山寨币跌跌不休:是时候重新关注Defi

在笔者看来,在BTC一度创出新高后山寨币齐齐下跌的奇特市场背景下,Defi板块,尤其是其中的头部项目可能迎来了其诞生以来最佳的布局时刻。

JinseFinance

JinseFinance

Abstract

After nearly two rounds of bull and bear fluctuations and policy cycles, the Bitcoin mining industry has all gone overseas. With the United States With the approval of Bitcoin ETF, the rise of AI computing power and a new round of semiconductor process upgrades, mining companies are standing at a new starting point, and integration has become a common strategy. Take Bitcoin mining hosting, self-operated mining and cloud computing power service provider BitDeer as an example. On January 5, 2024, it announced on its official website that it has developed a self-developed mining machine and has placed an order with TSMC to purchase a mining machine specially designed for mining. Mine-designed chips are expected to be delivered in the first quarter of 2024 for further design verification and prototype testing.

What do you think of minersself-developed mining machines?

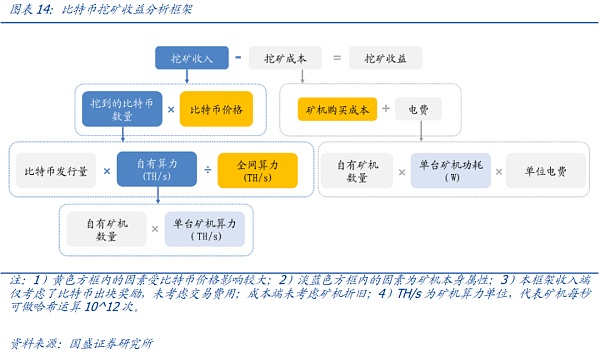

——The income from Bitcoin mining is mainly affected by the mining difficulty and electricity costs. The mining difficulty and currency price of the entire Bitcoin network are the same and uncontrollable for all miners. Miners can only increase their income by expanding their own computing power. Mining machines are the main means of production for miners. The energy efficiency ratio (J/TH, power consumption per unit of computing power) of the mining machine can affect both mining income and cost. Mining machines with the same computing power have the same mining income, but can Mining machines with low power consumption ratio have less electricity bills, which means that mining profits are theoretically higher.

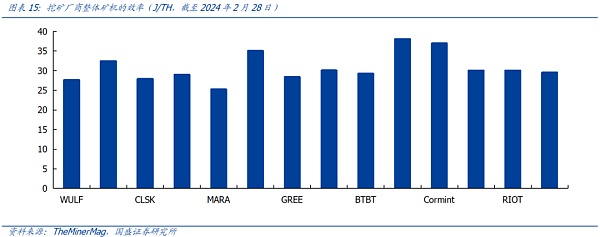

——The halving is coming, the cost of mining is about to double, and high-performance mining machines have become the key. Bitcoin halving means that the number of Bitcoin blocks that miners receive as a reward for confirming transactions is halved. Since the launch of Bitcoin, halvings have occurred three times, and the next halving is expected to occur in April 2024. For miners, the Bitcoin halving means that the income is reduced by half, that is, the cost doubles with the same income. The key to cost control is to control the electricity cost of the mining machine, in which the performance of the mining machine (reflected in the energy efficiency ratio J/TH) has great room for improvement. At present, the level of overall mining machines of mining manufacturers is uneven, and the resulting difference in computing power costs is obvious. Considering that the upcoming Bitcoin mining halving will bring about a surge in costs, only more efficient and advanced mining equipment can ensure mining efficiency and ensure that mining machines are not eliminated by the market.

