Note: The Bitcoin2024 conference held in Nashville, Tennessee, USA not long ago has received great attention from the crypto community, especially the speeches of Trump and Snowden. However, according to feedback from participants, the speech of MicroStrategy CEO Michael Saylor was also very exciting, but it was ignored by the Chinese crypto community. In order to fill the information gap of the Chinese crypto community, Golden Finance 0xjs specially compiled Michael Saylo's speech. The following is the full text:

It's great to have a group of Bitcoin enthusiasts gathered together. I am very happy to come to Nashville, a city famous for music and freedom. I am honored to speak after Senator Hagerty.

Today I decided to use slides. Those who have seen my speech know that some speeches use slides and some do not. I got a lot of good comments about using slides, so I thought the best way to improve this talk would be to use more slides.

Bitcoin Revolution: Rebuilding the Global Economy with Digital Capital

I want to talk about the Bitcoin Revolution, and I also want to talk about rebuilding our global economy with digital capital.

The world we know is based on 20th century ideas and technology. Stock trading runs from 9:30 in the morning to 4:00 in the afternoon. There is no trading on bank holidays and weekends. Everything is slow and everything is expensive.

If we want to prosper in the 21st century, we need new ideas and new approaches based on new technologies.

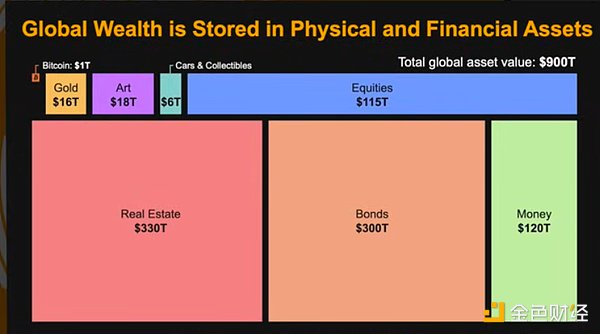

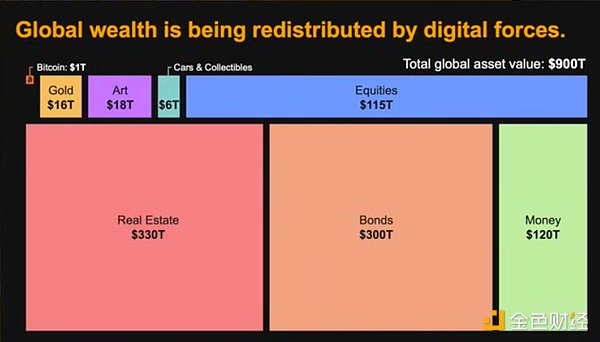

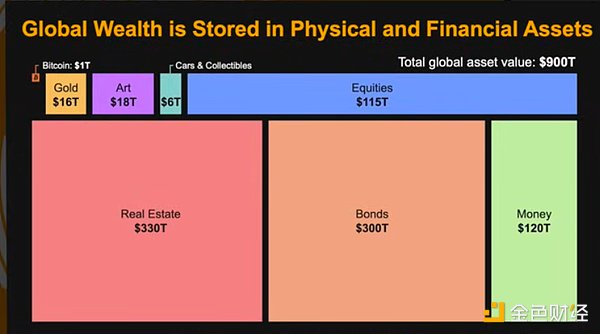

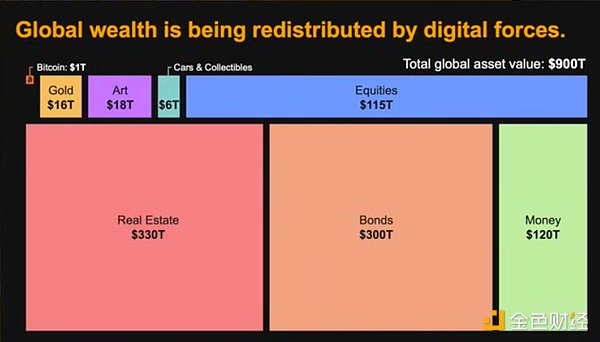

You've seen this chart before, $900 trillion in global wealth. It's spread out across physical assets and financial assets, both 20th century ideas and technologies. There's a little orange dot in the upper left corner, that's the orange asset we call Bitcoin, it's $1 trillion. If you start from zero, that seems like a lot, but when you put it in the larger context of the world, it's only 0.1%. Here's another way to look at the same chart. It's not $900 trillion in assets, it's a bunch of assets that are used as utility value and a bunch of long-term capital assets that are a store of value.

When I buy a house, I want to live in it; but when I buy a bond, I just put my money there because I don't know where to put it.

When you start looking at the world as a huge long-term capital, over $450 trillion or more of capital, and you start thinking about how we store that capital, you see the engine of revolution.

The global economy struggles because we rely on imperfect assets and systems to store that capital, and it is undermining our capital preservation.

How can we design a better system?

The Physics of Money

This is Tesla. He has a quote that says, "If you want to understand the universe, think in terms of energy, frequency and vibration."

I translate this as "The Physics of Money."

Energy is money or capital or wealth. You can use them interchangeably in this talk.

Frequency is about duration or life cycle, how long? A minute, an hour, a year, a century.

Every time we trade with each other or transfer from one place to another or convert one property into another asset, we vibrate money.

This is an important equation, The useful life is equal to the value of the asset divided by the cost of maintaining that asset.

If you are looking for ways to maintain a financial asset, then the way to calculate its useful life is to ask how much money do I need to spend each year to keep the asset in good condition. How much do I need to spend to avoid the asset from depreciating or decaying? This useful life is very close to the stock-to-flow ratio that we know in the Bitcoin community, and they are very similar in terms of years.

Many individuals and most companies use financial assets to preserve capital. This is the root of our challenge.

Financial Assets

Let's talk about financial assets. I want to preserve my money for the long term, starting with $1 billion.

Put it in an Argentine Peso, in two years the money will be worthless, 98% inflation will rob you of your economic energy or capital, it's not a good long term asset.

Turkish Lira, your capital will last three years.

The dollar might last 14 years with traditional monetary inflation over the past century, but it's not like you have 14 years, the life force of those years will be sucked out linearly.

Put it in a hedge fund, the management fee is 2% per year, then there's a 20% increase, about 4% per year in costs. If you invest in ordinary assets, that means it's a 25 year asset.

Treasuries, you'll get a yield, but a 3.5% after tax yield vs 7% monetary inflation, your money might last 30 years.

Invest in a mutual fund and you’ll pay 1% in fees, which is the best you can get. If you buy a diversified portfolio for 10 basis points, counterparty risk will cost you 1%.

These are your financial assets, we run the world on 20th century ideas and technology, and on average, financial assets last 30 years.

We all know that inflation dilutes the value of financial assets, but inflation is just the tip of the iceberg.

You are also diluted by tariffs, tolls, lawsuits and transfer taxes, we have all kinds of taxes: income taxes, capital gains taxes, every time you vibrate and move money, you are destroyed by taxes.

