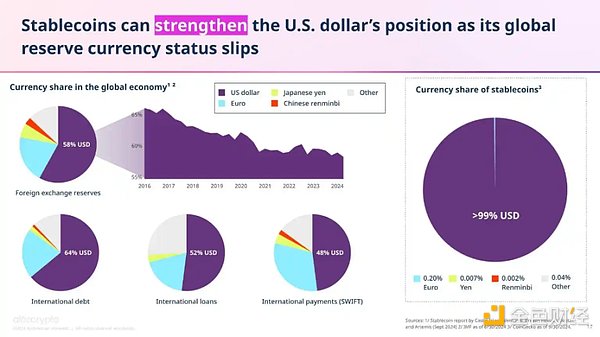

Strengthening the dollar's international influence

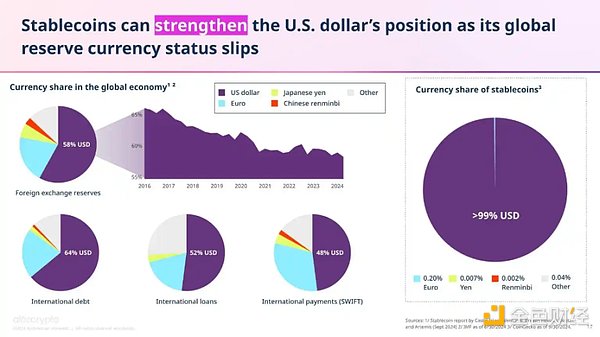

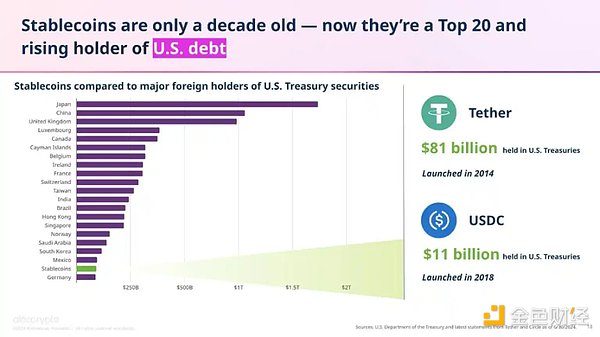

As one of the most popular crypto products, stablecoins have become a hot topic in policy discussions, with several related bills under consideration in the U.S. Congress. One of the key factors driving this discussion is the recognition that stablecoins can help continue to strengthen the dollar's international influence as its global reserve currency status gradually weakens. Currently, more than 99% of stablecoins are denominated in U.S. dollars, far exceeding the second largest denominated currency, the euro, which accounts for only 0.20%. The widespread use of stablecoins has further consolidated the dollar's dominance in the digital asset market, while also providing a new way for the United States to maintain its advantage in the global financial system.

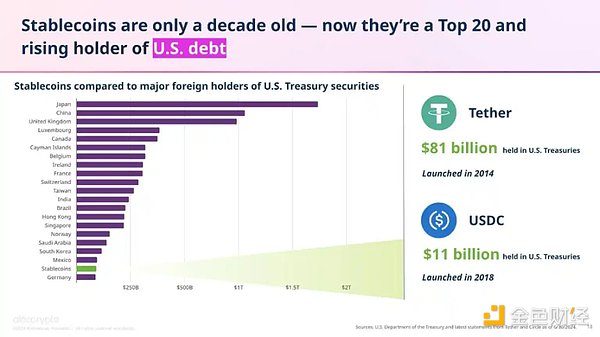

In addition to strengthening the dollar's influence internationally, stablecoins may also further consolidate the United States' financial foundation domestically. Although stablecoins have only been around for a decade, they have become one of the top 20 holders of U.S. Treasuries, surpassing countries such as Germany. This shows that stablecoins not only help to enhance the global dominance of the U.S. dollar, but also become an important part of the U.S. financial system by absorbing a large amount of Treasuries, providing additional liquidity support to the economy.