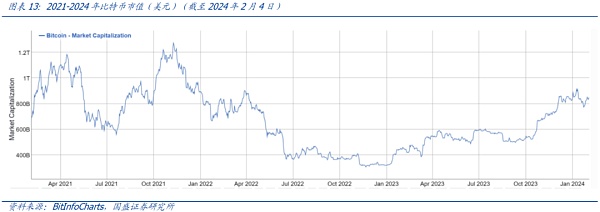

——The currency price has bottomed out, the mining market has begun to recover, the price of mining machines has increased, and the trend of centralization of computing power has become established. Coin price is the "ultimate factor" that affects miners' income. The currency price bottomed out in 2023. As of February 4, 2024, the Bitcoin price has risen from US$16,000 on November 11, 2020 to US$4.3 million, an increase of 175%. The currency price has generally emerged from the bear market, confidence has increased, the mining market has recovered, and the price of mining machines has also "raised". As the difficulty of mining increases and the output of Bitcoin decreases, traditional retail miners have left the market one after another, and the trend of miners becoming institutionalized has gradually emerged.

Self-developed mining machines are expected to reduce costs and increase efficiency. It is expected that more mining manufacturers will enter the field to develop self-developed mining machines in the future. Independent research and development of mining machines is conducive to the further expansion of the company's business and will help the company cope with the subsequent halving and increase in mining machine prices. Since mining machines are related to the income and costs of mining manufacturers, and the upcoming halving and rising prices of mining machines are also common problems faced by all manufacturers, we expect that more mining manufacturers will start to develop their own mining machines. At this stage, various manufacturers have different overall mining machine efficiency levels due to problems such as mining machine procurement batches and mining machine product upgrades. Under the example of BitDeer taking the lead in self-developed mining machines, manufacturers with relatively high energy efficiency may seek to surpass themselves through self-research, while manufacturers with relatively low energy efficiency may also consider ensuring their leading edge through self-research.

Investment suggestions: It is recommended to pay attention to: BitDeer, currency purchase company (MSTR), Bitcoin miners (MARA, etc.), Bitcoin mining machine manufacturer Canaan Technology (CAN), Crypto Asset Exchange (Coinbase), Hong Kong Crypto Asset Exchange (BC Technology Group), etc.

Risk warning:Bitcoin prices have fallen, countries have tightened supervision of Bitcoin, power supply has fallen short of expectations, and computing power has not increased as expected.

1. Bit Deer officially announced its self-developed mining machine, and the Bitcoin mining industry is now vertically integrated

After In the past two rounds of bull and bear fluctuations and policy cycles, the Bitcoin mining industry has all gone overseas. With the passage of the US Bitcoin ETF, the rise of AI computing power and a new round of semiconductor process upgrades, mining companies are standing at a new starting point. , and integration becomes a common strategy. Take Bitcoin mining hosting, self-operated mining and cloud computing power service provider BitDeer as an example. On January 5, 2024, it announced on its official website that it has developed a self-developed mining machine and has placed an order with TSMC to purchase a mining machine specially designed for mining. Mine-designed chips are expected to be delivered in the first quarter of 2024 for further design verification and prototype testing.

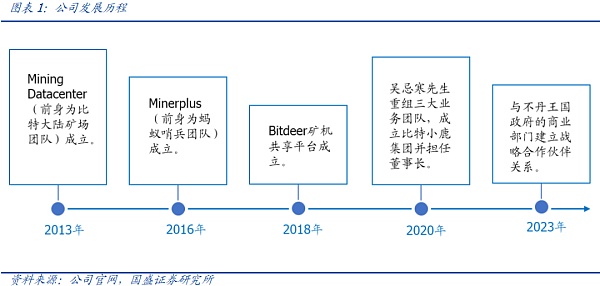

The world's leading digital asset mining service provider. In 2013, the Bitmain team was founded to provide hardware design and various solutions for the blockchain field and artificial intelligence applications, becoming the leading well-known brand in the digital currency mining industry. In 2016, the integrated intelligent software platform Minerplus was established. In 2018, the BitDeer mining machine sharing platform was established. In 2020, the business team was reorganized and the BitDeer Group was established. In 2023, the company established a strategic partnership with DHI, the commercial arm of the Royal Government of Bhutan.