If taxes don't break you, and lawsuits don't break you, you have weather, competition, obsolescence and political disasters that will dilute the value of your capital.

If you want to maintain economic energy, you have to fight these frictions. Most people realize that this is a frustrating task and a task that cannot be won, so they give up financial assets and start turning to physical assets to preserve capital.

Physical assets

A Ferrari among physical assets is not a good way to keep your money for a long time, because after 5 years you will spend as much on insurance and maintenance as it will depreciate.

A yacht is not much better than a Ferrari, if you spend 10% of your money every year to operate it, you will still be hit by depreciation, don't store your money in a yacht.

A house in Miami Beach, if you buy a $10 million house, you better be able to come up with $10 million to maintain the house for 17 years, then you have no money.

Silver, 22 years;

Warehouse, 40 years;

Gold bars, 62 years;

A painting, 72 years;

Land, the average property tax in the United States is 1.1%, which means your money will last 91 years, unless the government reassesses the value of your property, then it will be less than 91 years.

The oldest family farm in the United States is King Ranch, they held on for 173 years. Every other family in the United States has failed.

The longest held property is the British Crown Estate 958 years. You could say the English crown has held it since 1066, but on the other hand it went from the Plantagenets to the Stuarts, through Lancaster and York, and eventually to the Hanoverians. So there were probably seven different families that split it up, and no one family could hold it all.

So real assets you might think could last a thousand years, but in reality about 50 to 75 years is the best you can do.

Entropy is diluting the value of your real assets, it's sucking the capital energy out of them.

It’s called Earth and not Heaven for a reason, because politicians get very creative, they have city taxes, county taxes, state taxes, federal taxes, transfer taxes, property use taxes, and if those don’t knock you out, there’s rent control, price controls, or culture shock.

Then there’s competition, you can get discriminated against, there’s recessions, currency crashes, tenants don’t pay, someone slips on the front sidewalk and sues you, there’s weather, wars, crime, and disasters. If energy prices skyrocket, you’ll have a hard time staying afloat.

Physical capital is not an easy solution.

Digital Capital: Bitcoin

The three laws of thermodynamics that I learned at MIT are: you can't win it, you can't break it, and you can't quit it.

You can stop here and feel a little frustrated, but we don't want to lose, so you start thinking, if we find a way to quit the game, then we can tie, then you can win.

Satoshi Nakamoto found a way, and he created Bitcoin.

Bitcoin is digital capital, and that's what he created.

Bitcoin is immortal, immutable, and immaterial capital.

I use it here in the sense that it has an infinite lifespan, it is immune to the attacks of weather, entropy, and inflation. It is immaterial because it is not in the physical world and is not subject to all those terrible problems of finance and physical assets.

It is the solution to our economic difficulties, the process of transforming from financial and physical assets to digital assets solves the problems we face.

How long is the life of Bitcoin?

Putting your Bitcoin with an institutional grade custodian and paying 10 basis points in fees means your asset will last a thousand years. The custodian may not last a thousand years, but that doesn't matter because you can move your Bitcoin every year or every ten years, you can stay one step ahead. You can't teleport a building, you can't teleport King Ranch, so Bitcoin is an asset you can move.

You can self-custody your Bitcoin for a cost of one basis point per year, assuming you buy good hardware wallets and signing devices, and spend a day tracking it every year, now you have an asset that lasts ten thousand years.

If you give Bitcoin to an AI or a computer program that can maintain those private keys at the cost of electricity, you have a 100,000 year asset. The AI will want Bitcoin. If they have a choice between owning Bitcoin, owning a ranch in Texas, owning a gold bar, or owning an Argentinian peso, it's obvious what they would choose.

You can see why they would want Bitcoin.

Digital assets are a unique class in terms of capital preservation. When you compare them to all the other assets for capital preservation, they are extraordinary.

The lifespan of other assets is 30, 40, 50 years, while the lifespan of digital assets is 1,000 to 100,000 years.

This is a breakthrough in capital preservation, which makes it a revolution in economics.

The Great Trades in History

If you want to be rich, trade smartly.

It's a very simple principle:

Exchange something temporary for something permanent. Trade your (soon-to-melt) ice cream for pesos, trade pesos for dollars, trade dollars for land, and trade land for bitcoin.

Trade money for capital;

Trade fragile things for resilient things;

Trade local things for global things;

Trade physical things for digital things;

Trade securities for commodities;

Trade commodities for scarce assets.

Go in this direction and you can’t go wrong.

Now let's talk about some of the great deals in history, some of the trillion dollar deals.

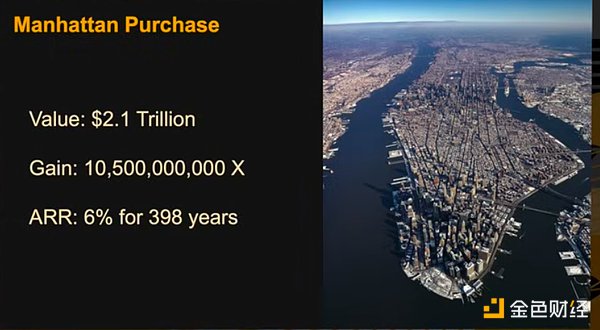

The Dutch understood naval power, they understood ships, they had thousands of them. They bought the best port in the New World (New York) for a few hundred dollars of plastic and textile trinkets.

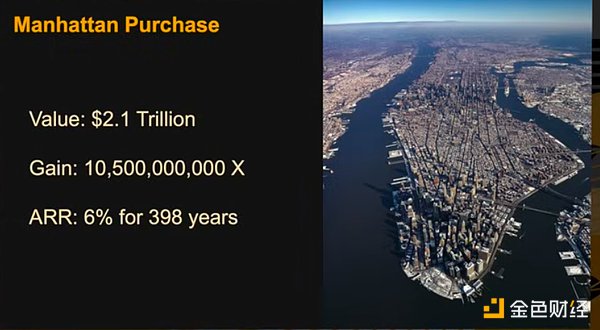

Now this port is worth $2.5 trillion. It is an investment that has grown at a 6% return rate for 398 consecutive years, a return rate of 1.05 billion times.

If you think about it, you would ask, Why would anyone trade the best American port for a bunch of textiles and plastics and glass products? The people who sold Manhattan did not understand the importance of naval power.

If you don't understand the reason for owning a certain property, you won't value it.

