Author: Crypto_Painter Source: X, @CryptoPainter_X

Recently, there has been a hint of panic in the entire market, which is largely related to the huge short positions held by CME. As an old leeks in the currency circle, I vaguely remember that when CME officially launched BTC futures trading, it just ended the epic bull market in 2017!

Therefore, it is of great significance to study these huge short positions of CME!

First, let me introduce the background:

CME refers to the Chicago Board of Trade, which launched BTC futures trading at the end of 2017 with the commodity code: [BTC1!]. Subsequently, a large number of Wall Street institutional capital and professional traders entered the BTC market, which dealt a heavy blow to the ongoing bull market and caused BTC to enter a 4-year bear market;

As more and more traditional funds entered the BTC market, institutional traders (hedge funds) and professional traders mainly served by CME began to participate more and more in BTC futures trading;

During this period, CME's futures holdings became larger and larger, and last year it successfully surpassed Binance and became the leader in the BTC futures market. As of now, CME's total BTC futures holdings have reached 150,800 BTC, equivalent to approximately US$10 billion, accounting for the entire BTC futures trading market 28.75% share;

Therefore, it is no exaggeration to say that the current BTC futures market is not controlled by traditional currency exchanges and retail investors, but has fallen into the hands of professional institutional traders in the United States.

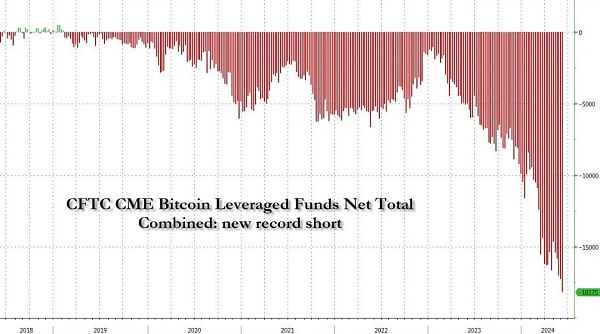

As more and more people have recently discovered, CME's short positions have not only increased significantly, but have recently broken through historical highs and are still rising. As of the time I am writing this article, CME's short positions have reached US$5.8 billion, and the trend has not shown a significant slowdown;

Does this mean that Wall Street's elite capital is shorting BTC on a large scale and is completely pessimistic about the future performance of BTC in this round of bull market?

If we simply look at the data, it is true. Moreover, BTC has never experienced a situation where it has maintained volatility for more than 3 months after breaking through a record high in a bull market. All signs indicate that these big funds may be betting that this round of BTC bull market is far less than expected.

Is this really the case?

Next, I will explain to you where these huge short positions come from, and whether we should be afraid? And what impact does this have on the bull market?

First, if you often check the price of CME, you will find an interesting feature, BTC1! The price of this futures trading pair is almost always at least several hundred dollars higher than the Coinbase spot price. This is easy to understand, because CME's BTC futures are due and delivered on a monthly basis, which is equivalent to the swap contract of the month in the traditional currency exchange;

Therefore, when the market sentiment is bullish, we can see that swap contracts often have different degrees of premium. For example, the premium of the second quarter contract in the bull market is often very high.

If we subtract Coinbase's spot price from CME's BTC futures price (they are both USD trading pairs), we can get the following chart:

The orange curve is the trend of BTC price at the 4h level, and the gray curve is the premium of CME futures price relative to CB spot price;

It can be clearly seen that CME's futures premium fluctuates regularly with the monthly contract extension (automatically moving positions to the next month's contract), which is similar to the swap contract premium of traditional exchanges in the currency circle. They will have a higher premium when the contract is generated, and when the contract is about to expire, the premium is gradually smoothed;

During this period, no matter how the price fluctuates, the short order will hardly be liquidated. As long as the premium is gradually smoothed before the expiration of the quarterly contract, you can get a stable return of 2% under 1 million US dollars without risk, that is, 20,000 US dollars.

Don't underestimate this little bit of income. For large funds, this is a high return with almost no risk!

