Author: YASH AGARWAL; Source: DefiLlama 24

Recommended message:

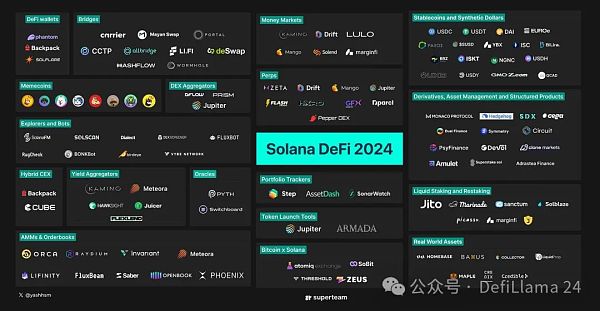

"Everyone in 2023 Dancing on the grave of Solana DeFi, in 2024 Solana returns with meme and airdrop craze, and everything is a big step forward. This article deeply explores the current status and status of all categories of Solana DeFi Trends, involving 100+ noteworthy projects. Enjoy."

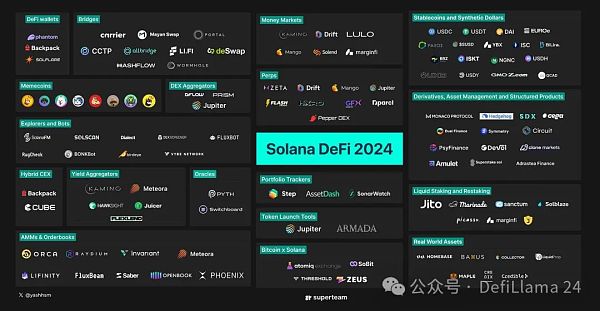

USD 3.8 billion + TVL. $2.5 billion + daily trading volume. Fueled by memecoin mania and airdrop mania, Solana DeFi is back!

While 2023 may seem like a quiet year for Solana DeFi, it’s a crucial year. The year started with many people dancing on its grave, declaring the death of Solana DeFi. However, the Solana DEX ended up surpassing the Ethereum DEX in weekly trading volume!

This is achieved by about 50 top teams led by blue chip protocols such as Marinade, Phoenix, Jito, MarginFi, Kamino, BlazeStake, Solend, Jupiter, Meteora, Orca, Raydia, Lifinity and Drift, they were building during a bear market. Now, Solana DeFi has more than 100 high-quality projects.

Last year, at one of the lowest points (SOL was $20), we wrote an article titled "Solana DeFi in 2023" and many of the arguments we made in that article came to fruition , and has been highly appreciated by the community. Inspired by the previous article, I wrote the same article for 2024 - dividing it into two parts:

1. The current state of Solana DeFi.

2. What to build for Solana DeFi?

In Part 1 of this article, we will briefly introduce the overview of Solana DeFi, Learn about the various DeFi categories, briefly discuss various Solana projects, and conclude with a summary of what follows. After reading this article, you will get all the necessary insights about Solana DeFi.

If anyone asks about what’s going on with Solana or the top Solana DeFi projects, please forward this article to them. Only insights, no bubbles.

Solana DeFi Overview

While the entire DeFi ecosystem was hit hard by the FTX collapse, Solana DeFi plummeted to a measly $200 million TVL in early 2023 Especially being declared "dead". Its TVL remained around $300 million until the SOL price started rising again towards $200 million. End of October. Over the past four months, TVL has soared to an impressive $3.3 billion, driven primarily by SOL prices. A healthy stablecoin market cap of around $2.5 billion is also a good indication of the liquidity available in the ecosystem.

Solana DeFi Overview (as of March 14, 2024)

Solana DeFi Overview (as of March 14, 2024)

The most capital efficient chains:

Breaking popularity last year, and TVL Might be a vanity metric; DeFi velocity (daily DEX volume/chain’s TVL) is the one metric where Solana DEX really dominates.

Is Solana DeFi really OPOS?

During the bear market, the phrase “Only possible on Solana” (OPOS) became a widespread rallying cry within the community, but what exactly makes Solana worthy of this title? The simple answer lies in its low fees and high throughput.

Low fees and high throughput make OPOS possible, such as:

1. On-chain order book: two The order book continues to handle over $150 million in trading volume, a feat not feasible on Ethereum or even Layer 2 due to the frequency with which orders are placed and canceled. Additionally, perpetual order books like Zeta exemplify OPOS.

2. DEX aggregators such as Jupiter: A $100 order on Jupiter is split, passed through 4-5 DEXs, and then reassembled. On a Layer 2 platform like Arbitrum, this process would incur a fee of over $20, making it impractical.

3. Anything high frequency: like rebalancing, faster liquidation, etc.

While Move chains like Aptos and Sui also offer high throughput and low fees, these advantages are lost as layer 2 solutions become more affordable and parallel EVMs such as Monads emerge May no longer be exclusive. However, Solana's vibrant community and its highly qualified builders really set it apart.

The memecoin phenomenon is a perfect example of the combined power of community/culture and high throughput/low fees. Consider this: If you purchased $1,000 of CatCoin, would you be willing to pay a $100 fee per transaction? Solana enables users to do so for as low as $1, supported by fast transaction speeds, seamless bridging front-ends like Jupiter, efficient DEXs, and ample liquidity.

Why is the Solana airdrop so hyped? That’s because Solana is home to a bunch of talented builders, and who wouldn’t want to take a chance on farming their potentially high FDV tokens?

Solana DeFi Category

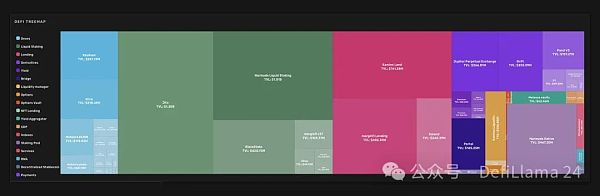

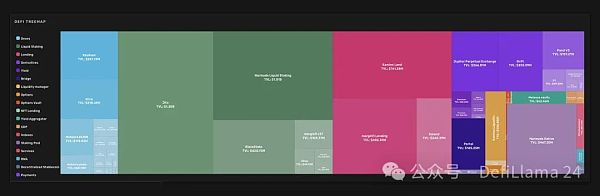

Just like any other DeFi ecosystem, Solana has a wide range of forks, with most TVL contributions coming from LST, DEX, lending platforms and Perps.

Chart of Solana DeFi TVL on Vybe

Chart of Solana DeFi TVL on Vybe

Just like any other DeFi ecosystem, Solana has a wide range of forks, with most TVL contributions coming from LST, DEX, lending platforms, and Perps.

