FHE vs ZK vs MPC: What are the differences between these three encryption technologies?

Many people still confuse FHE with ZK and MPC encryption technologies, so this article will compare these three technologies in detail.

JinseFinance

JinseFinance

Author: CaptainZ Source: X, @hiCaptainZ

Summer of Inscriptions

Before, everyone was speculating on which track the bull market would start, whether social, gaming, or ZK? There should be no suspense now, there is no doubt that it is the "inscription".

However, how to view "inscription" seems to be a confusing thing. Builders, investors, old OGs, new leeks, different people have different opinions. different perspectives. For a long time, I have been instilled with a wrong view that "inscriptions are a new way of issuing assets, similar to the violent pull of MEME coins", which led to a wrong understanding. It wasn’t until I saw the articles by teachers Wang Feng (@wangfeng_0128) and Joslter (@jolestar) that I realized the true meaning of the inscription.

In this article I will explain why "the essence of inscription is actually the third form of token SFT that is different from NFT and FT" and the cognitive implications of this Coming to the $ORDI valuation model, several common cognitive errors will be reviewed at the end.

1. What is SFT

For a long time, we Several fixed perceptions have been formed about tokens. Tokens are generally divided into two types: FT and NFT.

Fungible token: English is "fungible token", referred to as FT. The English word fungible means "interchangeable". As the name suggests, the characteristic of FT is that the tokens of any two units are exactly the same and can be replaced with each other, so they are "homogeneous" as a whole. Because FT directly corresponds to value units such as currencies, common stocks, and points in the real world, and can perform calculations such as addition and subtraction, it is easy to understand, so it appeared earliest. As early as 2015, when Ethereum was just launched, Vitalik Buterin proposed the idea of implementing FT through smart contracts, and Fabian Vogelsteller proposed the ERC-20 standard in November 2015. After 2016, ERC-20 has become the most widely used and well-known token standard, opening up a huge industry worth hundreds of billions of dollars.

Non-fungible token:English is "non-fungible token", or NFT for short. It is the antonym of FT in every way. The tokens of any two units in FT are exactly the same and can be substituted for each other, while each NFT is unique, unique, cannot be replaced, and cannot participate in calculations. FT represents an abstract quantity unit, and NFT represents specific digital items, such as virtual artwork, domain names, music, game equipment, etc. In order to express its uniqueness, each NFT has its own unique ID (determined by the creation contract address and serial number) and metadata. The main standard for NFT is ERC-721, which was proposed in January 2018 by three people including William Entriken. In the first three years after NFT was born, it can be said that it was an unknown supporting role. Until 2021, with the popularity of encrypted art, the NFT industry suddenly exploded. In the first five months of 2022, new NFT assets reached $36 billion. Today NFT is considered one of the most important infrastructures of Web3 and the Metaverse.

SFT: Semi-fungible token "semi-fungible token" is a new The token type is the third universal digital asset type alongside FT and NFT. Since it is called a "semi-" fungible token, as the name suggests, it is between FT and NFT. It can be split and calculated and is unique.

Everyone should note that because BTC lacks smart contract functions, the previous issuance of tokens was from the perspective of the ETH technology stack." "Definition", for example, the token standard of FT is ERC20, and the token standard of NFT is ERC721. What about SFT? Solv Finance, the team of Teacher Meng Yan (@myanTokenGeek), proposed ERC3525 in September 2022, defining the SFT token standard for the ETH ecosystem for the first time.

