Abstract

This paper provides an in-depth analysis of the transformative impact of cryptocurrencies on financing strategies, with a particular focus on the evolution from initial coin offerings (ICOs) to airdrops and beyond. We explore the importance of tokens and elucidate the advantages of ICOs over traditional financing methods such as initial public offerings (IPOs) and crowdfunding. In addition, we critically evaluate the effectiveness of airdrops as a launch mechanism and a tool to promote project development. We propose a set of airdrop design mechanisms to optimize the benefits of the ecosystem. In addition, we introduce the latest financing strategies and point out meaningful directions for future research. By providing valuable insights and references, our article serves as a comprehensive guide for researchers and practitioners exploring new cryptocurrency financing strategies.

1. Introduction

Cryptocurrencies, created using cryptographic techniques and stored as data in virtual space, have revolutionized the financial industry in recent years (Geuer &L2023). These decentralized digital assets operate independently of central banks and provide a new payment system based on blockchain technology (Jiménez.et.al2021). Cryptocurrencies, especially Bitcoin, have significantly changed the way transactions, investments and wealth storage are managed (Stein &S2020). They have significant advantages in terms of transaction transparency, reduced fees and speed of cross-border transfers, marking a paradigm shift in the financial world (Enajero &S2021). It is crucial to understand their long-term impact. One of the significant impacts of cryptocurrencies is their ability to facilitate successful fundraising for projects and bring benefits and changes to society (Li.et.al2019).

This article will serve as a comprehensive guide to rethinking strategies for using cryptocurrency financing in a modern financial environment, depicting the evolution of financing and future development directions. The second part explains the core value of tokens. The third part introduces the initial coin offering (ICO) and its development, including opportunities and risks, and compares it with other traditional fundraising methods. The fourth part introduces the most popular way to start financing, namely the airdrop mechanism. The fifth part proposes effective standards for using cryptocurrencies for future protocol financing. The sixth part shows the latest ways that cryptocurrency native projects use cryptocurrencies to launch projects, such as Inscription BRC-20 and Decentralized Physical Infrastructure Network (DePIN).

2. The importance of tokens

With the advent of the digital age, the adoption of digital financial instruments has become widespread (Johnson.et.al2021). However, there are still many people in the world who have difficulty accessing traditional banking services, limiting their growth opportunities (Yao.et.al2021). Digital currencies deployed on consortium chains or private chains are limited to specific fields. Cryptocurrencies deployed on public chains offer an innovative solution to these problems. They facilitate the free flow of wealth without relying on trusted third parties (Li.et.al2020). This decentralization helps build a more inclusive financial system that is not controlled by centralized entities. Cryptocurrencies can provide important financial support to individuals and businesses in areas where traditional financial services are limited (Corbet.et.al2018). The decentralization of cryptocurrencies is an important step towards a more inclusive and free financial system.

In addition, cryptocurrencies are an important coordination mechanism (Enajero.et.al2021). As the influence of decentralized autonomous organizations (DAOs) increases, more people will buy governance tokens that represent ownership of the organization, pushing up the price of the tokens (Light2019). This increase in value not only provides financial benefits to token holders, but also strengthens the connection between the organization's stakeholders (Jagtiani.et.al2021). This will attract more contributors and drive the development of the organization.

3. Initial Coin Offering (ICO)

3.1 Introduction to ICO

ICO, also known as token sale, is a new type of financing mechanism that allows projects to raise funds by issuing digital tokens on the blockchain. It is a community-driven way for blockchain startups to execute their experiments by exchanging newly created tokens for highly liquid cryptocurrencies. It is an innovative way to access funds and indirectly fiat currency by exchanging tokens. Instead of purchasing equity, investors exchange their cryptocurrencies for tokens created by the software (Lee & Low 2018).

In the growing ICO space, tokens have multiple uses in addition to representing equity. Some tokens act as vouchers that grant holders access to specific services or products that the project intends to provide, effectively acting as a pre-sale mechanism. The white paper, a comprehensive document detailing the project's goals, team, technical specifications, and token allocation strategy, is at the heart of the ICO process. During the ICO era, significant capital growth was often driven by speculative enthusiasm rather than the intrinsic value of the projects (Li.et.al2021). This has led to some startups with only conceptual white papers reaching multi-million dollar valuations, comparable to the dot-com bubble era. This speculative environment is inevitably followed by market corrections, creating risks for investors, especially those entering the market with high valuations (Li.et.al2020).