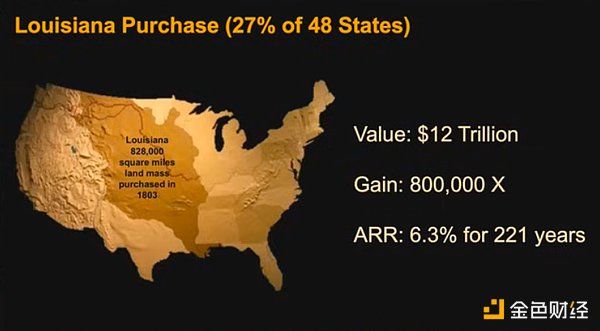

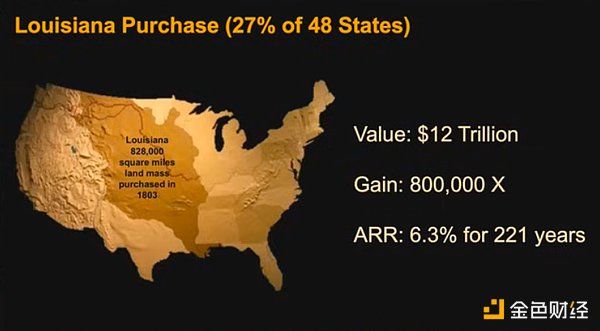

Napoleon wanted to run around in the Old World, while Jefferson wanted to expand in the New World. So France sold Louisiana to the United States for $15 million in 1803.

The $15 million was probably only enough to sustain the French army for a few months, and then it was gone. Jefferson got 27% of the US territory.

This was a deal with a return rate of 800,000 times, now worth $12 trillion or more, and its value will continue to grow.

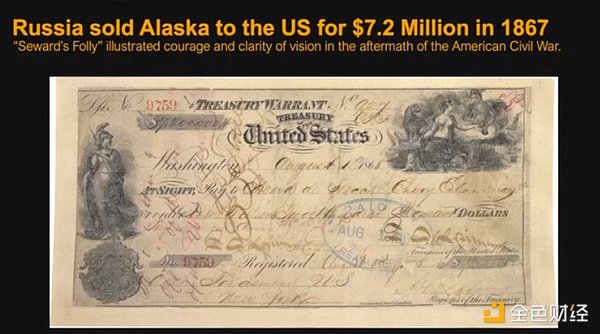

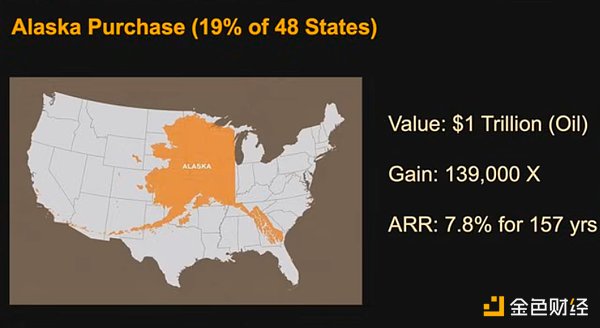

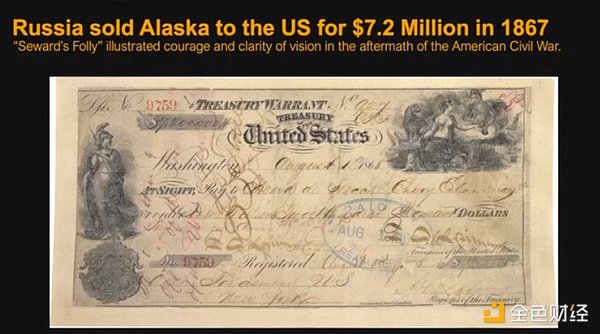

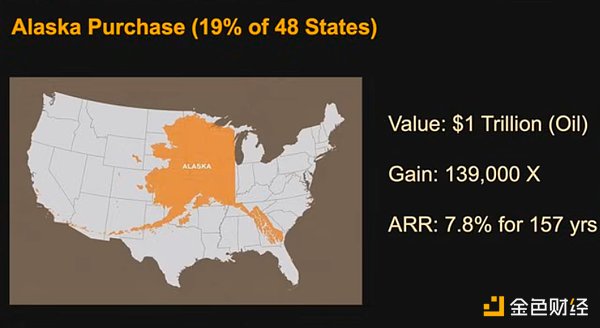

Jefferson had a vision, just like this Seward. Two years after the Civil War, he bought Alaska for $7 million.

At the time, Rockefeller was starting an oil company. Now there is trillions of dollars worth of oil under the ground in Alaska. This is a huge return from a single contract.

Bitcoin total value forecast

What is the value of digital capital?

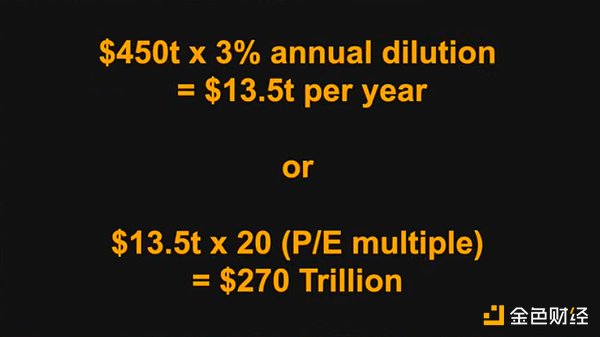

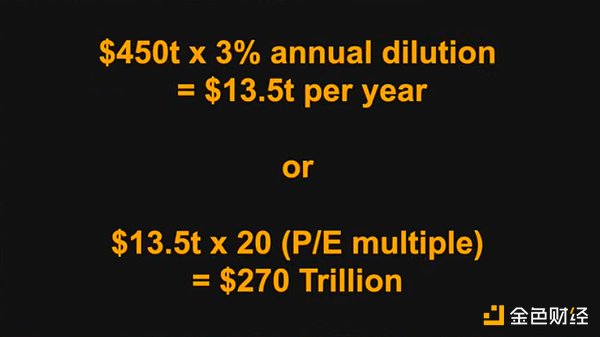

Assuming global wealth is $450 trillion, multiply that by a 3% inflation cost, that means $1.35 trillion per year is needed to combat all these financial problems.

If you value it like a company or a long-term bond, and give it a 20x P/E, it's worth $270 trillion.

So the annual return value of digital capital is between 10 and 15 trillion US dollars, and the total value is hundreds of trillions of dollars.

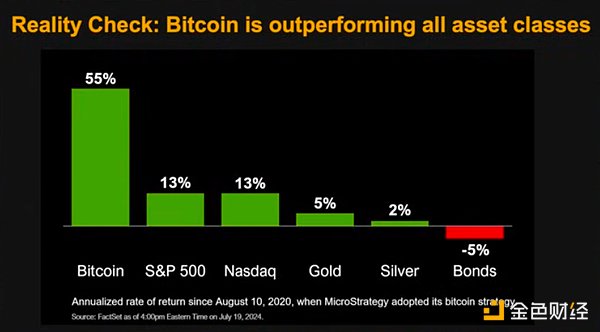

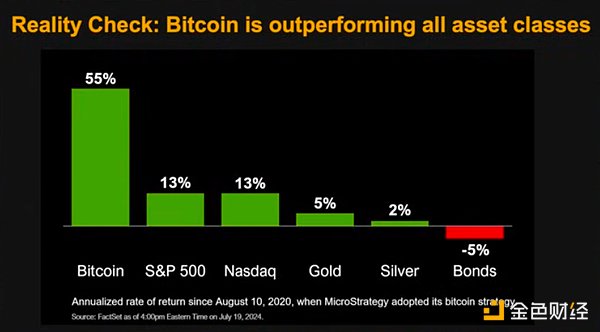

In fact, digital capital has an annual return rate of 55% in the past four years, while financial capital (the best capital in the world) is bonds, which has an annual return rate of -5%.

