Source: Zhichun Capital

On January 10, the U.S. SEC approved 11 Bitcoin spot applications, officially marking the entry of crypto assets into the core asset allocation pool of mainstream institutions around the world. However, on the first day after the ETF opened, the price trend of Bitcoin was completely opposite to the previous high market sentiment. It fell from a minimum of US$49,000 to US$41,500, erasing almost all the gains in the past month. What happened in the middle? What caused this crash? Why would a large amount of funds flow out of the BTC market through ETFs instead of inflows after the adoption of spot ETFs? After practical operation, the editor will take the entire process of the circulation of US$1,000 in ETF as an example to help you understand the transaction execution mechanism behind ETF, hoping to help investors better grasp the investment opportunities of crypto assets in the ETF era.

Part1: Through the operation of 1,000 US dollars, reveal the fund flow process behind ETF< /strong>

First of all, you must understand the4 important participants in the Bitcoin spot ETF system:

Issuer (Sponsor): Responsible for designing and managing ETF products, calculating the daily net value (NAV) of ETF products, and collecting management fees. Currently There are 11 approved companies, such as Blackrock, Fidelity, Ark, Grayscale, etc.

Authorized Participant (AP): Only has the right to subscribe and redeem directly with the issuer The institution is generally an asset management company/brokerage firm.

Market Maker: Provide liquidity in the secondary market, buy and sell ETF shares, and detect insufficient/excess liquidity In this case, request the authorized participant (AP) to subscribe/redempt ETF shares.

Investors: Individual or institutional investors buy and sell ETF shares through the secondary market.

After understanding the above participants, let us now follow a $1,000 ETF investment and reveal the fund flow process behind it

It should be noted that: Since the US SEC only approved Bitcoin ETFs based on cash subscription and redemption, all Bitcoin ETFs currently issued cannot Carry out physical subscription and redemption. Therefore, the flow of funds can only be carried out in the following ways:

When you decide to buy Bitcoin spot ETF with $1,000 At that time, you usually choose an online trading platform, such as Robinhood, Interactive Brokers (IBKR); place an order according to the market price at that time. After the transaction is successful, your $1,000 will flow to theMarket Maker ;

At the same time, the market maker may have received many buy orders of $1,000, and the ETF held in If the share is not enough to meet the demand for buying orders, the ETF price rises, and the market value is unanchored relative to the total Bitcoin assets held by the issuer, resulting in a positive premium, then the market maker will provide authorized participants (AP)Apply for assistance in purchasing ETF shares. Part of your $1,000 will be transferred to Authorized Dealer (AP), such as 200 U.S. dollars;

The Authorized Dealer (AP) will send the issuer (Sponsor) Apply for ETF shares and transfer US$200 to Issuer (Sponsor);

Issuer (Sponsor) strong>The US$200 will be used to purchase Bitcoin through platforms such as coinbase. According to the agreements of different funds, the time for funds to purchase Bitcoin can be from the day of subscription to 1-2 days after the subscription, and the funds will eventually flow into the cryptocurrency market;

Part 2: ETF secondary market purchase Selling volume ≠ Net inflow and outflow of Bitcoin market funds

Through the research and operation of the circulation process, we can draw the conclusion:ETF secondary market purchase Selling volume ≠ Net inflow and outflow of funds in the Bitcoin market. These two values cannot be directly equated but they influence each other.

When we discuss the impact of Bitcoin spot ETFs on the price of Bitcoin, the most important issue is to focus on how much US dollars USD flows from the traditional financial market to the Bitcoin market to purchase Bitcoin spot through ETF, which is the total net inflow (Total Net Inflow).

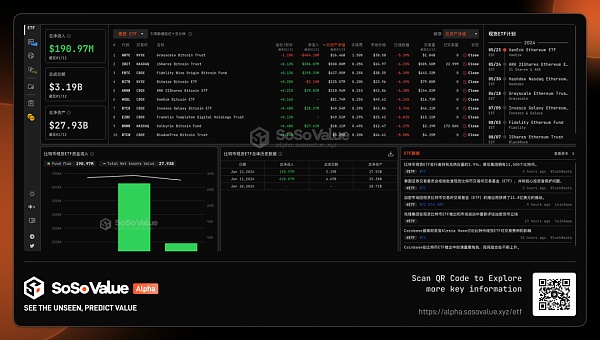

So how is the net inflow calculated? By adding up the overall subscription and redemption data of these 11 ETFs, it can be calculated. Each issuer (sponsor) will disclose the corresponding values on their official websites, or through professional data tracking tools, such as Bloomberg, or SoSo Value's ETF sector, check by day. Take SoSo Value’s ETF dashboard , for example.

