At 2 a.m. Beijing time on September 19, the Federal Open Market Committee (hereinafter referred to as FOMC) of the Federal Reserve announced that it would cut the federal funds rate by 50 basis points to 4.75%~5.00%, exceeding market expectations and starting the first rate cut since March 16, 2020.

So far, the Fed's policy shift has been completed, and its new round of monetary easing cycle has officially begun.

The FOMC policy statement stated that although inflation has made further progress toward the 2% target, it is still at a "slightly high" level, and the risks facing employment and inflation targets are in a balanced state. After the announcement of the Fed's interest rate decision, the gains of U.S. stocks expanded. As of press time, the Nasdaq rose by more than 1%, the S&P 500 rose by 0.72%, and the Dow rose by 0.74%. Spot gold continued to rise, reaching the $2,600/ounce mark, a record high.

The Fed's rate cut has a very important impact on global asset allocation, US dollar liquidity, US stocks, US bonds, commodity trends and other countries' economies. Which markets or fields will usher in new investment opportunities? How will the US dollar, US stocks and US bonds perform? Will China's economy and capital market be affected by the Fed's rate cut? How will investors "respond"?

In this regard, the reporter of "Daily Economic News" (hereinafter referred to as "Daily Economic News Reporter") interviewed the chief economists, chief strategy analysts and research teams of many well-known institutions at home and abroad, and selected six representative judgments for reference by investors, economic researchers and policy system makers.

1 Brian Coulton, Chief Economist of Fitch Ratings:This round of easing cycle will last for 25 months, with 10 interest rate cuts, a cumulative reduction of 250 basis points

At 2 a.m. on the 19th, the Federal Open Market Committee of the Federal Reserve ended its two-day interest rate meeting and announced the interest rate resolution, lowering the target range of the federal funds rate by 50 basis points to 4.75%~5.00%. This means that the Federal Reserve has officially joined the ranks of major global central banks such as the European Central Bank and the Bank of England to start an easing cycle.

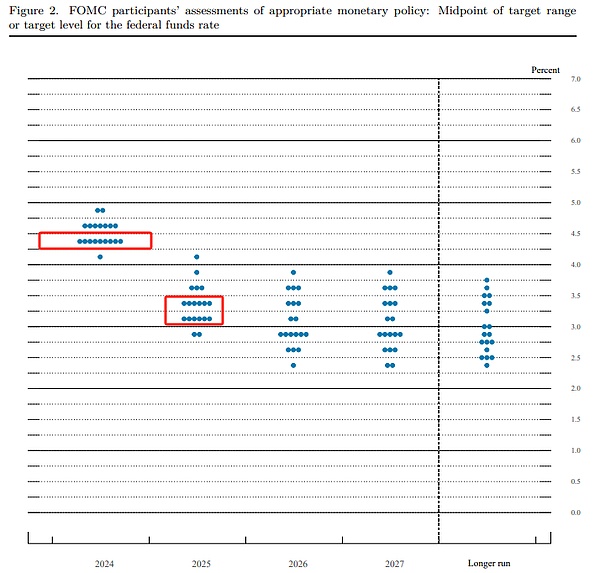

The press release issued by the FOMC showed that except for Director Bowman who believed that the interest rate should be cut by 25 basis points, all other voting members voted in favor of a 50 basis point interest rate cut. The "Summary of Economic Projections (SEP)" and "Dot Plot" released at the same time show that the FOMC lowered its forecast for US GDP growth this year from 2.1% in June to 2%, lowered its forecast for core PCE at the end of the year from 2.8% to 2.6%, raised its forecast for unemployment rate at the end of the year from 4.0% to 4.4%, and expected another 50 basis point rate cut this year.