To do a simple calculation, CME generates a new contract once a month on average. Since 2023, its average premium has been 1.2%. Taking into account the handling fee of this operation, let's calculate it at 1%, which means a fixed 1% risk-free arbitrage opportunity every month for a year.

According to 12 times a year, it is almost a 12.7% risk-free annualized return, which is already higher than the yield of most US money funds, not to mention the interest earned by depositing this money in the bank.

Therefore, at present, CME's futures contracts are a natural arbitrage venue, but there is another problem. Futures can be opened on CME, but where can spot be bought?

CME serves professional institutions or large funds. These customers cannot open a CEX exchange account like us to trade. Most of their money is also LP, so they must find a compliant and legal channel to purchase BTC spot.

Clang! Isn't it a coincidence that the spot ETF of BTC has passed!

So far, the closed loop has been completed. Hedge funds or institutions have made large purchases on US stock ETFs, and at the same time opened an equal amount of short orders on CME, making risk-free fixed arbitrage once a month, achieving a minimum annualized stable return of 12.7%.

This set of arguments sounds very natural and reasonable, but we can't just rely on words, we also need to verify with data. Do institutional investors in the United States conduct arbitrage through ETFs and CME?

As shown below:

I have marked on the chart the periods when CME's futures premium has been extremely low since the ETF was passed, and the sub-chart indicator below is a bar chart of BTC spot ETF net inflows that I wrote myself;

You can clearly see that whenever the CME futures premium begins to shrink significantly and is less than $200, the net inflow of the ETF will also decrease accordingly. When CME generates a new contract for the current month, the ETF will see a large amount of net inflows on the first Monday when the new contract begins trading.

This can explain to a certain extent that a considerable proportion of the ETF's net inflows are not simply used to buy BTC, but are used to hedge the high-premium short orders to be opened on CME next;

At this time, you can turn to the top and look at the data chart of CME futures short positions. You will find that the short positions of CME really began to surge by 50% after January 2024.

And the spot ETF of BTC just started to be officially traded after January 2024!

Therefore, based on the above incomplete data, we can draw the following research conclusions:

1. CME's huge short positions are likely to be used to hedge spot ETFs, so its actual net short positions should be far less than the current $5.8 billion, and we don't need to panic because of this data;

2. ETFs have a net inflow of $15.1 billion so far, and it is likely that a considerable portion of the funds are in a hedging state, which just explains why the second highest ETF single-day net inflow in history (US$886 million) in early June and the ETF net inflow for the entire week did not cause a significant breakthrough in the price of BTC;

3. Although CME's short positions are very watery, they have already seen a significant increase before the ETF was passed. After the subsequent bull market, the price rose from $40,000 to $70,000. There is no large liquidation in the US dollar market, which means that there may still be funds among US institutional investors that are firmly bearish on BTC, and we should not take it lightly;

4. We need to have a new understanding of the daily net inflow data of ETFs. The impact of net inflows on market prices may not necessarily be positively correlated, and there may be a negative correlation (ETFs buy in large amounts, BTC prices fall);

5. Consider a special case. When the futures premium of CME is eaten up by this group of arbitrage systems one day in the future, and there is no potential arbitrage space, we will see a significant reduction in the short position of CME, which corresponds to a large net outflow of ETFs. If this happens, don't panic too much. This is simply the withdrawal of liquidity from the BTC market to find new arbitrage opportunities.

6. The last thought, where does the premium in the futures market come from? Is the wool really on the sheep? I may conduct new research on this later.

Okay, the above is the summary of this research. This issue is biased towards market research and does not have a clear directional guidance, so it cannot be of much help to trading, but it is still very helpful for understanding market logic. After all, when I saw the huge amount of short orders on CME, I was a little scared and even recalled the long bear market from 2017 to 2018. . .

That bear market was much more disgusting than today's volatile market, but fortunately, at present, BTC is indeed favored by traditional capital. To put it bluntly, hedge funds are willing to come to this market for arbitrage, which is essentially a recognition, although the money is paid by us retail investors.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex Tristan

Tristan Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph