Author: Revc, Jinse Finance

Foreword

World Liberty Financial (WLFI), a decentralized financial project associated with Donald Trump, announced that its public sale will be launched on Tuesday (October 15), with the goal of raising $300 million at a valuation of $1.5 billion. The participation of the Trump family has brought a lot of attention to WLFI, but it has also raised concerns about whether the project is politically colored.

WLFI co-founder Zak Folkman recently revealed that more than 100,000 people have registered since the whitelist registration was opened on September 30. Paxos announced that its co-founder Rich Teo has joined the WLFI team to be responsible for stablecoins and payments.

WLFI co-founder Zak Folkman recently revealed that more than 100,000 people have registered since the whitelist registration was opened on September 30. Paxos announced that its co-founder Rich Teo has joined the WLFI team to be responsible for stablecoins and payments.

World Liberty Financial

Former US President Donald Trump is about to launch a cryptocurrency project called "World Liberty Financial" (WLFI). Trump has always been supportive of cryptocurrencies and promised to fire Gary Gensler, chairman of the US Securities and Exchange Commission (SEC), establish a cryptocurrency advisory committee, and formulate clear industry regulatory rules during his presidency.

Specifically, WLFI is operated by his sons Donald Trump Jr. and Eric Trump. The project provides cryptocurrency lending and investment services through a decentralized platform and is only open to US investors who meet KYC requirements.

While Trump's supporters welcomed the project as a sign of his attention and support for cryptocurrencies, the transparency and decentralization of the project have been questioned within the cryptocurrency community. Prominent figures in the cryptocurrency space, such as Billy Marcus, the founder of Dogecoin, have criticized the project, arguing that it could affect Trump's political ambitions.

WLFI's initial plans include launching a DeFi lending platform on Ethereum's second-layer solution "Scroll", supporting transactions in Bitcoin, Ethereum and stablecoins. The lending platform is modeled after Aave, and 7% of the token supply will be allocated to Aave DAO to promote governance participation and liquidity provision. Future plans also include the development of a stablecoin-centric credit card, integration with cryptocurrency exchanges, and decentralized ownership of real-world assets such as hotels and clubs through the platform. WLFI aims to help the United States maintain its leading position in the global cryptocurrency field by promoting the mass adoption of stablecoins.

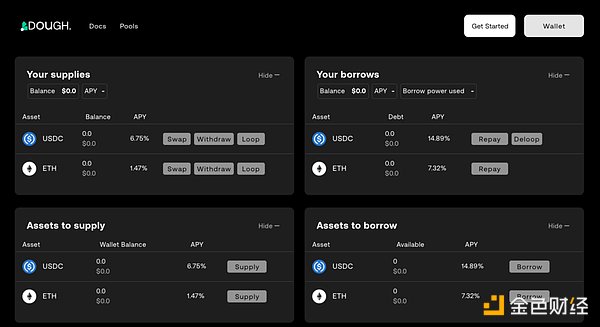

However, there are concerns about the security of the project in the market, as two of the leaders of the WLFI project, Zachary Folkman and Chase Hero, were previously involved in the "Dough Finance" platform, which was hacked in July 2023 and lost more than $2 million. Because WLFI uses similar code to Dough Finance, the security of the project has been questioned.

Dough FinanceThe protocol is based on Aave V3 and provides solutions for lending, asset management, and yield maximization. Its features include automated DeFi Smart Accounts (DSA), a yield multiplier mechanism, and governance through DOUGH tokens. However, the platform's design also has some limitations, such as high borrowing fees, permanent lock-up of pre-sale tokens, a centralized governance structure, and strict liquidation thresholds, which may limit the participation of some users.

WLFI Token Sale

The WLFI Token Sale is scheduled for October 15, 2024, open only to whitelisted users, with a goal of raising $300 million, or 20% of the total WLFI supply. The fully diluted valuation of the project reaches $1.5 billion. Of the total token supply allocation, 63% is for public sales, 17% for user rewards, and 20% is allocated to the founding team, advisors, and future employees, including WLF Foundation and affiliates of the Trump Organization.

The sale of WLFI tokens is pursuant to the SEC's Regulation D, specifically Rule 506(c), which allows the sale of unregistered securities to accredited investors in the United States. This means that only accredited investors can participate in token sales, which may limit participation by the general public.

Although WLFI's governance tokens give holders voting rights, the fact that a large number of tokens are concentrated in the hands of teams and giants makes it not fully meet the standards of traditional decentralized crypto projects.

Summary

The WLFI project has obvious political overtones, such as its claim to "help the United States maintain its leading position in the global cryptocurrency field." Before the election, the project received widespread support from the crypto industry. The investment value of WLFI depends not only on the development of the project itself, but also on Trump's political fate. If the election results favor Trump, the related MEME tokens and WLFI tokens are likely to achieve explosive growth.

However, investors should also remain cautious. During the Space live broadcast on the evening of October 14, participants had different opinions on the prospects of the WLFI project. Some people are optimistic about the project's innovation and potential market value, but others have questioned the team background, token distribution, technical implementation and regulatory compliance. Specifically, the past experience of team members, the imbalance of token distribution, technical uncertainty, and changes in US cryptocurrency regulatory policies are all potential risks that the project may face.

Miyuki

Miyuki

WLFI co-founder Zak Folkman recently revealed that more than 100,000 people have registered since the whitelist registration was opened on September 30. Paxos announced that its co-founder Rich Teo has joined the WLFI team to be responsible for stablecoins and payments.

WLFI co-founder Zak Folkman recently revealed that more than 100,000 people have registered since the whitelist registration was opened on September 30. Paxos announced that its co-founder Rich Teo has joined the WLFI team to be responsible for stablecoins and payments.