FOMC September "Dot Plot" Image source: Federal Reserve

With the implementation of the first interest rate cut, the subsequent rate cut rhythm has also become the focus of market attention. Most of the voting committee members believe that the federal funds rate will be lowered to 4.25%-4.50% at the end of this year, but the voting committee members disagree on whether the rate should be cut by a total of 100 basis points or 125 basis points in 2025. Brian Coulton, chief economist of Fitch Ratings, said in an email to the reporter of "Daily Economic News" that the Federal Reserve is expected to cut interest rates twice, five times and three times this year, 2025 and 2026 respectively, and the federal funds rate will be lowered to 3% by September 2026. This means that during this easing cycle that is expected to last for 25 months, the Federal Reserve will cut interest rates 10 times, with a cumulative rate cut of 250 basis points. Coulton explained: "If we exclude some very short-term interest rate cuts in the 1970s and early 1980s, the median rate cuts and duration of the Fed's easing cycles since the 1950s will be 550 basis points and 18 months respectively." He also pointed out that the reason why the Fed is expected to ease at a relatively moderate pace is that it still has work to do in fighting inflation. 2 Barclays Research Team: Options trading can be an attractive tool to hedge against recession risks. In recent times, the US dollar has been under pressure as traders prepare for the Fed's first rate cut. In theory, the Fed's rate cut will reduce investors' motivation to buy US Treasuries, thereby weakening demand for the US dollar.

Analyzing the impact of previous Fed rate cut cycles on the trend of the US dollar, Goldman Sachs believes that monetary policy coordination is the key, and the extent and speed of the Fed's rate cuts will not have a clear impact on the US dollar. Even during the Fed's rate cut cycle, the US dollar will not necessarily perform worse than other currencies. On the contrary, the coordination of rate cuts and the macroeconomic environment are more important.

Performance of US stocks, the US dollar and 10-year US bonds in past interest rate cut cycles. Image source: Meijing Charting (Data source: Haitong Securities)

In an interview with the reporter of the "Daily Economic News", the Barclays research team pointed out that the recent foreign exchange market volatility has intensified due to the increase in economic uncertainty caused by the risk of a US recession, but from a historical standard, the current foreign exchange volatility level is still low, and the risk premium of major currency options is still below the historical average. Therefore, option trading can become an attractive tool for hedging recession risks.

As for the impact of interest rate cuts on US stocks and US bonds, Dr. Zhang Ling, chief economist of Huatong Securities International, believes that in the short term, it is necessary to consider the extent of interest rate cuts. A 25 basis point rate cut means a higher probability of a precautionary rate cut, while a 50 basis point rate cut indicates that the Fed may believe that a "hard landing" of the economy is more likely, which will bring uncertainty.

3 Lian Ping, Chairman of the China Chief Economist Forum:Rate cuts may work together with a series of other factors to push up gold prices

Since early June this year, as expectations of a rate cut by the Federal Reserve continue to rise, COMEX gold has continued to make efforts. As of noon on September 17, COMEX gold has risen from $2,304.2/ounce at that time to more than $2,600/ounce. After the Federal Reserve announced the rate cut, spot gold continued to rise, and as of press time, it hit the $2,600/ounce mark, a record high.

Lian Ping, president and chief economist of Guangkai Industrial Research Institute and chairman of China Chief Economist Forum, told the reporter of Daily Economic News that the Fed's interest rate cut will have an impact on the gold market in the short term, which may lead to a large increase, or a certain degree of decline as the interest rate cut "landed". Overall, there may be large fluctuations in the short term.

From a medium- to long-term perspective, Lian Ping analyzed that this round of interest rate cuts may be relatively gradual, and is expected to last from September this year to the end of next year or even longer. This is a preventive interest rate cut, mainly to avoid a continuous decline in the economy and a recession, so the interest rate cut will not be too strong, and is expected to be between 150 and 200 basis points, unless the US economy shows a significant recession in the short term. Therefore, the stimulus of the Fed's interest rate cut on gold prices may be a gradual increase in the medium term, and the thrust is relatively mild. Lian Ping further analyzed that, in fact, in the future, the Fed's interest rate cut is likely to push up the gold price together with a series of other factors. After the interest rate cut, inflation may gradually rise slightly, so the value-preserving function of gold will be revealed again. At the same time, in the complex environment of continuous geopolitical conflicts, "black swan" events may continue to occur in the future, promoting more obvious risk aversion demand. In addition, a series of new changes have also occurred in the international monetary system, the credit of the US dollar has been shaken, and the euro has performed weakly. In the context of de-dollarization, the RMB has won development opportunities. However, the RMB is still in the early stage of internationalization. In this case, for the sake of reserve function, central banks of various countries may pay more attention to maintaining and increasing their gold reserves. In summary, Lian Ping pointed out that in the medium and long term, gold still has room for further increase.

