Author: Revc, Golden Finance

Foreword

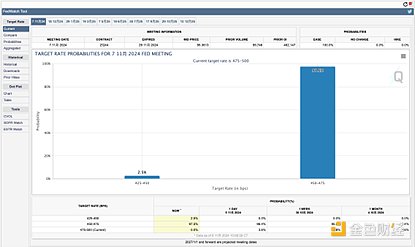

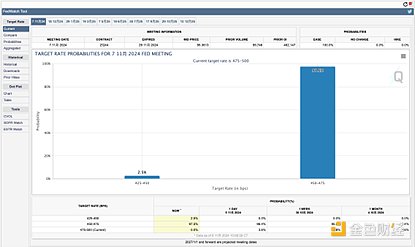

After Donald Trump won the US presidential election again, the focus of the global financial market gradually shifted from the election results to Federal Reserve Chairman Jerome Powell and his monetary policy direction. In the upcoming interest rate decision meeting of the Federal Reserve (Beijing time 7th 3 am ... If implemented, these measures could increase inflationary pressure and push up the federal deficit, posing greater challenges to the Fed's inflation target and employment stability. Economists believe that the Fed may continue to cut interest rates to support the economy, but Powell may be cautious about the pace of rate cuts to avoid increasing economic uncertainty. Against this backdrop, the market predicts that Powell will avoid political issues at the upcoming press conference, focus on the economic situation, and carefully analyze the new government's economic policies while remaining neutral. Trump's victory has changed the market's expectations of the future interest rate path. According to CME's "Fed Watch Tool" data, investors expect the Fed to continue to cut interest rates in the coming months, and the federal funds rate may fall to 3.75%-4.0% by the end of 2025. Some analysts believe that Trump's fiscal policy will increase inflationary pressure and may force the Fed to accelerate rate cuts. However, some experts, such as economists at Nomura Securities, predict that the Fed may only cut interest rates once in 2025, with the terminal interest rate remaining at 3.625%. Professor Bill English of the Yale School of Management believes that the Fed may pause interest rate cuts in the middle of the interest rate cut cycle to assess the response of economic data and provide a buffer for market uncertainties.

Market impact and global attention of Powell's speech

As the interest rate decision approaches, global investors look forward to Powell's assessment of the economic situation and the frequency of interest rate cuts. Whether Powell will indicate that inflation has been gradually brought under control and whether the pace of interest rate cuts will be slowed down in the future has become the focus of the market. CME data shows that some traders believe that interest rate cuts may be suspended next year, and any statement by Powell may directly affect market expectations. In the political environment of Trump's victory, the Fed's future monetary policy is seen as an important factor affecting economic recovery and global asset prices. Trump's policies and potential fluctuations in the global capital market

Trump's economic policies, including tax cuts, increased government spending and high tariffs, will affect the Fed's policy path if fully implemented. Economists believe that if inflation rises rapidly due to fiscal expansion, Powell may have to adjust the pace of the current monetary policy and take more cautious easing measures to stabilize market expectations. This will not only affect bank interest rates, housing loans, savings rates, etc. in the United States, but will also have a profound impact on the global capital market through fluctuations in the US dollar and interest rates. The market expects Powell to gradually slow down interest rate cuts to meet this challenge, and global investors will pay close attention to this.

Crypto MarketShort-termReactions and Outlook

Changes in the Fed’s policies also have an indirect impact on the cryptocurrency market. Whenever the Fed announces a rate cut or loosens its policies, the returns on traditional assets decline relatively, and some funds may flow into crypto assets such as Bitcoin to hedge risks. If Trump’s policies lead to rising inflation, cryptocurrencies may further attract safe-haven funds.

Summary

As the US election comes to an end, the Fed’s monetary policy will become a weather vane for the global market. Against the current political and economic backdrop, Powell and the Fed’s policy decisions, especially the dynamic adjustments to inflation, interest rate paths, and the impact on global capital markets, will continue to guide investors’ attention.

Joy

Joy