Imagine capitalizing your company or country with a -5% return instead of +55%, clearly digital capital is working.

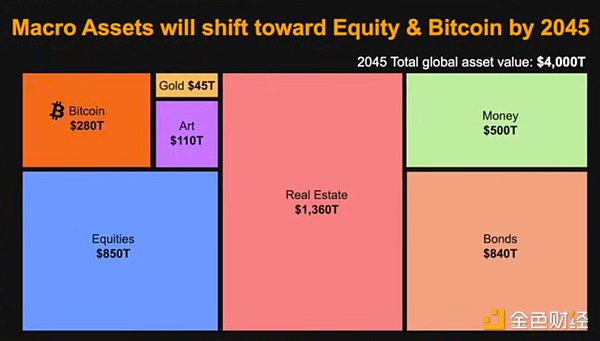

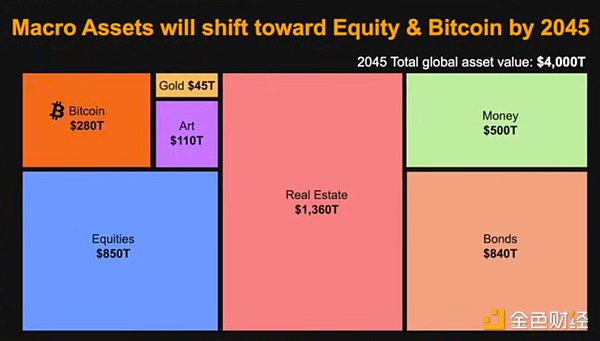

Now back to my "Global Wealth" chart, we can look at it like this, and see the little Bitcoin in the upper left corner. What happens?

Bitcoin Price Prediction

This is my Bitcoin prediction, the price of Bitcoin from 21 years to 2045.

What is my prediction? I think the annual return rate will gradually decline from 55% to 50%, 45%, 40%, 35%, 30%, 25%, 20%, and finally stabilize at about 20%, which is about twice as fast as the growth rate of the S&P index.

At this rate, by 2045, the price of Bitcoin will reach $13 million per coin in the baseline case, and at that time, Bitcoin will account for 7% of global assets. The bear case prediction might be $3 million, and the bull case prediction might be $49 million.

So what about other assets? I actually think AI and technology is going to revolutionize the tech industry. There weren't trillion dollar companies before, and then we had some trillion dollar companies. You're going to see more of that because there will be companies with 100,000 AIs and no employees, and they're going to do the work that used to take 100,000 employees. You're going to see large companies develop, like robot transportation, self-driving cars, and a company that can provide a billion people with a personal doctor without having a doctor on staff. So obviously equity is going to grow fast, gold is going to be demonetized, and land is going to be less demonetized.

But the future won’t look that revolutionary in 2045, it will look pretty much the same as it does today. It’s just that Bitcoin has become obvious on the charts. When Bitcoin becomes obvious, that will be the baseline scenario.

Your Personal Bitcoin Strategy

Let’s talk about personal Bitcoin strategy.

What should you do?

Make Bitcoin your main reserve asset,

Convert your surplus into Bitcoin,

Take advantage of low-interest loans, if the government will lend you money, borrow money to buy Bitcoin,

Find a tax-efficient way to invest in Bitcoin.

What shouldn't you do?

Don't quit your day job,

Don't lose your focus on Bitcoin,

Don't use margin loans and leveraged trading, otherwise you may be liquidated while sleeping on a Saturday night, which is not good. A 30-year government-backed loan at 3% is good, while 10x leverage overnight is not good.

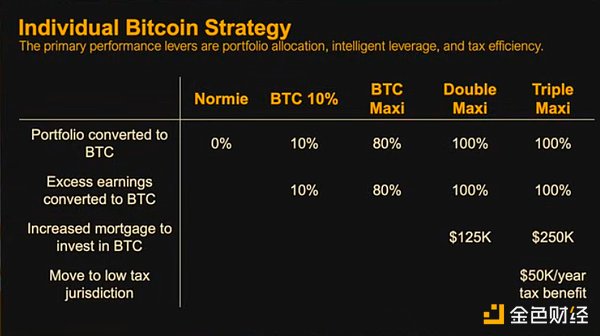

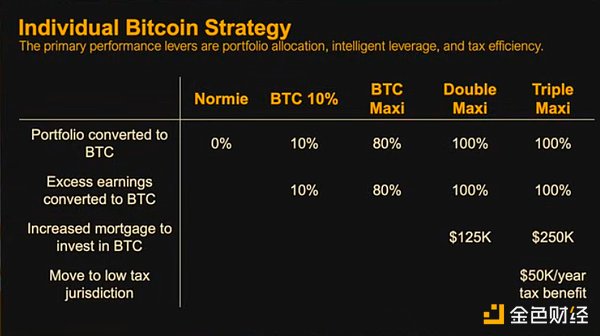

What about a typical person? We modeled a person.

What about a typical person? We modeled a person.

Assume you have a net worth of $750,000, an income of $200,000 per year, growing at 5% per year, a savings rate of 25%, and can invest $50,000 per year.

There are many strategies:

You can be a regular person and adopt a diversified portfolio strategy;

You can be a 10%er and put 10% of your assets in Bitcoin;

You can be a Bitcoin maximalist and put 80% of your assets and income in Bitcoin;

You can be a double maximalist, in which case you actually mortgage your house and borrow an additional $250,000;

A triple maximalist would finance the purchase of Bitcoin with your house, convert all your assets into Bitcoin, and then move to a low-tax area like Singapore or the UAE to invest an additional $50,000 in Bitcoin.

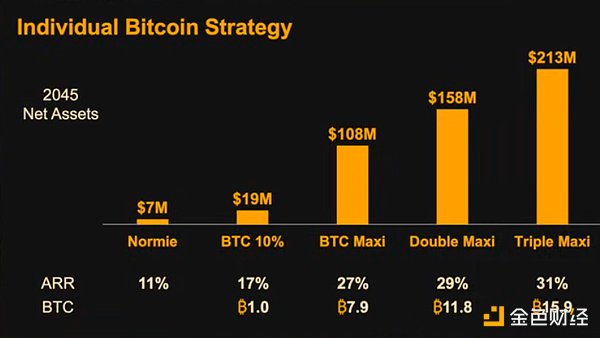

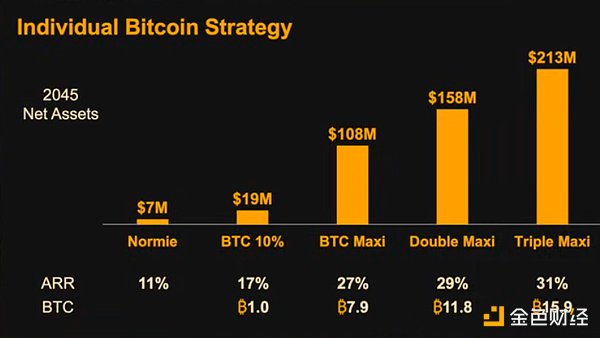

What is the result? Here are the results:

The average person will have $7 million in assets in 21 years, 10% will have more than double that, a Bitcoin maximalist will have $100 million, a double maximalist will have $150 million, and a triple maximalist will have $214 million.