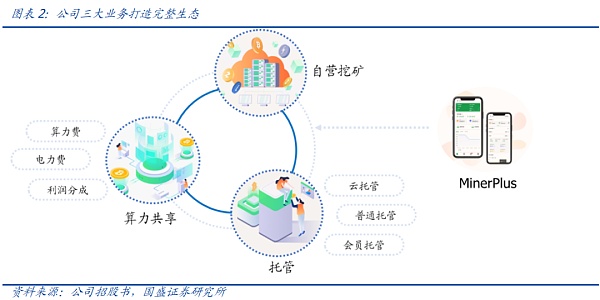

Bit Deer is committed to meeting the personalized mining needs of different users around the world. It plays an important role in the entire digital currency mining ecosystem as a provider of hardware, software and various support services.Three vertical business lines jointly create Complete mining ecology. The company’s self-operated mining, computing power sharing and hosting businesses supported by the independently developed Minerplus make up the company’s three main businesses.

Among the three business lines:

Self-operated mining business That is, the company mines cryptocurrency for its own account.

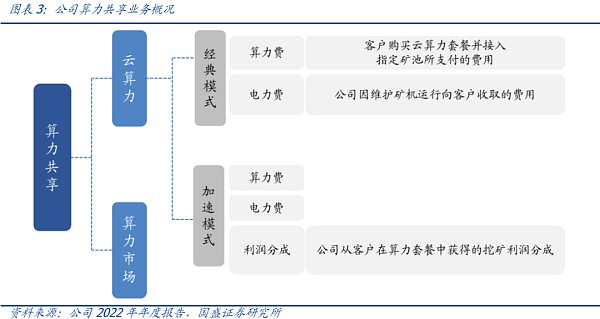

Computing power sharing business Provides two solutions: cloud computing power and computing power market to facilitate , transparent and reliable computing power supports cryptocurrency mining activities worldwide. As of December 31, 2022, the company's revenue from the computing power market plan is not important relative to total revenue. The revenue from the computing power sharing business is mainly cloud computing power, among which:

Hashrate Market In the plan, the company acts as a mediator to connect third parties (such as miners or mine owners) and customers who need computing power, and only charges service fees.

Cloud computing powerThe solution provides customers with the computing power of the company's self-operated mining machines, according to the continuous cycle , the current packages on sale can be divided into three types: 30/45/360 days; according to the charging method, they can be divided into classic mode and accelerated mode:

Classic mode The fee consists of two parts: 1) the computing power fee, which is the fee paid by the customer to purchase the cloud computing power package and access the designated mining pool. The computing power fee needs to be paid in one lump sum when purchasing the package; 2) the electricity fee, that is, The fee required to maintain the mining machines that provide computing power is fixed at the beginning of each power subscription and can be paid in installments during the package week.

The computing power fee that customers need to pay in acceleration mode is relatively The classic model is lower, but the company gets a share of the profits after the costs paid by the customer are recouped. That is, in addition to the computing power fee and electricity fee, the company is entitled to receive additional profits based on the percentage of the mining profit the customer obtains from the cloud computing power package.

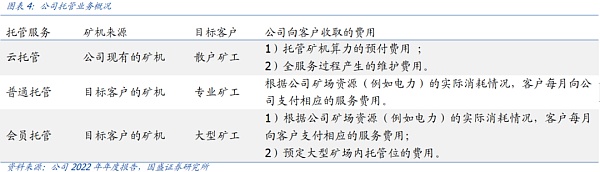

Hosting includes three types of services: cloud hosting, ordinary hosting and member hosting, to meet customers' diverse needs for professional hosting solutions and reduce the upfront cost of mine construction, deployment and operation Investment cost, including:

Cloud hosting model provides a "group purchase" service for mining machines, and retail miners can raise funds to purchase the company's mining machines. computing and maintenance services. The company plans to use the capacity for future mine expansion for general and member hosting services. The existing cloud hosting services will continue to be maintained, but will no longer be a mainstream product.

The mining machines hosted in the ordinary hosting mode and member hosting mode are all from target customers, among which members The hosting model is aimed at large miner customers looking for long-term and stable hosting services. The company will give priority to meeting the hosting needs of members and provide discounts on service fees.