While ICOs offer a promising avenue for fundraising in the digital age, they also come with inherent risks and challenges (Şarkaya.et.al2019). Unfortunately, the lure of rapid capital accumulation in the ICO space has attracted bad actors. Investors, often driven by the phenomenon of FOMO (fear of missing out on a good investment opportunity), sometimes forgo rigorous due diligence, making them vulnerable to elaborate scams (Shehu.at.al2023). Copied white papers, fake project websites, and “exit scams” that disappear after fundraising highlight the need for project evaluation. Participating in the ICO space requires understanding its regulatory ambiguity, as countries have adopted different approaches (Oliveira.et.al2021). While some jurisdictions, such as Switzerland, have adopted a more relaxed attitude, others, such as China, have implemented strict prohibitive measures. This diversity of regulation, coupled with the ever-changing regulatory perspective, requires project sponsors and investors to be familiar with its rules. In addition, the value proposition of these tokens depends on a single demand period, which may limit the financing potential compared to the traditional multi-round equity financing mechanism (Sousa.et.al2021). A comprehensive understanding of its dynamics, coupled with an appropriate regulatory framework, is essential to safeguard the interests of investors and realize its full potential.

3.2 Key Milestones of ICO

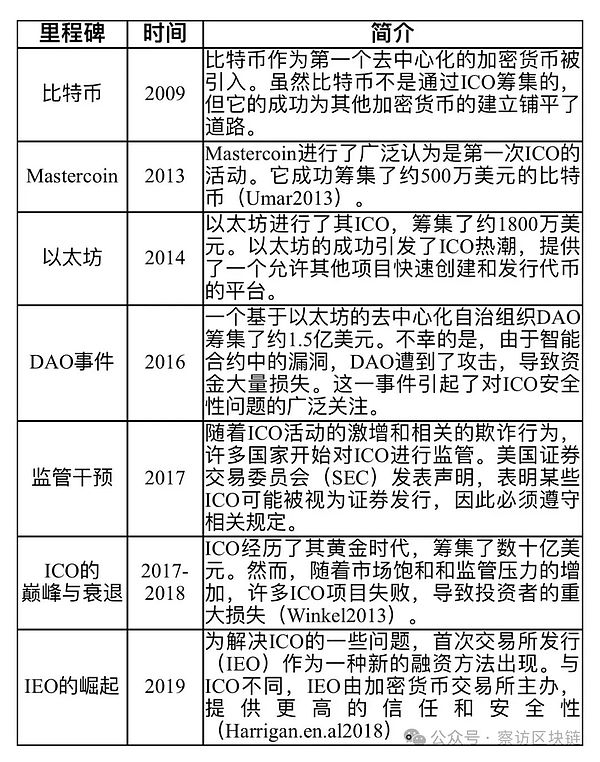

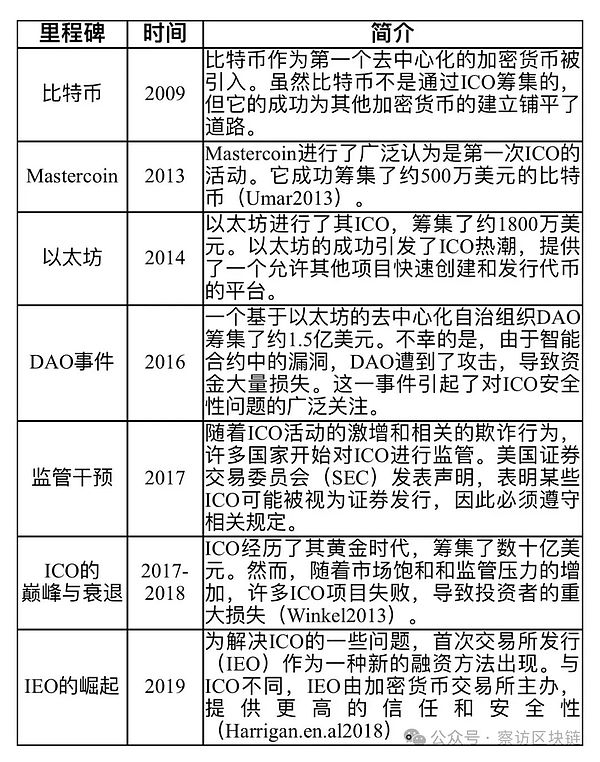

The concept of ICO originated from the emergence of Mastercoin. Its popularity surged after the launch of the Ethereum network in 2015. Table 1 shows the key milestones of ICO (Zheng.et.al2020).