The average person will have $7 million in assets in 21 years, 10% will have more than double that, a Bitcoin maximalist will have $100 million, a double maximalist will have $150 million, and a triple maximalist will have $214 million.

You can see the power of leverage, the choice is in your hands. You can also see that it takes 15.9 bitcoins to become a triple maximalist. 6.25 bitcoins will make you wealthy.

The company's Bitcoin strategy

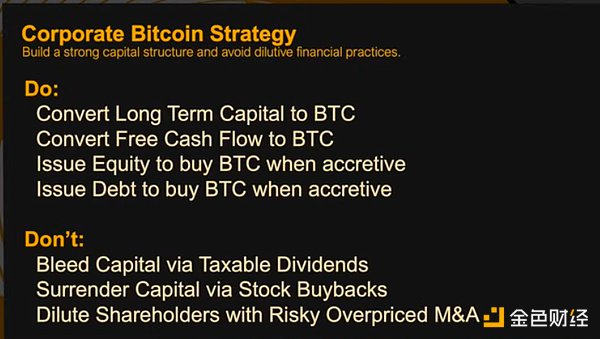

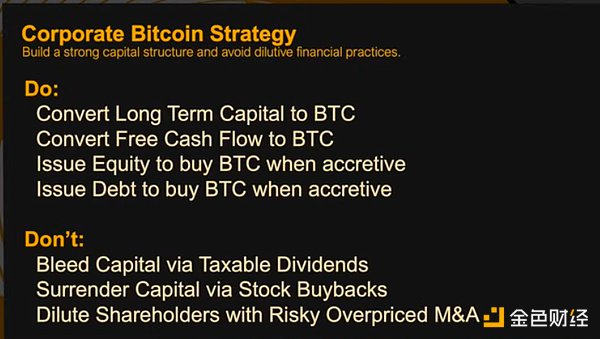

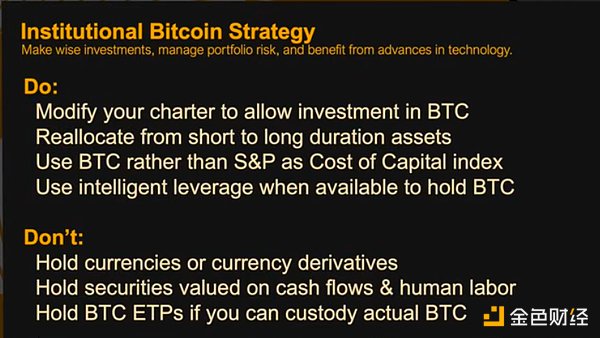

Let's talk about what the company should do:

Convert your capital into Bitcoin,

Convert your cash flow into Bitcoin,

When stock prices are overvalued, issue stocks to buy Bitcoin,

When debt interest rates are low, issue debt to buy Bitcoin.

Don’t use taxable dividends to deplete your capital,

Don’t use stock buybacks to give away your capital,

Don’t use high-risk, high-valuation M&A activities to dilute your shareholders.

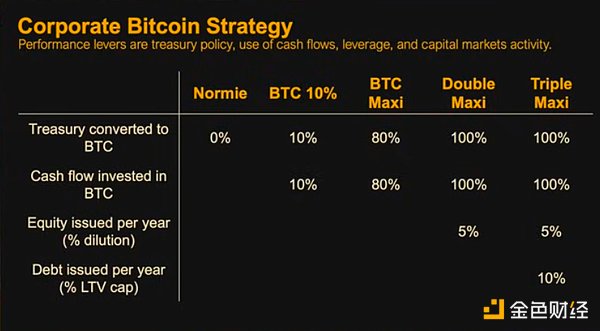

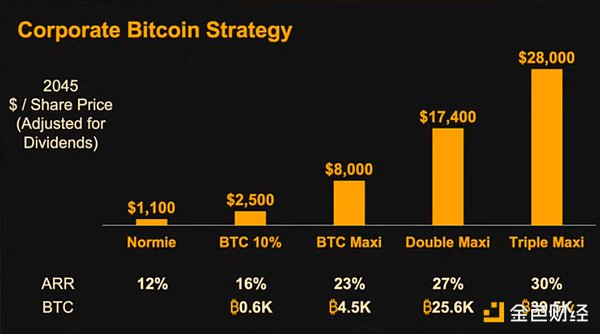

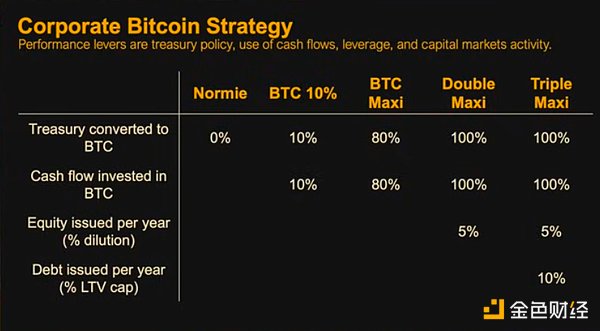

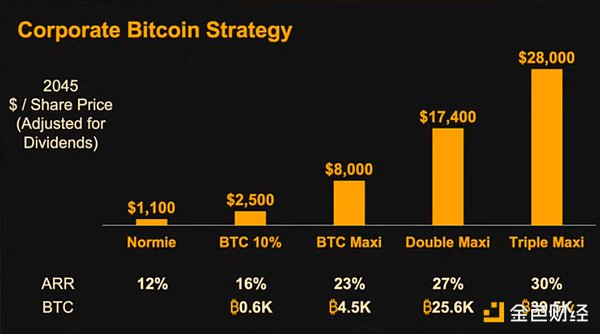

Let’s take a typical company example, with $100 million in cash flow, $1 billion in enterprise value, and a share price of $100.

What is your strategy? Normal strategy, Bitcoin maximalism strategy, double maximalism strategy or triple maximalism strategy?

The vanilla strategy would get you a $1,200 share price, but a mere 10% allocation would double it, the Bitcoin maximalist strategy would get it close to 8x, the double maximalist strategy would get it to $177,000, and the triple maximalist strategy would get it to $28,000.

What type of company do you want to run?