We can see that in the Bitcoin ETFGrayscale GBTC had an outflow of $594 million on January 16 (the third trading day after approval), and two trading days after the ETF passed There were also redemptions on the 11th and 12th, with net fund outflows of US$95 million and US$480 million respectively. The total outflow on these two days was US$580 million. Therefore, although the trading volume of all market ETFs on the 11th and 12th was as high as US$4.67 billion and US$3.19 billion respectively, and other ETFs such as ARK, BlackRock and Fidelity received a total of US$1.4 billion in net subscriptions, due to the large volume of Grayscale ETF The net outflow of funds in the overall Bitcoin market was significantly lower than market expectations, which in turn caused the Bitcoin correction that began on the 12th (see the cross-sectional data on January 12th in the figure below).

Source: SoSo Value cross-sectional data on January 12, 2024 (https://alpha.sosovalue.xyz)

Source: SoSo Value cross-sectional data on January 12, 2024 (https://alpha.sosovalue.xyz)

Part 3: Why there is a large amount of funds in the Grayscale Bitcoin ETF Outflow? How long will this outflow last?

The redemptions of the Grayscale Bitcoin ETF for three consecutive days have brought selling pressure of approximately 26,000-28,000 Bitcoins, increasing the market’s wait-and-see sentiment. . According to SoSo Value data, there were redemptions of Grayscale GBTC on January 11, January 12 and January 16, with net outflows totaling US$1.174 billion.

Source: SoSo Value cross-sectional data on January 16, 2024 (https://alpha.sosovalue.xyz)

Source: SoSo Value cross-sectional data on January 16, 2024 (https://alpha.sosovalue.xyz)

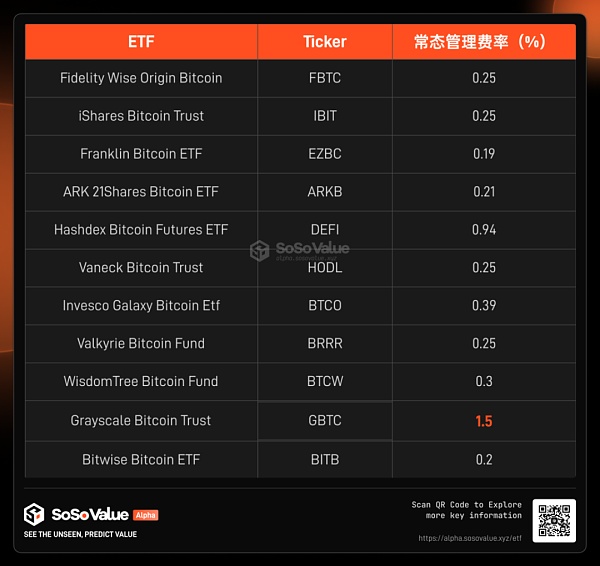

Compared to competitors 6 times higher management fees, and the closing of early trust discount arbitrage ordersare the net outflows of Grayscale Bitcoin ETF two core reasons.

Grayscale Bitcoin Spot ETF (stock code GBTC), formerly a Bitcoin trust, can only be purchased and traded in the secondary market, and no redemption is allowed. From the perspective of the Bitcoin market, it is equivalent to a Bitcoin trust subscribed through Grayscale. When funds flow into Bitcoin, they cannot flow out. Since its launch 8 years ago, GBTC hasaccumulated approximately 620,000 Bitcoins. On January 10, it was upgraded to an ETF approved by the SEC. Investors can finally redeem it freely through an authorized dealer (AP), turning their ETF shares into U.S. dollar cash,thus opening up the This part of Grayscale’s funds is the channel through which funds flow out from the crypto asset market. Specific redemption transactions are divided into two types based on the different attributes of investors. By analyzing the trading intentions and behaviors of these two types of investors, we can more clearly analyze and predict whether this round of gray ETF net outflows will How does it affect the price of Bitcoin over a long period of time:

The first type of investors: long-term optimistic about Bitcoin assets, but because the grayscale management fee is too high, they have moved away Position into other ETFs. Horizontal comparison of 11 ETFs, Grayscale GBTC’s management fee is 5-6 times that of similar competitors Grayscale’s management fee is 1.5%, while others are generally below 0.3%, and early Investors with management fee reductions and exemptions; for investors with large amounts of funds, they are very motivated to sell Grayscale ETFs and switch to other ETFs; for example, Ark was once a top ten investor in GBTC, and is expected to shift its positions to ETFs issued by itself in the future. (ARKB). It is unknown whether BlackRock and Fidelity previously held corresponding positions in Grayscale and needed to move their positions. This process of repurchase and redemption of positions will bring about the time difference between the outflow and the inflow of funds into the cryptocurrency market. The fall in BTC price caused by the time difference will also increase the wait-and-see mood of new inflows of funds in the market.

