Source: C Labs Crypto Observation

Recently, several traditional bigwigs have entered the crypto circle, not to invest in crypto assets, but for a simple reason: using U to receive payments.

In fact, every time a new technology revolutionizes, large-scale applications are like gray rhinos, and the application is popularized without knowing it.

Having said that, it is really exaggerated that modern society still uses Swift, a heaven-defying experience, for cross-border dollar settlement:

The average cost of wire transfer is still tens of dollars, while the transfer cost of stablecoins has been steadily declining in recent years due to the development of on-chain performance.

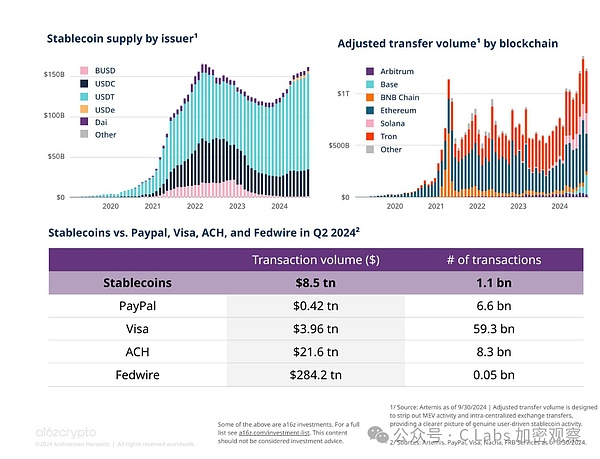

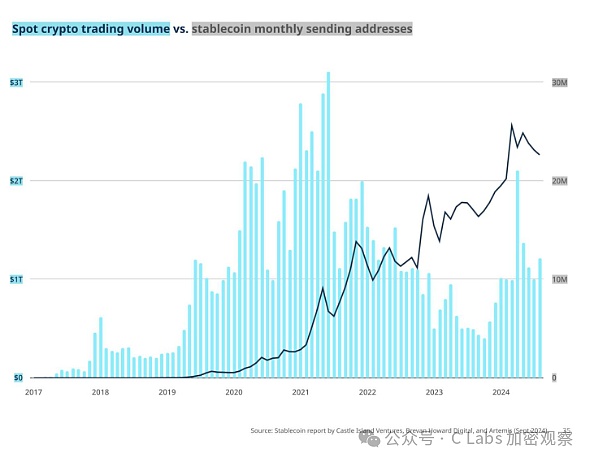

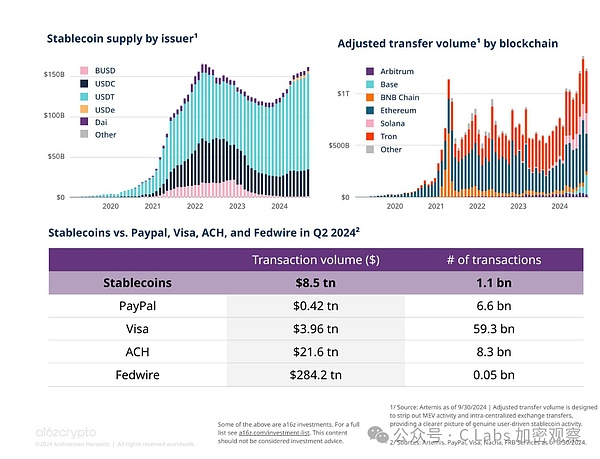

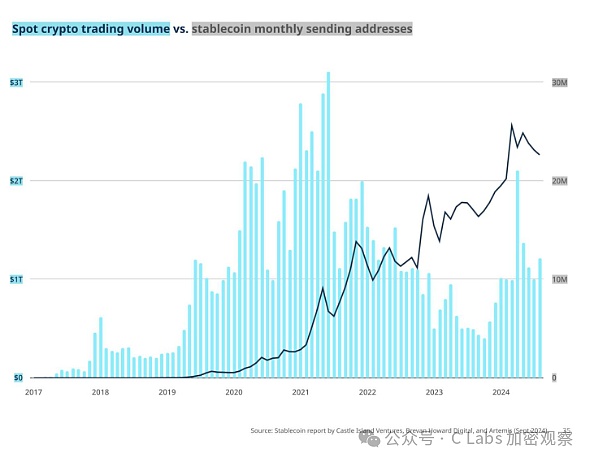

In fact, the transfer scale of stablecoins this year is not much higher than that in 2021, but this scale has remained stable during the bear market:

The transfer scale of stablecoins in the second quarter of this year was 8.5 trillion US dollars, more than twice that of Visa's 3.96 trillion in the same period.

The transfer scale of stablecoins is second only to Fedwire of the Federal Reserve and ACH, the clearing system of Bank of America.

More importantly, the transfer scale of stablecoins has remained stable during the bear market. In the deep bear market of 2023, the transfer scale was half of the current bull market.