Let’s take a deep dive into each DeFi category and analyze their strengths, limitations, and opportunities that exist. We’ll try to go chronologically, following the typical DeFi user journey – from beginner to advanced; and also provide some alpha tips.

Wallets and Bridges:

Starting with wallets, the wallet war has now focused on three of the most DeFi-friendly wallets, each equipped with All the features you need for DeFi: Backpack, Phantom and Solflare. Phantom’s browser functionality is an excellent discovery tool for DeFi apps and tokens.

In the area of interoperability, Wormhole stands out as the dominant messaging layer, supporting messaging between Solana and over 25 other chains. Wormhole supports several major bridges:

Portal Bridge (developed by Wormhole team) - one of the oldest bridges with a historical value of more than 40 billion US dollars, but the user experience is very Difference.

Mayan Finance — One of the fastest growing bridges with a cross-chain exchange protocol built on Solana, allowing exchange between chains such as Arbitrum, Polygon, Optimism, Avalanche and BSC Perform native asset exchange.

Allbridge — Another liquidity pool-based bridge that facilitates connections between Solana and Ethereum, Ethereum L2, BNB Chain, and Tron.

Bridge aggregator LiFi has also made its way to Solana, providing support for Phantom's cross-chain exchanger while integrating Solana into its bridge aggregator frontend - Jumper. Currently, the system is powered by Allbridge, with plans to incorporate additional bridges.

deBridge is one of the fastest bridges with an intent-based architecture powered by its own messaging layer. Hashflow and Carrier are two other bridges, although they are used less frequently.

Circle’s CCTP is also scheduled to launch in late March 2024, with some of the aforementioned bridges as launch partners. This will enable anyone to bridge any amount of USDC for a very low fixed fee, significantly increasing bridging liquidity. The launch of LayerZero in Q2 is also highly anticipated; this could change cross-chain applications on Solana, as LayerZero has a larger ecosystem and community than Wormhole.

Jupiter has also developed a Bridge Comparator to help users choose the best bridge. However, it only facilitates transfers from Ethereum to Solana and does not include all bridges.

User Tip — Bridges to Solana: For Ethereum, Sui, and Aptos, use the Portal bridge. For Ethereum L2, compare Jumper, deBridge and Mayan.

Spot DEX:

Solana’s DEX daily trading volume reached a peak of 2-3 billion US dollars, and the weekly trading volume reached 120 billion, with monthly transaction volume reaching $28 billion – a sea change for Ethereum on good days and weeks. Approximately 60% of total DEX trading volume is provided by Jupiter, the leading DEX aggregator on Solana and the largest DeFi project on the platform. Use Jupiter as a case to analyze DEX trading activities in February:

1. The top 10 tokens by trading volume are mainly:

a. About 82% of blue chip tokens – SOL, USDC and USDT.

b. ~10% of meme coins - WIF, MYRO, SILLY and BONK.

c. ~6% LST — JitoSOL, mSOL and bSOL.

2. Unique Wallets: Over 840K | Total Transactions: Over 29M.

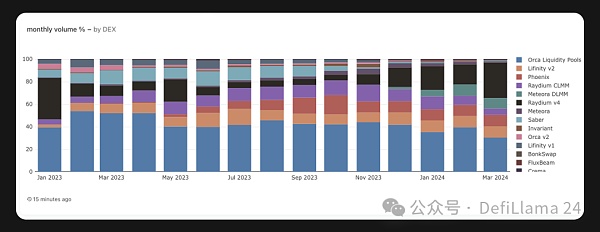

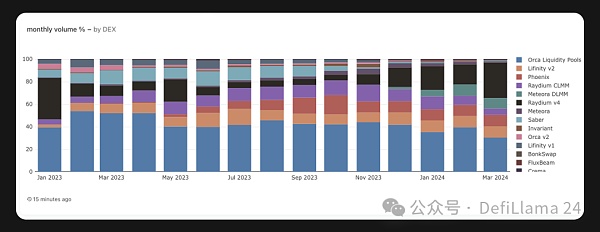

Unlike the EVM ecosystem where Uniswap dominates, Solana’s spot DEX remains highly competitive, with top DEXs fiercely competing for market share. Orca held over 50% of the market at the beginning of the year and remains the leading DEX despite a slight decline in market share. Sales of Raydium and Openbook were significant, especially during the meme coin trend.

Fierce competition among Solana DEX for market share

Fierce competition among Solana DEX for market share

DEX aggregator:

Jupiter Not only at Solana The undisputed leader internally, but also in the entire cryptocurrency space, surpassing EVM peers such as 1inch and Matcha. Jupiter is the premier Solana aggregator, managing approximately 80% of trade flows (after excluding bot activity). This is in stark contrast to the Ethereum mainnet, where a large portion of transactions still occur through DEX frontends, and multiple aggregators share around 40-50% of order flow.

Jupiter utilizes its sophisticated routing algorithm (Metis) to determine the best price among more than 30 integrated DEXs. It also provides the following features:

1.

strong>Limit Order – Buy/sell at a predetermined price by using a fill bot.

2. Cost Averaging — Facilitates the regular purchase or sale of tokens over a set period.

For developers, Jupiter offers a payments API (allowing merchants to accept payments in any token while receiving the final amount in USDC) and terminal functionality (enabling any dApp to incorporate exchange functionality into its interface). Jupiter has facilitated over $100 billion in transaction volume to date.

Prism is an OG protocol in the space, also featuring a DEX aggregator (with negligible trading volumes compared to Jupiter) and Prism Pro (a front-end for Openbook trading ). It plans to open source its aggregator.

Dflow A potential competitor to Jupiter, it was created by a strong team (it received $5.5 million in funding last year, with more likely to follow) ). Dflow has developed a Jupiter-like routing algorithm called Segmenter, with significant product differentiation:

1. A mobile-first approach and integrated non-custodial wallet.

2. A mechanism for liquidity venues such as AMMs to identify toxic order flow (such as bot activity and high-frequency trading firms) and apply higher rates to it.

Although not yet fully operational, Dflow has activated deposits and is running a points program, hinting that the token may be launched soon. It would be exciting if they could take any significant share away from Jupiter.

CLOB (Central Limit Order Book):

CLOB represents the first iteration of the On-Chain Order Positioning System (OPOS). One of the first major DeFi projects on Solana was Project Serum, launched by FTX, which launched the first fully on-chain order book with unified liquidity across the entire ecosystem. Project Serum (along with FTX) played a key role in sparking the initial momentum in the Solana DeFi space, attracting numerous projects to the platform that are now considered blue chips in the Solana ecosystem. It’s important to give recognition and praise where it’s due.

