Author: Sankalp Shangari; Translator: Felix, PANews

For the past decade, we have been preaching the dream that cryptocurrency will revolutionize the world, solve real-world problems, and welcome a large influx of Web2 users into this bold new world. But let’s be honest, cryptocurrency has not fully delivered on this promise. Instead, we have collectively become thrill-seeking Degens, constantly shuttling between various Ponzi schemes like squirrels that have drunk espresso.

This situation is perfectly presented at the more than 500 side events of Token 2049. Projects are overfunded to the point that marketing budgets are greater than actual revenue (if any), and gorgeous booths and five-star venues mask the reality of minimal user adoption. VCs who once poured billions of dollars into anything with a white paper are now silent. The good news? Only serious projects can get funded now. The bad news? It took the crypto industry so long to get to this point.

We’ve seen over 100 L1/L2s all vying for the same crypto audience — with less engagement and fewer meaningful conversations. We went from Solana to Ethereum memes, then Base, and now Justin Sun playing Icarus, flying dangerously into the sun. (Note: Icarus is the son of Daedalus in Greek mythology. When he and Daedalus used wings made of wax and feathers to escape Crete, he flew too high and the wax on his wings melted by the sun and fell into the water and died. He was buried on an island.) This is great for short-term drama, but where is the long-term vision? Where is the promised mass adoption? Jumping from one meme to another, from one chain to another, this is not real business.

Over the years, we’ve gone from IC0 hype to DeFi yield farms, from NFT mania to GameFi distribution Ponzi schemes, PoS staking, re-staking plans to the current Bitcoin re-staking (really?), and finally to the points and airdrop pyramids. What’s the next gimmick? People I talk to are very worried about the direction the industry is heading. There’s a lot going on, but nothing is coming to fruition.

VCs are frustrated that they can’t touch the space with regulated funds because they didn’t anticipate the memecoin craze. Founders complain because VCs are no longer funding every “weed” in the garden, just hoping that one of them will grow into a “rose”. Degens are tired of jumping from one narrative to another, and Farmers are frustrated that airdrops and points don’t bring free wealth (Grass, Eigen, Blast, etc.). The only ones who can laugh are those who work in trading (CEX, DEX, maybe), gambling (Rollbit, Shuffle, Polymarket, memecoins), and the infrastructure that supports it all. This is evident in the F1 sponsorships, big booths, and multi-million marketing budgets.

Meanwhile, AI and stocks are coming into focus as Nvidia stock offers crypto-like returns, with higher returns, lower risk, tighter regulation, access through fiat currencies, and simpler UI/UX. Smart TradFi money earns returns from stocks with much less risk (yes, I know stocks are risky, but look at the prospects of crypto). Why bother investing in crypto when you can buy options on MSTR or COIN to get exposure?

Well, it’s not all doom and gloom. There is still a light at the end of the tunnel. Some talented founders continue to receive funding, and real-world use cases with real income potential are beginning to emerge. Thankfully, VCs are becoming more discerning, seeing more and more corporate players like Sony, global banks and financial firms creeping into the space. But this isn’t the mass adoption we were promised.

So where are the opportunities? Explored below. Two types of games are emerging in crypto:

Short-term narrative driven (quick in and out). There’s nothing wrong with this, but it’s mostly played by Degens, short-term founders, venture capitalists and KOLs looking to get rich quick.

So while the atmosphere of these events may be a bit like a rainy day parade, there are still some outstanding founders, projects, and VCs that may surprise us in the next few years. If Bitcoin reaches $100,000, we will all return to the land of Ponzi schemes faster than you can say "decentralization". No one will care about the fundamentals - until the market sounds the alarm bell, and by then, it will be too late.

Always stay "hungry", stay humble, and stay hedged.

Crypto Audience

1. Crypto Retail Degens (65%)

These newcomers are like enthusiastic puppies chasing every shiny object, mainly to catch the next Bonk, WIF or Poppet, and "hope" to exit quickly with their winnings. Their characteristics include:

Hopeful speculators: believe they can get rich overnight, short-term rotation from one memecoin to another memecoin, like a child jumping from one candy to another at a carnival.