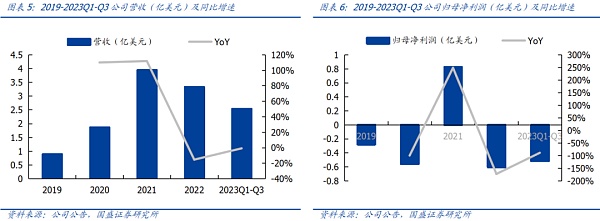

Revenue and net profit are highly volatile and are greatly affected by the price of Bitcoin. The company's revenue continued to rise from 2019 to 2021. In 2022, revenue fell by 15.5% year-on-year due to the impact of currency prices. The company's net profit attributable to the parent company fluctuates greatly, peaking at US$83 million in 2021, a year-on-year increase of 248%, and falling to a loss of US$60 million in 2022. As the currency price rebounded in 2023Q1-Q3, the company's revenue and net profit attributable to shareholders were US$250 million and a loss of US$50 million respectively. The year-on-year declines were both better than in 2022.

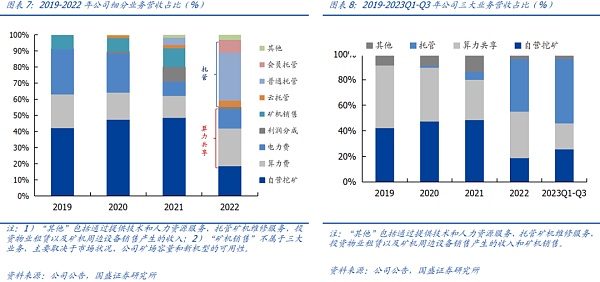

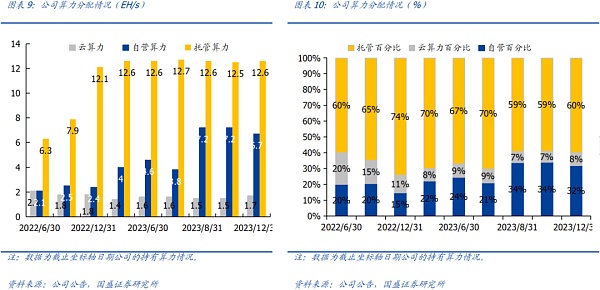

Vertically integrate the three major businesses and freely adjust distribution strategies. The company’s business relies on its mines and mining machines, and it has broad freedom in pricing strategies and resource allocation. It can flexibly adjust mine capacity and self-operated computing power allocation in response to market conditions. . The revenue share of self-operated mining business will be significantly reduced to 18.7% in 2022, reaching 25.6% in 2023Q1-Q3. After the company launched hosting services in 2020, its revenue share continued to rise, and hosting services quickly became the main source of revenue, accounting for 50.7% in 2023Q1-Q3. According to the company’s December 2023 operating report, the company’s current self-operated computing power reaches 8.4EH/s, a year-on-year increase of 105%.

2.Half halving is coming, mining machine prices are rising, self-developed mining machines may become a trend in the mining industry

2.1. Mining machines are the main means of production for miners and can affect both mining income and costs

Bitcoin It is a medium of exchange and a store of value. It uses cryptography to control the creation of monetary units and to authenticate the transfer of funds. Many consumers use Bitcoin because it offers cheaper and faster peer-to-peer payment options without the need to provide personal information. Bitcoin has the characteristics of decentralization, global circulation, exclusive ownership, low transaction fees, no hidden costs, and cross-platform mining. Its value can be judged without being attached to a third-party pricing agency.