After the FTX crash, the DeFi community forked the Serum code, turned it into a public asset, and renamed it OpenBook. OpenBook is quite possibly Solana's most underrated public resource, sustaining $50-100 million in daily transaction volume, charging no transaction fees, and allowing the creation of marketplaces without permission. For more information about Openbook, read a previous article I wrote.

Portal: https://tinyurl.com/24paeccr

However, currently the most famous order on Solana is Phoenix built by a strong team, with daily trading volume Between $100-150 million. Currently, it operates a permissioned market (with plans to transition to a permissionless model), with the majority of its trading volume coming from trading pairs such as SOL/USDC (~70%), SOL/USDT (~10%), and BONK/USDC (~ 10%).

Compared to OpenBook, Phoenix offers:

1. Instant settlement (i.e. no crank required).

2. More streamlined on-chain data, such as market events (such as placement and cancellation of limit orders, order executions) and more compact on-chain account size.

Root Exchange is another user interface built on Phoenix that provides enhanced functionality for limit orders.

AMM:

Despite continued innovation in the order book, the top four Solana AMMs still dominate the majority of trading volume.

Orca — Inspired by Uni v3, Orca has become a centralized liquidity automated market maker (CLAMM). It is currently the most important DEX on Solana and focuses on developing the ecosystem. basic liquidity. Orca has facilitated more than $26 billion in deal volume and generated more than $40 million in limited partner fees so far in 2024. It strives to be the most user-friendly liquidity integration platform with open source and proven smart contract deployment.

Raydium - Unlike other CLAMMs, Raydium also leverages CLOB (i.e. Openbook), adopting a hybrid model. Additionally, it supports permissionless farming, allowing anyone to create a pool and bootstrap the token’s liquidity. This feature has enabled thousands of meme coins to be launched on Solana, making Raydium the DEX of choice for meme coin issuance.

Meteora — Meteora’s DLMM (Dynamic Liquidity Market Maker) system is modeled on Trader Joe’s Liquidity Manual, which arranges the liquidity of asset pairs into different price ranges . Each bin is defined by a specific price and liquidity amount, eliminating swap slippage that occurs within that bin.

Meteora’s DLMM can be seen as a hybrid between an order book and an AMM, thus requiring proactive provision of liquidity and allowing for spot (uniform distribution), curve (concentrated approach to low volatility) and Strategies such as buying and selling carry out different liquidity allocations (inverse curve distribution of high volatility). This is particularly helpful for dynamic fee capture by limited partners. That is, limited partners earn more in fees during periods of high volatility.

In addition to DLMM, Meteora also offers AMM pools (formerly Mercurial pools), which include dynamic pools, multi-token pools, and FX and LST pools.

Lifinity — The platform runs as an Oracle-based AMM. Unlike other DEXs that rely on arbitrageurs for price adjustments and use pool asset balances for pricing, Lifinity hires its own market maker. Furthermore, it does not rely on LP liquidity but instead utilizes protocol-owned liquidity (PoL) to distribute the revenue generated to its token holders. In the last monthly cycle, for example, it generated about $550,000 in revenue. Among all AMMs, Lifinity stands out as the most OPOS and capital efficient DEX, with daily trading volume of $100-200 million and TVL of only ~$800,000 (total TVL ~$7.5 million, including market makers).

Fluxbeam is the only AMM specializing in token scaling and is about to launch its launchpad. Other AMMs like Invariant and Saber (now SaberDAO) may not be as actively developed, but still have a significant presence.

Hybrid Exchange:

Backpack Exchange – a centralized exchange developed by the team behind Backpack and Mad Lads Place. It is regulated by Dubai VARA and is about to receive additional licenses. The exchange currently offers spot trading and plans to launch margin trading, derivatives and cross-collateral options soon. It has managed to attract more than $70 million in deposits, spurred by anticipation of the potential snapshot.

Cube Exchange — Another centralized exchange founded by former members of the Solana Labs team. Its latency is just 0.2 milliseconds, which is lower than Binance (5 milliseconds). The exchange maintains an off-chain order book, while settlements are performed on CubeNet, a meta L2 blockchain that is reportedly a fork of SVM.

My predictions:

1. The order book will continue to gain market share, especially for blue chip asset pairs.

2. As trading front-ends become more social (e.g. Bonkbot, Fluxbot or Dialect) , the specialization of DEX will be enhanced.

Given the boom in token issuance, the Solana ecosystem has two token issuance tools:

1.Armada—— The platform provides a set of open source protocols covering three key aspects of token issuance: token issuance (customizable auctions and pool-based issuance), liquidity provision (via CLMM vaults), and Tokenomics (automated protocol reward distribution and Token pledge). Projects like Flowmatic and Pepper are among the first to be launched through Armada.

Jupiter’s LFG Launchpad — The top DeFi project on Solana has also built a Launchpad leveraging its existing ecosystem and community:

1. Features a customizable boot pool powered byMeteoraAG DLMM.

2. Provide complete trading functions, focusing on pre-order process and price discovery.

3. Includes a mechanism for voting on projects launched through the JUP DAO.

Projects such as Zeus and Sharky were among the first launched through Jupiter.

Solana Assets:

The assets (or tokens) on Solana can be roughly divided into:

1. SOL and LST

2. JUP, RNDR and other project tokens

3. memecoin

4. > Stablecoins and RWA

MemeCoins:

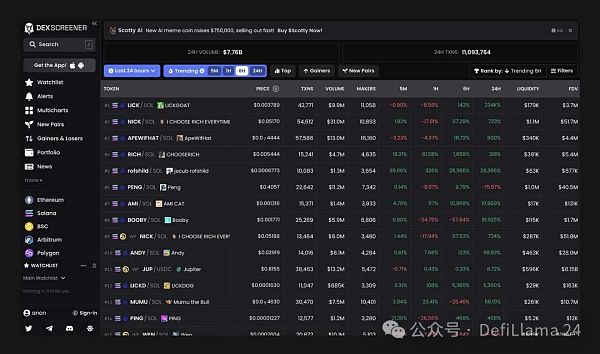

Memecoin is a culture on financial steroids. They are the lifeblood of DEX on Solana and attract a lot of attention. Many have speculated that we may be experiencing a Memecoin supercycle, and that Solana will lead the charge.