Freebie Enthusiasts: These people are mainly interested in booth giveaways, parties and countless side events that promise free drinks and snacks.

Short-term thinkers: They focus on immediate benefits and often ignore the bigger picture and the complex game behind the scenes.

Project builders: Some even try to launch their projects, usually funded by like-minded short-term VCs. However, most founders have difficulty getting support.

2. "Smart" developers and venture capitalists (25%)

This group of people are sleek, self-proclaimed elites who aim to emulate the likes of Vitalik, Anatoly or Raj, while selling their dreams to venture capitalists who are obligated to provide them with funds. Their strategies include:

Funding first: They prioritize securing funding for the next 2-3 years and have detailed plans to create a sensation through collaboration with KOLs and eye-catching announcements.

Token hedging: They often fund more project operations and hedge their tokens when they go public, planning to gradually sell them after cashing out, letting the price fall.

Letting others take the blame: If a bear market hits, venture capitalists and retail investors will be left empty-handed, while these founders enjoy fat salaries and business class travel.

The guise of a long-term vision: They pretend to be champions of change until the token is launched, at which point their true intentions are revealed - think Blast and Friend.tech, before they jump into the next Ponzi scheme. There are hundreds of examples like this.

3. Real builders (10%)

The last group is made up of true dreamers - the real "Chads", committed to building the "future of France" (or whatever their vision is). They embody:

Smart minds: More than just selling a dream, these people are focused on generating revenue and adding real value.

Persistence: While they may have struggled to gain traction initially, they remain steadfast and refuse to issue tokens simply for exit liquidity.

Long-term commitment: They are here for the long haul, grounded in reality, outspoken, and advocate for sustainable growth in the industry.

In short, these three groups illustrate the range of attitudes in crypto — from impulsive Degens to savvy conspirators and, finally, to the true builders who may be just the ones to lead us to a brighter future.

L1/L2 and Infrastructure

ETH Identity Crisis: Ethereum is currently having an identity crisis — think of it as a mid-life crisis, trying to buy a sports car when everyone else is opting for an electric car. With much of the attention (and development) shifting to Solana and select EVM L2s, many users are disparaging ETH. At the end of the day, price is more important than block size. Are ETH thought leaders too comfortable in their mansions to engage with the frontline developer community? Why can’t they be Solana? Is Vitalik the right savior?

Solana is the clear frontrunner: Solana is strutting down the runway like it just won “Best in Show.” The buzz around the Solana ecosystem has intensified after the Breakpoint event. They’re not just talking; they’re shipping product faster than a pizza delivery on game night. Look at Firedancer. The Solana community is very organized, especially compared to the chaotic ETHGlobal activity. Solana's single-chain focus and unified community give them the upper hand - focus is key.

TON: TADA and TON-paid taxi services are a big success on Token 2049. Everyone is using it and passing around referral codes for TON and TADA. The marketing campaigns for both companies are really brilliant. TON is a clear contender for the next L1 position with 800 million internal users and the potential to truly achieve mass adoption.

VC Interest and Funding the Next SOL Killer: VC continues to flow to the next potential Ethereum or Solana killer. Mathematically, it’s a no-brainer: If you can find a project that will deliver a 1,000x return in the next few years, backing it is like finding a golden ticket in your chocolate bar. There are over 10 L1s with barely any activity and still trading between $1 billion and $10 billion. That in itself is a huge return for any VC.

Gen Z L1s of the Season: Projects like Monad and Berachain are the latest hot topics, while SUI and Base are also getting a lot of attention. In contrast, older chains like Aptos, SEI, and TIA (Millennial L1s) are losing steam, while baby boomer chains like Polygon, Algorand, and Cosmos are fading fast. Sure, we see occasional price spikes driven by market makers and new narratives (like FTM and AVAX), but they tend to be fleeting.

Niche chain specialization: We are witnessing a shift towards specific chain niches. Solana for memes/payments/trading, Ronin for GameFi, Arbitrum for DeFi. This trend is coupled with chain abstraction and cross-chain solutions that enhance the user experience and make interactions smoother.

Move toward B2B infrastructure and service providers: Some OG chains are offering CDKs, SDKs, rollups, and app chains. While this may keep their tokens relevant, it feels like a band-aid solution — great for yacht life, but not entirely sustainable for the ecosystem.