Rise in Voter Interest in Cryptocurrency

In the Harris Poll, a national survey conducted by Grayscale representatives, about half of potential U.S. voters said they were more likely to support candidates who were positive about cryptocurrencies than those who were not interested in them.

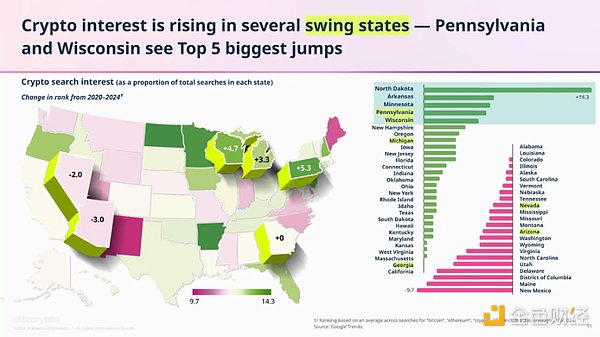

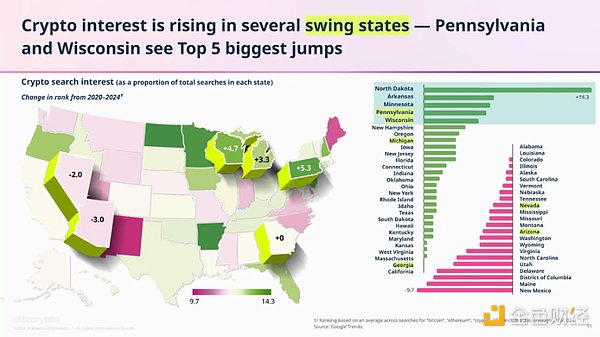

At the same time, voters in swing states have also shown a significant increase in their attention to cryptocurrencies. In Pennsylvania and Wisconsin, two key states that are about to face fierce competition, Google search interest in cryptocurrencies has risen to fourth and fifth place respectively since the 2020 election, while Michigan's crypto search interest ranks eighth in the United States.

Biden Administration's Regulatory Hunting of Crypto Companies

The Biden administration has been working to strengthen cryptocurrency regulation since its inception, working to establish a stricter framework, including securities charges against Ripple, strengthening tax reporting requirements for crypto companies and Bitcoin miners, and imposing capital gains taxes. After the collapse of FTX, the government has stepped up its efforts to hold large cryptocurrency companies accountable and has made a series of legal advances. For example, Zhao Changpeng, the former CEO of Binance, the world's largest cryptocurrency exchange, was sentenced to four months in prison for involvement in U.S. and international lawsuits. Soon after, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Coinbase, accusing it of operating its crypto asset trading platform as an unregistered securities trading platform. If the lawsuit is successful, it will pose a major threat to Coinbase's business model. Other accused companies include crypto exchange Kucoin and others.

Crypto corporate donations play a central role

In 2024, cryptocurrency companies have become one of the main forces in political donations in the United States. Coinbase and Ripple are now the largest corporate political donors this year, accounting for nearly 48% of total corporate donations. The Fairshake Super Political Action Committee (PAC), founded in 2023 and led by former New York Governor's Assistant Josh Vlasto, has raised more than $200 million for candidates who support cryptocurrency, becoming the PAC with the most spending in this election cycle. Fairshake's goal is to elect candidates who support crypto and defeat skeptics, and has received support from companies such as Coinbase, Ripple and Andreessen Horowitz.

These funds not only influence the policies of presidential candidates, but also promote congressional election policies that are favorable to cryptocurrencies. The cryptocurrency industry has thus moved from behind the scenes to the foreground and become an important force in American politics.

A typical case occurred in March of this year, when Democratic radical star Katie Porter raised more than $30 million in the California Senate election and was expected to win. But because she followed Elizabeth Warren's political line and stood with Harris on bank regulation issues, Fairshake regarded her as an "anti-crypto ally." In the California primary, Fairshake invested more than $10 million to attack Porter, weakening her base among young voters. Through Hollywood banner ads and comments targeting her, Fairshake claimed that Porter misled voters to support the big business bill, causing her campaign funds to be hedged, and eventually fell behind her party member Adam Schiff and failed to enter the fall general election.