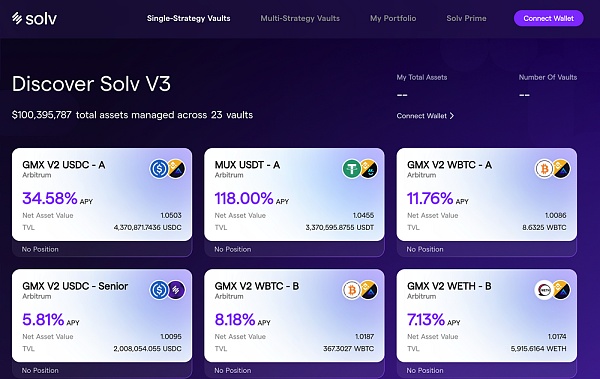

Although the ERC3525 of the Ethereum ecosystem has been proposed for nearly a year, it has not caused a lot of waves in the market. One reason is of course the bear market, but another reason is that the SFT tokens jointly issued by Solv are financial assets of some institutions. , or it belongs to the bond market, which is aimed at institutional traders and has nothing to do with ordinary retail investors.

2. How does the BTC chain issue FT?

Before the emergence of various smart contract platforms, many people had already experimented with issuing FTs and NFTs on the BTC chain. The most famous one is the Colored Coin scheme.

Colored coins refer to a group of similar technologies that use the Bitcoin system to record the creation, ownership and transfer of assets other than Bitcoin, and can be used to track digital assets and tangible assets held by third parties, with ownership transactions through colored coins. The so-called dyeing refers to adding specific information to Bitcoin UTXO to distinguish it from other Bitcoin UTXO, thus bringing heterogeneity between homogeneous Bitcoins. Through colored coin technology, the assets issued have many of the same characteristics as Bitcoin, including prevention of double spending, privacy, security, transparency and censorship resistance, ensuring the reliability of transactions.

It is worth noting that the protocol defined by colored coins will not be implemented by general Bitcoin software, so specific software is required to implement it. Identify transactions related to colored coins. Obviously, dyed coins only have value among groups that agree with the dyed currency protocol. Otherwise, heterogeneous dyed coins will lose their coloring properties and fall back to pure satoshi. On the one hand, the dyed currency recognized by the small community can take advantage of the many advantages of Bitcoin for asset issuance and circulation; on the other hand, it is almost impossible for the dyed currency protocol to merge into the Bitcoin-Core software with the largest consensus through a soft fork. possible.

The Mastercoin project conducted an initial token sale (today we call it ICO or initial coin sale) in 2013 and successfully raised hundreds of million, this is considered the first ICO in history. Mastercoin's most famous application is Tether (USDT), which is the most well-known legal stablecoin and was originally issued on Omni Layer.

The biggest difference from Colored Coins is that Mastercoin will only publish various types of transaction behaviors on the chain and will not record relevant asset information. In Mastercoin nodes, a database of state models is maintained in off-chain nodes by scanning Bitcoin blocks. Compared with Colored Coins, the logic it can complete is more complex. And since the status is not recorded and verified on the chain, there is no requirement for continuity (continuous coloring) between transactions. However, in order to implement the complex logic of Mastercoin, users need to trust the status in the off-chain database in the node, or allow the Omni Layer node to verify it themselves.

3. How does the BTC chain issue NFT?

The above The two protocols mainly issue FT assets based on the BTC chain. For NFT assets, Counterparty must be mentioned.

Counterparty launched in January 2014, initially as a platform for FT financial asset tokens, but quickly became the birthplace of some of the earliest NFTs , such as Spells of Genesis, Rare Pepes and Sarutobi Island. In Counterparty, you must give up a special Counterparty transaction in order to transfer the ownership of the token. The Counterparty node will parse the transaction data outside the chain, and then update a ledger/database placed in the Counterparty node. This is done using OP_RETURN, a method of storing arbitrary data in a Bitcoin transaction (so the data can be deposited into the Bitcoin blockchain).

The real explosion of Counterparty came after the launch of 1,774 NFTs in the Pepe the Frog series. Collectors use Counterparty wallets to secure these NFTs, and Counterparty uses the OP_RETURN output to anchor the index of these NFTs to the Bitcoin blockchain. The data size that can be attached to the OP_RETURN output is limited to 80 bytes, which is only enough for Counterparty to put the description, name and quantity of the NFT (but for ordinal NFTs, the only limit on the data volume is the size limit of the Bitcoin block, which we will be discussed in detail later).

