Author: Brandon Kae, Ivan Wu Source: theblock Translation: Shan Ouba, Golden Finance

The non-fungible token market continued to be turbulent in 2024, with trading volume reaching $300 million in June, a far cry from the high of $867 million in January. The decline reflects broader market trends, with NFTs feeling the pressure as one of the more speculative assets in the crypto ecosystem.

Despite the overall economic downturn, the battle for market dominance has heated up again, giving us a glimpse into the evolution of trader preferences and platform strategies.

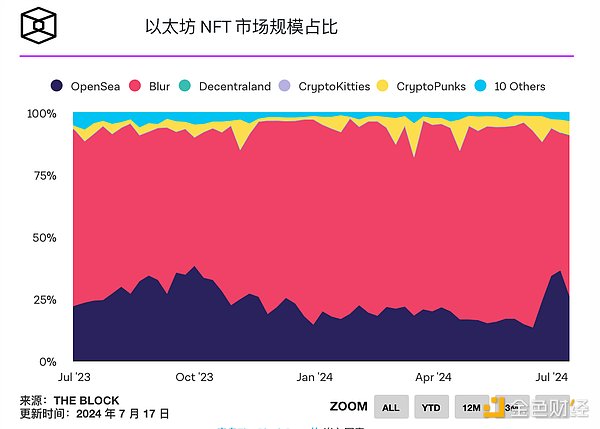

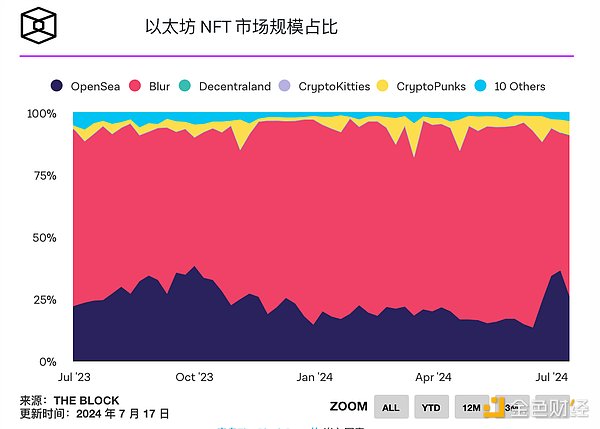

Blur has long been the undisputed volume leader, consistently accounting for 60% to 80% of the market share this year. The platform's success can be attributed to several factors.

BLUR tokens:This provides trading incentives and gives users a stake in the platform’s success, fostering a loyal community.

Enabling NFT “order books”:This feature introduces more advanced trading tools for NFT trading, allowing for more efficient price discovery and deeper liquidity.

Meanwhile, OpenSea, once the undisputed leader in the space, is showing signs of a possible comeback. Its market share has surged to 37.34% from a low of 13.19%, showing that the platform’s established brand and user base still have huge appeal.

Although OpenSea has not yet launched its own token, it has still achieved a recovery, which may trigger speculation that OpenSea will abandon its own token.

However, the current state of the NFT market still shows that users' preferences are clear. Traders are increasingly inclined to platforms that provide more than just basic buying and selling functions.

The success of the Blur order book system shows the demand for more complex trading tools in the NFT field, which may blur the line between NFT and traditional asset trading.

However, OpenSea’s resilience shows that factors such as user experience, brand recognition, and established networks still play a crucial role.

As we head into the second half of 2024, the battle for the NFT market continues to evolve. While Blur has the upper hand, OpenSea’s recent gains suggest the game is far from over. Traders and investors will be watching closely to see how these platforms innovate to grab market share in an increasingly competitive environment.

JinseFinance

JinseFinance