This phenomenon has led many Democratic candidates to set up special sections on their campaign pages to support cryptocurrencies, sending signals to crypto PACs to win financial support, and crypto PACs have significantly influenced the candidates' positions.

Election Impact

Policy Propositions of Both Campaigns

Harris

Harris's stance on cryptocurrency policy is relatively limited, saying only that it will "encourage innovative technologies such as artificial intelligence and digital assets while protecting consumers and investors." In response to the problem of lower-than-expected support among black male voters, she recently launched a series of economic security plans, including a commitment to develop a crypto regulatory framework to protect black men's crypto investments. However, this framework is only aimed at black voters, lacks clear regulatory details or specific policy positions, and has been criticized by the crypto community for lack of sincerity, believing that she is only using cryptocurrency as a tool to win votes.

The current Biden/Harris administration has a more confrontational regulatory stance on the crypto industry, taking actions including filing multiple lawsuits, restricting traditional banking services, vetoing bipartisan legislation, and continuing to consider imposing capital gains taxes on cryptocurrencies. Although Harris' crypto policy may be friendlier than Biden's and is expected to improve the regulatory environment for the industry, her stance on key issues such as taxation, Bitcoin mining, and self-custody is still more cautious and far less than Trump's pro-crypto stance.

Trump

The Republican Party has always emphasized individual freedom, and its values are somewhat consistent with the decentralized concept of cryptocurrency (crypto). The Republican National Committee mentioned cryptocurrency in its official platform, saying that Trump will defend the right to mine Bitcoin and "ensure that every American has the right to keep their own digital assets and trade them without government monitoring and interference." In contrast, the Democratic Party tends to strengthen government power and regulation, which has some friction with the cryptocurrency community in terms of concept.

Trump has shown great interest in the digital asset industry, claiming to make the United States the "global capital of cryptocurrency and Bitcoin." He supports Bitcoin mining and promises to protect the right to self-custody. In addition, Trump once used BTC to buy burgers for diners during the campaign, and publicly criticized the U.S. Securities and Exchange Commission (SEC) for its tough stance on cryptocurrencies, saying that if he comes to power again, he will appoint a new crypto-friendly chairman. Trump also launched his own decentralized finance project (DeFi) - World Liberty Financial.

Trump has put forward a series of cryptocurrency policy recommendations, including:

Establish a Bitcoin government reserve: Trump pointed out that his government will "retain 100% of the Bitcoin currently held by the U.S. government or acquired in the future," and that these Bitcoins will constitute the "core of the national strategic Bitcoin reserve." As of October 2023, the U.S. government is estimated to hold more than $5 billion worth of Bitcoin, mostly seized through criminal investigations. However, it remains unclear how these reserves will be used, whether they are actually feasible, or even whether they will be widely accepted by the crypto industry.

Establish a Cryptocurrency Advisory Committee: Trump proposed the formation of a "Presidential Advisory Committee on Bitcoin and Cryptocurrency" in Nashville, and said that the committee would be made up of "people who love this industry" rather than "people who hate the crypto industry."

Prevent the Fed from launching a digital currency: Many countries around the world are moving forward with central bank digital currencies (CBDCs), but this trend has been resisted in the U.S. crypto community. Although the Fed has not decided whether to launch a digital dollar, it released a report in January 2022 discussing the potential costs and benefits of a CBDC. Trump has publicly opposed the idea many times, calling it a "significant threat to freedom." In May 2024, the House of Representatives passed a bill that would prohibit the Fed from creating a CBDC, but the bill is still a long way from becoming law.

It is important to note that despite Trump's support for cryptocurrencies, his tariff policy could cause economic uncertainty, and the long-term impact on the market and the cryptocurrency industry remains to be seen.