Solana has become synonymous with memecoin because:

1. A fun community embracing a unified meme culture, led by influencers like Ansem.

2. Low cost and fast transactions promote inclusivity, eliminating the need to mentally think about gas fees before transacting.

3. Seamless user experience for memecoin trading through aggregators like Jupiter, backed by strong liquidity on DEX.

This is the typical journey of a memecoin enthusiast:

1. Discover a newly listed mining pool on Orca or Raydium, learn about memecoin from friends or Twitter , or get insights from the Ansem team.

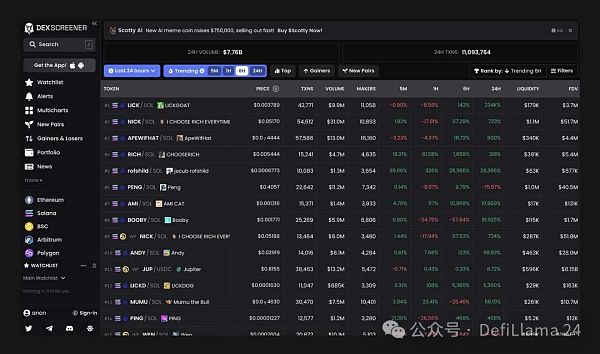

2. View memecoin charts and statistics using DEXScreener and Birdeye - the best part is that both platforms have Jupiter integration to its interface, allowing users to invest directly in memecoin. One can also use Rugcheck to perform a quick check on a coin’s risk parameters.

3. Continuously monitor your portfolio and share your findings with friends!

The adage “bet on retail” rings true—and retail is represented in Solana.

All trending coins are Solana memecoin on DEXSCREENER

All trending coins are Solana memecoin on DEXSCREENER

My predictions:

1. Culture will become more fungible – I believe memecoin will serve as a "Monetization culture" and greater liquidity and inclusivity than NFTs, providing them with significant advantages.

2. Vertical memecoin platforms will emerge; for example, a political platform containing all politically related memecoins such as Tremp and Boden. Memecoin will lead us into the promised “metaverse”.

User Tip - Portfolio Trackers:

Solana supports three main portfolio trackers (or address trackers): Step Finance, < strong>Sonar Watch andAsset Dash. While Sonar Watch excels in DeFi integration, Asset Dash and Step Finance are more popular for those looking for mobile-friendly options and better NFT support. For analyzing or monitoring any wallet, these portfolio trackers, along with Phantom’s watch wallet feature, are extremely useful. Compared to the two major browsers Solscan and SolanaFM, SolanaFM is much more advanced in transaction analysis.

Stablecoins:

Solana now has a variety of fiat-backed stablecoins.

USD – USDC, USDT, USDP, USDY, ZUSD

< /li>EUR – EURC, EUROe, VEUR

GYEN, QCAD, VCHF, TRYB, ISKT, BRZ, Etherfuse CETES, NGNC

Currently, Solana’s stablecoin market value is approximately US$2.5 billion, of which USDC (67.5%) and USDT (31.5%) occupy the majority of the market share, followed by other market values below 1,000 A long-tail stablecoin worth $10,000. Although many fiat-backed stablecoins have been launched recently, with the exception of USDT and USDC, most other stablecoins face the challenge of low liquidity and limited DeFi integration. To solve this problem, Meteora has launched a FX pool (currently only available on the EURC - USDC pool with a TVL of $20,000) which is still in its early stages but represents a step in the right direction.

UXD (backed by over-collateralized positions, real-world assets, and delta neutral positions) and USDH (backed by CDP) are two decentralized stablecoins on Solana.

On-chain Foreign Exchange (FX) Market Case

The FX market is huge, with daily trading volume exceeding $6 trillion. The availability of fiat-backed stablecoins with ample liquidity could pave the way for the establishment of on-chain spot FX markets through order books and AMMs. Imagine a scenario where merchants can accept USDX payments and instantly convert them to YENX, while Jupiter routes transactions through multiple liquidity venues. Sooner or later someone will build a spot FX trading platform on Solana.

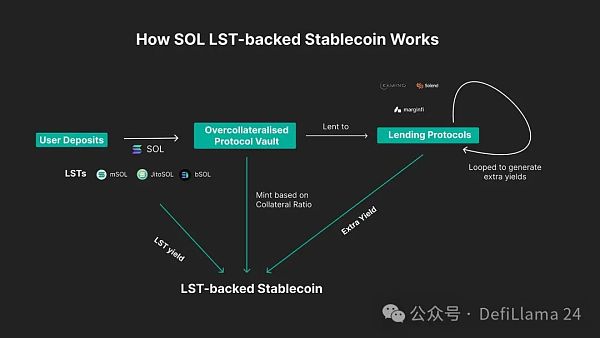

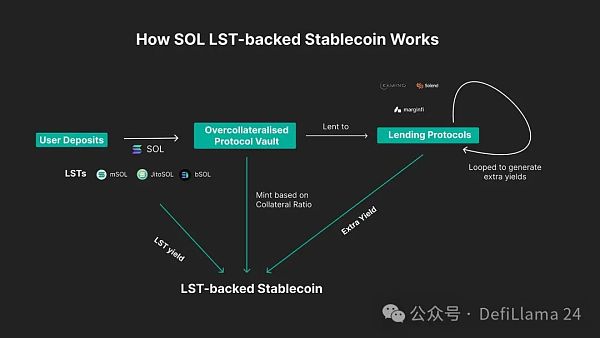

Two LST-backed stablecoins will also be launched on Solana – MarginFi’s YBX and Jupiter’s SUSD. These are essentially CDP stablecoins, but utilize LST as collateral (equivalent toLybra’s EthereumeUSD andPrisma’smkUSD ).

My prediction:

1. Inspired by Ethena, someone will develop UXD v2 (mirroring the previous model of UXD, similar to Ethena).

2. DeFi stablecoin mechanisms will become increasingly innovative, seeking to provide holders with yields and enhance liquidity in lending positions.

User Tip – Not all stablecoins are created equal. Fiat-backed stablecoins are generally the most secure, while other DeFi stablecoins (often referred to as “synthetic USD”) carry inherent DeFi risks and are best suited for DeFi applications. Always verify liquidity and redeemability before holding any large amounts of stablecoins.

Bitcoin? Solana

In recent efforts to scale Bitcoin, multiple projects have begun creating Bitcoin<> Solana interoperability solutions to enable seamless use of Bitcoin with Solana :

1. Atomiq — A cross-chain DEX that facilitates the integration of Solana assets (SOL and USDC) with Bitcoin (on-chain and on the Lightning Network ) exchange. Their payment demo is very innovative, showing off Solana to Bitcoin transactions in stores that accept BTC.