Table 1: Key Milestones in the Development of ICO

During the development of ICO, many cases such as Tezos, EOS, and Filecoin have successfully raised a lot of funds. However, many projects failed for various reasons, providing valuable lessons for investors and regulators (Lee.et.al2018).

3.3 Comparison with Initial Public Offering (IPO)

In the stock market, an IPO is the first time a company publicly lists its shares on a stock exchange, with the purpose of raising capital by exchanging ownership of the company (Lee et al. 2021).

ICO and IPO represent very different paradigms in the field of capital financing, each with unique advantages and challenges. ICOs, based on blockchain technology, provide a fast and decentralized funding mechanism that enables projects to access capital in a significantly shorter time than the traditional IPO process. This fast approach in ICOs, without complex regulatory entanglements and intermediaries, democratizes investment opportunities, breaks down geographical barriers, and welcomes a diverse investor base. In contrast, IPOs provide a more structured but lengthy path to funding through their rigorous audits, regulatory compliance, and partnerships with established financial institutions. The dichotomy between ICOs and IPOs encapsulates the trade-off between speed and decentralization versus regulatory rigor and stability, with the choice depending on the investor's risk tolerance, goals, and familiarity with the evolving cryptocurrency space.

Shareholders in an IPO enjoy the right to vote on company affairs or receive dividends. The purpose of an IPO is to raise funds in exchange for company ownership. However, ICO participants do not usually share in profits. Their potential gains are usually related to the value appreciation or utility of the tokens in the project ecosystem.

IPOs are usually limited to institutional investors or those with a lot of capital at an early stage. ICOs democratize the process, making it accessible to anyone with an internet connection and some cryptocurrency. Table 2 summarizes the comparison between ICOs and IPOs.

Table 2: Comparison of ICOs and IPOs

3.4 Further Developments: IDOs and IEOs

While ICOs were groundbreaking, they faced challenges in terms of regulation and investor protection. This led to the emergence of initial exchange offerings (IEOs) and initial decentralized exchange offerings (IDOs), which offer similar fundraising opportunities but with fewer regulatory restrictions, greater decentralization, and better due diligence.

In 2017, regulators in several countries began to scrutinize ICOs more closely. In particular, the U.S. Securities and Exchange Commission (SEC) stated that certain ICOs may be considered securities offerings and need to comply with relevant regulations. In addition, countries such as China and South Korea have directly banned ICO activities. The increase in ICO activity has also led to an increase in fraudulent schemes and scams. Many projects have disappeared after raising large amounts of funds, causing significant losses to investors. The popularity of ICOs has waned over time.

IEOs, unlike ICOs, are hosted by cryptocurrency exchanges. This provides investors with greater trust and security, as exchanges conduct an initial review and screening of projects. Additionally, tokens are usually listed on exchanges immediately after the IEO ends, ensuring liquidity for investors. Binance exchange launched Binance Launchpad, which aims to provide projects with a more structured and secure platform to raise funds. Endorsement from a well-known exchange adds more credibility to a project. The success of Binance Launchpad prompted other major exchanges to launch their own IEO platforms. This shift marked a transition from the decentralized ICO model to the more centralized and potentially safer IEO model. With the support of a well-known exchange, investors feel more confident about participating in an IEO, knowing that the project has undergone some vetting.

In contrast, IDOs involve token sales on decentralized exchanges (DEXs), offering greater decentralization than IEOs. This allows project teams to raise funds more quickly and flexibly in the IDO model. This approach combines the decentralized spirit of ICOs with the structured approach of IEOs. Conducting token sales through IDOs means that projects can bypass the typically strict listing standards of centralized exchanges. In addition, DEXs provide instant liquidity for project tokens. While ICOs have revolutionized the fundraising space, the security of smart contracts cannot be ignored. The market's evolution toward IEOs and IDOs reflects the industry's adaptability and constant efforts to strike a balance between innovation and security. As the cryptocurrency space matures, regulators around the world are struggling to keep up. The shift from ICOs to IEOs and IDOs can be seen as a response to this changing regulatory landscape, providing more protection for investors while promoting innovation.

