Author: Terry, Plain Language Blockchain

In the fiercely competitive L2 track, Arbitrum and Optimism, which were originally sitting on the Diaoyutai, seem to have ushered in unprecedented variables.

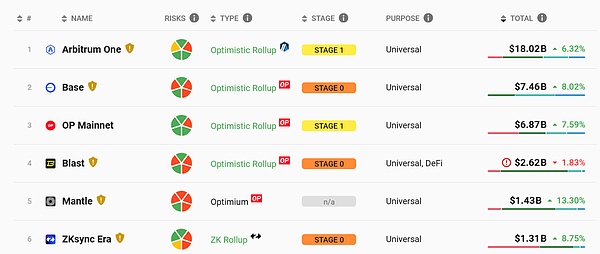

According to the L2BEAT data in the figure below, as of July 23, Base's TVL has climbed to nearly US$7.5 billion, successfully surpassing Optimism's US$6.87 billion, and ranked second, becoming the second largest L2 network after Arbitrum.

If we recall that Base itself is a super chain launched based on OP Stack, this drama of "the disciple surpasses the master" seems to be full of fate.

So why did Base emerge suddenly, what kind of involvement and secrets does it have with Web3 giants such as Coinbase, and what projects in the current Base ecosystem are worth paying attention to?

01 Base: L2 "upstart" based on OP Stack

If we use one sentence to summarize Base, it is also very simple: backed by Coinbase, relying on OP Stack, and making a fortune from the myth of Meme's wealth creation and the traffic of social applications.

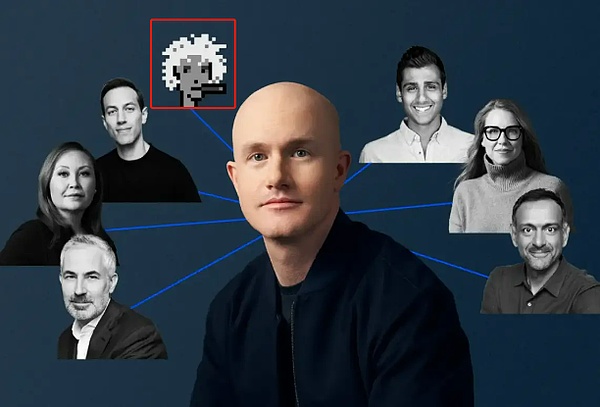

Previously, Forbes wrote an article about 7 powerful people in Coinbase, among whom Base founder Jesse Pollak was prominently listed (that is the PUNK avatar in the picture below). He joined Coinbase in 2017 and is an out-and-out "veteran".

According to an exclusive interview with Fortune magazine, in 2021, he was in charge of Coinbase's consumer products and had the idea of starting a business. In order to retain Jesse Pollak, Coinbase CEO Brian Armstrong (C position in the picture below) asked him to try to bring Coinbase to the chain, which became the initial opportunity for the birth of Base (this may also be the reason why Base naturally has the consumer application gene).

Source: Forbes

Source: Forbes

On August 9, 2023, Coinbase officially launched the Base mainnet. In terms of technology, Base relies on Optimism's open source modular toolkit OP Stack - OP Stack allows developers and project parties to customize the Layer2 network according to their own needs and scenarios, thereby accessing the Ethereum network and sharing security and resources.

For this reason, Base and Optimism jointly launched a governance and revenue sharing framework:

The larger of 2.5% of the total revenue of the Base sorter or 15% of the net revenue of the Base chain sorter (L2 transaction revenue minus L1 data submission costs) will belong to the governance system Optimism Collective;

The Optimism Foundation also provides Base with the opportunity to earn up to approximately 118 million OP Tokens in the next six years;

Now, in less than a year, Base has not only stood out in the OP superchain ecosystem, but also surpassed a number of Ethereum L2 networks including Optimism and ranked second, which can be said to be successful.