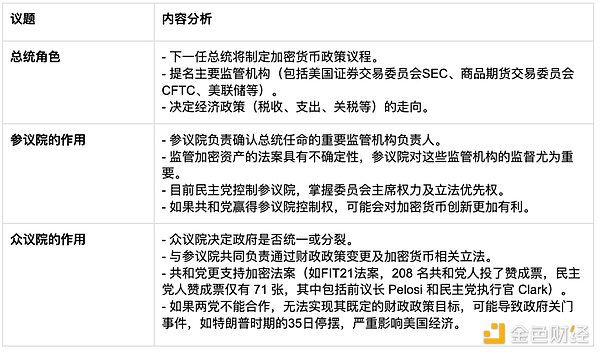

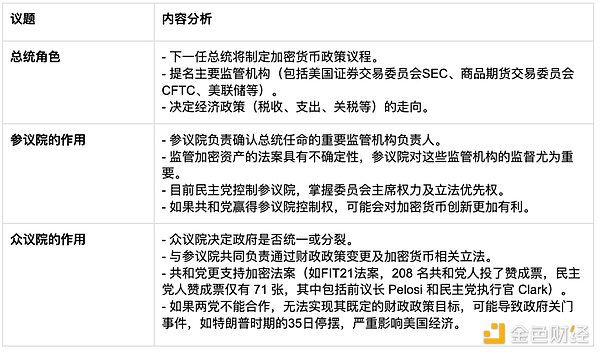

A "divided government" scenario could occur

At present, unless one party can win both the Senate and the presidency, instability is almost inevitable in other cases.

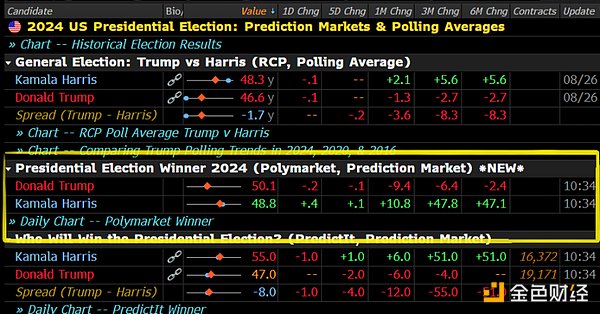

As of October 25, Polymarket data showed that different parties had different probabilities of winning the presidential, Senate, and House of Representatives elections. Among them, the only specific result with a high probability is that the Republicans control the Senate. At the same time, a "divided government" situation is also very likely to occur - this refers to the situation where the president and the Senate are controlled by different parties. The last split government occurred during Obama's term, and it did not occur during Biden's and Trump's terms.

This political situation usually leads to policy deadlocks, because the president and the Senate must compromise on major legislation and personnel nominations. If the Republicans win comprehensively, they are expected to pass new legislation in just three to six months, which will be a positive result for the cryptocurrency market because the Republicans tend to promote a looser regulatory framework for cryptocurrencies.

The U.S. Congress passed a temporary spending bill on Wednesday, September 25, which will maintain the funding of government agencies until December, temporarily avoiding a government shutdown. The passage of this bill also postponed the final spending decision until after the presidential election on November 5. In other words, from December to the inauguration of the new Congress on January 3 of the following year, the government's fiscal budget issues will be subject to certain restrictions. This means that during this transition period, the president's power may not have a broad impact on fiscal policy until the new House of Representatives takes office and a formal fiscal budget is passed.

SEC leadership is likely to change

Since Gary Gensler became chairman of the SEC, his tough regulatory policies have aroused strong dissatisfaction in the cryptocurrency community. Although he has made some achievements in combating illegal securities issuance, his overly strict law enforcement methods have also been protested by many crypto companies.

Trump has publicly stated that if he is re-elected, he will "fire" Gensler and push the SEC to take a more friendly attitude towards cryptocurrency innovation. Traditionally, if the White House changes, the SEC chairman usually resigns, and it is not surprising that the Harris administration takes a similar stance to its opponent in an attempt to win the favor of the industry. Therefore, whether Harris or Trump wins, there may be major changes in the leadership of the SEC.