4. Airdrops

The concept of airdrops dates back to the early days of cryptocurrency, when developers would distribute tokens to holders of specific tokens or wallets that met certain criteria. Since something similar to dropping from the air does not require any effort from the recipient, the term "airdrop" was coined. The first famous airdrop was in 2011, when Bitcoin holders were allocated Litecoin for free.

Airdrop is a marketing strategy used in the cryptocurrency space to distribute tokens to a large number of wallet addresses for free or at only a small cost. Various protocols adopt this method to conduct a fair distribution of their tokens, build decentralized communities, and sometimes incentivize users to interact with the protocol. A classic example is the story between UniSwap and SushiSwap. SushiSwap created the SUSHI token as a fork of Uniswap to provide additional rewards for liquidity providers. The platform attracted Uniswap's liquidity providers to move their funds to SushiSwap and rewarded them with SUSHI tokens. This strategy was very successful, resulting in a large amount of liquidity moving from Uniswap to SushiSwap. In order to maintain its market position, Uniswap launched its governance token UNI in response to SushiSwap's strategy. UNI tokens were distributed to liquidity providers and users who had previously traded on the platform. This event is a major milestone in the decentralized finance (DeFi) space and in the history of airdrops, demonstrating how protocols can attract and reward users through strategic airdrops.

The core advantage of airdrops is their cost-effectiveness in implementing ideas quickly and sustainably. At the beginning of the Web3+ project, users spent time and resources to participate in protocol testing without any compensation. Protocols improve their products based on user feedback before seeking financing. Investors identify promising protocols through due diligence. Once these protocols receive funding, they reward early users through airdrops that distribute tokens. These early users can use these tokens to actively participate in DAO governance or exchange them for other cryptocurrencies. Users who receive tokens are more likely to use the service, provide feedback, and support the protocol. Entrepreneurs and investors committed to advancing the Internet support these blockchain-based solutions, coordinating all stakeholders at the lowest cost. Web3+ breaks free from the constraints of relying on Web 2.0 giants to initiate changes and competes directly with Web 2.0 companies (Zheng and Lee 2023).

Airdrops are very important in generating excitement and publicity, attracting new users to the platform. When airdrops are distributed, media and community members actively promote, promote, and research the protocol, giving it a lot of exposure. Developers foster loyalty and stimulate ongoing community engagement by incentivizing and rewarding early supporters. This approach boosts the visibility of the project, attracts a wider user base, and ensures a decentralized distribution of tokens, reducing the risk of being controlled by a few people.

However, airdrops also have disadvantages. Users holding a large number of airdropped tokens may manipulate the market or sell them at a low price. Users may create multiple wallets to receive more airdrops, diluting the expected returns of the airdrop. In addition, resources used for airdrops can be used for other development or marketing activities. Airdrops can be challenging in an uncertain regulatory environment. If classified as securities, they may be subject to strict regulatory requirements. Therefore, projects must understand the current regulatory environment and ensure compliance to avoid legal disputes. The amount of distribution can also be a double-edged sword. If the airdrop rewards are insufficient, it may cause dissatisfaction among community members. On the other hand, too much distribution may dilute the value of the token, negatively affecting its price and weakening investor enthusiasm. This instability is exacerbated if many recipients decide to sell their tokens at the same time. These drawbacks were clearly demonstrated in the recent airdrop distributions of zkSync and LayerZero. To combat this, projects can implement carefully planned airdrops with clear guidelines and unlocking periods to curb sudden value dilution. The structure and release of airdrops can significantly influence the behavior of participants. Poorly designed airdrops can encourage a short-term mentality among holders, potentially jeopardizing the overall goals of the project. It is critical to ensure that airdrop incentives resonate with the long-term vision of the project, promoting continued growth and development.