All in all, while Ethereum is struggling with an identity crisis like a teenager unsure of his haircut, Solana is charging forward, fostering innovation and community engagement. As we continue down this path, we’ll see how that evolves and which projects truly stand the test of time.

Projects and Founders

The harsh reality of crypto funding: Most projects face a slow, painful death in the crypto wilderness. Gone are the glory days when you could just make a PowerPoint presentation that shone like a disco ball and get cash. Now, it’s like trying to sell ice to Eskimos.

The Fundraising Cycle: A never-ending hamster wheel, and projects that get funded aren’t much better off. They get stuck in the hamster wheel, burning through VC money. Once funds run out or get very low, it’s time to raise more money or launch a token. If the token is successful, they may survive another 2-3 years; if not, they have to start all over again. Without new users or real revenue, the path to profitability is as murky as a foggy night on a deserted road.

The Rise of the New Projects: Old projects are like toys that were once popular, but no one wants to play with them anymore. Why invest in the old stuff when the likes of SUI, Aptos, Berachain, and Monad are offering grants to attract activity? It’s still the same old stuff, just old wine in new bottles — and maybe not even old wine.

Ponzi Schemes 2.0: Ponzi schemes seem to keep popping up like weeds after rain. This reminds me of the Celsius and BlockFi days, when lending got out of control and led to a spectacular crash. Now, we’re seeing a similar cycle of staking, re-staking, and the old “your tokens generate my tokens, and together we generate yield” — but this time, the scale is 10x, and the chain has increased by 10x. When will it end?

The Tech Founder’s Dilemma: Most tech founders don’t seem to know that crypto is a completely different beast. They often don’t realize that token economics, product-market fit, community building, and all those buzzwords are critical to success. It’s more than just having a great product; you need a big network and a bit of luck to make it work. If you’re not in the right VC gang or “KOL mafia,” good luck.

In short, crypto is a strategy game, and if you want to play, you better know the rules — otherwise you might just end up being another cautionary tale of the Wild Crypto West.

Venture Capital Funds

The Year of the Venture Capitalist: Navigating the Crypto Swamp.

Most VCs had a tough year: they either got in too early and watched their investments languish, or invested this year only to find out that vesting schedules are still 12-18 months away. In crypto times, that’s like waiting for a snail to finish a marathon.

The Smart Few: However, there are a few VCs who play the game like chess masters. They help list tokens at high fully diluted valuations (FDVs), hedge their risk, and then wait for the tokens to hit bottom before buying them back at a low price. It’s like buying a nice suit on clearance after a fashion show — just know when to hold and when to walk away.

The Revenue Race: Most VCs have finally realized that there are projects that can generate real revenue — like Friend Tech, Pump Fun, and Polymarket. Now, everyone is racing to catch the next wave. What’s the challenge? Picking winners and losers among the multitude of competitors — there are over 100 alternatives to Pump Fun alone. On social, everyone is trying to outdo each other, it’s simply too crowded.

Liquidity Woes: Liquidity providers are becoming the darlings of the crypto world as projects desperately need more TVL and capital to successfully launch their tokens. Looking back, it’s hard to ignore that most liquidity funds have underperformed Bitcoin this year — unless they specialize in trading memecoins or crypto stocks.

Memecoins Are Unavailable: Regulated funds can’t touch memecoins, and unfortunately, this year it’s all about memecoins.

LP interest is starting to pick up, but they’re all waiting for something dramatic to happen. I’ve been talking to Asian wealth managers and family offices. ETFs then generated interest, but they needed a trusted party to manage their funds, and they get some scary news/hacks/scams from time to time, and often back off.

In summary, while the outlook is bumpy and challenging, those who hold strong convictions may find a path to success in this crypto chaos.

Narratives

AI projects stand out and take the largest market share. It seems like everyone is building a decentralized computing network. Just like everyone is building a better TPS L1/L2.

Most frequently asked question - What do you think is the next narrative? Everyone wants to build or invest in the next short-term narrative.