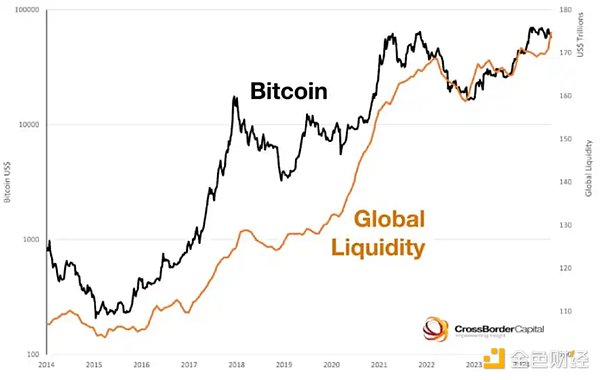

Macro liquidity: volatility is inevitable, and the degree of QE is the determining factor

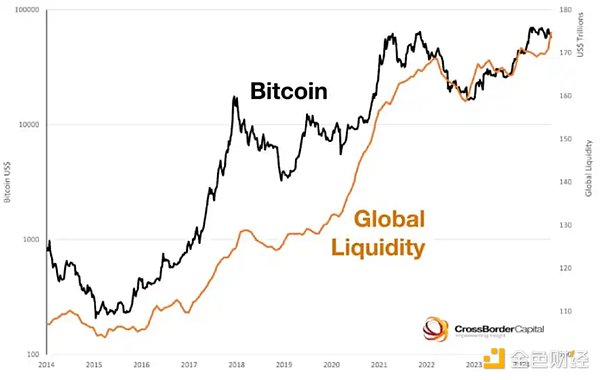

When the Fed cuts interest rates and global capital liquidity increases significantly, it is often a period when the price of Bitcoin (BTC) continues to rise, indicating that macro liquidity still has a decisive impact on the crypto market.

In 2020, the Trump administration launched an unlimited quantitative easing (QE) policy in response to the COVID-19 pandemic, injecting a large amount of funds into the crypto market. On March 15, 2020, the Federal Reserve lowered the target range of the federal funds rate by 1 percentage point to between 0% and 0.25%, and launched a quantitative easing program with a total amount of US$700 billion. Subsequently, the Federal Reserve further announced the cancellation of the QE limit, purchased assets according to "actual needs", and launched unlimited QE, which brought great liquidity to the crypto market.

On October 21, 2024, Trump reiterated at an event at Lancaster City Hall in Pennsylvania that if he is re-elected president on November 5, he will significantly reduce U.S. interest rates. This promise may once again drive up crypto assets such as Bitcoin, especially against the backdrop of further enhanced liquidity.

How the election affects crypto startups

Web3 prediction markets achieve absolute superiority over Web2 competitors

Since its launch in 2020, Polymarket has quickly risen to become a leader in this field, accounting for 80% of the total betting volume in the US presidential election. It is rare for applications created by Polymarket in an on-chain environment to compete in existing markets and have the highest market share. Polymarket allows users to predict and bet on the results of future events in multiple fields such as sports, politics, business, and science. The platform first gained significant attention during the 2021 US election, facilitating 91% of the total betting volume, worth $3.5 million.

Polymarket has gone through a number of challenges, including a $1.4 million civil penalty agreement with the U.S. Commodity Futures Trading Commission (CFTC), after which Polymarket no longer officially operates in the U.S., and U.S. users are blocked from the site by geo-fencing. Still, CFTC Chairman Rostin Behnam warned that if they have a large enough "footprint" in the U.S., they should register their derivatives contracts or risk enforcement action.

Prediction markets are gradually becoming a broader financial tool that goes beyond pure speculation. As Polymarket expands, their influence has expanded to multiple areas such as public opinion, financial hedging, and business decision-making.