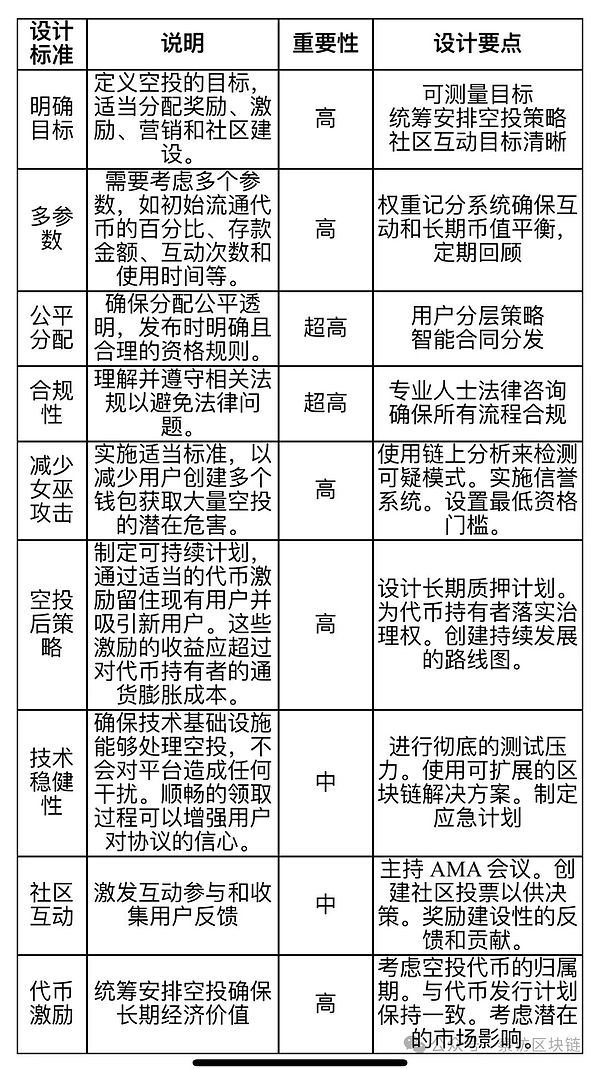

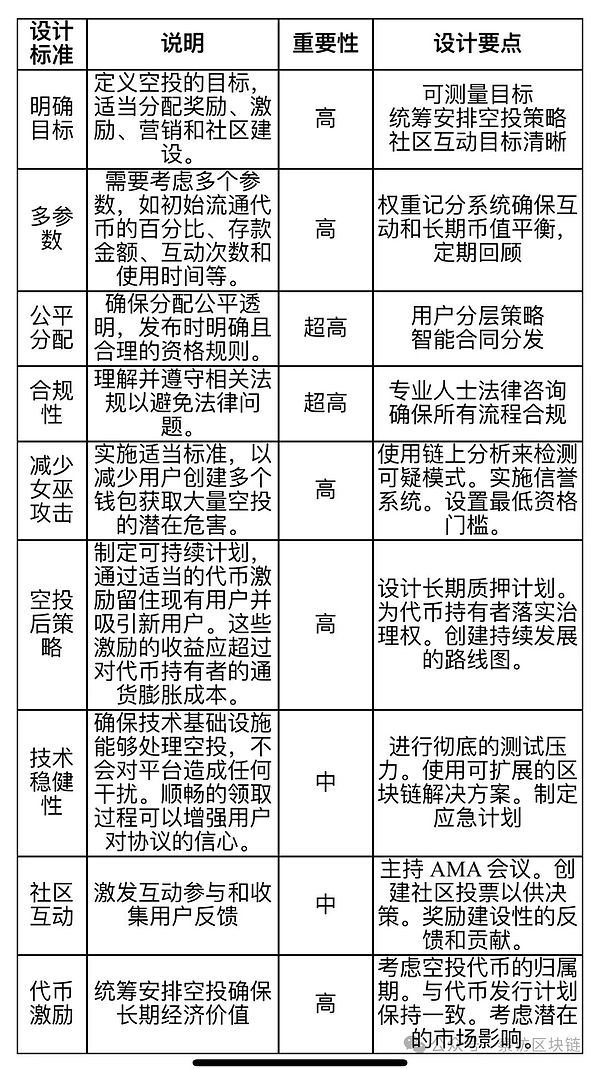

Industry builders can refer to the design standards in Table 3 to use when creating token economics, while investors can refer to these standards when deciding whether to hold tokens for the long term.

Airdrop design standards

5. Other funding mechanisms using cryptocurrencies

Inscription BRC-20 and Decentralized Physical Infrastructure Network (DePIN) are two innovative funding mechanisms.

Bitcoin is generally regarded as a store of value asset, while Ethereum is regarded as an innovative ecosystem for creating decentralized applications. However, with the Ordinals protocol proposed by Casey (2023), a core member of the Bitcoin community, there is growing interest in creating a Bitcoin ecosystem.