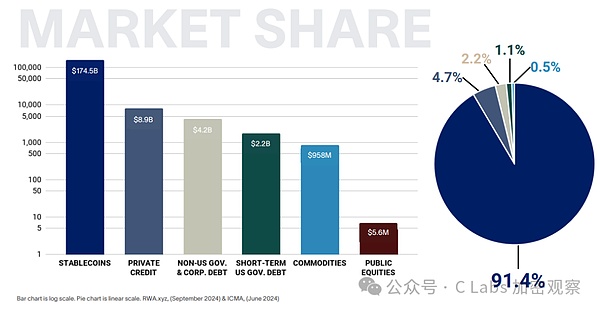

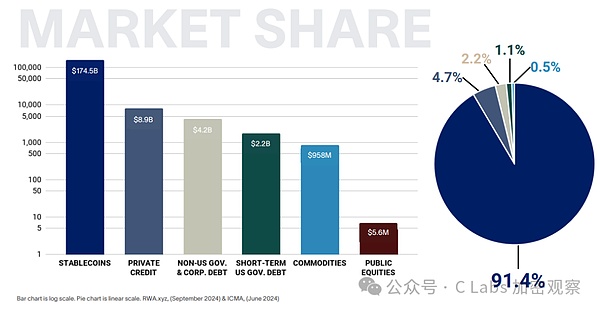

In the current development of RWA and even the entire crypto circle, stablecoins should be the most widely recognized use case (no one else)

In the past, these stablecoins did not have any stable interest-bearing channels.

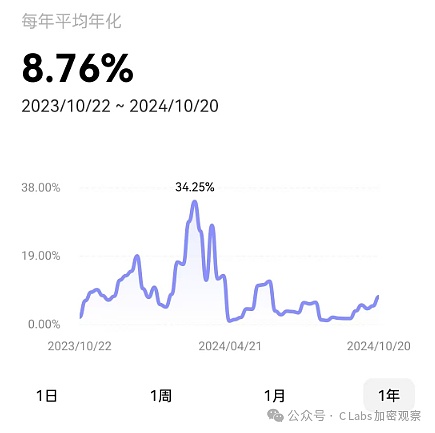

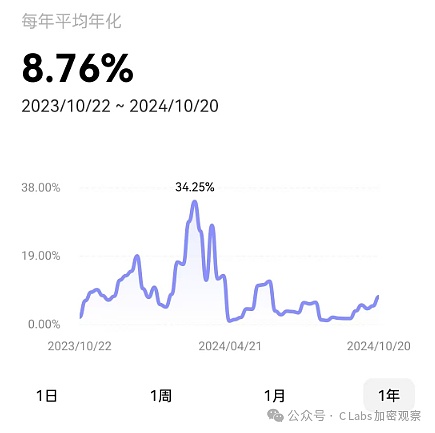

But now it is different. Now the interest rate of US bonds has entered a downward cycle, and the current account income of the exchange is about 5% at the lowest time this year, and even more than 30% at the highest time!

The current account interest income of the exchange mainly comes from the user's leverage or the allocation of funds required by the contract, which is essentially the same as the security of stock configuration.

When other RWA products still have compliance thresholds, the configuration requirements of the exchange can also provide a stable income scenario for stablecoins.

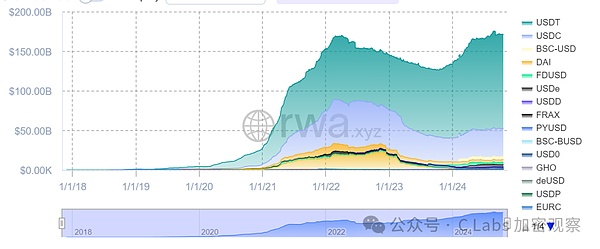

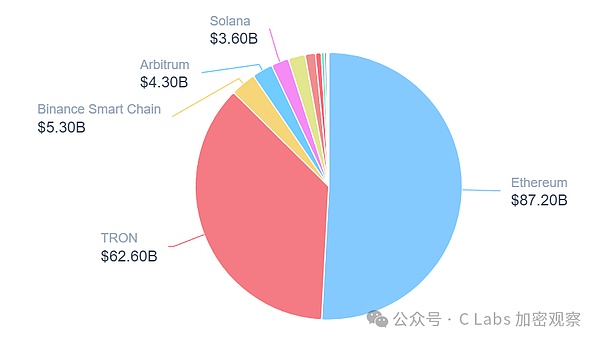

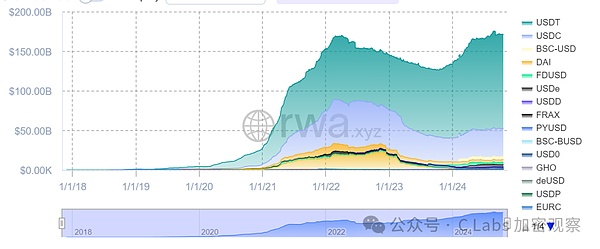

From the perspective of the issuer of stablecoins, Tether has withstood the test and provided about 70% of stablecoins.

Circle ranks second in market share, providing about 20% of stablecoins.

All other stablecoins combined have a market share of about 10%.