The second type of investors: arbitrage grayscale GBTC discount rate, OTC short BTC hedging. Due to the chain reaction in the crypto asset market triggered by the FTX thunderstorm, Grayscale’s GBTC trust shares are not redeemable, which results in the GBTC discount rate being as high as 49% and remaining around 20% for a long time >. 6 months ago the market began to expect that the SEC would approve a Bitcoin spot ETF, GBTC could be converted from a trust into ETF shares redeemed based on NAV, and the discount would disappear. Arbitrage funds began to intervene, buying discounted GBTC and shorting BTC on the market to arbitrage the discount rate. After the Bitcoin Spot ETF was launched on January 10, the discount rate of GBTC on January 12 was only -1.18%. Therefore, for some investors who hope to make a profit when the discount disappears, there is a relatively strong motivation to take profits. Since most of the arbitrage discount rate funds should have corresponding off-site hedging mechanisms, after the profits are known, the off-site hedging short positions will also be closed accordingly. Therefore, the overall arbitrage discount rate funds are logically suitable for BTC The price will not have much impact.

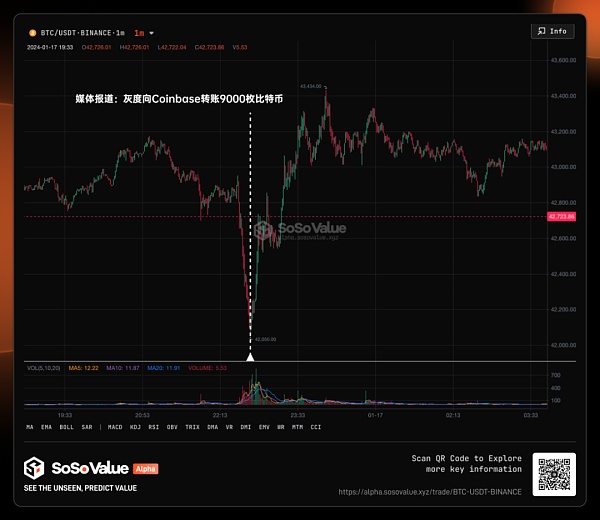

Through the above analysis, we can conclude that in the next 1-2 months, Grayscale GBTC’s selling pressure will directly affect the price of Bitcoin, so Grayscale How long will the net outflow of GBTC last? According to Grayscale’s current total Bitcoin holdings of around 620,000 Bitcoins, the average daily sales in the past three trading days were around 9,000 Bitcoins. According to this outflow rate, < strong>The net outflow of Grayscale GBTC should have no more than two months of impact on Bitcoin price fluctuations.

Part 4: ETF will introduce a wider range of investors to participate in the crypto market, which will be beneficial in the long term

Although Grayscale It has brought a certain amount of selling pressure on Bitcoin spot in the short term, butLooking at all Bitcoin spot ETFs, the three trading days from January 11 to January 16 still brought a net gain of US$740 million to Bitcoin. Buying,Among them, BlackRock ETF (IBIT) led the way with a net inflow of US$710 million in three days. Bitcoin prices rebounded quickly after the news that Grayscale transferred 9,000 Bitcoins to Coinbase on the 16th plunged. At around 43,000, Bitcoin prices tend to stabilize.

The reason behind it is because of Grayscale’s redemption The impact of pressure on the overall Bitcoin market is short-term,and a wider group of investors will participate in the investment of crypto assets, which is the main narrative of the ETF era. As analyzed in the previous section, if investors relocate only because of management fees, they are expected to buy other Bitcoin ETFs in the future and will continue to contribute to Bitcoin; the impact of investors who earn discounts on Bitcoin is neutral. But on the other hand, let’s take a look at the strength of the new Bitcoin spot ETF managers. Issuers approved this time include Blackrock (total assets under management of US$8.59 trillion), Fidelity (total assets under management of US$4.5 trillion), Invesco (total assets under management of US$1.6 trillion) USD), are all the top companies in the global asset management industry. Among them, BlackRock, Vanguard Group, and State Street were once known as the "Big Three" and controlled the entire index fund industry in the United States; and the current size of the entire cryptocurrency market Only 1.7 trillion. Leading asset management companies are generally considered to have more sufficient management experience, stricter compliance processes and stronger loss acceptance capabilities, which can enhance investor trust for emerging assets such as Bitcoin. In addition, the global sales channel network accumulated by leading brands for many years will help better promote Bitcoin spot ETF, a new category of assets.