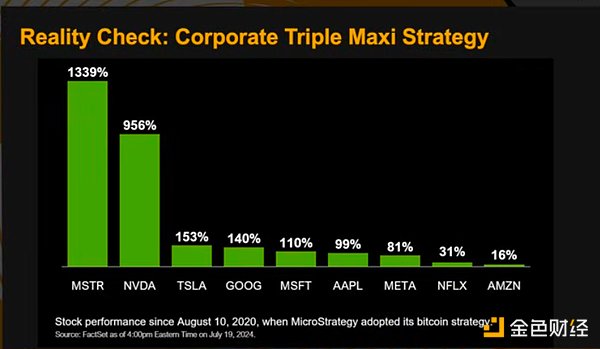

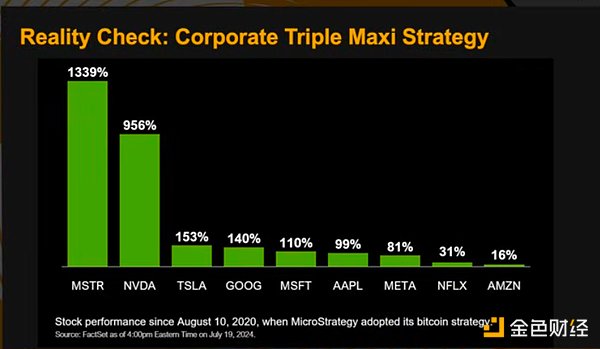

Here’s a reality check.

This is MicroStrategy, which is currently implementing the triple maximalism strategy. August 10, 2024 will be the 48th month we are on this path.

In company management, if you think you can operate like Microsoft, Apple, and Google, then congratulations, you can achieve an annual return of 20% to 25%. If you want to emulate Nvidia, you will surpass everyone. But I think that now in the boards of Microsoft, Apple, Google, and Tesla, they are anxious about emulating Nvidia.

Ironically, it is not difficult to replicate MicroStrategy's strategy. I have given you the playbook to achieve 1,300% growth in four years.

The bottom line is: build a strong capital structure and avoid dilutive financial practices.

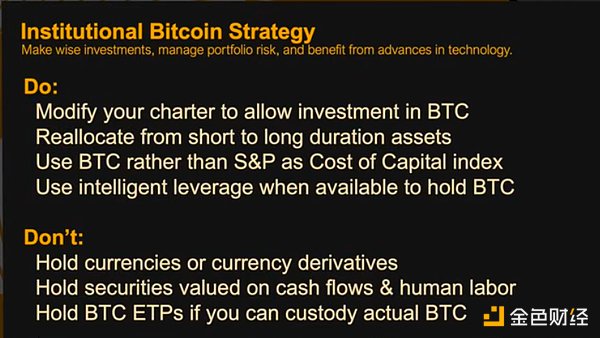

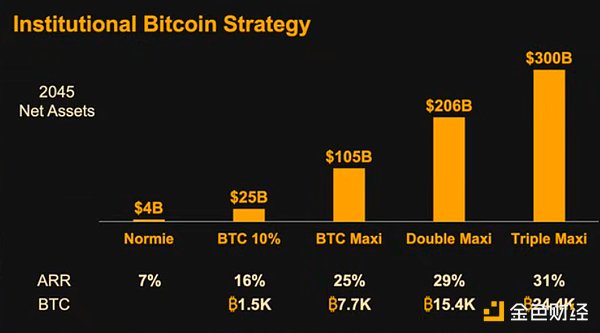

Institutional Bitcoin Strategies

If you have a church, charity, endowment fund or non-profit organization such as Harvard University, what should you do?

Modify your charter to invest in Bitcoin

Reconfigure short-term assets into long-term assets, don't invest in (soon-to-melt) ice cream or pesos, don't hold financial instruments for 20 years or physical land for 50 years

Buy millennial assets, use Bitcoin as cost of capital, not the S&P index. The annual return of the S&P index is 133%, while Bitcoin is 55%

Use Smart Leverage

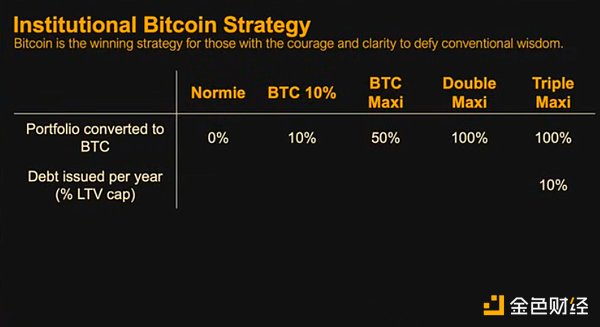

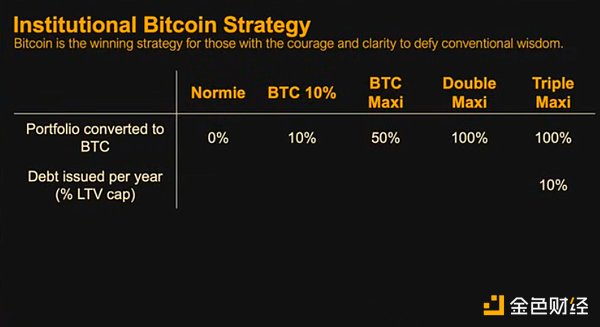

Suppose you have a $1 billion portfolio, do you want to be a regular, a Bitcoin maximalist, or a triple maximalist? A double maximalist would put 100% of his money into Bitcoin, and a triple maximalist would use 10% leverage to invest.

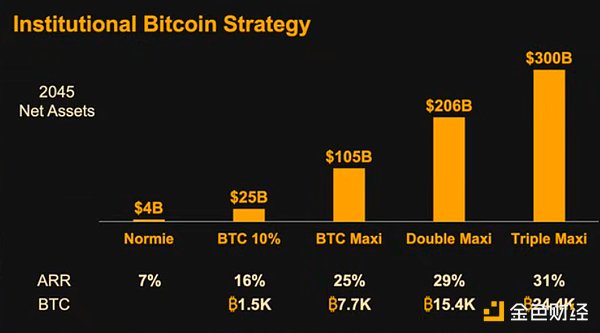

What is the final result?

If you are a normal strategy, you will have $4 billion in 21 years,

If you are a triple bitcoin maximalist, you will have $300 billion. Triple extremists will have a 100x increase.

National Bitcoin Strategy

Now let's discuss the wealth of the country, which is an interesting topic.

What are the "dos and don'ts" of the national Bitcoin strategy?

Reallocate fiscal resources from gold and bonds (which are short-term assets) to a 10,000-year asset (Bitcoin),

issue currency to buy Bitcoin,

issue debt to buy Bitcoin,

encourage Bitcoin ownership, pass favorable laws

protect self-custody for individuals and companies,

and support integration with national banking systems.

These are the things to do.

What you shouldn’t do is: don’t adopt policies that are hostile to Bitcoin and its holders. This isn’t complicated.