2. Zeus Network — An open communications layer connecting Solana and Bitcoin. It introduced zBTC, a wrapped version of BTC, allowing users to stake or lend on Solana to earn yield. The project has ambitious plans, including deep integration of BTC into Solana’s DeFi ecosystem, offering BTC-backed stablecoins, cross-chain lending between Solana and Bitcoin, layer 2 integrations like Stacks, and more.

3. Sobit Bridge — SoBit acts as a token bridge and users can initiate the bridging process by depositing BRC20 tokens to a SoBit specific address. The platform verifies these deposits and then mints tokens of equal value on Solana.

These initiatives are still in their infancy and have not yet been fully launched. Threshold Network’s tBTC also offers a tokenized version of Bitcoin on Solana, powered by Wormhole Crypto.

For more insights and predictions, check out my post on the Bitcoin x Solana paper!

Portal:https://twitter.com/yashhsm/status/1739658770941129094?s=20

Real World Assets (RWA):

Tokenized RWA (Real World Assets) brings off-chain financial assets onto the chain. For example, real estate, private credit, treasury bills, green bonds, gold and other commodities.

In addition to stablecoins, Solana has a wide range of RWAs, including:

1. Tokenized Treasury Bills (Ondo and Maple Finance)

2. Real Estate (Homebase and Liquidprop) p>

3. Physical goods (BAXUS and CollectorCrypt)

4. Private Credit (Credix and Credible)

My Prediction:

1.DeFi Composability: For example, holders can earn by tokenizing U.S. Treasuries, using them as collateral in the DeFi lending market, borrowing stablecoins, buying more Treasuries, and repeating the cycle Higher yields. This scenario is just one example: integrating real-world assets (RWA) into the Solana DeFi ecosystem opens the door to the creation of valuable new products, some of which are only possible through crypto-native mechanisms.

2. Expanding more assets and markets will introduce more high-quality tokenized assets to DeFi.

I wrote a comprehensive article on Real World Assets that outlines all RWA on Solana as well as my thesis.

Portal:https://tinyurl.com/2dae28ts

LST (Liquid Staked Token)

On Solana, approximately 400,000 wallets have staked their SOL. As an asset class, Liquid Staked Tokens (LST) contribute the most to the protocol’s total value locked (TVL). Take any lending protocol and you will see LST dominate TVL. However, Solana’s LST adoption remains low at 4-5% of the total SOL supply compared to Ethereum, which has an impressive staking rate of 24%. While most LSTs offer similar yields, it’s the higher secondary market liquidity and broader utility in DeFi that make them stand out. Currency markets dominate when it comes to DeFi integration, with platforms such as Solend, Kamino and Marginfi becoming central hubs for LST activity, partly in anticipation of the airdrop.

On Solana, all LSTs generate yield, meaning their value increases as their yield increases. In comparison, popular Ethereum LSTs like Lido’s stETH are rebased every day (meaning the amount of stETH in your wallet keeps increasing at about the same price as ETH).

1. Marinade [mSOL]: Marinade is the pioneer of the Solana LST protocol, founded in 2021 by two teams at the Solana Hackathon merged. The project launched the MNDE token in November 2021 and transitioned to an on-chain DAO in April 2022. Its TVL is distributed in:

a. Native staking (35% at 3.5 SOL)

b. Liquid staking ( 75% at 6.72 SOL)

Marinade Native stands out because it gives institutions the option to stake directly to a decentralized selection of the best performing validators without exposing smart contracts, which Attracting those who are hesitant to participate in DeFi.

2. BlazeStake (bSOL): Initiated by an anonymous developer named solblaze, it provides token incentive rewards and extensive DeFi integration. Driven by , BlazeStake quickly gained attention and accumulated 2.7 million SOL (approximately US$400 million) in TVL in less than a year. This approach provides bSOL holders with additional earning opportunities.

3. Jito (JitoSOL): While Marinade was initially in the lead, by the end of 2023, Jito had become a formidable competitor, partially The reason is that it effectively uses points and airdrops to increase visibility. JitoSOL stands out for its focus on MEV, entrusting SOL to high-quality validators that support MEV. Equipped with Jito Labs’ software, these validators auction block space to earn additional MEV rewards, which Jito redistributes to users as additional APY.

Jito’s boosted earnings = standard staking earnings + MEV rewards

Jito’s Stakenet: When we stake SOL using any LST solution, the staking program is run by Hot Wallet operation, the hot wallet is managed by an off-chain robot, which decides:

- Add or remove validators

- Delegate or undelegate interests

This Centralization risks are introduced. Stakenet solves this problem by moving all delegation logic on-chain, transforming a previously trusted and opaque system into a transparent one.

Recently, Jito Labs suspended the mempool service provided by Jito Block Engine due to an increase in sandwich attacks. The decision sparked mixed reactions within the community, with some appreciating Jito's positive stance, while critics believed it could lead to private transactions and the potential development of a new private mempool in response.

While LST represents one use case, StakeNet is particularly interesting for restaking networks, liquid restaking protocols, oracle networks, etc. In these cases, StakeNet can autonomously allocate assets across a decentralized network of Active Validation Services (AVS) and high-performance node operators. It combines the best of both worlds: automation (by moving processes on-chain) and governance (allowing configuration parameters to be set through governance).

Many other LSTs exist, operated by individual validators, some of which try to differentiate themselves. For example, LaineSOL and CompassSOL have been offering higher staking rewards with the help of MEV. To compare APY and active benefits, check out this list.

Portal:https://solanacompass.com/stake-pools

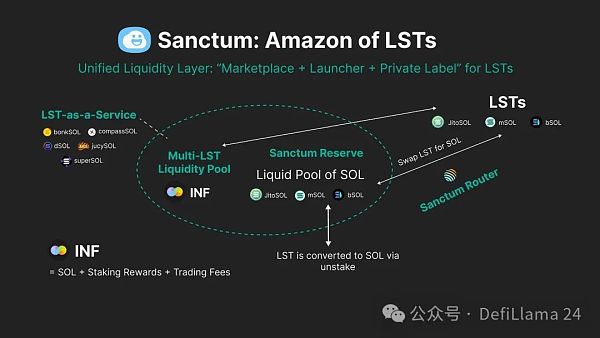

LST on Solana faces Liquidity challenges, which is why there are only three main LSTs (JitoSOL, mSOL and bSOL). Smaller LSTs face the problem of fragmented liquidity, and sainttum solves this problem.