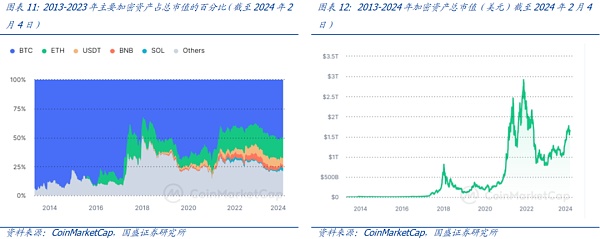

Bitcoin has always maintained its dominance among crypto assets. According to CoinMarketCap data, as of February 4, 2024, the total market value of global crypto assets (including stablecoins and tokens) reached US$1.65 trillion. The main crypto assets include Bitcoin, Ethereum, Tether and BNB etc. Among them, Bitcoin, as the first encrypted asset to appear, has always been in a dominant position in the market value of cryptocurrencies. As of February 4, 2024, Bitcoin accounted for 51.21% of the total market value of encrypted assets.

Blockchain is the underlying technology of Bitcoin. It is a decentralized digital ledger, consisting of bottom-up data layer, network layer, consensus layer, incentive layer, contract layer and application layer, which can be used without third-party intermediaries. Record and implement secure peer-to-peer transactions to confirm the ownership of digital assets. When a user requests the blockchain network to process a transaction, a peer-to-peer network of miners (specialized computers) uses known algorithms to verify the transaction and compete for accounting rights for the transaction.

After the transaction is verified, a new data block is generated on the blockchain. The new block is added to the existing blockchain in a permanent and tamper-resistant manner, and the transaction is completed. Every transaction and the ownership of every digital asset in circulation is recorded on the blockchain. Every time a transaction occurs, the miner updates the BTC ledger.

Miners that successfully verify transactions receive Bitcoin rewards and transaction fees (Bitcoin is publicly issued in this way), as of Bits The market capitalization of the currency is close to8400billion dollars. The following conditions have been determined:

1. When Bitcoin goes online in 2009, miners who "dig" new blocks can get 50 bits The coin reward will be halved every 4 years thereafter. The current block reward of Bitcoin is 6.25 Bitcoins (Note: Bitcoin rewards are 50-25-12.5-6.25, and the next halving is expected to occur in April 2024).

2. Regardless of the computing power of the entire Bitcoin network, the Bitcoin network block production speed remains constant, and a new block will appear approximately every 10 minutes.

3. The current unit price of Bitcoin is approximately US$42,842 (BitInfoCharts, 2024.2.4).

To sum up:

Bitcoin theoretical sunrise block reward = block reward * (Full day time/mining time per block)

= 6.25 * (24 * 60 / 10)

span>= 6.25 * 144

= 900 (Bitcoin)

p>Theoretical daily block reward market price = Bitcoin price * Bitcoin daily block reward

= 42842*900

= 38557800 (USD)

≈3855.78 ( million US dollars)

As of 17:00 on February 4, 2024, the block rewards and transaction fees of the entire network in the past 24 hours were 975 BTC and 186.53 BTC respectively. A total of $49.75 million. Theoretically, the smallest unit of Bitcoin will be mined in 2140, and the income earned by miners will only be transaction fees.

Bitcoin is "issued" in this way, and the number is approximately 21 million. According to BitInfoCharts, as of February 4, 2024, 19.617 million Bitcoins have been mined, and the price per Bitcoin is $42,842. The market value of all mined Bitcoins as of February 4, 2024 is approximately $840 billion.

Miners’ mining income is directly related to the proportion of their computing power in the entire network’s computing power. During the mining process, miners need to solve a complex mathematical problem to prove their workload. The difficulty value of this mathematical problem determines how many hash operations the node needs to undergo to generate a legal area. piece. To maintain a constant rate of new block generation under the ever-changing computing power of the entire network, the difficulty value must be adjusted according to changes in the computing power of the entire network. There is a relationship:

The mining time of each block (constantly about 10 minutes) = difficulty value * 2^32 / the computing power of the entire network

Can be converted We get "difficulty value = 10 * computing power of the entire network / 2^32", that is, the higher the computing power of the entire network, the greater the difficulty of mining. The daily mining income of miners depends on the number of Bitcoins mined per day and the currency price, which can be calculated:

Daily mining income = Bitcoins mined per day Quantity * Coin price

= (Hashing power owned/Computing power of the entire network) * Bitcoin daily block reward * Coin price

Since the daily block reward and currency price of bits are the same for all miners, the miner’s mining income only depends on the computing power of the mining machine and the computing power of the entire network. is related to the proportion of computing power. The greater the proportion of computing power, the greater the mining income.