Satoshi is the smallest unit of Bitcoin, equivalent to one hundred millionth of a Bitcoin. The Ordinal protocol assigns a unique ordinal number to each satoshi based on the order in which the satoshi is mined. This ordinal number remains unchanged during any transfer of a satoshi, making each satoshi unique and non-fungible. Inscriptions are a core part of the Ordinals protocol, allowing information to be inscribed on a single satoshi. Some consider satoshis with inscriptions to be unique digital artifacts. Ordinals make satoshis non-fungible, while inscriptions add unique information to these satoshis, similar to drawing on a blank piece of paper. Combining these two features creates a new NFT standard for the Bitcoin ecosystem.

Inspired by ERC-20 tokens and the Ordinal protocol, Twitter user @domodata created a new fungible token standard, BRC-20. It uses JSON data of ordinal inscriptions for the deployment of token contracts and the minting and transfer process of tokens. BRC-20 tokens are deployed on a "first come, first served" basis. Once a certain BRC-20 token is deployed, tokens with the same name will no longer be deployed. Although @domodata classified BRC-20 as a social experiment, the standard has been widely adopted with the promotion of community members and the support of centralized exchanges and Bitcoin miners.

Venture investors get a large number of tokens at very low prices during private placements. They use their reputation to support the protocol and put forward a persuasive narrative to attract retail investors to invest. However, these retail investors unfortunately become liquidity providers when venture investors sell tokens. Retail investors are tired of this unfair mechanism. The emergence of BRC-20 provides an opportunity for fair distribution. There is no private placement for venture capital or angel investors. Everyone has an equal opportunity to obtain tokens by minting tokens. During the minting event, investors pay gas fees to mint tokens. There is no limit on how many tokens each investor can mint. This mechanism distributes tokens fairly and decentralized. Token holders are incentivized to promote and support the protocol spontaneously. When using the BRC-20 standard, there is a strong consensus among community members because they have an equal opportunity to participate in minting. If venture investors want BRC-20 tokens, they must participate in minting or buy them in the secondary market. It is worth noting that many successful BRC-20 tokens have a strong community atmosphere, and some are even integrated into the meme culture. Meme coins play an important role in the cryptocurrency ecosystem. The current price of BRC-20 tokens is mainly supported by consensus and meme culture within the cryptocurrency community. Intrinsic value refers to the discounted value of cash flows generated over the life cycle of a product or business; therefore most BRC-20 tokens have no intrinsic value. However, the psychological value of BRC-20 tokens is determined by the subjective emotions of the holder, similar to the emotional value of other collectibles or pets. Since BRC-20 is a fungible token standard, its liquidity is better than NFT. On the other hand, some BRC-20 tokens have specific utilities, such as being used as fuel fees or tickets to token launch platforms.

After the success of BRC-20, many other token standards emerged on the Bitcoin system and other blockchains. For example, ARC-20, Rune, BRC-420, SRC-20. These innovative token standards that originated from Inscription deserve further research and development. These new token standards provide an inclusive financial ecosystem with improved functionality, ensuring that everyone with internet access has an equal opportunity to participate in fundraising.

Another increasingly popular track is the Decentralized Physical Infrastructure Network (DePIN). The emergence of DePIN represents a new paradigm that uses blockchain technology to facilitate and manage distributed physical infrastructure systems. DePIN aims to solve the challenges of deploying and managing physical infrastructure, which are usually dominated by large companies because they require a lot of capital and complex logistics.

IoTex (2021) first proposed the concept of DePIN, calling it MachineFi, which aims to merge machines and decentralized finance (DeFi) to leverage machine-driven data, events, and tasks. Messari introduced the term "DePIN" based on a Twitter poll in its 2022 report.

At the beginning of the protocol, DePIN uses tokens or potential airdrops to incentivize users to participate in ecosystem construction and attract skilled developers to provide more cost-effective products. As more and more users use the product or service, the protocol's revenue increases, which can be used for market capitalization management and further marketing, giving back to the demand and supply sides, incentivizing more participants and attracting market attention, and building a prosperous ecosystem. During the bull market, DePIN will generate a good positive flywheel effect. By implementing an incentive mechanism, the DePIN network can generate initial momentum to compete with established Web2 companies and achieve widespread adoption (Sami 2023). DePIN is an important connection between the virtual Web3+ and the real world, which can effectively promote data security, coordinate idle resources and improve our lives, while allowing more people to see the actual value of cryptocurrency. This is the first time that cryptocurrency has been used to develop physical facilities in the real world.