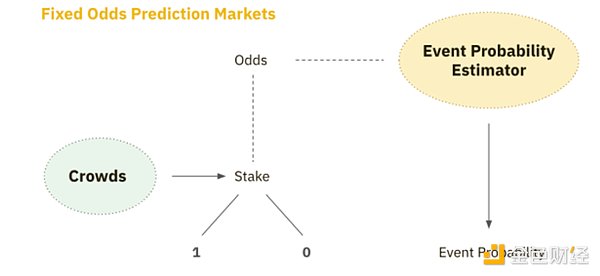

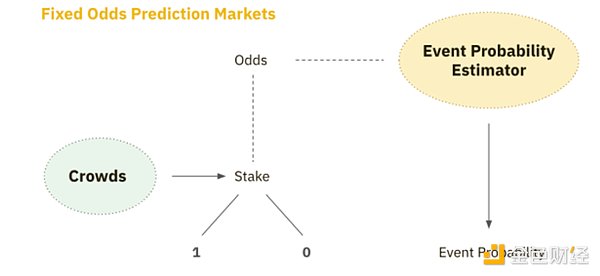

How prediction markets work

Prediction markets are a type of derivatives market where participants bet on the outcome of an event. These markets are usually binary options, for example, assuming this is a binary market, "whether to approve a Bitcoin spot ETF" can be decided with "yes" or "no". The price distribution of "yes" or "no" is determined by the predictions and bets of market participants, which add up to $1, or slightly more than $1.

On the expiration date when the outcome of the event is revealed, the value of the stock converges to $0 or $1. The position of the participant who predicted successfully becomes $1, and the position of the participant who predicted incorrectly becomes $0, which is how profits and losses are determined.

Outside of cryptocurrencies, offshore centralized providers often limit the amount of bets on specific outcomes, similar to sports betting. This limits individuals from fully leveraging their insights, and the final results are often controlled by centralized operators. On-chain prediction markets eliminate these barriers, and smart contracts and decentralized ledgers create transparent global markets that ensure that the platform is fair and cannot be cheated.

Polymarket's order book is a hybrid decentralized model. Orders submitted by users are sent to Polymarket's operators, who match and place orders off-chain. The underlying trading system is a customized trading contract that performs atomic swaps (settlement) between binary outcome tokens and collateral assets (ERC20) based on signed limit orders.

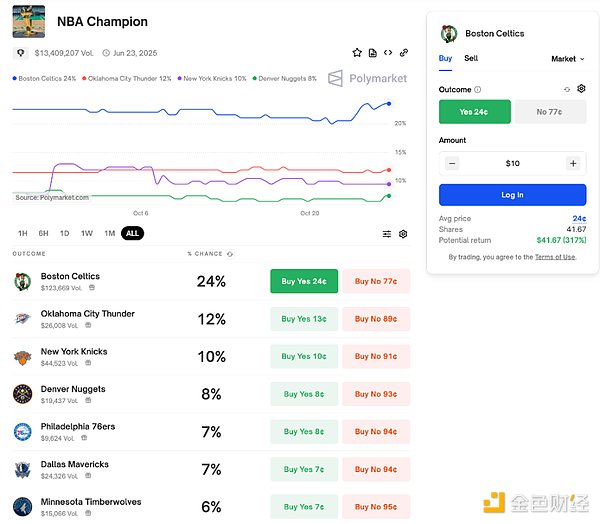

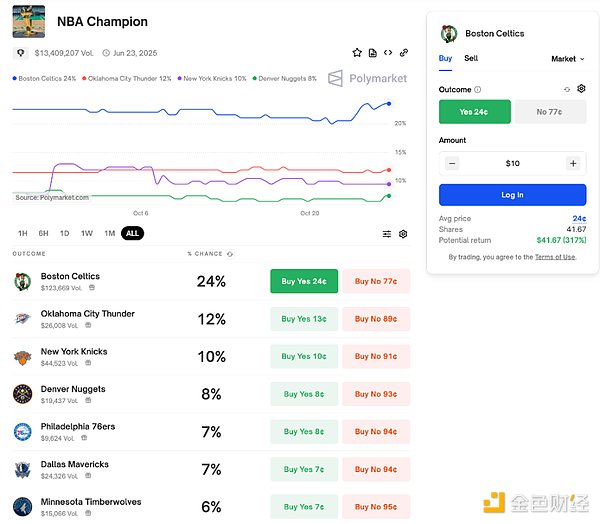

In addition to the binary markets shown in the example above, Polymarket also offers classified markets and scalar markets. Classified markets allow users to bet on multiple options, each of which is ultimately worth $1 or $0, depending on the outcome. For example, the market predicts that the 2025 NBA champion may include options such as the Celtics, Thunder, Knicks, and Nuggets. Since the regular season has just started and everything is uncertain, users can choose to bet on multiple teams at the same time. Scalar markets operate differently from the above two types of markets. Their profitability and settlement depend on the position of the final result within a predetermined range.