In addition to using OP_RETURN, BTC itself is also developing. The technical changes brought about by SegWit (2017) and Taproot (2021) updates are all for The launch of Ordinals paved the way.

The Ordinals protocol was essentially created for NFTs that exist in the Bitcoin ecosystem. In January 2023, Casey Rodarmor introduced Ordinals. He describes Ordinals as electronic art. Its principle is also very simple. Satoshi (sat) is the smallest unit of Bitcoin and is named after the creator of Bitcoin, Satoshi Nakamoto. Since there are 100 million sats in one Bitcoin, each sat is 0.00000001 BTC. When all 21 million Bitcoins are mined, 2100 trillion sats will exist. Typically, each sat is indistinguishable from other sats. Because each sat is equivalent to another sat—and can be exchanged for equal value—they are considered fungible.

Ordinals protocol is a system that can distinguish and track individual sats. When a new Bitcoin block is mined and new Bitcoins are created as mining rewards , the protocol assigns each Bitcoin a unique number based on when it was mined, with smaller numbers corresponding to earlier sats.

When a transaction occurs, the Ordinals protocol tracks each subsequent transaction in a "first-in, first-out" manner. Numbers of sats are called Ordinals because both the identification and tracking mechanisms of the numbers depend on the chronological order of creation and transactions. After sat is identified by the Ordinals protocol, users can engrave arbitrary data on sat to give it unique characteristics, defined as cryptographic art. This feature is only available after SegWit (2017) and Taproot (2021) are upgraded to Bitcoin Core.

When an Ordinal is inscribed, Inscriptions are bound to a special type of taproot code. While this approach makes storing arbitrary data on Bitcoin more restrictive before, it allows Inscriptions to contain more and larger data. Creating and interacting with Inscriptions requires running a full Bitcoin node and a special wallet that supports Ordinals. Finally, we have

Ordinals + Inscriptions = NFTs

Ordinals theory can be imagined as a way of looking at the Bitcoin blockchain while wearing special goggles, allowing users to create, view and track additional information related to each sat.

Then the final question is, how do we issue SFT assets based on the BTC chain?

4. The essence of inscription token is SFT

The BTC chain lacks smart contract functions, so the issuance of any assets requires the use of script areas such as OP_RETURN or TAPROOT. Then there are two theoretical ways to issue SFT:

1. "Add" a certain "uniqueness" on the basis of FT tokens,

2. "Add" some kind of "homogeneity" on the basis of NFT tokens.

So the BRC-20 token was generated, and the second method was used. We mentioned in the previous chapter that "users can engrave any data on sat to give it unique characteristics." Then engrave a piece of text, it is a text NFT (corresponding to Loot on Ethereum), engrave a picture, It is a picture NFT (corresponding to PFP on Ethereum). If a piece of music is engraved, it is an audio NFT. So what if we engrave a piece of code, and this code is a piece of code for "issuing FT fungible tokens"?

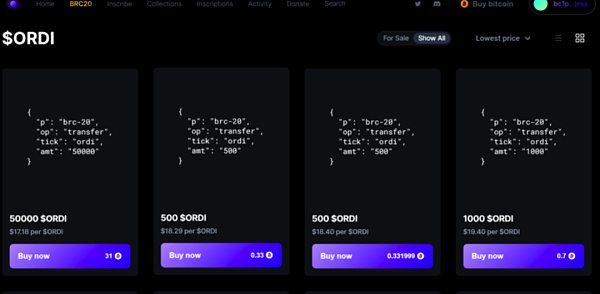

BRC-20 deploys Token contracts, mints and transfers Tokens by using the Ordinal protocol to set inscriptions (inscriptions) into JSON data format. JSON contains executable code fragments that can be implemented on the Bitcoin network, describing Token's Various properties such as its supply, maximum minting capacity, and unique code.