Although BRC-20 and DePIN are innovations in cryptocurrency financing strategies, they have failed to change the speculative atmosphere of cryptocurrency. When the market turned from a bull market to a bear market, a large number of BRC-20 tokens had no transaction volume, and the DePIN track tokens went to zero. How to better empower organizations with tokens and create a long-term and sustainable distribution mechanism is the focus that cryptocurrency entrepreneurs need to think about and practice. Only in this way can we avoid wasting the once-in-a-century financing method created by Satoshi Nakamoto. Otherwise, the cryptocurrency industry will become a new type of casino and will not be able to develop further.

6. Conclusion

The evolution of cryptocurrency financing, powered by blockchain technology, has ushered in an era that challenges traditional financial paradigms. This democratization of financing has redefined the nature of value exchange and trust, and expanded access to global investment opportunities. However, this profound shift has also brought challenges, particularly regulatory ambiguity and potential for fraudulent activity. The dynamic nature of the cryptocurrency ecosystem, as demonstrated by its adaptability and innovation (such as ICOs, IEOs, and strategic airdrops), is a testimony to its resilience and potential.

Facilitating financing is one of the core functions of cryptocurrency. It operates more efficiently and brings more inclusiveness than traditional finance. The inclusiveness of cryptocurrency in financing activities cannot be underestimated. Cryptocurrency provides more fundraising opportunities and exposure, lowering the barrier for investors to fund potentially world-changing projects. When considering how to get more people to understand and use cryptocurrencies for fundraising, protecting investors and reducing the risk of fraud without inhibiting innovation are directions that policymakers, industry groups, academics, and project owners need to consider and work together.

Finally, but most importantly, due to the permissionless nature of public chains, anyone who is interested in raising funds through cryptocurrencies can issue coins at a lower cost. If a project fails, entrepreneurs are likely to set up another project. According to statistics, 92% of blockchain projects ceased operations one year after launch. In contrast, the IPO application process is more difficult, and entrepreneurs listed in traditional markets have more motivation to keep the project running. Therefore, investors should carefully assess the risks of cryptocurrency investments.

References

L. Geuer, "The impact of cryptocurrencies on the financial market", Advances in Finance Accounting and Economics Book Series, 2023. doi: 10.4018/978-1-6684-8368-8.ch004.

V. Jiménez-Serranía, J. Parra-Domínguez, F. De la Prieta, and J. M. Corchado, "Cryptocurrencies impact on financial markets: Some insights on its regulation and economic and accounting implications", 2021. doi: 10.1007/978-3-030-86162-9_29.

S. Stein Smith, "Cryptocurrencies & The Financial Services Landscape", 2020. doi: 10.1007/978-3-030-29761-9.

S. Enajero, "Cryptocurrency Money Demand and the Mundell-Fleming Model of International Capital Mobility", Atlantic Economic Journal, 2021. doi: 10.1007/S11 293-021-09701-W.

Z. Li, Q. Lu, S. Chen, Y. Liu, and X. Xu, "A Landscape of Cryptocurrencies", 2019. doi: 10.1109/BLOC.2019.8751469.

J. Jagtiani, M. G. Papaioannou, G. P. Tsetsekos, E. Dolson, and D. Milo, "Cryptocurrencies: Regulatory Perspectives and Implications for Investors", 2021. doi: 10.1007/978-3-030-65117-6_7.

D. K. C. Lee and L. Low, "Inclusive FinTech: Blockchain Cryptocurrency and ICO", World Scientific, 2018. doi: 10.1142/10949.

K. Light, "Cry ptocurrencies: Can They Live Together with National Currencies and What Impact Do They Have on National and Global Economies?", 2019. doi: 10.1007/978-3-319-90659-1_23.

C. Wilson, "Cryptocurrencies: The Future of Finance?", 2019. doi: 10.1007/978-981-1 3-6462-4_16.

E. Fouad, "The role of cryptocurrencies in financial transactions considering modern global conditions", 2020. doi: 10.21608/AASJ.2020.155061.

J. Kregel and P. Savona, "The Impact of Technological Innovations on Money and Financial Markets" , 2020.

A. Rejeb, K. Rejeb, and J. G. Keogh, "Cryptocurrencies in Modern Finance: A Literature Review", Etikonomi, 2021. doi: 10.15408/ETK.V20I1.16911.

H. Izhar and A. S. Gundogdu , "Characterizing Cryptocurrencies and Why It Matters", 2019. doi: 10.1007/978-3-030-10749-9_7.