Image source: Meijing Chart

4 Guan Tao, Global Chief Economist of BOC Securities: Interest rate cuts will help expand China's autonomous space for monetary policy. From the perspective of the economic cycles of China and the United States, Guan Tao, Global Chief Economist of BOC Securities, pointed out in an interview with the "Daily Economic News" reporter that, given that other conditions remain unchanged, the Fed's interest rate cut will help converge the divergence between the economic cycles and monetary policies of China and the United States, ease China's capital outflow and exchange rate adjustment pressure, and expand China's autonomous space for monetary policy, but we cannot expect too much from this.

First, in his view, China has always insisted on "self-centered" monetary policy. Before 2022, in the response to the epidemic, China's monetary policy was first-in-first-out, playing the role of a leader rather than a follower. The Fed's interest rate cut in the future does not mean that China will necessarily follow the reserve requirement ratio cut and interest rate cut, because China also needs to take into account the long-term and short-term, internal and external balance, stable growth and risk prevention.

Secondly, after the first interest rate cut, the market focus will turn to the timing and magnitude of the Fed's next interest rate cut. The market expectations will continue to switch between a "soft landing", "hard landing" and "no landing" of the US economy, and international financial turmoil is inevitable.

Guan Tao pointed out that no matter what happens to the US economy, it will have both advantages and disadvantages for the Chinese economy. The key for China is to do its own thing well. If the US economy does not fall into recession, it is possible that the Fed will not cut interest rates significantly, and the US dollar will not weaken in a trend. This will continue to be an external constraint on China's monetary policy, but it will help stabilize external demand and support the smooth operation of the Chinese economy. If the US economy falls into recession, it may trigger a sharp interest rate cut by the Fed. After the market's risk aversion subsides, the US dollar will weaken in a trend, which will help open up China's monetary policy space and ease the external pressure of China's capital outflow and exchange rate adjustment, but it will not be conducive to stabilizing external demand and affecting the smooth operation of China's economy.

For China, Guan Tao finally pointed out that it is necessary to make a response plan based on scenario analysis and stress testing to be prepared for any eventuality.

For other emerging markets, the Barclays research team also pointed out in an interview with a reporter from the Economic Daily that the Fed's influence on emerging market policies has declined. Barclays believes that with the lifting of restrictions on the Fed's monetary policy, slow global growth and global commodity inflation under control, emerging market central banks may give priority to more relaxed policies rather than strong currencies. The bank believes that most central banks have relaxed their policies as much as possible under low inflation conditions, but maintained high real interest rates to protect their currency exchange rates.

5 Zhang Ling, Chief Economist of Huatong Securities International:Emerging markets are likely to receive more international capital inflows

As the Fed starts to cut interest rates, changes in exchange rates will not only affect the settlement costs of international trade, but may also trigger the acceleration of capital flows and changes in foreign exchange reserves. In theory, the Fed's monetary easing cycle will lead to a decline in the interest rate of the US dollar, driving international capital to flow into emerging markets with higher returns.

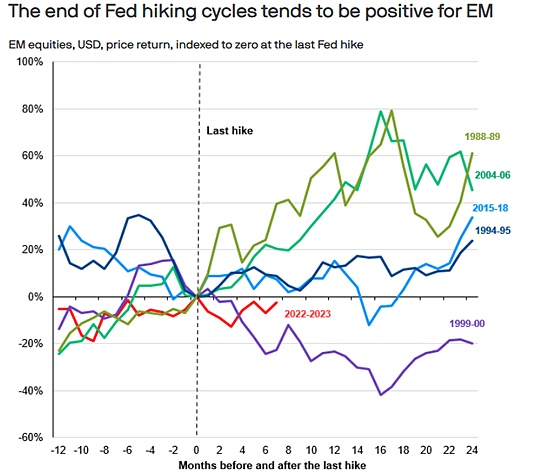

JPMorgan Asset Management said in an article recently that in the past five interest rate hikes by the Fed since 1988, four of them saw positive performance in emerging market stocks two years after the Fed's last rate hike, with an average return rate of 29%, even 17 percentage points higher than the return rate of developed market stocks in the same period.