Part 5: In the next three months, there will be three major nodes that will play a decisive role in the encryption market

The order of importance is as follows:

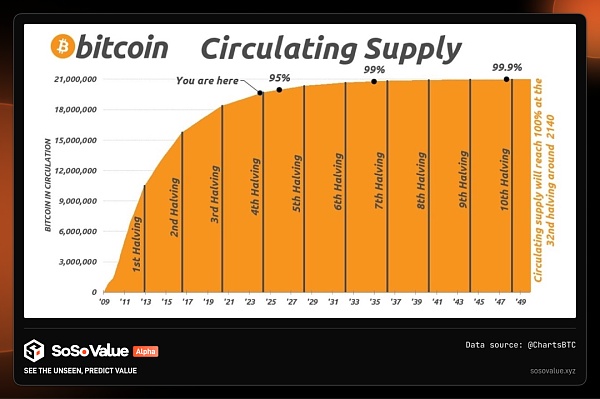

< em>1/ Bitcoin Halving: It is expected that in April 2024, the new supply of Bitcoin will decrease significantly, while the demand will increase with ETFs.

Bitcoin ensures that its total supply will never exceed 21 million through the mechanism of halving its output every four years. Halving will directly lead to a significant reduction in the new supply of Bitcoin. Combined with the adoption of Bitcoin ETF, it opened up the channel for funds to flow into Bitcoin and brought a large amount of new demand for Bitcoin. On the one hand, the new supply of Bitcoin is about to be halved. On the other hand, demand is increasing. At the same time, the U.S. dollar interest rate cut cycle has increased preference for risky assets. Investors in the crypto market generally believe that 24 years will usher in a new round of rise, commonly known as Mingpai. bull market.

We can refer to the changes in Bitcoin price within one year after the previous Bitcoin halving. When Bitcoin was released in 2009, mining output was 50 BTC per block. It has experienced three halvings since then.

The first halving occurred in November 2012. The mining output dropped from 50 BTC per block to 25 BTC. The price of Bitcoin rose from a maximum of US$13 to US$13 in one year. $1152.

After the second halving in July 2016, mining output further dropped to 12.5 BTC per block, and the price of Bitcoin rose from $664 to a maximum of $17,760.

The third halving in May 2020, the mining output was halved again to 6.25 BTC per block, and the Bitcoin price rose from a maximum of $9734 to $67,549.

The next halving is expected to occur in April 2024.

In addition, according to Coinshares report calculations, after this Bitcoin halving, the average Bitcoin miner’s mining cost per Bitcoin (electricity excluding one-time mining machine costs consumption + maintenance costs, etc.) will rise to $37,856.

2/ Ethereum spot ETF approved: expected in May 2024. BlackRock, Fidelity, Invesco and other institutions have also applied for Ethereum spot ETFs and are more likely to be approved. With the passage of the Bitcoin ETF, the market has begun to anticipate that the Ethereum ETF will be approved in May, and prices have begun to react to this.

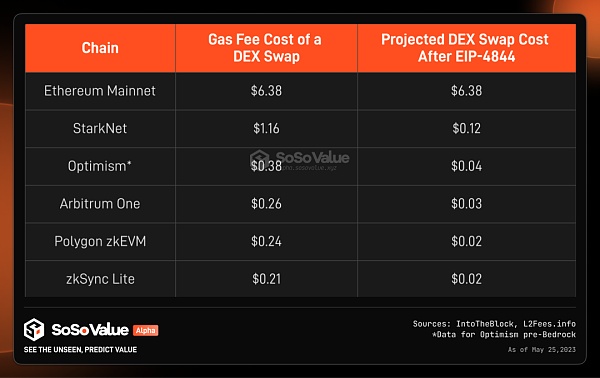

3/ Ethereum Cancun upgrade: expected in February-March 2024, will reduce the transaction cost on the Ethereum Layer2 network to one-tenth. The Cancun upgrade may be like the iPhone moment of the mobile Internet to Ethereum. Lower transaction fees and better transaction experience will lead to more application scenarios that can truly serve large-scale users.

Most of the time, people tend to overestimate the short-term impact; The long-term effects are underestimated. The launch of Bitcoin spot ETF is a milestone and the first door to introduce crypto assets into core financial assets. Looking back many years later, this must be a lasting and long-term benefit.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Bernice

Bernice Alex

Alex Bitcoinist

Bitcoinist