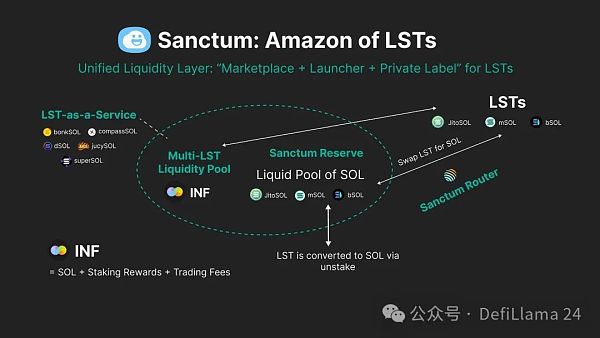

Sanctum - Unified LST Liquidity:

An interesting project from one of the OG teams helped Solana Labs build the SPL stake pool plan and launch the first An SPL equity pool Socean.

In order to solve liquidity, Sanctum has created two major products:

1. Sanctum Reserve – A pool of liquid SOL used as a reserve. This makes all LST immediately unstakeable, regardless of size. So far, 60k SOL has been withdrawn from the Sanctum Reserve for instant unstaking or LST-SOL swap!

2. Sanctum Route — Built with Jupiter, it allows transitions from one LST to another even if there is typically no route between the two LSTs. An LST. This unifies LST liquidity by allowing smaller LSTs to access the liquidity of larger LSTs using the Sanctum reserve pool. It has facilitated more than $380 million in historical transaction volume.

But how does it exchange LST? It simply assumes that all LST is redeemable for SOL in the next epoch, and that the price of LST is derived from the blockchain itself (based on its accumulated yield).

Sanctum also launched two other products:

a. Sanctum LST — Validators can now launch their own LST, in fact, there are already 6 New validators have been added: bonkSOL, compassSOL, dSOL, jucySOL, pwrSOL and superSOL.

Why do validators choose LST instead of ordinary staking?

‧ Through Sanctum, there are zero deposit, withdrawal and management fees for these LSTs.

‧ More DeFi integrations may increase stakeholder returns and potentially launch tokens and kick-start the entire ecosystem.

Benefits to the Solana Ecosystem:

‧ TVL can be significantly increased when LST is integrated into DeFi.

‧ This also reduces Solana’s risk of contagion, as no one LST will monopolize the market.

b. Sanctum Infinity — A multi-LST liquidity pool (automated market maker or AMM) that allows swaps between all LSTs in the pool. Here's how it works:

‧ Users deposit any (whitelisted) LST into Infinity.

‧ They receive INF tokens (representing LST itself), staking rewards and transaction fees from the mining pool.

‧ All LSTs can share the liquidity of INF-USDC and INF-SOL, or obtain liquidity from any other LST pair through INF.

For example, JitoSOL can be first converted to INF through on-chain yield calculation, and then converted to USD or SOL. In this way, INF could become one of the most liquid LSTs on Solana. Think of INF as LST, but with transaction fees added from the pool.

Think of Sanctum as the Amazon of LST, like:

1) You can buy/sell products on Amazon - You can buy/sell SOL (Sanctum Reserve and Router) LST

2) Launch your own product on Amazon, and Amazon takes care of end-to-end delivery - You can launch your own LST, and Sanctum takes care of liquidity (Sanctum LST)

3) Amazon’s own brand – Sanctum launches its own LST (Sanctum Infinity)

My prediction:

1. More Multiple LSTs: Many LSTs will emerge in the coming months, with the help of solutions like Sanctum or standalone solutions; with differentiation such as dual-token models (like Frax) or better MEV/tip sharing .

2. Deeper LST integration in DeFi: I am particularly passionate about developing LST yield tokenization on Solana.

Will there be SOL Restaking?

Restaking on Ethereum is huge, mainly due to the need for economic security in AVS (rollups/appchains/bridges), And the same doesn't apply to Solana - it doesn't have a modular paper yet.

However, Solana can still have AVS (Active Verification Service), since anything that requires distributed verification can use it:

‧ Clockwork-type Keeper networks

‧ Pythnet-style appchains

An early team called Cambrian is also exploring this direction. Picaso is another solution exploring SOL LST re-staking to secure the cross-chain intent settlement protocol Mantis. Beyond that, Jito is another team that's perfect for building anything around Restake through the Staking Network.

Lending:

Solana utilizes a peer-to-peer model to host three major currency markets, following floating (variable) interest rates and similar interest rate mechanisms. They operate on a utilization-based interest rate model, where the rate of return depends on the utilization rate (the proportion of supply capital lent) with the formula: supply rate = borrowing rate * utilization rate * (1 – reserve factor). The “reserve factor” represents the percentage of capital provided by the lender that does not earn interest; on the contrary, this mechanism favors the agreement. Utilization depends heavily on the system's need for leverage.

All three markets have active points programs, and MarginFi and Kamino plan to launch tokens soon:

1. Kamino Lend

strong>: Currently the largest Solana lending platform, it has upgraded from 0 to 700 million US dollars in just 5 months. Similar to Aave v3, Kamino also introduces E-Mode, which enables users to borrow highly correlated assets (such as LST or stablecoins) at a more capital efficient LTV ratio. Additionally, it allows some LP tokens to be used as collateral.

Kamino develops products such as Multiply and Long/Short, which are one-click treasury products designed to generate leveraged returns through cycles. Kamino has a comprehensive risk dashboard for examining all types of risks as well as various scenario analyses. Uniquely, Kamino implements automatic deleveraging, where borrowers deleverage (i.e. partially liquidate) their positions based on market conditions to prevent bad debts.

2. MarginFi: One of the earliest DeFi protocols to launch a points program on Solana, from 3 million in less than a year The dollar surged to over $600 million. In addition to its lending protocol, it also launched its own LST-backed stablecoin – YBX.

3. Solend: The original protocol on Solana, Solend currently has approximately $200 million in TVL. In terms of SOL, the past 1.5 years (after the FTX crisis and the Solend whale liquidation incident) have fluctuated between 1-2 million SOL. It is based on the spl-token-lending scheme (Solana Lab’s reference implementation) and also provides profitable deposit receipts, called “cTokens”, for every deposit.

Although all protocols use similar lending mechanisms, they each use different methods of risk management parameters, such as price oracles, liquidation, risk engines, etc. Given the high demand for leverage, interest rates have surged, with USDC currently yielding 30-40%!