Product iteration of prediction markets

Augur is one of the earliest blockchain prediction markets. Its trading volume in 2018 reached $400,000. Considering the on-chain activity at the time, this number is quite high, which fully demonstrates the market demand for on-chain prediction markets, but due to complex mechanisms and malicious attacks, it failed to maintain a long-term user base.

Unlike Polymarket, in Augur, anyone can create a market by staking REP (Augur's governance token). According to Augur's mechanism, if there is an error in the components that constitute the market (market definition, market expiration time, market decision conditions) when the market is created, the market will fail. Then the attacker can create a market with errors and use this mechanism to deliberately make the market fail and make a profit. At the same time, Augur's permissionless creation of any market has also caused some highly controversial events, such as the creation of a market for "when a certain singer will die."

In order to focus on attracting users in the initial process of building an application, Polymarket will centralize the creation of the market internally, provide a market that is easy for users to understand as much as possible, and plan a market strategy that is free of moral controversy and useful to society to ensure a stable initial user base, and select a small number of centralized strategies to ensure the smooth introduction of initial users, as long as transparency and traceability are ensured in the core trading links.

Prediction market breaks the circle and enters the mainstream society

According to the efficient market hypothesis, asset prices in the capital market quickly and completely reflect all information available to market participants. Based on this, the prediction market is always effective, so it has the potential to solve incorrect predictions, that is, market inefficiency, and achieve accurate predictions.

Polymarket founder pointed out that Polymarket was launched in response to the widespread errors and misinformation during the pandemic. In fact, Polymarket has also realized the significance of transforming the speculative demand of market participants into a tool for collecting public opinion. It captured the prediction that Kamala Harris is likely to be nominated as the Democratic candidate and J.D. Vance will be selected as Trump's vice presidential candidate before the official announcement. It has been widely adopted by multiple mainstream media (even mainstream media in mainland China that are not friendly to encryption) as an alternative source of news. The widely purchased and used Bloomberg trading terminal even began to add Polymarket data to its panel in August 2024.

Polymarket is also integrating with content platforms. On July 30, Substack, a well-known content subscription payment platform, announced the launch of the prediction market embedding function from Polymarket, marking the launch of its new Substack THE ORACLE by Polymarket. In The Oracle, readers will find insights and analysis from thousands of active markets on the Polymarket trading platform. Polymarket's The Oracle will regularly summarize some noteworthy markets and their key statistics, and conduct in-depth analysis of some of the hottest issues at the moment.

Prediction market future development direction

Currently, Backpack Exchange has launched a prediction token for the US election, SynFutures and dYdX have launched leveraged trading related to the US election, and introduced advanced order functions (such as limit orders and stop-loss orders) to help users manage risks. This leveraged trading allows users to leverage larger positions with smaller initial funds and amplify potential profits. dYdX is more focused on Trump's perpetual prediction trading, allowing traders to participate in the market through long or short positions and use up to 20 times leverage. This flexible trading structure allows users to take advantage of every fluctuation in the market and even obtain high returns in the short term.

In general, the combination of leveraged trading and prediction markets is currently more complicated for ordinary users to understand and operate, and is more suitable for professional traders.

Trump's victory means that cryptocurrency companies will be encouraged to incubate and list in the United States

Under the leadership of the Trump administration, there will be a clearer regulatory framework and a relaxed regulatory environment, which will greatly change the current situation where a large number of crypto companies flee the United States and block US IP. At the same time, according to Bloomberg, a number of crypto-related companies such as Circle Internet Financial, Kraken, Fireblocks, Chainalysis and eToro may be listed in the next one or two years, and some other crypto companies that meet the requirements are also expected to go to the normal listing process.