S. H. M. Zubir, N. A. Awi, A. Ali, S. Mokhlis, and F. Sulong, "Cryptocurrency Technology and Financial Reporting", The International Journal of Management, 2020. doi: 10.35940/IJMH.I0898.054920.

J. Paul, "A study on blockchain technology its implications on the financial landscape and its future", Journal of Emerging Technologies and Innovative Research, 2019.

S. Corbet, B. M. Lucey, A. Urquhart, and L. Yarovaya, "C S. Corbet, B. M. Lucey, A. Urquhart, and L. Yarovaya, "Cryptocurrencies as a financial asset: A systematic analysis", 2018. doi: 10.1016/J.IRFA.2018.09.003.

K. N. Johnson, "Decentralized Finance: Regulating Cryptocurrency Exchanges", William and Mary Law Review, 2021.

Y. Yao, X. Li, D. Zhang, and S. Wang, "How cryptocurrency affects the economy? A network analysis using bibliometric methods", International Review of Financial Analysis, 2021. doi: 10.1016/J.IRFA .2021.101869.

S. Enajero, "Cryptocurrency Money Demand and the Mundell-Fleming Model of International Capital Mobility", Atlantic Economic Journal, 2021. doi: 10.1007/S11293-021-09701-W.

K. Light, "Cryptocurrencies" : Can They Live Together with National Currencies and What Impact Do They Have on National and Global Economies?", 2019. doi: 10.1007/978-3-319-90659-1_23.

A. Shehu Umar, "Cryptocurrencies", Advances in Finance Accounting and Economics Book Series, 2023. doi: 10.4018/978 -1-6684-5691-0.ch011.

C. Şarkaya İçellioğlu and S. Öner, "An Investigation on the Volatility of Cryptocurrencies by means of Heterogeneous Panel Data Analysis", Procedia Computer Science, 2019. doi: 10.1016/J.PROCS.2019.09.131 .

V. C. Oliveira, J. A. Valadares, J. E. de A. Sousa, A. B. Vieira, H. S. Bernardino, S. M. Villela, and G. Goncalves, "Analyzing Transaction Confirmation in Ethereum Using Machine Learning Techniques", ACM Digital Library, 2021. doi: 10.1145/3466826.346 6832.

J. E. de A. Sousa, V. C. Oliveira, J. A. Valadares, A. B. Vieira, H. S. Bernardino, S. M. Villela, and G. Goncalves, "Fighting Under-price DoS Attack in Ethereum with Machine Learning Techniques", ACM Digital Library, 2021. doi: 10.1145/3466826.3466835.

X. Li, T. Chen, X. Luo, and C. Wang, "CLUE: towards discovering locked cryptocurrencies in ethereum", ACM Digital Library, 2021. doi: 10.1145/3412841.3442130.

X. Li, T. Chen, X. Luo, and C. Wang, "CLUE: Towards Discovering Locked Cryptocurrencies in Ethereum", arXiv: Cryptography and Security, 2020.

A. S. Umar, "Cryptocurrencies", in Advances in Finance Accounting and Economics Book Series, IGI Global, 2023. doi: 10.4018/978-1-6684-5691-0.ch011.

B. J. Winkel, "Extraordinary cryptology collection", Cryptologia, 2003. doi: 10.1080/0161-110391891847.

M. Harrigan, L. Shi, and J. Illum, "Airdrops and Privacy: A Case Study in Cross-Blockchain Analysis", arXiv: and Security, 2018.

D. K. C. Lee and S. Low, "Inclusive Fintech: Blockchain Cryptocurrency and ICO", World Scientific, 2018.

D. K. C. Lee, J. Lim, K. F. Phoon, and Y. Wang, "Foundations for Fintech | Global Fintech Institute", World Scientific Series on Fintech, 202 1. [Online]. Available: https://www.worldscientific.com/doi/epdf/10.1142/12330. [Accessed: 08-Aug-2023].

J. Zheng and K. C. Lee, "Understanding the Evolution of the Internet: Web1.0 to Web3.0 Web3 and Web 3 plus", SSRN, 2023. [Online]. Available: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4431284. [Accessed: 21-Jun-2023].

K. Sami, "The DePIN Sector Map", Messari, 2023. [Online]. Available: https://messari.io/report/the-depin-sector-map

JinseFinance

JinseFinance