The end of the Fed's rate hike cycle is often good for emerging markets. Image source: JPMorgan Chase

"Of course, the broader fundamental background is also important, but US interest rates do play a disproportionate role in driving capital inflows and outflows from emerging markets. As a riskier asset class, emerging market assets tend to benefit when the Fed completes its rate hikes, global economic sentiment improves, and risk appetite is high," the article pointed out.

Dr. Zhang Ling, chief economist of Huatong Securities International, also pointed out to the reporter of "Daily Economic News" that based on the long-term performance of the Fed's multiple rate cut cycles in the past few decades, emerging markets do generally perform well during the rate cut cycle. It can be seen that in the past two weeks, the prices of assets that are closely related to the US dollar and US stocks have increased significantly.

"However, how international capital flows during the interest rate cut cycle still depends on whether the U.S. economy can reflect people's expectations as a whole and whether its fundamentals are strong enough. If interest rates are cut too quickly, it may cause people to worry about the global economy. At present, we remain cautiously optimistic. As far as the performance of the current global economy, especially those economies with a high degree of correlation with the United States, overall asset prices are at a low level. In the case of the Fed's interest rate cut, it is highly likely that more international capital will flow into emerging markets." Dr. Zhang Ling added to reporters.

However, some studies have pointed out that in past monetary easing cycles, funds flowing into many emerging and developing markets have proved to be relatively resilient, thanks to their sound policy frameworks and healthy foreign exchange reserves.

6 Gui Haoming, Chief Market Expert of Shenyin & Wanguo Securities Research Institute:From an investment perspective, US dollar holders are unlikely to sell immediately,which will not have a big direct reaction on the domestic capital market

How can major asset allocations be strategically responded to the impact of the Fed's rate cut?

Gui Haoming, Chief Market Expert of Shenyin & Wanguo Securities Research Institute, pointed out in an interview with the reporter of Daily Economic News that in terms of equity assets, the Fed's rate cut will help improve market risk appetite, especially in terms of causing funds to flow out of the US capital market and then flow to other markets. However, the current continuous adjustment of the A-share market has its own internal logic, and the focus is not on the relatively high interest rate gap between China and the United States.

According to his analysis, at present, it will take some time for the interest rate gap between China and the United States to eventually disappear. We cannot expect a rate cut to fundamentally change the flow of funds. This is a gradual process. Therefore, for domestic risky assets, it is difficult to expect a major shift in the Fed's rate cut this time.

In general, Gui Haoming said that the Fed's rate cut will bring certain benefits to domestic economic activities, but it is more based on a long-term perspective. Since we are at the end of the transmission of this effect, the short-term effect will not be great. As for A-shares, it is more of a psychological effect. In terms of low-risk asset allocation, Gui Haoming analyzed that low-risk investors pay more attention to safety. At present, although domestic interest rates are relatively low, investors value relatively stable returns. In this case, it is difficult to say that domestic fixed-income asset trading behavior is based on the US dollar interest rate as a reference.

From the perspective of US dollar allocation, he believes that one or two interest rate cuts will not change the relatively high level of US dollar interest rates. From an investment perspective, the US dollar is still more attractive, and US dollar holders are unlikely to sell immediately just because of this interest rate cut.

But Gui Haoming emphasized that the greater significance of the Fed's interest rate cut this time is that it has opened the channel for US dollar interest rate cuts. The trend of US dollar interest rate increases for several consecutive years has been substantially changed. In the future, there is a high probability that US dollar interest rates will gradually decline, and the impact on the operation of the international economy will become more and more apparent, but this requires a process. Therefore, for now, this US dollar interest rate cut will not have a big direct reaction on the domestic capital market.

Huang Bo

Huang Bo

Huang Bo

Huang Bo Huang Bo

Huang Bo Weiliang

Weiliang Cheng Yuan

Cheng Yuan Huang Bo

Huang Bo Miyuki

Miyuki Edmund

Edmund Bernice

Bernice Brian

Brian Aaron

Aaron