Bitcoin mining income is mainly affected by mining difficulty and electricity costs. Since the mining difficulty of the entire Bitcoin network (which determines the unit mining revenue) and the currency price are the same for all miners, the mining revenue of the miners is only related to the computing power of their mining machines. Therefore, < strong>The main factors that affect the cost of mining are the power consumption and electricity cost of the mining machine, and the energy efficiency ratio of the mining machine(J/TH)are indicators worth paying attention to. Mining machines with the same computing power have the same mining income, but their energy consumption and electricity bills are lower than that of smaller mining machines, which means that mining income is theoretically higher.

2.2. The halving is coming, and the cost of mining is about to double. Only high-performance mining machines will not be eliminated

Bitcoin halving refers to the reward that miners receive as a reward for processing transactions The number of Bitcoins is halved. Since Bitcoin’s launch, halvings have occurred on three separate occasions. The first halving occurred on November 28, 2012, the second on July 9, 2016, and the most recent halving on May 20, 2020 The Bitcoin rewards are 50-25-12.5-6.25, and the next halving is expected to occur in April 2024.

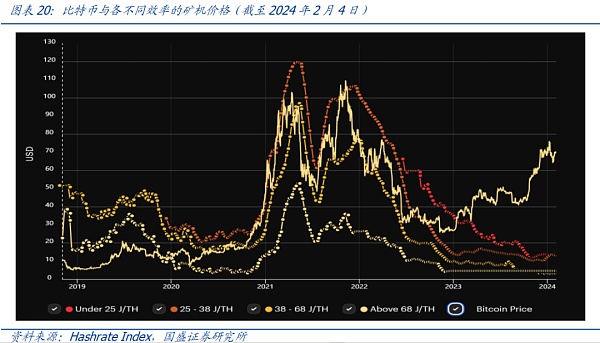

For mining manufacturers, the Bitcoin halving means that the income is reduced by half, that is, the cost doubles for the same benefit. The key to controlling mining costs lies in the power consumption and electricity cost of the mining machine. Among them, the performance of the mining machine (reflected in the energy efficiency ratio J/TH) has room for improvement.

At this stage, the level of overall mining machines of mining manufacturers is uneven, and the resulting difference in computing power costs is obvious. Considering that the upcoming Bitcoin mining halving will bring about a surge in costs, only more efficient and advanced mining equipment can ensure mining benefits and ensure that mining machines are not eliminated by the market.

2.3. Coin prices have risen sharply for more than a year, driving up the price of mining machines. Self-developed mining machines may be Helps miners reduce costs and increase efficiency

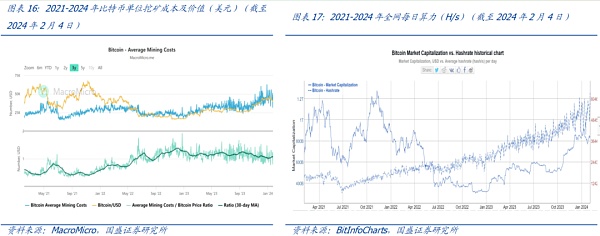

Coin prices bottom out and the mining market begins Resurgences. Coin price is the "ultimate factor" that affects miners' income. In the final analysis, the mainstream method for miners to obtain income is to sell the coins they mine, whether it is in the short or long term after mining the coins. According to MacroMicro, in May 2022, the average mining cost exceeded the value of a unit of Bitcoin, and many miners chose to exit the market or shut down their mining machines. The computing power of the entire network fell for the first time since 2021. In 2023, the currency price bottomed out and rebounded. As of February 4, 2024, the price of Bitcoin has rebounded from US$16,000 on November 11, 2020 to US$43,000, an increase of 175%. The currency price has generally emerged from the bear market, confidence has increased, and the mining market has recovered. According to BitInfoCharts, the average daily computing power of the entire network reached 582.403EH/s on February 4, 2024.

