Yesterday evening 《10.11 Teaching Chain Insider: Phished Again, Lost $35 Million》 said when BTC intraday spiked back to 61k, "This kind of spike usually shows the strength of market support and has a predictive effect on the future market rise". As soon as the voice fell, it rose all the way to 63k in the evening.

This round of halving cycle, this halving cycle, although it hit the previous high in March, caused the market to be full of two kinds of noise. One is the "bull market in advance theory", saying that this round of bull market will come in advance, and it will hit the top in the second half of this year, and it will not wait until next year. The other is the "big top collapse theory", saying that this year is the big top of the cycle in the past 15 years, and the market will collapse in the second half of the year, and then symmetrically reverse the rise in the past 15 years to a continuous decline, and finally return to zero.

Facts speak louder than words. Three quarters have passed since 2024. BTC has neither reached the peak of the bull market in advance nor collapsed. It has been sideways and stable, and has been calmer than before. In comparison, in terms of the macro structure, this halving is no different from the previous halvings; in terms of the micro, the trend after this halving is more leisurely. If the market does not start in another two weeks, it will set a record for the longest consolidation in BTC's history.

Especially in the past 7 months, BTC has experienced a healthy consolidation period. Although this is a tough test for many novices who entered the market at a high level in March, the eight-character formula of Jiaolian can deal with this problem well. Obviously, BTC has been in the 60-70k range for much longer than the 50-60k range, and this is the result after many terrifying selling pressures and negative tests. This shows the solid fundamentals of BTC at this stage and lays a solid foundation for the next stage of upward breakthrough. Once the market breaks through $80,000, the probability of seeing $60,000 again may be very small.

Jiaolian pointed out from a quantitative perspective in the article 《The most important factor that determines the success or failure of an investment is ()》 on July 11, 2024 that $60,000 is S+1.5 and $70,000 is S+2. Therefore, BTC that is less than $70,000 today is indeed worth cherishing. The fact that it has been sideways for 7 months also verifies the qualitative conclusion of Jiaolian's article "BTC may not have a long-term basis for decline at this stage" in March, 2024.

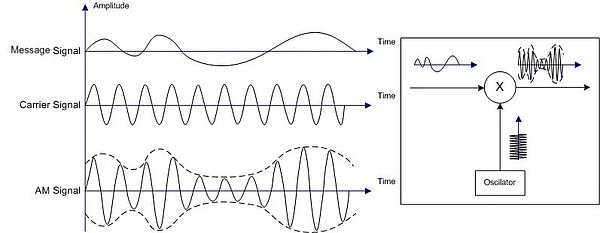

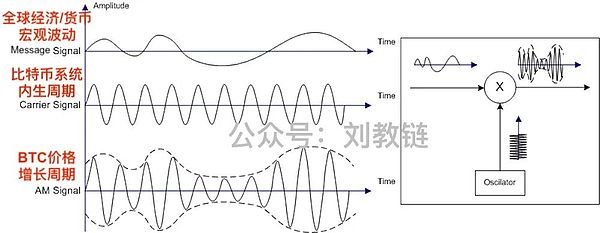

This calm and relaxed mood of "picking chrysanthemums under the eastern fence and leisurely seeing the southern mountains" shows the strong strength and unique charm of BTC. As the 10.9 Teaching Chain Internal Reference: Have Your Own Rhythm, Not Be Driven by the Market Teaching Chain uses the analogy of radio modulation to say: "BTC seems to have a unique ability to modulate all complex and chaotic external macro factors into its own 4-year cycle rhythm, and to shape all irregular external energy input into regular cycle waveforms! It's so interesting!"

BTC's 10-minute block generation and halving every 4 years are like a ticking clock with a carrier wave with a constant frequency. The macroeconomic and monetary cycles of the external world, the changes in the Fed's policies, the impact of the US dollar tide, the prosperity and depression of society, and the speculation of retail investors are all irregular energy fluctuations and input signals. The input signal carries energy and is absorbed and modulated by the BTC system. The modulated frequency is the same as the endogenous frequency of the BTC system (the period remains unchanged), and the external energy is converted into the energy of BTC itself.

Last night, the US Producer Price Index (PPI) data for September was released, and the annual growth rate fell to 1.8%. Although it is still higher than the expected 1.6%, the downward trend has led the market to expect that the consumer price index (CPI) will continue to fall, thereby increasing bets on the Fed's continued interest rate cuts.

When the Fed has been irreversibly on the path of interest rate cuts, the blood-sucking market of the A-share market has temporarily come to an end, and the time for BTC to launch a crypto bull market is getting closer and closer.

Alex

Alex

Alex

Alex Kikyo

Kikyo Brian

Brian Alex

Alex Alex

Alex Alex

Alex Joy

Joy Brian

Brian Snake

Snake Kikyo

Kikyo