So we saw something that seemed strange: when we typed the inscription, we typed "one piece", which is 100% an NFT, and "one piece" "It can also be split and the homogeneous tokens inside can be divided one by one. This is somewhat similar to the concept of "wholesale and retail" in the real world. No wonder some people think that "Inscriptions are NFTs that can be split." , but this kind of property has both NFT and FT properties. Isn’t it the SFT we mentioned earlier?

Domo (@domodata) inadvertently achieved the issuance of SFT assets without using smart contracts through this seemingly atavistic technical method. , is really a great thing!

5. How does the ETH chain issue SFT?

We briefly discussed above how the non-smart contract public chain (BTC chain) issues FT and NFT, and for Ethereum, In fact, everyone is very familiar with how smart contract platforms issue FT and NFT. These are the common ERC20 tokens and ERC721 tokens. Then the question arises, how to issue SFT on the ETH chain? There are two token standards to choose from: ERC-1155 and ERC-2535.

ERC-1155 is a multi-token standard. Based on its essence, we prefer to call it the multi-instance NFT (multi-instance NFT) standard. It is suitable for a relatively narrow application scenario, that is, there are multiple identical instances of the same NFT. Note that these instances must be identical to each other and cannot be the slightest bit different.

ERC-3525 is a semi-fungible token standard. It is a universal standard and has a wide range of applications. It can identify multiple similar but not identical tokens as "same kind", and then allow special operations such as mutual transfers between the same kind. In effect, it is equivalent to performing mathematical operations such as merging, splitting, and fragmentation between similar ones.

The main difference between the two is the definition of "similar".

•ERC-1155 believes that objects of the same type must be exactly the same, and they are not the same type if they are slightly different.

•ERC-3525 believes that similar objects can seek common ground while reserving differences, and be harmonious but different. The key properties of each other are the same, but non-key properties are allowed to differ.

For SFT tokens that only issue MEME attributes, ERC-1155 is sufficient. For assets with more financial attributes, ERC-3525 is more suitable. . But unfortunately, whether it is 1155 or 3525, the Ethereum ecosystem has not seen large-scale use. Only a few institutional users have issued a small amount of debt-based SFT.

6. Why is the inscription successful?

Inscriptions are a large and general word. The original definition is "a piece of content is engraved on the chain." Looking back at history, we can clearly see that the inscription version of NFT was not successful and caused very little noise. The focus of discussion at that time was that after the smart contract version of NFT (ERC-721), the issuance was based on Are NFTs on the BTC chain worth it?

Modeling the concept of fully on-chain game, we can introduce the concept of fully on-chain NFT (fully on-chain NFT). As we all know, NFT based on Ethereum ERC-721 stores only the address of the image or content in the metadata. If the content is placed in a traditional cloud server, this address is the web link. If the content is placed in a distributed In storage, this address is the hash value. No wonder Musk has been ridiculing NFT and said, "At least small pictures must be encoded on the blockchain." Therefore, we say that NFT on Ethereum is "storage content off-chain and storage address on the chain." If the centralized storage server or distributed storage server disappears, then the NFT will also disappear.

The inscription version of NFT is a veritable full-chain NFT. The content is directly stored in the BTC on-chain space. It only uses sequenced sats to point to the content. This is indeed an advantage, but this advantage It's not enough to convince everyone. So before March, Ordinals NFT was tepid, just a small activity in the small picture market, until the emergence of BRC-20.

I think the success of BRC-20 is due to the following reasons:

1.BRC-20 uses a stupid method to realize the issuance of SFT assets on the non-smart contract public chain. SFT tokens are a new asset form that is different from FT and NFT tokens. This is the most essential factor for success. reasons (Ordinals NFT was not successful in the early days).