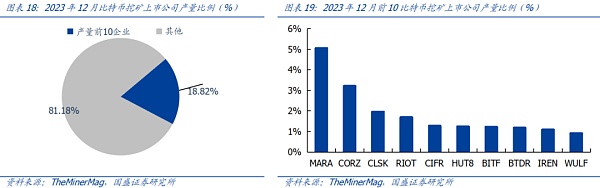

The trend of centralization of computing power has become a reality. As the difficulty of mining increases and the output of Bitcoin decreases, traditional miners who are profit-oriented with short-term investment have left the market one after another, and the remaining miners are mostly institutional mines, computing power product centers, and national capital. Oriented by mining entities linked by capital such as mines. According to TheMinerMag data, the top 10 listed companies in mining company Bitcoin output accounted for 18.82% of the entire network's Bitcoin output in December 2023. Marathon's (MARA) Bitcoin output accounted for 5.05% of the entire network's Bitcoin output that month. . With the recovery of currency prices, competition in computing power has intensified again. According to BitInfoCharts, the average daily computing power of the entire network reached 582.403EH/s on February 4, 2024, a year-on-year increase of 124.5%.

According to theHashrate Indexdata, the price of mining machines has increased . For more than a year, the price of Bitcoin has continued to rise, and the price of mining machines is still at a low level. Starting from the end of 2023, the prices of mining machines have begun to "raise" and show an upward trend. In addition, the Bitcoin halving is approaching, the demand for high-performance mining machines will increase, and the price of mining machines is likely to continue to grow in the future.

BitDeer’s self-developed mining machine is expected to reduce costs and increase efficiency. As a mining manufacturer, the company’s three main businesses are closely related to the performance of mining machines. Independent research and development of mining machines will help further expand its business and help the company cope with the next halving. and mining machine prices rising.

We expect that more mining manufacturers will begin to develop their own mining machines. In summary, since the efficiency of mining machines is key to the income and costs of mining manufacturers, the upcoming halving and the increase in mining machine prices are also problems faced by all manufacturers. At this stage, various manufacturers have different overall mining machine efficiency levels due to problems such as mining machine procurement batches and mining machine product upgrades. Under the example of BitDeer taking the lead in self-developed mining machines, manufacturers with relatively high energy efficiency may seek to surpass themselves through self-research, while manufacturers with relatively low energy efficiency may also consider ensuring their leading edge through self-research.

在笔者看来,在BTC一度创出新高后山寨币齐齐下跌的奇特市场背景下,Defi板块,尤其是其中的头部项目可能迎来了其诞生以来最佳的布局时刻。

JinseFinance

JinseFinanceDespite the Ethereum ETF approval, it is highly unlikely that other altcoin ETFs will receive significant approval any time soon.

JinseFinance

JinseFinanceCrypto market, altcoins, what is the future of altcoins? Will it get worse? Golden Finance, maybe buying Bitcoin is the best choice.

JinseFinance

JinseFinance10X Research further elaborated on this point in a newsletter.

JinseFinance

JinseFinanceIn the next six months, the scale of altcoin unlocking will reach US$20 billion, and nearly US$6 billion of new tokens will be issued every month.

JinseFinance

JinseFinanceCryptocurrency market analysts believe that the decline in altcoins may be related to the recent large outflows from spot Bitcoin ETFs.

JinseFinance

JinseFinanceAfter the “shock” of the past four months, the altcoin market may present “some opportunities” for investors.

JinseFinance

JinseFinanceWhat would the passage of an Ethereum ETF mean for your favorite altcoins? Some altcoins would clearly benefit, but some, like Solana, would likely suffer.

JinseFinance

JinseFinanceAnalysts say the sideways movement in the Bitcoin dominance chart could be a reversal signal that could kick off the entire altcoin season.

JinseFinance

JinseFinanceThe Solana and Avalanche ecosystems have seen near-parabolic growth as Bitcoin dominance has declined slightly. Is it altcoin season?

JinseFinance

JinseFinance