On the trading side, there are two Perps - Drift and Mango - that have lending capabilities and can also be used as trading margin.

Lending platform on Solana (Source: Flexlend)

Lending platform on Solana (Source: Flexlend)

Revenue aggregators:

Revenue aggregators typically aggregate two types of earnings:

1. Borrow/Loan, for example:

‧ Automatic: Meteora provides dynamic treasury , which automatically rebalances between top lending protocols on a minute-by-minute basis to optimize yields.

‧ Machine Gun: Flexlend Similar to Jupiter, but used for lending, it summarizes the best interest rates for assets such as USDC on five lending platforms—— Mango, Drift, Mango (listed twice assuming importance is emphasized or a spelling error should be corrected), MarginFi, Solend and Kamino. It automatically rebalances deposits to the protocol offering the highest APY at any given time. Flexlend features a unique Homebase where users can set a minimum desired interest rate and if requirements are not met, funds will be restored to the wallet or designated protocol.

‧ JuicerFi acts as another revenue maximizer by aggregating different lending protocols and strategies to maximize points.

2. LP in DEX, for example:

‧ Kaminoenables users to earn cryptocurrency yields by providing liquidity to CLMMs such as Meteora, Orca, and Raydium. It issues kToken as receipt tokens representing the value deposited into Kamino vaults and allows users to create their own DIY automated strategy vaults.

‧ Hawksight is a centralized liquidity yield optimizer for active limited partners on Solana, providing self- Managed and automated market making strategies. It is similar to Kamino Liquidity but has launched its token, achieving a TVL of $10-12 million.

My predictions:

1. Yields will move higher, driven by demand for leverage and high trading volumes , attracting large amounts of capital.

2. Experiments will be conducted with yield derivatives such as yield stripping, fixed rate loans, interest rate swaps, etc. (more on this in Part 2).

Notes about oracles:

Oracles not only bring off-chain data to the chain, but are also critical to DeFi infrastructure because All calculations rely on oracle price feeds. Pyth (licensed - only verified publishers can publish) is the go-to integration for most players, while Switchboard (no permission required - price feeds can be customized) is another player that acts as a backup or backup oracle for most DeFi players.

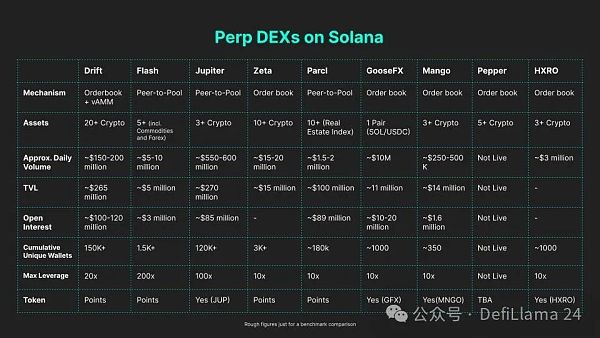

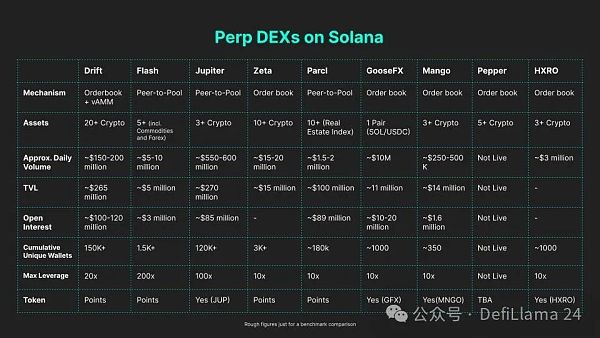

Perp DEX:

Perps are the highest PMF derivatives in cryptocurrencies, and like every chain, Solana has an extensive Perp protocol:

p>

1. Peer-to-Pool Perp DEX: Jupiter, Flash Trade, Parcl

2. Perp DEX based on order book: Drift , GooseFX, Zeta, HXRO, Pepper, Mango

Most of the Perp DEXs on Solana have active points programs, which has resulted in a significant spike in trading volume.

Peer-to-Peer Pools:

Solana draws significant inspiration from GMX and has two operational permanent DEXs: Jupiter andFlash. Both are based on novel LP-to-trader models and offer up to 100x leverage. They utilize LP pool liquidity (Flash’s FLP and Jupiter’s JLP) and oracles, ensuring zero price impact, zero slippage, and deep liquidity. Users can open and close positions in one simple step, with no additional account opening or deposit required. However, there are significant differences:

1. Jupiter only supports 3 assets, while Flash offers a wider range of assets, including commodities such as gold and silver.

2. Flash introduces a unique NFT x DeFi gameplay with built-in gamification.

3. Jupiter aggregates all fees (trading, swaps, and liquidity) into the LP pool, while Flash separates transaction fees and allocates them to the USDC-staking FLP pool.

Nevertheless, the network effects are powerful, as Jupiter Criminals are integrated into the Jupiter front-end, the most visited DeFi site, giving Jupiter Criminals a significant advantage – the numbers speak for themselves And metaphor. Jupiter achieves more transaction volume than all other Perps on Solana combined, proving that crypto frontends can cross-sell anything (which might not even be the best product) – generating fees, which generates value!

Parcl – An interesting permanent decentralized exchange that allows one to go long or short on real estate indices in cities like Las Vegas and Paris. The price feed oracle for this permanent decentralized exchange is Parcl Labs, the company behind the Parcl platform. Despite attracting a large amount of TVL, its organic sales were low.

Order Book Perp DEX:

As one of the other features of OPOS, Solana is the only chain that runs the order book completely on the chain, and large Most other chains have off-chain order books (as sidechains/application chains/rollups).

Drift Protocol — Drift v2 was originally built on the Virtual Automated Market Maker (vAMM) model pioneered by Perp Protocol and now follows the unique mechanism "Liquidity Trifecta", developed by Composed of 3 mechanisms:

‧ Just-in-time (JIT) auction (5-second Dutch auction for market makers to fill)

‧< /strong> Order book (the administrator robot tracks open orders in the off-chain order book)

‧ If the market order is not filled, the AMM mining pool will act as a liquidity backstop. By.

Drift's launch of a pre-release token could be an interesting marketing strategy, but, as we've seen from Hyperliquid and Aevo's pre-launch markets, trading volumes are still low.

Fully on-chain order books, such as:

1. Zeta Markets – Zeta v2 uses fully on-chain orders Book and matching engine that operates similarly to the Open Book DEX on Solana. It has managed to drive a recent surge in trading volume due to the upcoming launch of the coin.

