Source: Barron's Chinese

"The long-stretched rubber band finally broke," and investors should prepare for more declines as the stock market continues to clear excess liquidity.

The Federal Reserve's sober forecast for interest rates and inflation prospects in 2025 on Wednesday (December 18) shocked the market. The market correction may have begun, but it is not time to panic yet.

Federal Reserve Chairman Powell conveyed a message that no one wanted to hear: inflation is falling slower than expected, and only two interest rate cuts of 25 basis points are expected in 2025. Compared with previous forecasts of larger interest rate cuts and statements of more progress in reducing inflation, the signals sent by Powell on Wednesday disappointed investors.

After a 25 basis point rate cut on Wednesday, the target range of the federal funds rate fell to 4.25%-4.5%, but there were large differences within the Federal Reserve on the rate cut, with four officials opposing the rate cut.

Affected by the Fed's "hawkish" tone and Powell's speech, the S&P 500, Dow Jones Industrial Average and Nasdaq Composite Index all fell. The 3% drop in the S&P 500 on Wednesday was the biggest drop in the index on the day the Fed announced its interest rate decision in nearly 15 years. The Dow closed down 2.6%, falling for the 10th consecutive trading day. The Nasdaq closed down 3.6%, the worst performance on the day the Fed announced its interest rate decision since March 2020.

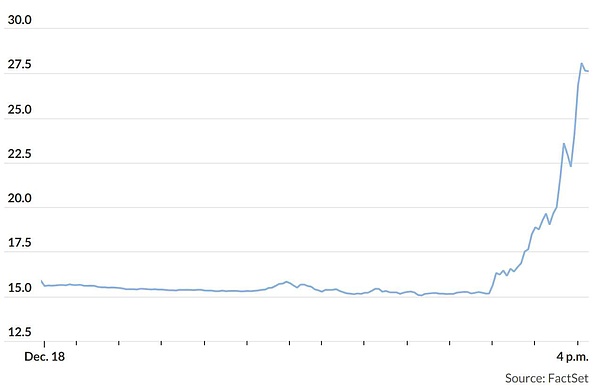

Small-cap stocks that are sensitive to interest rates were hit harder, with the Russell 2000 index falling 4.4%. At the same time, market volatility rose sharply. According to Dow Jones Market Data, the VIX panic index soared 74% to 27.62, marking the largest single-day percentage increase since February 2018.

VIX panic index soared

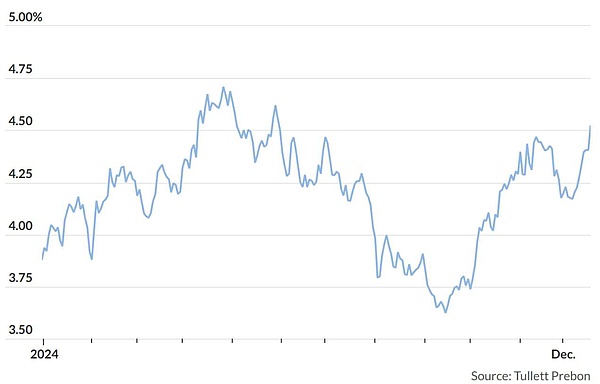

Bonds were not spared, with the 10-year Treasury yield soaring to 4.5%. The 10-year Treasury yield has risen in six of the past eight trading days and is up 0.87 percentage points from the 52-week low of 3.62% set in September.

The 10-year Treasury yield rose to its highest level since May 31

Powell's message was not so sensational, but since the markets were already on the edge of the cliff, it would not take much force to push them over the cliff. "Today, the rubber band that had been stretched so tight snapped," BTIG technical analyst Jonathan Krinsky wrote in a research note Wednesday.

Krinsky noted that the stock market's technical indicators are "exhausted": the number of declining stocks has exceeded the number of advancing stocks for 13 consecutive trading days, and only 8% of the S&P 500 components are above their respective 20-day moving averages. In addition, Adam Turnquist, chief technical strategist at LPL Financial, pointed out that only 53% of stocks are currently trading above their 200-day moving averages, which are at their lows for the year.

Krinsky pointed out that high-momentum stocks were close to a collapse before, and this finally happened on Wednesday: high-momentum stocks fell nearly 6%, experiencing their worst day since May 2022.

As the stock market continues to clear excess liquidity, investors should prepare for more declines. "Today's turmoil in financial markets following the Fed's hawkish rate cut could be the start of the pullback we've been expecting," strategist Ed Yardeni wrote in a note.

At the same time, investors didn't just sell. Tesla (TSLA), which fell 8.3%, wasn't immune, but Nvidia (NVDA) fell a relatively modest 1.1%, reflecting how much its stock has fallen in recent trading days.

In addition, UnitedHealth (UNH) was the only Dow component to rise, up 2.9%, and other health insurers also rose, including Cigna (CI), Centene (CNC) and CVS Health (CVS). The health care sector has been falling since the murder of a UnitedHealth executive, and investors seem to think the bad news has been exhausted.

Investors still have good reasons to expect the market to digest and deal with the Fed's more pessimistic outlook. First, Powell reiterated that the U.S. economy remains healthy. Second, inflation is in a range of 2% to 3%, making it hard to fall further, but it's not as bad as a sharp rise in inflation, which was the culprit for the stock market sell-off in 2022. Finally, there are no signs that corporate profits will start to fall.

It's also worth noting that the stock market is still a long way from a correction (a drop of at least 10%). The S&P 500 closed at 5,872 on Wednesday, just 3.6% below its all-time closing high of 6,090 reached on December 6.

When technical indicators deteriorate, as they have recently, they can take a while to recover. Krinsky noted that he can't rule out the possibility of further declines in the stock market, and expects a "larger and longer decline" in the stock market in early 2025.

However, corporate earnings still have a lot of support, and at the same time, Trump's proposed deregulation and tax cuts are expected to provide some stimulus to US economic growth and help corporate profits continue to grow (provided that tariffs don't cause the US economy to derail its growth track and inflation to soar again).

Yardney, who has always been bullish, has not changed his position. He wrote in the research report: "The government shutdown, the dock workers' strike, and the tariffs imposed by the new Trump administration on the first day of office are worrying and may cause the stock market correction to continue until January next year. However, our target price for the S&P 500 index at the end of next year is still 7,000 points."

Catherine

Catherine

Catherine

Catherine Kikyo

Kikyo Alex

Alex Weatherly

Weatherly Miyuki

Miyuki Weiliang

Weiliang Brian

Brian Weatherly

Weatherly Alex

Alex Miyuki

Miyuki