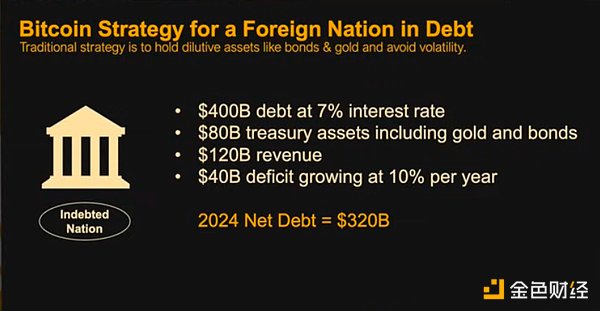

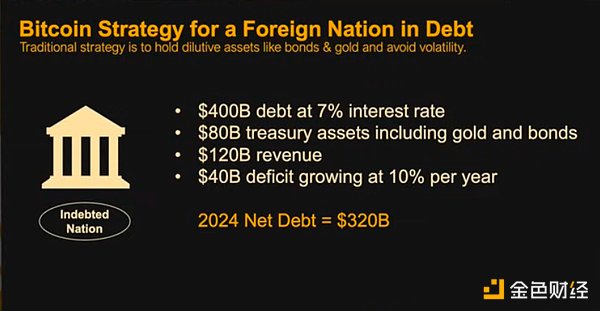

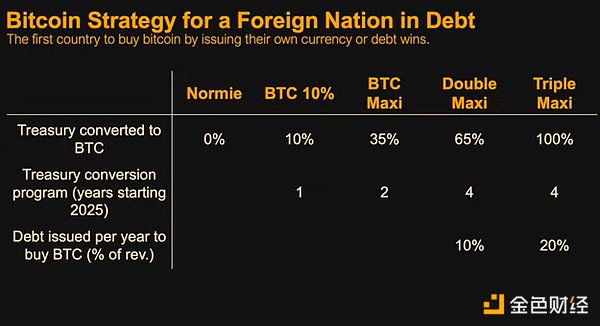

Debt Countries

Now let's say you are a heavily indebted country, you are actually in debt and you are running a deficit. I could name these countries but I won't, I'll just say you owe a lot of money and you are struggling, interest rates are high and you don't know what to do.

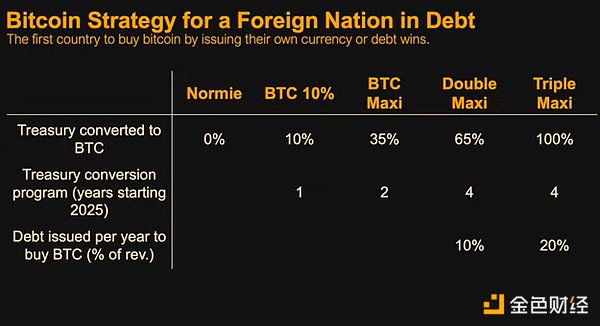

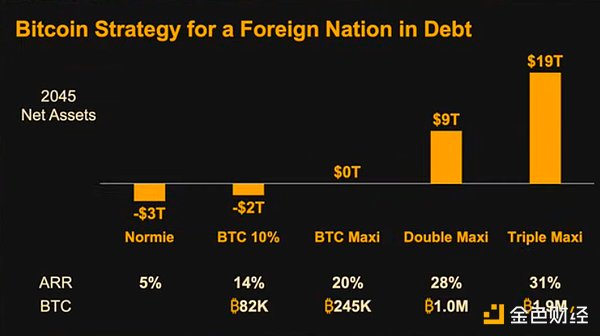

So what is your strategy? A regular strategist, a 10% strategist, a maximalist strategist, a double maximalist strategist, or a triple maximalist strategist?

The maximalist strategy is to put 35% of the finances into it; the double maximalist strategy is 65%; and the triple maximalist strategy is to put all of the finances into it and start issuing debt.

For those who can really understand, the subtext is: The first country to buy Bitcoin by issuing its own currency will win.

It's simple, you can print money. You know, two years after the American Civil War, the country is bankrupt, millions of people are dead, the South is broken, and the North is angry. This guy named Seward came up with an idea - buy a lot of frozen tundra from a bunch of Russians who want paper money.

So, even in worse situations, people have done things like this.

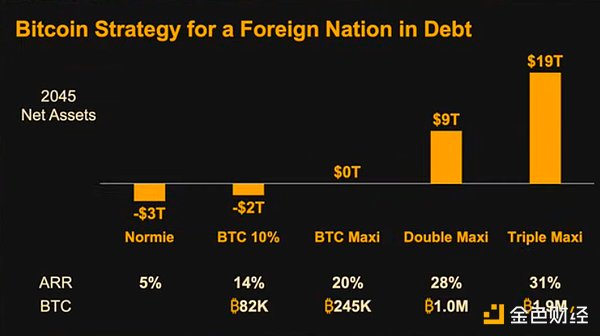

You can see that the average strategist is owing $3 trillion and you will get nothing; the maximalist strategist pays off the debt; the double maximalist strategist makes you rich; the triple maximalist strategist makes you very rich.

Why? Because you are buying an asset that everyone will fight over a hundred years later. Buying Bitcoin now is like buying Alaska in 1867. There was no Standard Oil Company, no gasoline, no cars, no diesel locomotives, nothing. We invented all these things later.

Common sense tells us that I can buy an asset the size of a country for a few dollars, so why not grab it?

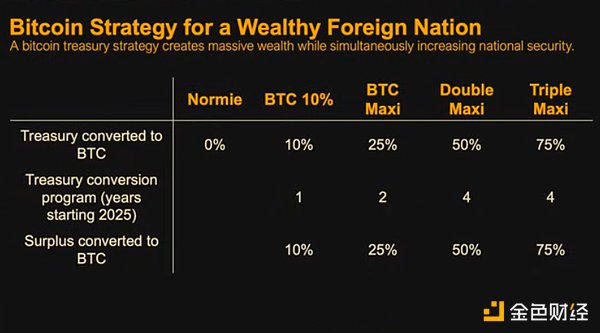

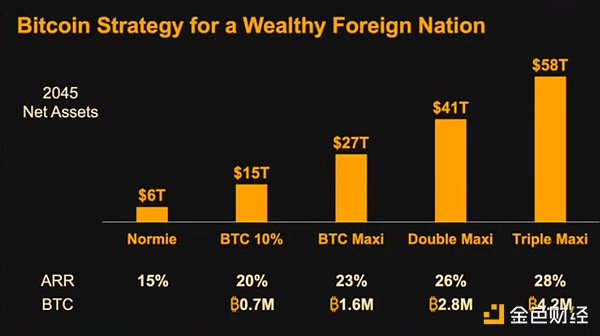

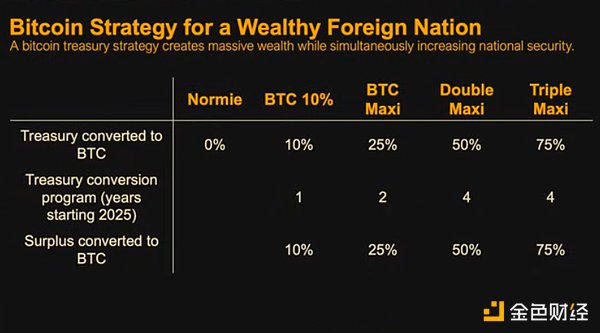

Rich countries

Now let's talk about the Bitcoin strategy of rich countries.

Suppose you have a lot of money, for example, you are Saudi Arabia, Norway, you make a lot of money, and have a net fiscal surplus of 350 billion US dollars.