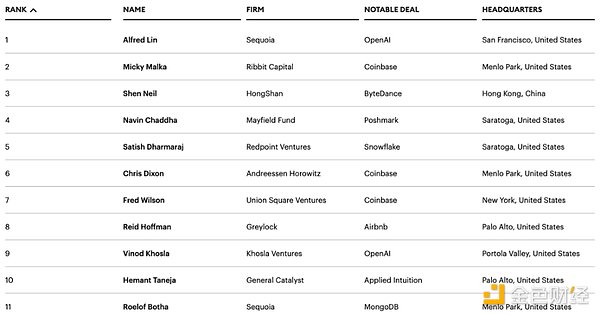

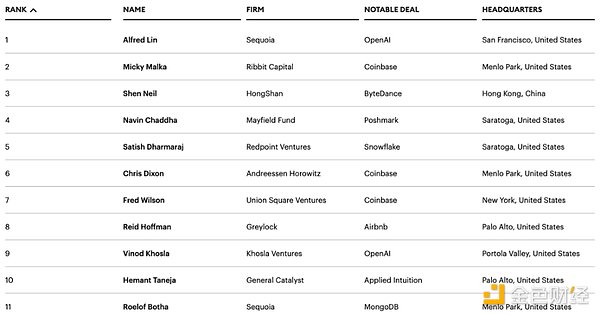

Looking back at Biden's administration, the tough regulatory attitude of the current SEC Chairman Gary Gensler has led to a small number of cryptocurrency IPOs in recent years, which has directly led to the difficulty of crypto companies to obtain financing from mainstream traditional funds. You know, the huge wealth effect of Coinbase's listing in 2021 has attracted a large number of traditional funds to open crypto departments. However, in the 2024 Forbes MidasList, the only crypto project is Coinbase.

DeFi and BTCFi will benefit first

Although Trump's own DeFi project World Liberty Financial's token WLFI only sold 4.3% and was accused of lacking practicality, it still showed its interest in the field of decentralized finance (DeFi).

In DeFi, BTCFi is easier to gather consensus, gain legitimacy, and has a more solid foundation, and its development is certain.

BTC is currently the largest consensus common denominator between the crypto industry, Wall Street and the SEC. The core of BTCFi is to leverage BTC-staking, lending, trading, and derivatives are all different forms of leverage. Over time, BTCFi will show a growth trend that multiplies the value of BTC itself, similar to the performance of other major asset classes. However, this development requires a long period of favorable external environment. If Trump wins in future elections, this process may be accelerated.

Crypto companies that develop BTC financial instruments can be encouraged and receive a more relaxed regulatory environment to consolidate their position as underlying assets. On the other hand, BTCFi's innovation will be led by developers, promoting a series of breakthrough applications based on Bitcoin programmability, such as the Bitcoin upgrade in 2025, as another upgrade since the taproot upgrade in 2021, which is expected to pass OP_CAT. As long as OP_CAT can pass, developers will be able to use Bitcoin native high-level programming languages such as sCrypt to achieve decentralized and transparent smart contract development on the Bitcoin mainnet. sCrypt is a TypeScript framework for writing smart contracts on Bitcoin, which allows developers to write smart contracts directly in TypeScript, one of the most popular high-level programming languages. The current Bitcoin layer2 can also be converted to zk rollup, and the total scale of BTCFi is expected to be more than ten times the current market value of BTC.

At present, many projects have been discussing the use of sCrypt for development around OP_CAT. For example, Fractal Bitcoin, as a Bitcoin parallel chain, has supported OP_CAT and launched the CAT protocol. Currently, the re-pledge project Babylon and the stablecoin lending project Shell Finance, which are currently developed using the Bitcoin script language, have the idea of conducting related development after OP_CAT is launched, to achieve complete decentralization and more complex on-chain functions, relying on Bitcoin consensus to fully guarantee security.

Joy

Joy