2. BRC-20 adopts the principle of fair sale, which is different from the "VC model" of the Ethereum ecosystem. It can be launched in a short time Open up the market through broader wealth effects and trigger FOMO (a stark contrast is Solv Finance).

3. SFT’s leading ORDI token is an experimental MEME token.This token without a valuation model has brought More imagination (or consensus value).

4. SFT combines the dual advantages of FT and NFT, allowing it to directly use the existing FT and NFT foundations facility. So we will find that inscription tokens can be traded on NFT trading markets like OpenSea like NFTs, or on centralized exchanges like Binance, OKX, or even on DEXs like Uniswap. trade. In the initial stage, when NFT transactions are characterized by low liquidity, it is easier to cause price increases (pulling the market). However, after being listed on the centralized exchange, there will be a huge amount of liquidity to take over, and all the benefits will be taken advantage of.

5. Undertake the overflow funds from the BTC ecosystem. For a long time, BTC holders who want to participate in on-chain activities such as DeFi, NFT, gaming and social networking have only been able to do so through cross-chain operations. Now there are finally native BTC products to play with.

7. Valuation of ORDI

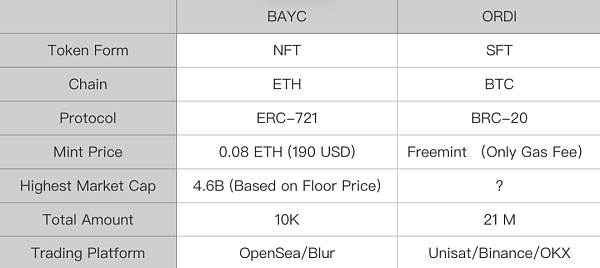

$ORDI is The first SFT token in the BTC ecosystem is itself a MEME attribute, so there is no Intrinsic valuation model. In other words, the only limit is your imagination. But we can still make an estimate by reviewing BAYC, the leader in the NFT market.

BAYC has always been the leading project of NFT tokens, similar to a fair sale (low-price Mint), and then rose thousands of times, reaching the highest market value in May 2022 Approximately US$4.6 billion.

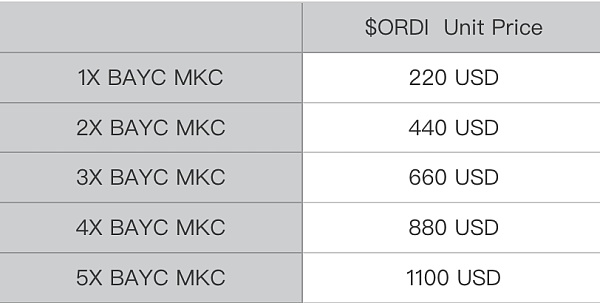

ORDI is the first token of BRC − 20. You only need to pay a little Gas to get free Mint, and then it will rise. Thousand times, the current price (December 2023) is stable at $70. We assume that ORDI will continue to maintain the leading position of SFT tokens in the future. Then the highest point of the bull market can at least align with the market value of BAYC. The unit price at this time is 220 US dollars. However, because ORDI can be traded on centralized exchanges, its liquidity is far away. Higher than NFTs like BAYC (many players who simply speculate in currencies will only trade on centralized exchanges and will not use wallets), then the total market value will be 3-5 times that of BAYC,which is also acceptable, so we have The following table is provided:

Of course, this horizontal comparison valuation method is relatively rough. Just take a look. After all, when emotions come, you have the final say on the price.

8. Several wrong perceptions

The blind man feels the elephant , when a new thing appears with many new characteristics, everyone may only see one leg or a long trunk of an elephant, but never think that that is all the elephant. In the past six months, I have read many people's explanations, and many of their opinions have led me astray. It was not until I read the articles by Wang Feng and Joslter that I truly understood the essence of the inscription.