So what is your strategy? Do you want to be a normal strategist, a maximalist strategist, a double maximalist strategist, or a triple maximalist strategist?

The maximalist strategist puts 25% of his money into Bitcoin; the triple maximalist strategist converts 75% of his money into Bitcoin and converts the surplus into Bitcoin.

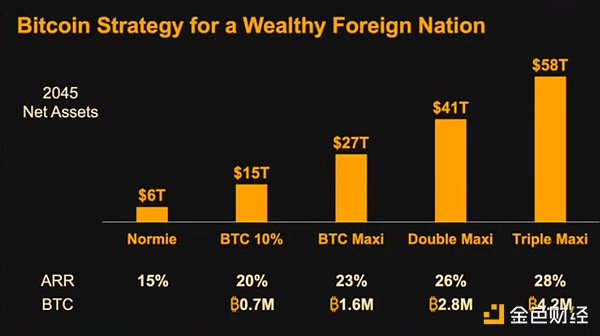

What is the result? The triple maximalist will become extremely rich, $58 trillion.

Not only that, it also enhances your national security, because you will have $50 trillion or more of digital capital, and nobody can take it away. If other countries bomb your country, invade your borders, they can't get the Bitcoin. So it's good for your financial security and good for your national security.

But note that if you are Saudi Arabia or Norway, and you do triple maximalism, which is very easy to do, you will end up with 4.2 million Bitcoins. That means there are not many triple maximalists at the national level, maybe only one or two.

This is an opportunity for radical actors. You can have a lot of triple maximalist families and companies, but not many triple maximalists at the national level.

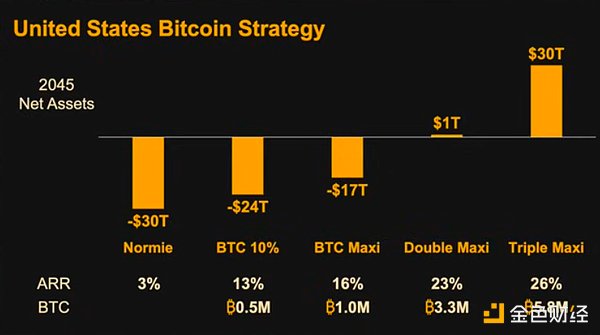

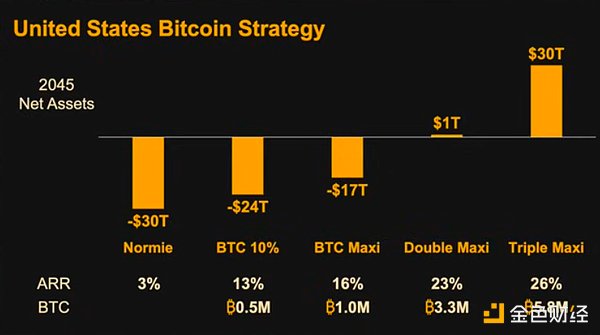

US Bitcoin Strategy

Let's look at the United States again. The United States is a special case.

The rules are still the same: buy Bitcoin, sell paper money, get rid of gold, and hold for the long term. What you shouldn't do is still: don't harass Bitcoin holders, don't move industries overseas, and don't move capital overseas.

But our base case is as above. $36 trillion in debt, 3.5% interest rates. We think AI and new technologies will drive growth. I'm going to assume that the U.S. will be led by capable executives who will leverage technology, and we will really leverage AI, create robot cars and robots, build billion-person websites that provide free accounting, legal, and medical advice, and that will make our revenues grow faster than our expenses, and we'll eventually get to a point where interest rates are lower.

So, what is America's Bitcoin strategy? We can be average strategists; we can be 10% strategists, buy 500,000 Bitcoins; we can be maximalists, buy 1 million Bitcoins; double maximalists, buy 2 million Bitcoins; triple maximalists, buy 4 million Bitcoins. And then start converting the country's surplus into Bitcoin.

So, what is America's Bitcoin strategy? We can be average strategists; we can be 10% strategists, buy 500,000 Bitcoins; we can be maximalists, buy 1 million Bitcoins; double maximalists, buy 2 million Bitcoins; triple maximalists, buy 4 million Bitcoins. And then start converting the country's surplus into Bitcoin.

What is the result? If you are an average strategist, even if you have huge productivity growth and superior technology, and robots do all the work for us, you will still be in debt, you just won't get worse.

If you are a maximalist strategist, you will pay off half of the debt. If you are a double maximalist strategist, you will have a surplus. If you are a triple maximalist strategist, not only will the country not owe $30 trillion, but it will have $30 trillion.

Bitcoin is not the solution to all our problems, but it is the solution to half of them. The important thing is that the other half of the problem is very complex and requires the energy and effort of many people, while this half is very simple. This is a very simple solution to half of our problems.

Bitcoin is the Manhattan of the Internet

So, Bitcoin is the Manhattan of the Internet.Trillions of dollars of capital will flow here. We will demonetize the Russian frozen soil, Chinese real estate, everything in Africa, and all those dilapidated buildings that no one needs but bought.

You buy a Bitcoin building, a street, or an entire neighborhood. It only has 276 to the power of 3, as you can see in the picture above.

It’s worth buying some Bitcoin

Finally, I’ll leave you with a quote.

Satoshi Nakamoto launched the Bitcoin network on January 3, 2009, and on January 17, 2009, Satoshi said, “It might be worth buying some, just in case it becomes popular. If enough people think so, it will become a self-fulfilling prophecy.” That was 16 months before Pizza Day, when Bitcoin was worth nothing and would not be worth much in the next year. Wiser words have never been spoken.

You see Bitcoin’s market cap now at $1 trillion, which proves Satoshi’s foresight. But there’s still a thousand times more to come. You have more information at hand, and the future is bound to happen (the writing is on the wall).

Bitcoin is the future of capital, the future of currency.

It may be necessary to buy some Bitcoin because it has become popular.

JinseFinance

JinseFinance

What about a typical person? We modeled a person.

What about a typical person? We modeled a person.

The average person will have $7 million in assets in 21 years, 10% will have more than double that, a Bitcoin maximalist will have $100 million, a double maximalist will have $150 million, and a triple maximalist will have $214 million.

The average person will have $7 million in assets in 21 years, 10% will have more than double that, a Bitcoin maximalist will have $100 million, a double maximalist will have $150 million, and a triple maximalist will have $214 million.

So, what is America's Bitcoin strategy? We can be average strategists; we can be 10% strategists, buy 500,000 Bitcoins; we can be maximalists, buy 1 million Bitcoins; double maximalists, buy 2 million Bitcoins; triple maximalists, buy 4 million Bitcoins. And then start converting the country's surplus into Bitcoin.

So, what is America's Bitcoin strategy? We can be average strategists; we can be 10% strategists, buy 500,000 Bitcoins; we can be maximalists, buy 1 million Bitcoins; double maximalists, buy 2 million Bitcoins; triple maximalists, buy 4 million Bitcoins. And then start converting the country's surplus into Bitcoin.