Therefore, although there is no executive title in Coinbase at present, because the Base that he is responsible for launching is almost one of the most successful products of Coinbase in the field of cryptocurrency in recent years, his influence in Coinbase cannot be underestimated.

Of course, as the only sorter on the Base network, Coinbase has also made a lot of money. For example, in the first quarter of 2024, users paid $27.4 million in transaction fees to Base (all fees included), of which Coinbase received $15.5 million.

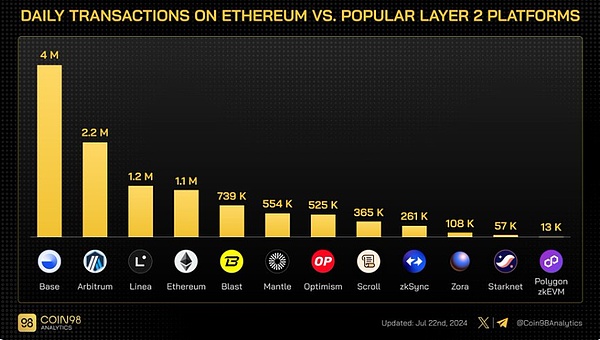

According to Coin98 statistics, in addition to Base's skyrocketing TVL, second only to Arbitrum, the number of daily transactions has surpassed Arbitrum, which is far ahead of the rest - As of July 22, Base's daily transaction volume hit a record high of more than 4 million transactions, almost twice that of the second-place Arbitrum!

Source: Coin98 Analutics

Source: Coin98 Analutics

Such an active on-chain performance is not a castle in the air. If we take a closer look at Base, we will find that its consumer genes are very mature, and it has demonstrated difficult-to-replicate competitiveness in the two areas of "Meme" and "SocialFi", making it a highly competitive network in the L2 field even without the expectation of issuing Tokens.

02 Meme and SocialFi walk on two legs

The first is naturally the layout of the Meme field. If we sort out the hot events of Base in the past year, we will find that the myth of Meme wealth creation has become the main driving force for the influx of funds and users into Base, which can almost be regarded as a clever "marketing and new user strategy" of Base officials.

To put it bluntly, from TYBG, Degen to Brett, etc., there will be "magic disks" with full wealth effects on Base almost every once in a while, which directly attracts a large number of on-chain traffic to squeeze Base in the short term, so that many Meme projects on the Ethereum mainnet even migrate their contracts to Base.

Because various memes with strong wealth-creating effects have broken out of the circle one after another, attracting the attention of the community with hundreds of times of increase, a large part of the funds pouring into Base are arranged around the slightest movement of MemeCoin, which to some extent further forms a kind of "self-proving" logic.

Source: OneKey

Source: OneKey

In addition to Meme becoming one of its constant strategies for operation, another label of Base is actually "SocialFi".

The well-known friend.tech brought the first wave of extremely valuable explosive community traffic in September 2023.By strongly binding with X, friend.tech allows users to purchase the shares (Share) of any user on friend.tech through the ETH of the Base chain, obtain the right to directly communicate with them, and also have the possibility of profiting from it, which also makes Base's layout in the social field emerge.

The subsequent Farcaster has made Base firmly sit on the position of L2's "social upstart"-not only is the activity level in Web3\social applications in a fault-like leading position, but also completed a large amount of financing of 150 million US dollars, and top venture capitals such as Paradigm and a16z have bet on it.

Previously, in the article A comprehensive inventory of projects and tracks that Ethereum founder Vitalik often "likes", we also mentioned Vitalik's optimism about it. In September 2023, Vitalik's X account was hacked. Later, Vitalik stated on Farcaster that his Twitter account was indeed attacked by SIM card hijacking. He also said that he had uninstalled Twitter and joined Farcaster, which can control account recovery through Ethereum addresses.

And as of the time of posting, Vitalik has indeed regarded Farcaster as his main social media platform. At present, Farcaster has become the favorite social platform of Ethereum OGs to some extent.