1. Inscription is a new way of distributing tokens.

This perception is completely wrong. The so-called "engraving" is to upload a piece of content to the blockchain space. This engraving method has been around for a few years, and several mining pools have even opened related engraving services. Moreover, Ordinals was not popular when it first engraved NFT. It only became popular when it was changed to a homogeneous token engraved in JSON format. So the correct understanding should be: Inscription token is a new type of token form SFT.

2. The inscription is a wave of capital pulls like MEME

This view is based on my previous understanding, which may or may not be correct. After all, the bull-bear cycle of the entire web3 is too obvious. Any track, including the previous DeFi and NFT, is "" in terms of the 4-year cycle. Narrative + pulling + smashing”, and ORDI is indeed the attribute of MEME currency. However, this understanding only sees the first leg of the elephant, and does not see the essence of "Inscription token is a new token form SFT", which is a partial generalization.

3. Inscription is a backward technology and a retrogression

This view is half correct and half wrong. In the current public chain, the BTC chain without smart contracts and the ETH chain with smart contracts should not be confused. For the BTC chain, the only way to issue SFT seems to be BRC-20 or a variant of a similar protocol, but for the smart contract public chain, issuing SFT in the form of inscriptions is indeed a step backwards technically, after all. There are better ERC-1155 and ERC-3525 standards, but this can only be seen as a speculative hype.

4. The inscription is the BTC ecology’s counterattack against the ETH ecology

This view is half correct and half wrong. The ETH ecosystem originally had the SFT standard, but it has not developed. It is indeed because only VCs and institutions participated, and it did not benefit retail investors. Retail investors can only choose BRC-20 protocol tokens that are sold fairly in the BTC ecosystem, which is not only a resistance to VCs, but also a resistance to the "legitimacy" of Ethereum. But this "resistance" is only the second leg of the elephant, not the elephant itself. Don't overgeneralize.

5. The inscription is carved on gold

This The views are right and wrong. If you compare BTC to digital gold, this metaphor is very vivid, but it still ignores the essence that inscription tokens are a new asset form such as SFT, which is a partial generalization.

Through the above discussion, we can see that the essence of Inscription Track is an explosion of new token form SFT. For non-smart contract public chains, SFT can only be issued through the "postscript" method of BRC-20. As for the smart contract public chain, there are two ways. One is to call VM to use smart contract to issue, and the other is to use it without calling VM. "Postscript" is released. In the next article, we will explore the two evolutionary directions of "Inscription Tokens": recursive inscriptions and smart inscriptions.

Many people still confuse FHE with ZK and MPC encryption technologies, so this article will compare these three technologies in detail.

JinseFinance

JinseFinanceSolana’s “Actions and Blinks” simplify transactions and voting operations through browser extensions, while Farcaster on Ethereum enhances social network interoperability and user data privacy protection through decentralized protocols.

JinseFinance

JinseFinanceIn this article, I will explain why "the essence of inscription is actually SFT, the third form of token that is different from NFT and FT" and the $ORDI valuation model brought about by this recognition. Finally, I will comment on several common perceptions. mistake.

JinseFinance

JinseFinance JinseFinance

JinseFinanceGerman federal financial regulator rules NFTs not securities, what it means for Europe's emerging crypto classification framework.

CryptoSlate

CryptoSlateThe SEC is investigating Bored Ape Yacht Club creator Yuga Labs for securities violations.

Others

OthersThe DeFi space continues to bring up disruptive innovations that cut across different industries and economies. The internet community has ...

Bitcoinist

BitcoinistWhen crypto bull market profits dry up, the best way to keep gains coming is by using leverage to open ...

Bitcoinist

BitcoinistDespite the recent downturn in crypto prices, decentralized finance, or DeFi, is still among the strongest sub sectors in the ...

Bitcoinist

BitcoinistThe "Never Fear Truth" NFT Collection by Johnny Depp takes off as the actor won the defamation case against his ...

Bitcoinist

Bitcoinist

Please enter the verification code sent to