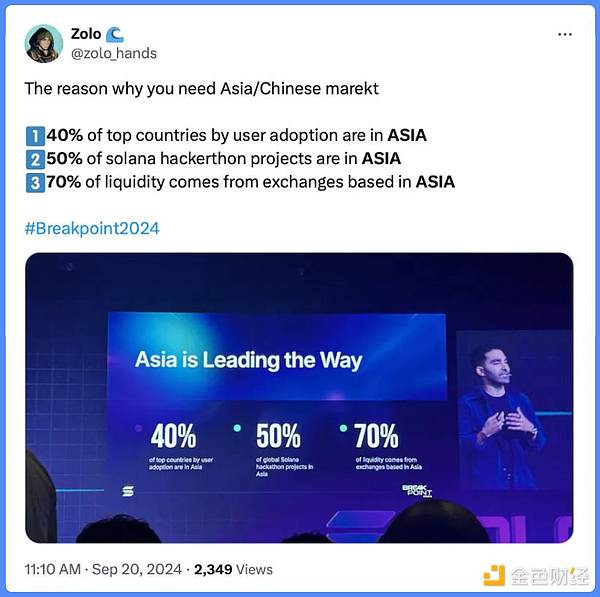

Asia is leading the crypto space, with as many developers, founders, and venture capital firms as the West. Compared to the West, Singapore/Dubai/Hong Kong have clearer regulations, and everyone I interviewed wants to enter Asia. Asia's population is younger, more eager to develop, and has a higher adoption rate.

After GMX, none of the other Perp DEXs except HyperLiquid have received any favor. Everyone is waiting for their launch, and some claim that the FDV at launch could reach $100 billion. This could set the tone for the launch and good performance of other innovative Perp platforms.

RWA seems to be another category of interest to the entire industry. Currently, Helium and Solana seem to be leading in this race. Helium, with its extended home wifi signal, is working with telephone companies to allow its signal and share Helium's coverage. Now with over 750k users, it’s an amazing real-world use case.

You can’t kill Memcoin mania — because we default to Degens. Memecoin is here to stay.

Chain abstraction as infrastructure is very exciting. But there were too many participants and booths at Token 2049. No clear winners yet, but the use case is clear — multi-chain transactions without knowing you’re on a blockchain.

The Bitcoin ecosystem seems to be slowing down. There’s a lot of activity and buzz, but not as much attention as last year. There’s still confusion across the ecosystem, and real use cases and user experiences are still far away.

Staking and re-staking is losing momentum because too many derivatives are on too many chains, creating fragmentation and risk for the entire ecosystem. The poster child for staking, LIDO, seems to be cursed, and people are moving on. I'm not too hopeful about the whole staking/restart mechanism, but would keep an open mind if I see anything interesting.

Winners and Losers

SOL is the clear winner, one chain to rule them all. ETH is a close second, with TON having the potential to be close, as mentioned above.

TON and SUI appear to have the highest market share of all L1s right now, with a potential internal audience of 800 million. SUI is about to hit its FDV cap of $25 billion, which is where I think it's capped.

TAO/Bitrensor is the most watched project, and one of my favorites in AI. It's the clear winner in its category. Render is another favorite.

Binance may change its face when CZ comes out. But BSC needs to make memes like Justin instead of listing the wrong "Neiro".

$Mother has caused a lot of sensation on memecoin, and I believe Izzy has been pushing this process in her way.

Hyperliquid is catching on. With a smooth user experience, it has quickly become the preferred exchange for many people. Some people like it, some people hate it. It's hard to predict how it will perform initially, but it's worth keeping a close eye on.

The liquidity of new projects will become a problem: more than 40 excellent projects will be launched in the fourth quarter, and more than 100 projects are on the sidelines. We are talking about more than $20 billion in new FDV. Who will buy them? If people are going to buy Monad and Berachain, L1s of millennials and baby boomers must be sold. I don't think there is enough liquidity. Many projects and their communities will suffer.

GameFi still hasn't gained momentum: People don't seem to be interested in GameFi. But I think GameFi will recover at some point.

Brian

Brian

Brian

Brian Hui Xin

Hui Xin YouQuan

YouQuan YouQuan

YouQuan Joy

Joy Hui Xin

Hui Xin Joy

Joy YouQuan

YouQuan Hui Xin

Hui Xin Brian

Brian