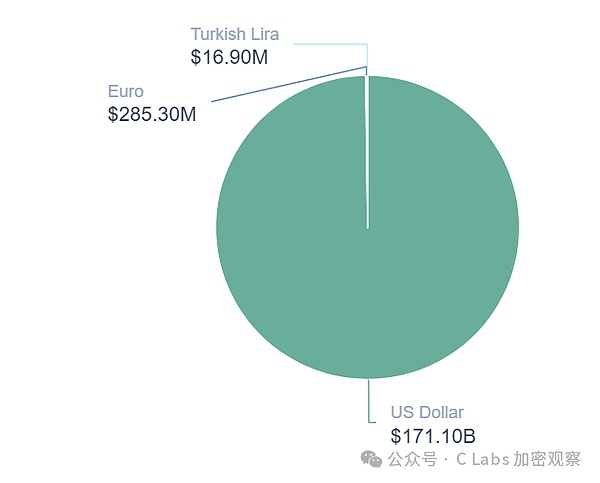

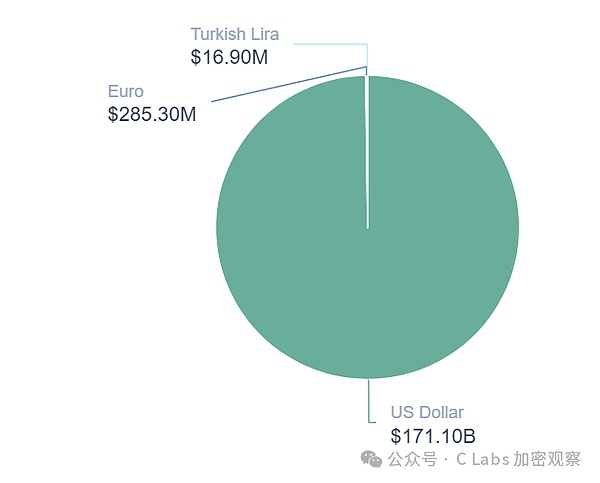

In the field of stablecoins, more than 99% are US dollar stablecoins. It can be considered that stablecoins are not a threat to the US dollar at all, but rather promote the dominant settlement position of the US dollar in the crypto market.

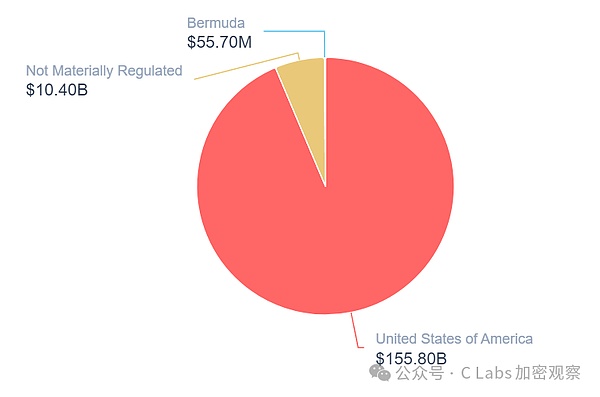

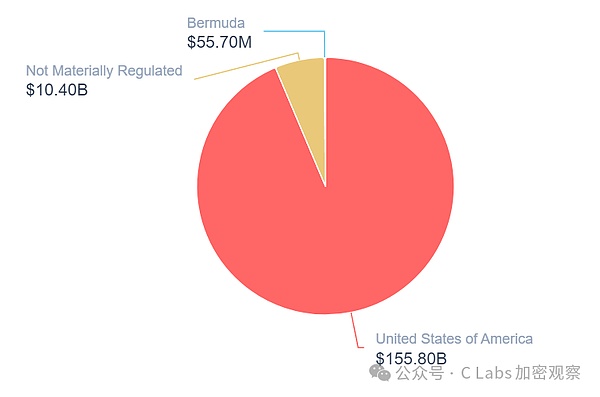

And most stablecoins are issued in the United States.

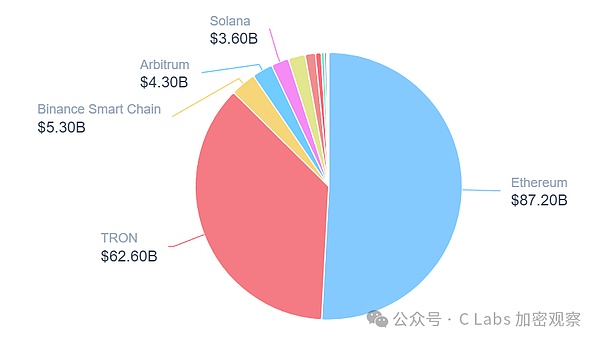

Ethereum still relies on its current ecological advantage to obtain more than half of the stablecoin market;

Tron was already the first in market share in the past few years, but it has retreated to second place in the past two years.

Although the transfer scale of stablecoins this year is similar to the high point in 21 years, the number of active addresses on the chain has achieved steady growth.

From this perspective, the changes in cross-border finance may begin soon~

Catherine

Catherine