2. Mango Markets – Once the largest DeFi protocol on Solana, but after the hack, it struggled to even crack the top 5 .

3. GooseFX – Another CLOB-based DEX with incentives built around its native token.

4. HXRO — The Hxro network is a shared liquidity layer for derivatives that any Perp DEX can leverage. It has two core protocols Dexterity (helps connect and build CLOB-based derivatives) and SPANDEX (risk engine). Anyone can build their own UI/UX and compose it using Hxro network protocol - Pepper DEX is one such upcoming project that builds a stylish UI while leveraging Dexterity (Shared Liquidity of the global order book).

Solana Perp DEX still lags significantly behind its Ethereum counterparts, especially hybrid DEXs (off-chain orders Book matching with on-chain settlement), such as Aevo, Hyperliquid, Vertex and dYdX, which are always the top 4 Perp DEX. However, Jupiter has seen high trading volume recently, ranking among the top 5 on good days.

My predictions:

1.Perps as a Solana application chain : In the EVM world, most Perp DEXs, especially those based on order books such as Aevo and Hyperliquid, are transitioning to their own application chains. In the future, Solana perp DEX can also build its own chain, which can bring the following benefits:

‧ Is protected from any mainnet congestion.

‧ Enhance users’ trading experience (transactions can be free for traders).

‧ In fact, Zeta has already begun to move in this direction.

2. Perp aggregators: Just as we have lending and spot DEX aggregators, we may soon see Perp aggregators as well, albeit with different design mechanisms. challenge. With the emergence of perp aggregators like Rage Trade and MUX, a similar trend may emerge on Solana - especially for designs similar to Flash and Jupiter.

3. Driven by excitement around off-chain order books and token issuance, Backpack and Cube began to gain market share and surpass On-chain transaction volume.

Structured Products and Options:

Structured products and on-chain derivatives (except Perps) were all the rage during the last bull market, with many innovative products For example, DeFi Option Vault (Katana and Friktion) was launched on Solana. As we are on the cusp of a bull market, we can expect similar manias to return.

Options:

On-chain options are challenging; however, they are making a comeback in a big way, with projects like Aevo recently seeing a surge in premium volume of around 500,000 US dollars, while nominal trading volume reached US$1-2 billion. This was followed by projects like Lyra, Typus and Premia.

On Solana, there are two very strong teams building on-chain options:

1. SDX Market - Developed by the OG team - PsyFi, an options AMM that supports fully collateralized, cash-settled European options, including calls, puts and vertical spread strategies. It utilizes AMMs rather than order books (most 2021 options platforms primarily use order books), offering:

‧ As options sell at a premium, passive limited partners and more Good risk-adjusted returns.

‧ SDX provides quotes at a variety of price levels and option terms, offering a wider range of options.

‧ The platform automatically adjusts the bid-ask spread to incentivize trading that maintains the best liquidity pool composition.

It is still in its early stages, but has historical trading volume of over $8 million, peak daily trading volume of $450,000, and available assets include SOL, ETH, BTC, and mSOL.

PsyFi also offers vault products withstandard strategies, such as whETH-covered calls, BTC-backed PUT, and SOL-covered calls.

2. DeVol – Similar to SDX Market, this is a fully collateralized European options AMM. However, it is underpinned by a unique pricing methodology based on basic units called Standard Risk Blocks (SRBs). The SRB is used to comprehensively price and settle the proceeds of any derivatives, including those of traditional options.

Regarding structured vaults, Cega is another OG product that offers multiple types of vaults, such as pure option strategies, bond + option strategies, leveraged option strategies, and dual currency treasury. It supports Solana deposits and withdrawals with a TVL of approximately $13 million and a transaction volume of over $380 million.

Perp-based Vault:

1. Circuit Trade - on Perp DEX Deposit into a vault for market making strategies (currently only Drift). They help increase passive liquidity and take advantage of high-yield MM strategies. For example, Supercharger Vault is a fully on-chain delta neutral market making strategy.

2. Adrastea Finance — allows you to earn leverage or a high fixed annual interest rate. Inspired by the GMX/GLP ecosystem, its initial strategy allows you to earn leveraged gains on JLP or stable APY on USDC. Yield enhancers like

Superstake SOL — help earn leveraged returns on LST through SOL recursive borrowing/lending powered by Drift.

Dual Finance - Provides options infrastructure, but is not intended for speculative use cases; instead, it serves as an incentivized liquidity infrastructure for the Web3 community. By using Stake Options, projects can provide staking rewards in the form of options. Dual Finance allows projects to reward participation in their ecosystem (e.g. using their protocol or providing liquidity) by granting users options on their native tokens. For example, BONK has staking options (staking rewards in the form of options) to incentivize long-term token holding and community participation.

Amulet — is a Solana-powered income/insurance protocol with various products including AmuVaults, AmuShield, and AmuVerse.

Symmetry is another platform for creating, automating, managing, and tracking on-chain funds.

My predictions:

1. Structured products and derivatives, especially order-based products and derivatives , will make a comeback on Solana.

2. Options will see a resurgence – bull markets require additional speculative products. If used correctly, options can provide leverage without the risk of liquidation.

User Tip - Options are risky and should only be explored after fully understanding them. Still, since most projects are still in their early stages and do not have tokens, they are worth considering if you are an options trader.

Concluding remarks: The road to $10 billion in both TVL and daily trading volume

Overall, I expect the following trends in DeFi:< /p>

1. Demand for leverage will increase significantly, leading to higher annualized returns and, in turn, a wider range of income products.

2. Speculation and the velocity of money will reach unprecedented levels – we will witness an unprecedented wave of speculative products (e.g., Power Perps and Everternity Options).

3. Permissionless real-world assets (RWA), AI and DePIN tokens will start to take a large share of DeFi.

As both ends of the Solana DeFi barbell develop, we’ll see even more innovation happen in the middle! Large-scale unlocking is about to happen, mainly to meet the utilization of profitable assets and revenue transactions within the ecosystem.

The Solana DeFi ecosystem is growing rapidly; blue chips have made huge efforts in bringing Solana DeFi to its current state - now is the time for new DeFi protocols to emerge. Solana’s biggest advantage is its composability. While composability is a double-edged sword from a risk perspective, it provides early-stage DeFi protocols with significant leverage to grow by standing on the shoulders of giants.

Focus on innovation and design mechanics “only possible with Solana”! Infrastructure is finally reaching a level that can sustain large-scale activity – many DeFi innovations that previously failed too early are now viable again.

Edmund

Edmund