Jessy, Golden Finance

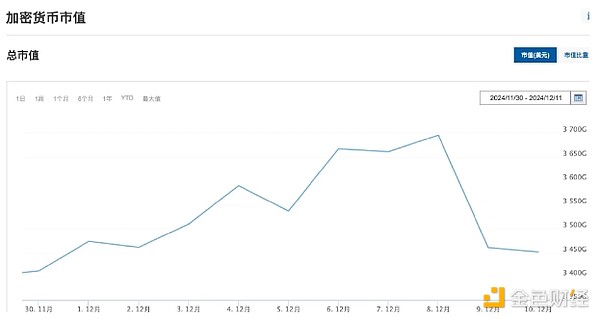

Since December 8, the crypto market has fallen for three consecutive days, with the overall market value falling from the peak of 3.7 trillion US dollars on December 8 to 3.45 trillion US dollars on December 10. In the continuous rising market, what factors have led to the decline in the past few days?

News level:

Google quantum chip progress: In the early morning of December 10th, Beijing time, Google launched the latest quantum chip "Willow" and claimed to have made significant achievements. People are worried that the chip may pose a threat to the security of cryptocurrencies: Bitcoin and other cryptocurrencies are mined by calculating complex mathematical problems to confirm transactions and record them on the blockchain. The demand for mining computing power is related to the number of "miners" in the network and the level of computing power. . Google's quantum chip "willow" has super computing power. In less than five minutes, it completed a "standard benchmark calculation" that would take at least 10 to the power of 25 years for the fastest computer today. If it is applied to mining, it will greatly improve mining efficiency, making it difficult for traditional mining machines to compete with it in terms of cost and efficiency. On the other hand, the security of cryptocurrency relies on mathematical problems in cryptography, such as elliptic curve encryption and RSA encryption, which are based on the assumption that current computing power cannot be cracked within a reasonable time. Quantum computers can run quantum algorithms such as Shor's algorithm, which are specifically used to crack encryption technology based on large number decomposition. Once quantum chip technology develops to a sufficiently mature stage, its powerful computing power may crack the existing cryptocurrency encryption system, resulting in the leakage of users' private keys. In summary, these factors have affected investor confidence and led to a market decline. .

Citron Research shorted MicroStrategy shares: The large-scale purchase of Bitcoin by large institutions such as MicroStrategy has driven the rise in Bitcoin prices to a certain extent, but it has also attracted market attention and concerns. Well-known institution Citron Research once pointed out that MicroStrategy was "overheated" and shorted it, causing MicroStrategy's stock to fall 20% in one day. MicroStrategy's stock was once called shadow Bitcoin. The shorting of MicroStrategy's stock by institutions has also affected the sentiment of the crypto market to a certain extent.

Microsoft will not invest in Bitcoin for the time being:Microsoft's major shareholders opposed the company's Bitcoin investment proposal on December 10 local time. Microsoft's board of directors had earlier urged shareholders to reject a proposal from the National Center for Public Policy Research that the company invest 1% of its total assets in Bitcoin to hedge against inflation.

Market:

Long-term investors take profits:

Recently, some KOLs and institutions have continued to sell. For example, on December 4, it was reported that Meitu sold the Bitcoin and Ethereum they had accumulated before, cashing out a total of about $180 million. These long-term holders have accumulated huge profits during the previous market rally. As the market showed signs of adjustment, they chose to take profits. The emergence of a large number of sell orders further exacerbated the market turmoil and caused prices to fall sharply.

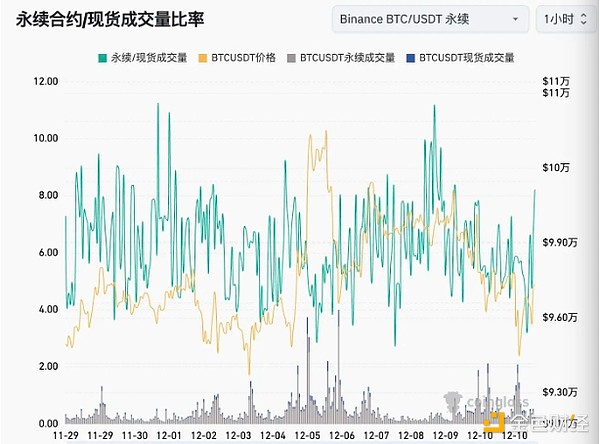

Market sentiment is overheated, and the trading volume has declined in the past two days: According to Coinglass data, the trading volume of both contracts and spot reached a recent peak on December 8 and 9, while the overall trading volume of the cryptocurrency market declined to a certain extent on December 10 and 11.

Similarly, on the 8th and 9th, the market sentiment was hot, and the long contract positions reached a historical high. When the market fell as a whole, the liquidation volume within 24 hours from the 9th to the 10th hit a new high in this round of bull market, reaching US$1.712 billion, of which long positions were liquidated for US$1.55 billion and short positions were liquidated for US$162 million. This also shows that the market sentiment is overheated, there are too many people doing long positions, the market has entered a correction, and clearing some leverage can also make the future market rise healthier and more sustainable.

Macroeconomic level:

US CPI data to be released:The United States will release the US November CPI data at 8:30 am local time on December 11. Before the data is released, the turbulence in the crypto market is normal. Because CPI is an important indicator for measuring inflation, and the United States will determine the extent of the interest rate cut in December based on inflation. The amount of interest rate cuts and the extent of waterproofing will affect people's preference for risky assets.

US dollar strengthens:Recently, the US dollar has strengthened. On December 9 and 10, the US dollar index closed at 106.11 and 106.1926, respectively, up 0.09% and 0.08% from the previous trading day. The strengthening of the US dollar is often seen as a signal of the relative strength of the US economy, and it may also imply that there is a certain degree of uncertainty in the global economy. In this case, investors' risk appetite will generally decrease.

At the same time, the strengthening of the US dollar has increased the attractiveness of US dollar assets. For example, the yields of risk-free assets such as US Treasury bonds have risen. In pursuit of higher returns and asset security, investors will transfer funds from risky assets such as cryptocurrencies to US dollar assets, thereby exerting downward pressure on cryptocurrency prices.

JinseFinance

JinseFinance

JinseFinance

JinseFinance WenJun

WenJun Hui Xin

Hui Xin Olive

Olive Sanya

Sanya Clement

Clement Catherine

Catherine Catherine

Catherine Nulltx

Nulltx Bitcoinist

Bitcoinist