03 Inventory of top projects

In addition to technology and hot products, ecological construction is also a necessary condition for L2 to achieve long-term sustainable development.

So to what extent has the current ecological landscape of L2 developed, and what are the exclusive top projects worth paying attention to in each track? (In addition to friend.tech and Farcaster, multi-chain top players such as Uniswap and Aave are not mentioned for the time being)

According to DefiLlama data, the current DeFi TVL on Base is US$1.74 billion, among which the TVL of several (semi-) native DeFi projects dominates, including Aerodrome ($650 million), Extra Finance ($106 million), Moonwell ($83.25 million), Morpho Blue ($73.26 million), etc.

The first is Aerodrome. As a "MetaDEX", it is also the DApp with the highest TVL on the Base chain, and is also regarded as the core ecological driver of Base. The total locked volume exceeds US$650 million, which is more than double the second-ranked Uniswap (US$282 million).

Aerodrome combines elements of various DEXs such as Uniswap V2 and V3, Curve, Convex and Votium. Its unique architecture adjusts the incentives between different protocol participants, including traders, LPs and protocols seeking to bring liquidity to Tokens, and achieves this through its Ve governance model.

Participants must lock AERO Tokens to receive fees. Locking AERO Tokens enables users to direct the emission of the protocol's tokens to specific pools, where they will receive 100% of the fees and emissions. Due to incentives, voters direct token emissions to the pools with the highest trading volume in order to receive the most rewards, which will undoubtedly create a flywheel effect that attracts LPs (liquidity providers), thereby providing traders with a low-slippage trading experience for popular token pairs.

Extra Finance is a decentralized lending and automatic compound leveraged income aggregation protocol based on Optimism, which can provide users with a variety of products such as lending, up to 3x leverage farming, long/short, neutral strategies, strategy vaults, etc.

Like Aerodrome, it also uses ve Token economics. VeEXTRA holders can unlock some rights and features, such as annual interest rate rewards, unlocking higher leverage for liquidity mining pools, obtaining high-utilization loan pools, and priority to enjoy more upcoming features and advantages.

Other online loan protocols, such as Moonwell and Morpho Blue, are also products with a TVL level of tens of millions of dollars.

In addition to the DeFi field, Base's DApps in consumer fields such as social and games are also worthy of special attention.

Warpcast is a decentralized social protocol Farcaster client. NFTs on Warpcast have been supported for display on Ethereum, Base and ZORA.

Blackbird is a Web3 platform built specifically for the hotel industry, focusing on establishing direct connections with its guests through loyalty and membership services.

In October 2022, Blackbird completed an $11 million seed round of financing, led by Union Square Ventures, Shine Capital, and Multicoin Capital, with participation from Variant, Circle Ventures, and IAC.

Other social networks that support Base include Friends With Benefits (FWB), Web3 community event platform Galxe, and others.

In addition, according to Base's official information, Animoca Brands, Game7 DAO, Web3 game solution provider ChainSafe Gaming, blockchain game company Faraway, NFT sci-fi card game Parallel, adventure and competitive game Pixelmon, word puzzle game Words3, Yield Guild Games, etc. are also its ecological companies or projects.

04 Summary

In less than a year, it has gone from 0 to the second place in L2, absorbing 7.5 billion US dollars in TVL, and this is an achievement without issuing native tokens.

From this perspective, Base, as a leader in the new L2 network, is amazing, and it also illustrates the unique advantages of Web3 consumer applications such as social networking.Does that mean that whoever can seize the future explosion of Web3 consumer applications will master the password for the explosive growth and large-scale adoption of Web3?

All the past is prologue. For those participants who are committed to making a name for themselves in the field of large-scale adoption of Web3, Base may be a rare reference sample.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Olive

Olive Joy

Joy JinseFinance

JinseFinance JinseFinance

JinseFinance